The fight to draw in stablecoin liquidity is a trending theme over the cryptocurrency landscape within the last year, especially as decentralized finance users have started to realize the hefty APY that may be earned on dollar-peg assets.

While Curve Finance continues to be the undisputed leader in interest bearing stablecoin liquidity pools, several new entrants have started to climb the ranks, including Vector Finance (VTX), a protocol that allows Avalanche (AVAX) network users to create boosted yields on their own stablecoin positions.

Data from CoinGecko shows the cost of VTX lately went through a pattern reversal since it’s cost rose 52% from the low of $.39 on May 1 to some daily a lot of $.60 on May 4.

Here’s phone factors which have helped spark a reversal in VTX cost and indicate a rise in the effective use of the Vector Finance protocol.

Total value locked hits a brand new high

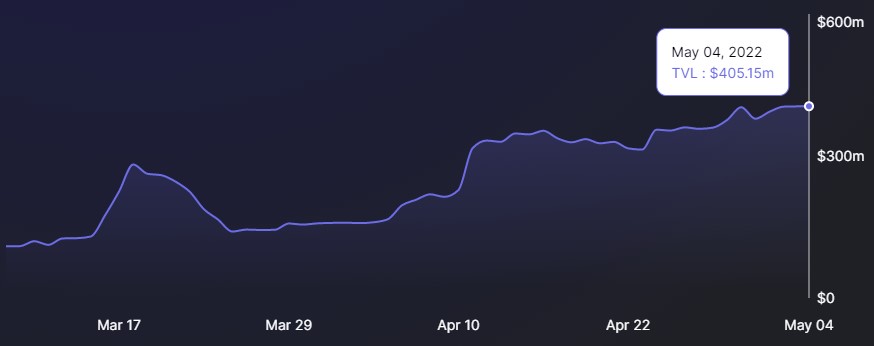

One sign pointing to elevated inflows to Vector Finance is the increase in the entire value locked (TVL) around the protocol, which arrived at a brand new all-time a lot of $405.15 million on May 4, according to data from Defi Llama. This really is notable because of the fact it came during a time period of prevalent weakness over the cryptocurrency market.

The increase in TVL may come as the woking platform integrated new pools from Trader Joe, that offer an optimum yield of 69.6% for deposits of JOE/USDC liquidity providers.

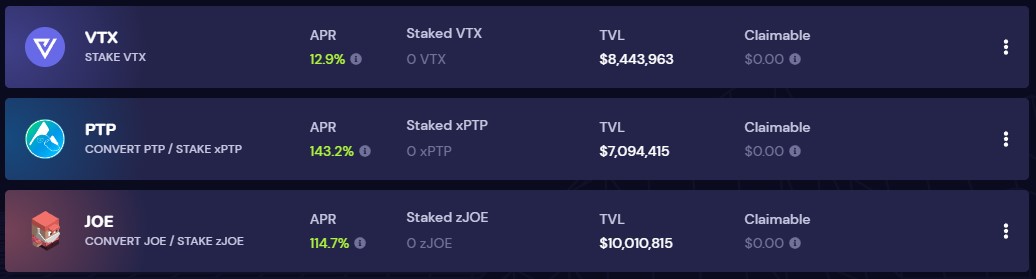

Vector also provides single staking abilities for VTX, Platypus Finance and JOE with yields of 12.8%, 144.9% and 117%, correspondingly.

Related: Avalanche (AVAX) loses 30%+ in April, nevertheless its DeFi footprint leaves room to become bullish

Vector finance also added support fo Frax Shares, MIM and UST, with yields varying from 7.3% to fifteen.1%.

Yields for USD Gold coin (USDC) and Tether (USDT) vary from 5.1% to eight.%, while wrapped DAI (DAI.e) deposits can earn 3.1%.

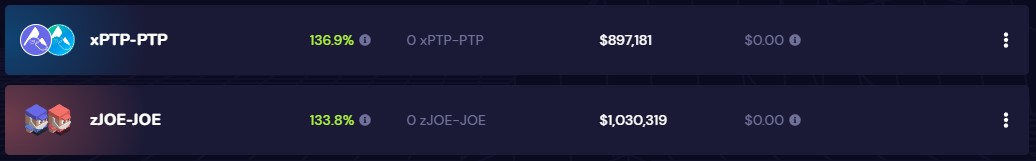

Vector can also be centered on accumulating voting power inside the Platypus and Trader Joe environments by providing yields of 137.3% for xPTP-PTP deposits and 129.4% for zJOE-JOE deposits.

Users who choose to provide liquidity during these pools can earn yet another 136.9% APY on the top from the yield earned by staking the person PTP and JOE tokens on Vector Finance.

Another perk attracting liquidity may be the bonus yield as high as 70% for VTX holders who made a decision to lock their tokens for 16 days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.