It’s weird to consider that anybody could expect to downturns within the crypto market, but that’s exactly the position held by many people developers and project creators who benefit from the low-pressure atmosphere that exists throughout a bear market.

As they say, bear financial markets are for building, and today is among the best occasions to survey the landscape to determine what sectors from the market are most active in designing the platforms which will soar to new heights within the next bull cycle.

Here’s a glance at five sectors from the blockchain ecosystem that could present the best possibilities for accumulation while costs are low and demand is non-existent.

Layer-1 protocols

Layer-1 (L1) protocols like Bitcoin (BTC) and Ethereum (ETH) make up the foundation much from the cryptocurrency ecosystem is made upon and let the majority of the other sectors from the sell to exist.

That being stated, presently, there are hardly any possibilities for launching other protocols around the Bitcoin network and Ethereum has well-known limitations when it comes to scalability, be responsible for high transaction costs and slow processing occasions.

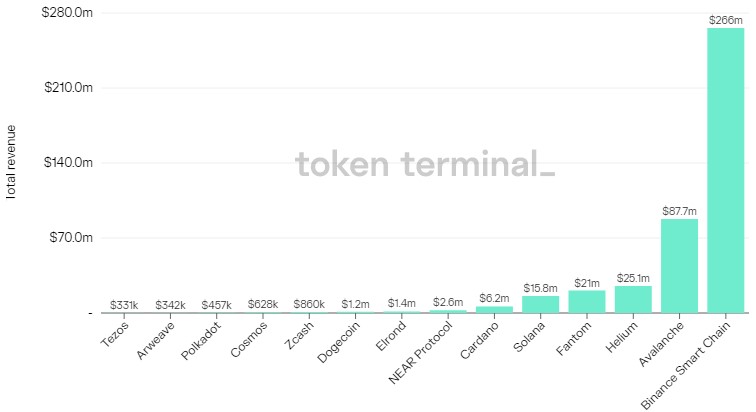

Because of these 4 elements, there remains a substantial chance for other L1 protocols to determine themselves and create a great slice of share of the market. The entire revenue generated with a protocol is a metric you can use to find out which systems begin to see the most usage.

According to data from Token Terminal, the very best five L1 protocols when it comes to total revenue in the last 180 days, excluding Bitcoin and Ethereum, are BNB Smart Chain (BNB), Avalanche (AVAX), Helium (HNT), Fantom (FTM) and Solana (SOL).

Layer-2 protocols

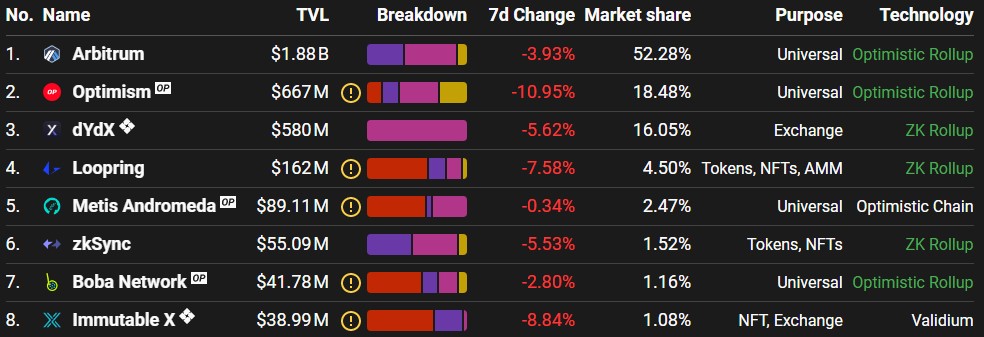

As pointed out above, the Ethereum network has limitations when it comes to scalability that will not be solved throughout the approaching Merge, departing a dent for layer-2 protocols to fill the necessity by assisting to lessen the activity occurring on the Ethereum blockchain.

Based on L2Beat, which tracks the stats on top Ethereum L2s, Arbitrum is rated number 1 when it comes to total value locked (TVL), adopted by Optimism and dYdX.

One network which was strangely enough ended their email list supplied by L2Beat, but continues to be the most highly adopted L2 when it comes to active wallets and protocols launched is Polygon (MATIC), which presently includes a TVL of $1.59 billion, according to data from DefiLlama.

