Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

The final week’s headline was covered with a few of the greatest hacks in DeFi. Now is redemption here we are at many DeFi protocols that either averted an attempted hack or had a significant slice of their stolen funds back.

The BitBTC bridge apparently were built with a bug that will basically allow an assailant to mint fake tokens somewhere from the bridge and swap them legitimate ones. However, one Twitter user could anticipate the vulnerability and informed the mix-bridge platform about this.

The Moola Market attacker has scored in regards to a half-billion dollar “bug bounty” after selecting to come back most the cryptocurrency they exploited in the Celo-based lending protocol. Cryptocurrency market maker Wintermute paid back a $92 million TrueFi loan promptly despite suffering a $160 million hack.

Mango Market online hackers that came back a substantial slice of the $117 million stolen in the protocol could still face law suit regardless of the protocol choosing to award him a $50 million bounty.

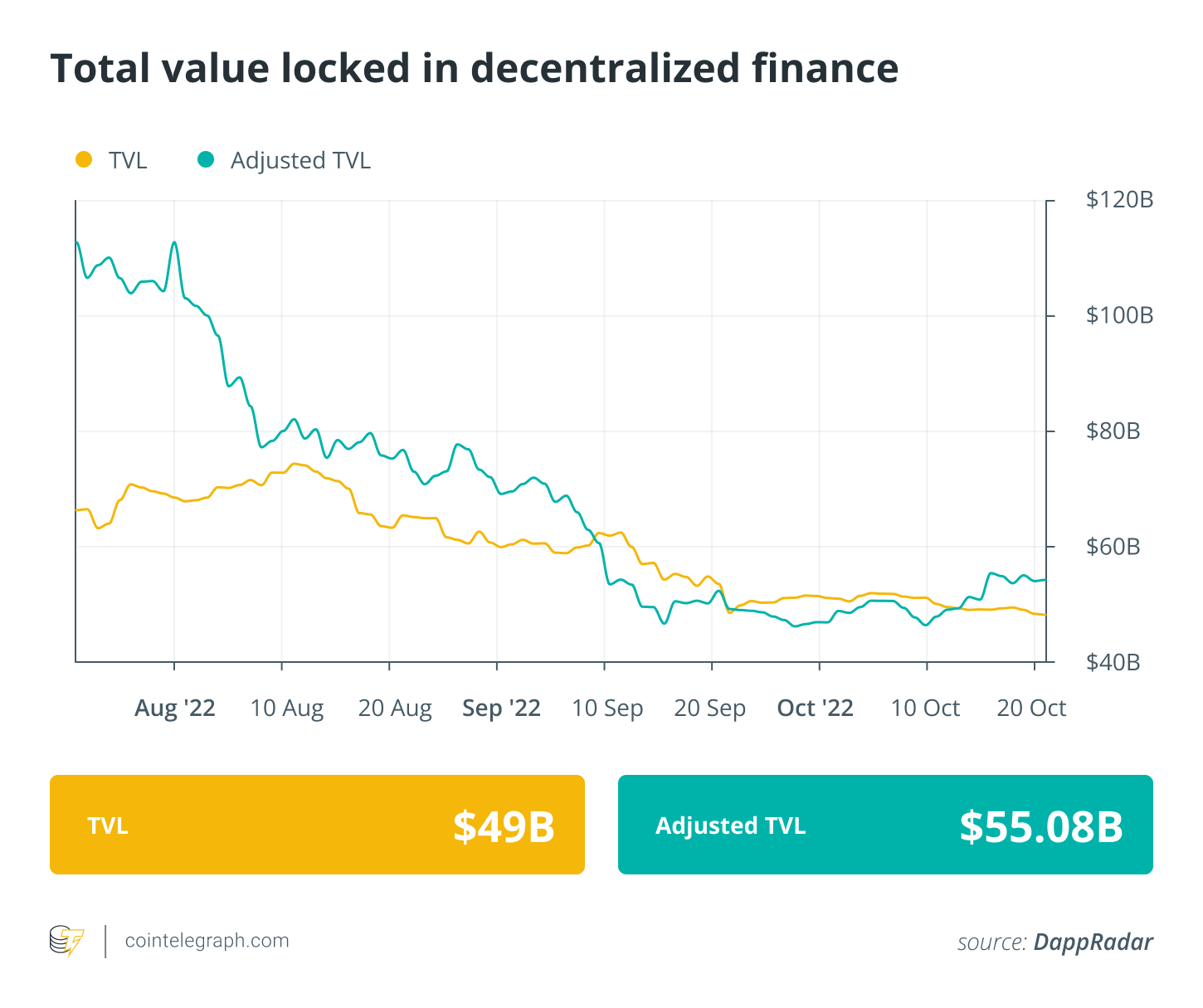

The very best 100 DeFi tokens continued to be bearish for an additional week, since most of the tokens traded in red, barring a couple of. The entire value locked also continued to be below $50 billion for that second consecutive week.

Twitter user saves mix-chain bridge from potential exploit

A mix-chain bridge between BitBTC and also the Ethereum layer-2 network Optimism has had the ability to avoid a potentially pricey exploit because of the work of the bald eagle-eyed Twitter user.

The custom mix-chain bridge provides a ramp for users to send assets between Optimism’s network and BitAnt’s DeFi ecosystem, including yield services, nonfungible tokens (NFTs), swaps and also the BitBTC token, by which a million BitBTC represents 1 Bitcoin (BTC).

Moola Market attacker returns the majority of $9M looted for $500K bounty

An assailant has came back approximately 93% from the greater than $9 million price of cryptocurrencies they exploited in the Celo blockchain-based DeFi lending protocol Moola Market.

Around 6:00 pm UTC on March. 18, the Moola Market team tweeted it had been investigating an accidents coupled with stopped all activity, adding it’d contacted government bodies and offered an insect bounty towards the exploiter if funds were came back within 24 hrs.

