A brand new homeowner has bought a condo in Austin, Texas, via a program that enables crypto holders to get traditional uncollateralized mortgages according to their credit ratings.

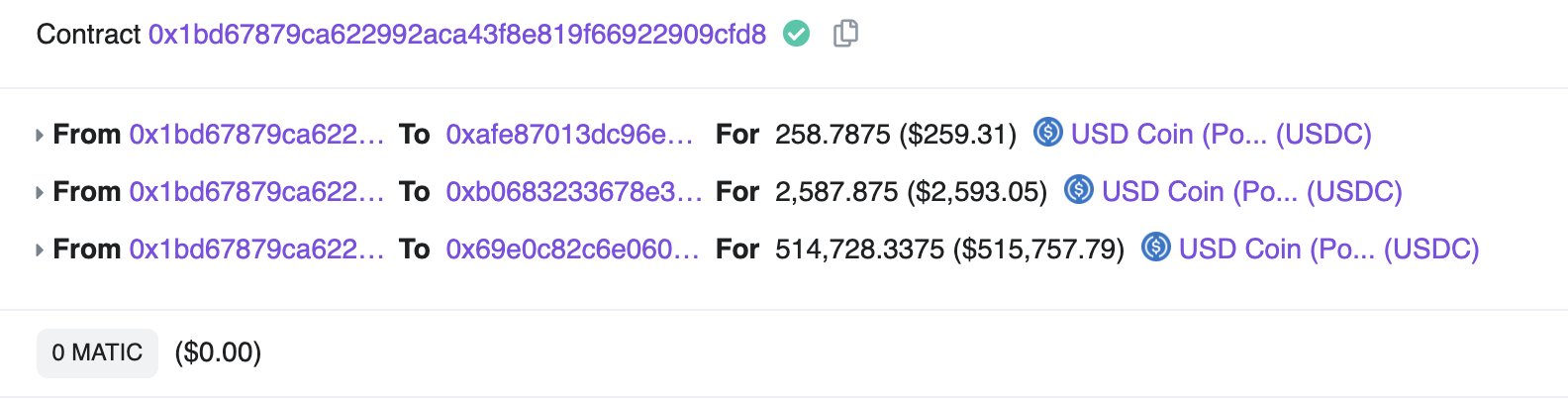

The USDC.homes crypto mortgages platform issued its first crypto loan for an Austin resident who purchased a $680,000 condo having a $500,000 loan issued in USD Gold coin (USDC) stablecoin within the Polygon network.

This latest platform combines practices from traditional lending markets for example leveraging a borrower’s credit rating to find out eligibility with new decentralized finance (DeFi) innovations for example cryptocurrency staking to assist remove the balance.

Today, we’re excited to debut https://t.co/26BgeWPd0Z and announce the appearance of crypto mortgages to Texas!

Find out morehttps://t.co/I3wcbfZXRY

— Teller (@useteller) April 26, 2022

Loans in the platform are issued in USD, but borrowers could make payments in Ether (ETH), Bitcoin (BTC) or USDC. It’s been built while using Teller lending protocol and supported by the TrueFi project that issues uncollateralized crypto loans. USDC.homes can issue 30-year mortgages the size of $5 million in a 5.5% rate of interest which need a 20% lower payment.

Each borrower’s lower payment is staked, not offered, and accrues interest with time you can use to assist homeowners repay their loans. Based on a Wednesday blog publish from Teller, the standard have to liquidate one’s crypto assets for fiat to have a loan exposes American borrowers “to the damages of taxation, charges, along with a lack of position.”

Real-world loan issuing has become a far more common use situation within the crypto industry. The LoanSnap platform expects to spread out its services to licensed lenders this season, according to some Tuesday report from Housing Wire.

While on an artificial intelligence (AI) loan origination system, Chief executive officer Karl Jacob told Housing Wire that LoanSnap has issued “billions of dollars” in traditional mortgages. His company’s services also have extended in to the crypto space with DeFi loan provider Bacon Protocol to link mortgage values to a nonfungible token (NFT)

Related: Decentralized credit ratings: Just how can blockchain tech change ratings

Bacon Protocol continues to be issuing NFT mortgages since last November, with lending rates varying up to 3.1%, far under the five.55% rate on the traditional 30-year mortgage, based on Investopedia.