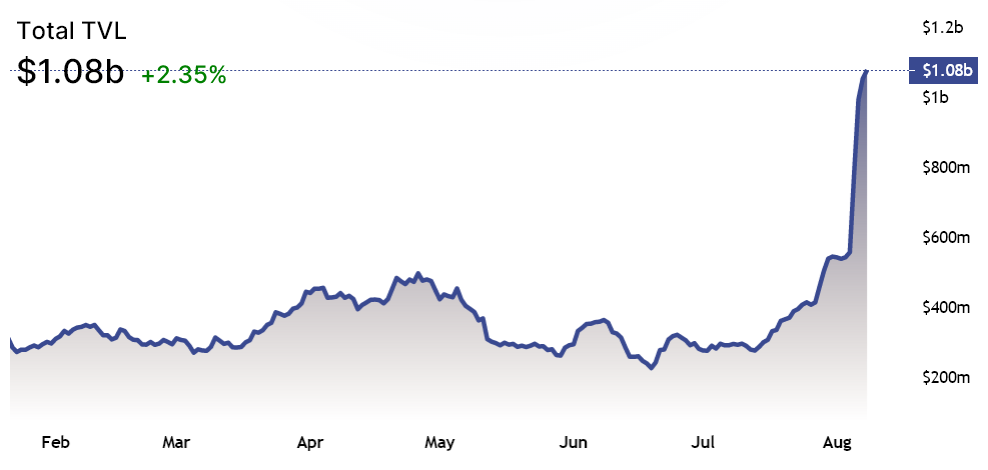

The mixture total value locked (TVL) within the crypto market measures the quantity of funds deposited in smart contracts which figure declined from $160 billion in mid-April to the present $70 billion, the cheapest level since March 2021. Although this 66% contraction is worrying, a lot of data shows that the decentralized finance (DeFi) sector is resilient.

The problem with using TVL like a broad metric is the possible lack of detail that isn’t proven. For instance, the amount of DeFi transactions, development of layer-2 scaling solutions and investment capital inflows within the ecosystem aren’t reflected within the metric.

In DappRadar’s This summer 29 Crypto adoption report, data shows the DeFi 2Q transaction count closed lower by 15% in comparison to the previous quarter. This figure is way less concerning compared to devastating TVL decline and it is corroborated with a 12% stop by the amount of unique active wallets within the same period.

Layer-2 may be the path for sustainable DeFi growth

Iakov Levin, Chief executive officer and founding father of Midas Investments told Cointelegraph that:

“I’m firmly believing that the present bear market isn’t the ‘end’ from the DeFi industry. For example, there’s an increasing competition among decentralized exchanges on layer-2 Ethereum scaling platform Optimism, as Velodrome arrived at greater than $130 million in TVL.”

Optimism is definitely an Ethereum scalability solution using layer-2 to bundle transaction verifications off-chain, lowering the processing and transaction cost for decentralized applications around the network.

Investment capital inflows further offer the resilience of DeFi thesis. On This summer 12, the crypto-centric Multicoin Capital launched a $430 million fund. An investment managing firm began in 2017 and aims to pay attention to developing Web3 infrastructure, DeFi applications and autonomous business models.

On This summer 28, Variant announced a effective $450 million capital increase to finance, amongst others, “financial empowerment through DeFi.” The process includes the financialization and productivity of NFTs, stablecoins, lending optimizers, DEX aggregators and “items that bridge the legacy economic climate with DeFi.”

These significant-size fund raises lead Levin to think that scaling solutions will require decentralized finance applications one stage further in a manner that wasn’t possible throughout the so-known as “DeFi Summer time 2.” within the 3Q of 2021. The typical Ethereum network transaction fee in that period was above $25, which makes it nearly impossible for that applications to achieve traction. Midas Investments Chief executive officer Levin stated:

“Ultimately, I see layer-2 like a potential factor for reviving the sector’s growth. This is driven through the scalability rise because of the positive and zk-Rollups solutions implementation. By supplying users with cheaper transaction charges and near-instant semi-confirmations, layer-2 will dramatically improve consumer experience and can soon be capable to onboard a brand new wave of users.”

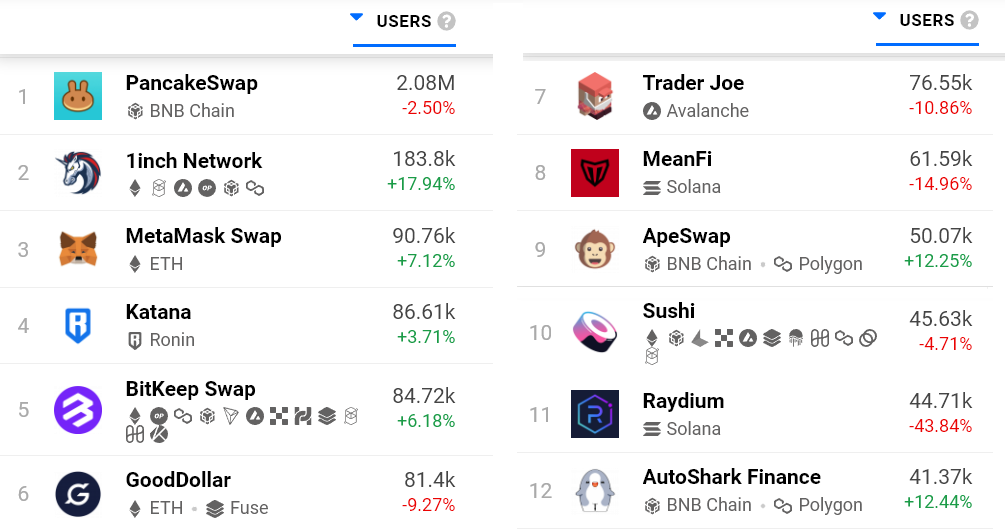

Metamask Swap and 1inch Network stick out

The amount of active addresses using DeFi applications has held reasonably stable in the last thirty days, based on data from DappRadar.

Data shows a typical 2% stop by active addresses, but four from the top fiv applications presented growth. Additionally, DEX aggregators 1inch Network and MetaMask published considerable user gains, thus invalidating concerns of the “DeFi winter.”

The bottom line is, the decentralized finance industry keeps growing in the amount of active addresses, investment capital investments and innovative solutions offering cheaper and faster processing abilities when compared to last peak at the end of 2021.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.