Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

Chainalysis chief researcher shared his thoughts about the Tornado Cash saga and stated the incident leaves a void for illicit fund mixing services, however the real impact from the sanctions might be determined over time.

The staking ecosystem of Ethereum publish Merge will have a significant effect on the crypto economy, according to a different report. Institutional lending platform Mapple Finance launched a $300 million lending pool for Bitcoin mining farms.

The Tribe DAO, a decentralized autonomous organization, voted in support of repaying affected people that use the $80 million exploit on DeFi platform Rari Capital’s liquidity pools. BNB Chain launched a brand new community-brought security initiative known as Avenger DAO.

Top-100 DeFi tokens by market cap possess a mixed week when it comes to cost action, where lots of tokens traded in red while a couple of others demonstrated weekly gains.

Tornado Cash created a void, time will inform what fills it — Chainalysis chief researcher

The sanctions on cryptocurrency mixer Tornado Cash have remaining vacuum pressure for illicit fund mixing services, but additional time is required before we’ll be aware of full impact, based on Chainalysis’ chief researcher.

Throughout a demo of Chainalysis’ lately launched blockchain analysis platform Storyline, Cointelegraph requested Chainalysis chief researcher Jacob Illum and country manager for New zealand and australia Todd Lenfield concerning the impact from the Tornado Cash ban.

Tribe DAO votes in support of repaying victims of $80M Rari hack

After several weeks of uncertainty, the Tribe DAO has transpired a election to pay back affected people that use the $80 million exploit on DeFi platform Rari Capital’s liquidity pools.

Following several models of voting and governance proposals, Tribe DAO, featuring its Midas Capital, Rari Capital, Fei Protocol and Volt Protocol, required the choice to election on Sunday using the intent to completely compensate hack victims.

Staking providers could expand institutional presence within the crypto space: Report

The Ethereum blockchain’s carbon footprint is anticipated to lessen by 99% following last week’s Merge event. By positioning staking like a service for retail and institutional investors, the upgrade could in addition have a significant effect on the crypto economy, based on a study from Bitwise on Tuesday.

The organization stated it projects potential gains of fourPercent–8% for lengthy-term investors through Ether (ETH) staking, while J.P. Morgan analysts forecast that staking yields across PoS blockchains could double to $40 billion by 2025.

Walnut Finance launches $300M lending pool for Bitcoin mining firms

On Sept. 20, institutional crypto lending protocol Walnut Finance and it is delegate Icebreaker Finance announced they provides as much as $300 million price of guaranteed debt financing to private and public Bitcoin mining firms. Qualified entities meeting treasury management and power strategies standards located throughout The United States, in addition to individuals around australia, can use for funding.

However, the venture seeks to provide risk-adjusted returns within the low teen percentages (as much as 13% per year) to investors and capital allocators. The swimming pool is just available to accredited investors who meet substantial earnings and/or internet worth qualifications inside a jurisdiction.

BNB Chain launches a brand new community-run security mechanism to safeguard users

BNB Chain, the native blockchain of Binance, has launched AvengerDAO, a brand new community-driven security initiative to assist safeguard users against scams, malicious actors and possible exploits.

The safety-centric DAO continues to be developed in colaboration with leading security firms and popular crypto projects for example Certik, TrustWallet, PancakeSwap and Opera, to mention a couple of.