MangoMarket’ss exploiter stated actions were ‘legal,’ but were they?

The $117 million Mango Markets exploiter has defended his actions as “legal,” however a lawyer shows that they might still face the effects.

Self-described digital art dealer Avraham Eisenberg outed themself because the exploiter in a number of tweets on March. 15, claiming he along with a team began a “highly lucrative buying and selling strategy” which was “legal open market actions, while using protocol as designed.”

Wintermute repays $92M TrueFi loan promptly despite suffering a $160M hack

When Wintermute, a cryptocurrency market maker, lost $160 million as a result of hack and concerns associated with the repayment of debt worth $189.4 million surfaced. However, within an exciting turn of occasions, Wintermute compensated back its largest debt due March. 15, involving a $92 million Tether (USDT) loan from TrueFi.

After repayment of TrueFi’s $92 million loan, Wintermute still owes $75 million to Walnut Finance in USD Gold coin (USDC) and wrapped Ether (wETH) and $22.4 million to Clearpool, as many as $97.4 million indebted.

Binance delegates 13.2M UNI tokens, becoming Uniswap DAO’s second-largest election-holder

Crypto exchange Binance has become the 2nd-largest entity by voting power within the Uniswap DAO, sitting just behind the venture firm Andreessen Horowitz, or a16z, based on the on-chain listing of delegates.

On March. 18, Binance delegated 13.two million Uniswap (UNI) tokens from the books, addressing 5.9% from the voting power — a portion of tokens delegated towards the exchange. When compared to total way to obtain UNI, the quantity delegated represents 1.3%.

DeFi market overview

Analytical data reveals that DeFi’s total value registered another dip, using the total value locked (TVL) falling below $50 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView reveal that DeFi’s best players tokens by market capital were built with a mixed week, with a lot of the tokens buying and selling in red around the 7-day chart, barring a couple of.

Maker (MKR) ongoing its bullish momentum in to the third week of October, registering a 12% gain in the last 7 days, adopted by Aave (AAVE) having a 10% weekly surge. Lido DAO (LDO) was another DeFi token that registered a 9.45% boost in the weekly charts

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insight,s, and education within this dynamically evolving space.