When it comes to Bitcoin network, the primary L2 solution that’s presently seeing elevated inflows may be the Lightning network, but there’s no token associated with the protocol. Rather, users can choose to operate a node if they would like to offer the network in addition to earn passive earnings.

Gaming

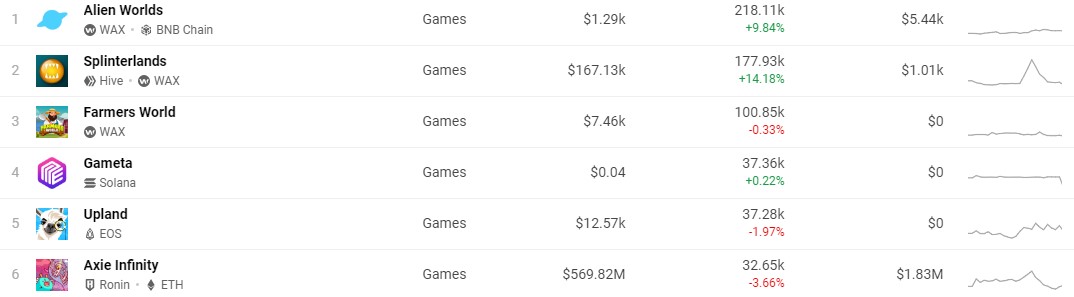

The gaming sector from the cryptocurrency ecosystem has shown to be one of the most resilient in relation to keeping users engaged throughout the current crypto winter.

The emergence of play-to-earn games like Axie Infinity (AXS) helped shine a spotlight around the options of blockchain-based gaming throughout the bull cycle of 2021 and it has brought for an kind of several “-to-earn” type protocols for example move-to-earn and discover-to-earn.

Data from DappRadar shows that a few of the top games when it comes to active users include Alien Worlds, Splinterlands and Maqui berry farmers World, which work on the WAX network while Axie Infinity may be the top game with regards to the worth of assets locked in it’s good contract.

There’s also a number of other games which are still in development but nonetheless attracting lots of attention, including Illuvium and Aavegotchi, in addition to tokens that represent gaming environments for example Enjin Gold coin (ENJ), Gala (GALA) and Ultra (UOS).

Social platforms

One sector from the cryptocurrency landscape which has yet to actually get established inside a notable way but represents a great chance to increase adoption is social engagement platforms much like Twitter, Facebook or Reddit.

Previous front runners within the social networking landscape include Steem and it is community-driven kind Hive, but neither protocol has truly achieved prevalent adoption up to now.

While not one other protocols presently functioning have were able to crack the code that draws lots of users who stay engaged lengthy-term, occasions within the wider world such as the ongoing drama around Elon Musk’s acquisition of Twitter reveal that social networking remains looking for an freely accessible community-focused platform.

Related: 34% of gamers desire to use crypto within the Metaverse, regardless of the backlash

Metaverse and NFT launchpads

Your final sector worth keeping track of because of its prevalent appeal with mainstream society including efforts which are already going ahead to integrate it into daily existence may be the Metaverse.

To assist simplify matters, th Metaverse is really a virtual reality representation of all of the data and interactions that occur on the web, built on the top of blockchain technology.

While the idea of the Metaverse continues to be in the infancy, it’s a well known subject of conversation round the crypto sphere and it is already attracting large investments from probably the most well-known and recognizable brands on the planet.

top 10 companies investing/building within the Metaverse:

1. Microsoft

2. Meta

3. Tencent

4. Nike

5. Alibaba

6. Accenture

7. Adidas

8. JP. Morgan

9. NVIDIA

10. RobloxBegin to see the future. Plan in advance.#Metaverse #web3 #blockchain pic.twitter.com/5JgOl1dlE4

— Upenyu (@AskUpenyu) Feb 16, 2022

Additionally towards the Metaverse, platforms specializing in the creation and launch of nonfungible tokens (NFTs) will also be worth having to pay focus on because the NFT sector continues to be proven to become well-liked by everyone.

Probably the most developed and adopted Metaverse and NFT platforms presently functioning range from the Sandbox (SAND), which lately partnered with Playboy to produce a MetaMansion social game around the platform, in addition to Decentraland (MANA) and ApeCoin (APE).

Want more details about buying and selling and purchasing crypto markets?

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.