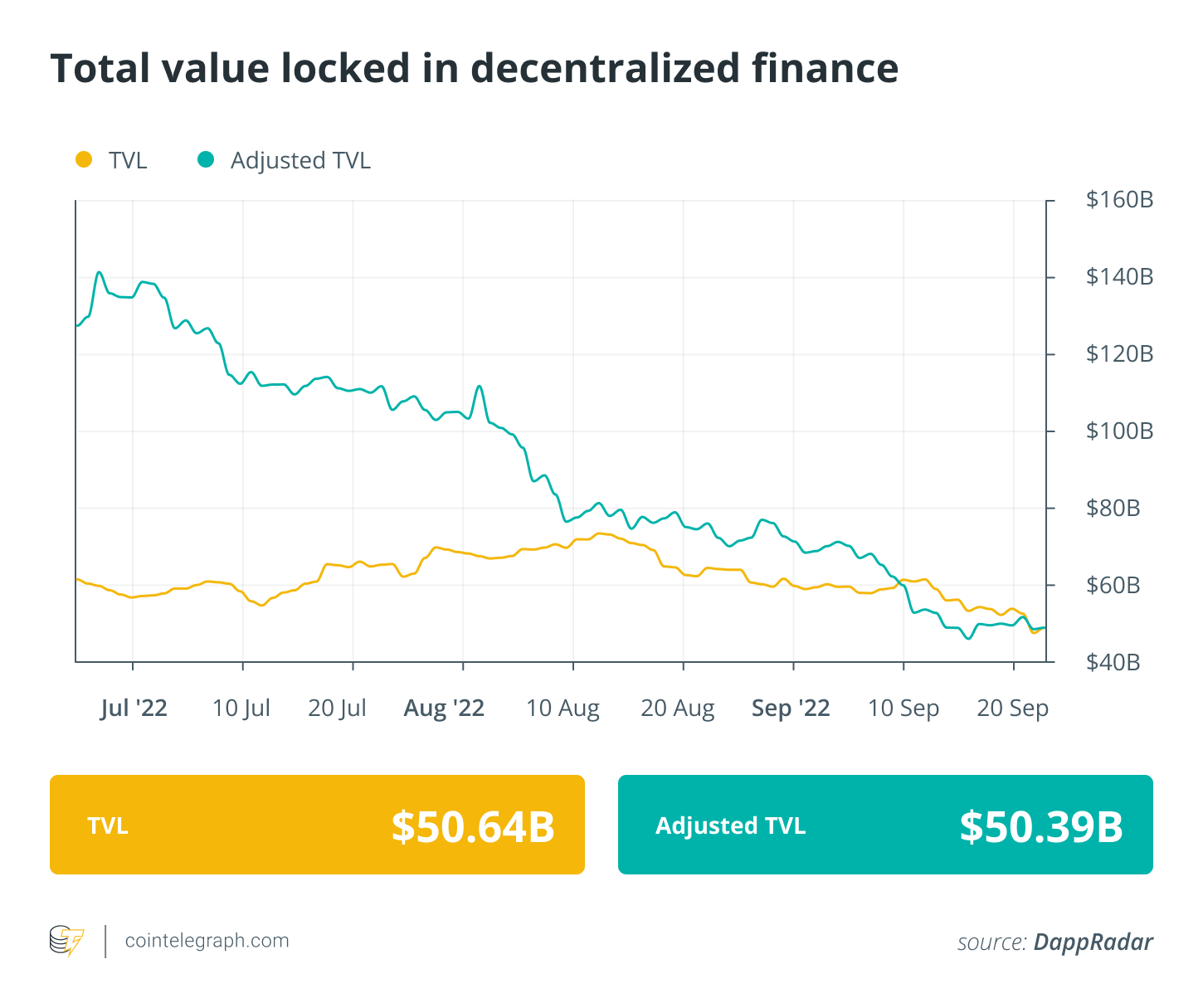

DeFi market overview

Analytical data reveals that DeFi’s total value locked registered a small dip in the past week. The TVL value involved $50.64 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView reveal that DeFi’s best players tokens by market capital were built with a mixed week, with lots of tokens creating a recovery toward the finish each week while a couple of others traded in red around the weekly charts.

Compound (COMP) was the greatest gainer, registering a 15% gain in the last 7 days, adopted by PancakeSwap (CAKE) by having an 8.8% gain. Theta Network (THETA) was another token within the best players to publish a 5% weekly gain.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.