Crypto investors found reason for celebration on This summer 14 because the market possessed a positive buying and selling session only one next day of the customer Cost Index (CPI) published a June print of 9.1%, its greatest level since 1981.

The move greater on the market wasn’t entirely unpredicted for seasoned traders who’ve study a one or two-day bounce in asset prices following the newest CPI prints. These traders also know there’s nothing not to become looking forward to because the bounces have typically been adopted by more downside once people understand that our prime inflation print is really a negative development.

Nonetheless, the eco-friendly on the market is really a welcome sight following the rough begin to 2022.

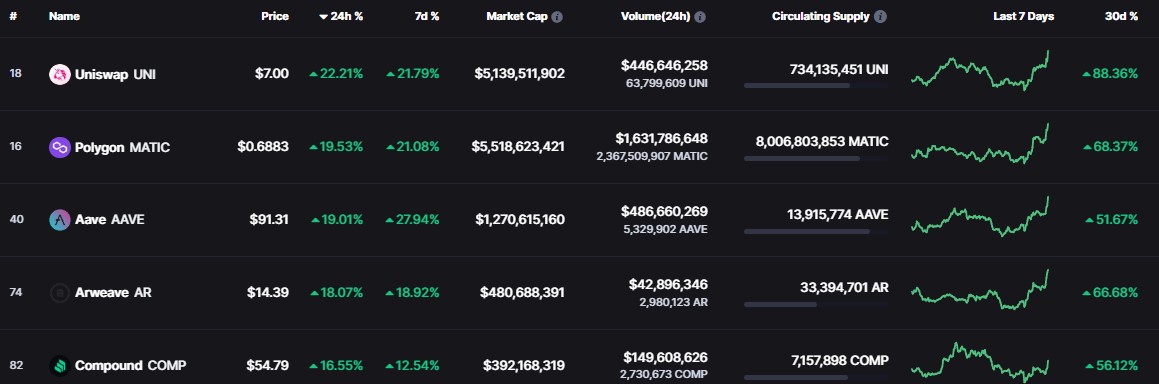

Based on data from Cointelegraph Markets Pro and TradingView, the greatest gainers in the last 24-hrs were Uniswap (UNI), Polygon (MATIC) and Aave (AAVE).

