Decentralized autonomous organizations (DAOs) have grown to be a rage within the ever-expanding crypto ecosystem and therefore are frequently viewed as the way forward for decentralized corporate governance.

DAOs are organizations with no centralized hierarchy and were meant to operate in a bottom-up manner so the community with each other owns and plays a role in the choice-making process. However, recent research data shows that these DAOs aren’t as decentralized because they were supposed to have been.

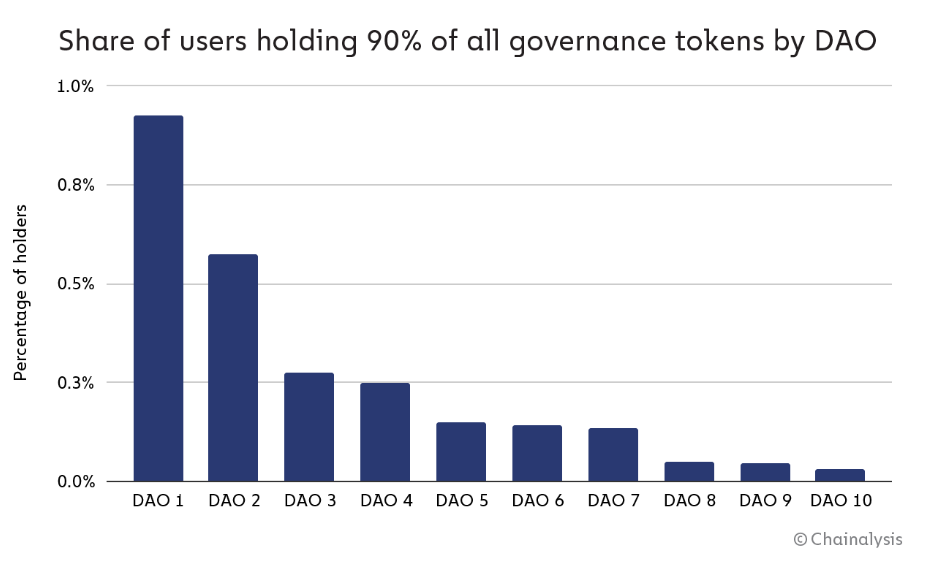

A current report from Chainalysis examined the workings of ten major DAO projects and located that typically, under 1% of holders have 90% from the voting power. The finding highlights a higher power of decision-making power at the disposal of a particular couple of, a problem DAOs were produced to solve.

This power of decision-making power was apparent using the Solana (SOL)-based lending DAO Solend. The Solend team attempted to consider more than a whale’s account and execute the liquidation themselves via over-the-counter (OTC) desks to avoid cascading liquidations over the DEX books.

This really is pretty wild. The Solend team really wants to dominate the whale’s account and execute the liquidation themselves. The whale’s position is really degenerate when SOL drops lacking it’ll create cascading liquidations over the DEX books (and potentially bad debt). “DeFi” https://t.co/TEVKz18NSm pic.twitter.com/2A3t2fOhnl

— FatMan (@FatManTerra) June 19, 2022

The proposal to consider over was passed with 1.a million “yes” votes to 30,000 “no” votes, however, from these total “yes” votes, a million came from one user holding considerable amounts of governance tokens. The election was later overturned following a heavy lash back.

Related: The way a DAO for any bank or lender may be like

The Chainalysis report highlighted that although all governance token holders have voting legal rights, the authority to create a new proposal for that community and also to pass it’s not super easy for everybody, given the amount of tokens needed to do this.

The report believed that between one in 1,000 and 10 %,000 governance token holders have sufficient tokens to produce a proposal. With regards to passing an offer only between 10 %,000 and one in 30,000 holders have sufficient tokens to do this.

The decentralized finance (DeFi) ecosystem makes up about 83% of DAO treasury value held and 33% of all the DAOs by count. Aside from DeFi, venture capital, infrastructure and nonfungible tokens (NFTs) are also environments which have seen a boost in quantity of DAOs.