Robinhood lists UNI

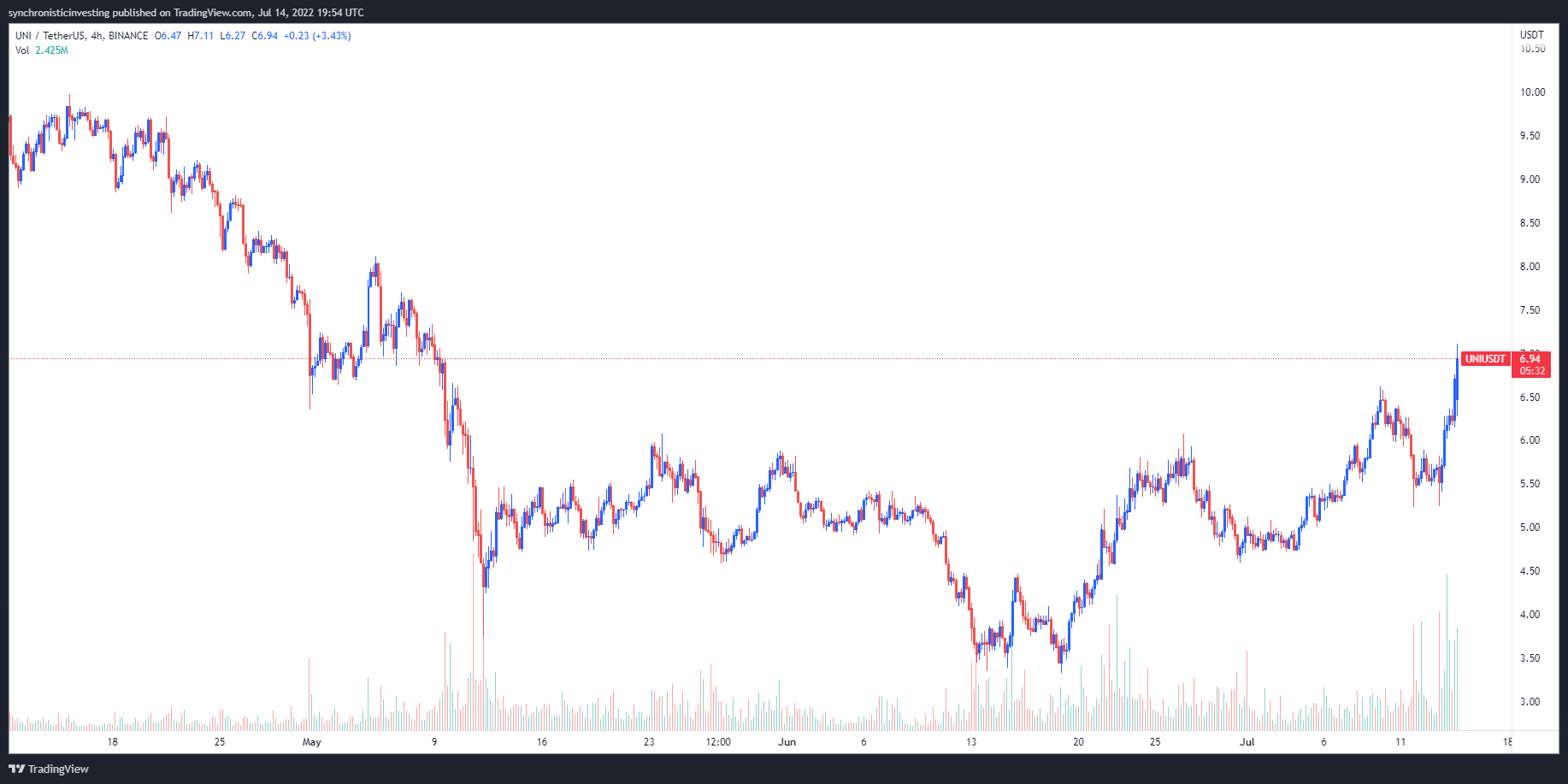

Uniswap, the very best decentralized exchange by volume, saw its token cost mind greater on This summer 13 after hitting a minimal of $5.23. The token has since rose 36% hitting a regular a lot of $7.11 on This summer 14 among a 104% spike in the 24-hour buying and selling volume to $449 million.

The sharp turnaround in UNI cost and buying and selling volume may come as the most popular broker Robinhood announced the UNI token has become open to trade around the platform, exposing the focal point in a sizable cohort of recent clients who do not have accounts on other cryptocurrency exchanges.

Disney news supplies a boost for MATIC

Polygon is among the top layer-two scaling solutions for that Ethereum network that provides a quicker, lower-fee transaction experience for users and protocols.

Data from Cointelegraph Markets Pro and TradingView implies that after briefly dipping to some low of $.52 on This summer 13, the cost of MATIC spiked 36% hitting a regular high at $.707 on This summer 14 on the rear of a 120% spike in the 24-hour buying and selling volume.

MATIC’s cost increase follows a comment the protocol was the only real blockchain selected by Disney to become a part of its 2022 Accelerator Program.

Interrupting the #GreenBlockchainSummit for many breaking news!

We are excited is the only blockchain selected to take part in the Disney Accelerator program. https://t.co/LaGU4bhidi

— Polygon – MATIC (@0xPolygon) This summer 13, 2022

Related: Bitcoin analysts weigh sub-$17.5K dip after ‘weak’ BTC cost bounce

Aave rallies on stablecoin developments

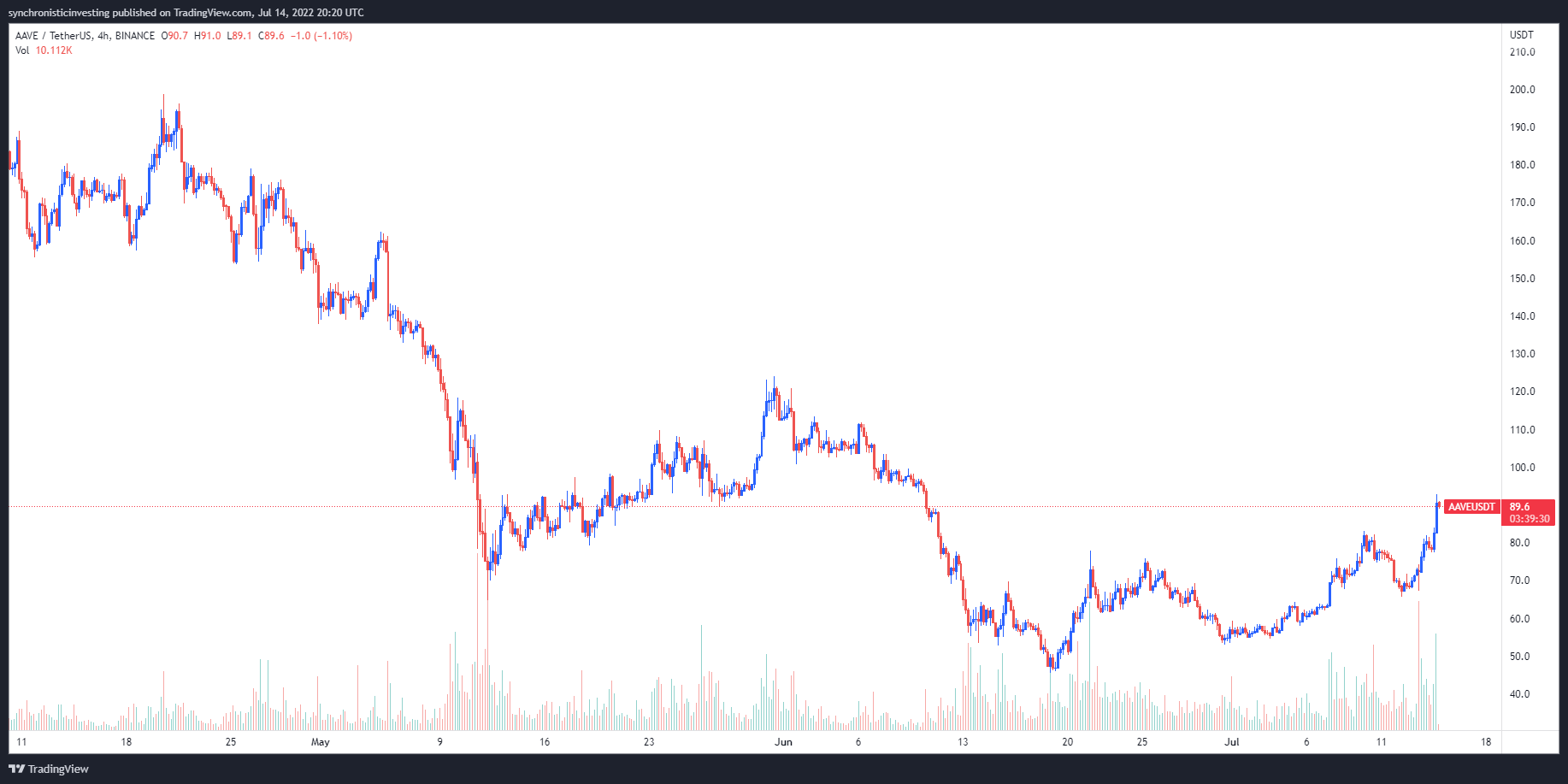

Aave, a populardecentralized finance platform, is really a lending and borrowing protocol that presently holds $5.63 billion as a whole value locked (TVL), which makes it the 2nd-rated DeFi platform by TVL behind MakerDAO.

Data from Cointelegraph Markets Pro and TradingView implies that in the last 24-hrs, the cost of AAVE has rallied 38.5% from the low of $67.10 hitting a regular a lot of $93 within the mid-day hrs on This summer 14.

Aave sparked excitement within its community on This summer 7 if this revealed intends to release its very own GHO stablecoin, which is a collateral-backed stablecoin that’s indigenous to the AAVE ecosystem.

1/ Calling all GHOsts

We’ve produced an ARC for any new decentralized, collateral-backed stablecoin, indigenous to the Aave ecosystem, referred to as GHO.

Find out more below and discuss your ideas for that snapshot (not far off)!https://t.co/P7tHl9LbBe

— Aave (@AaveAave) This summer 7, 2022

The general cryptocurrency market cap now is $927 billion and Bitcoin’s dominance rates are 42.6%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.