Decentralized Autonomous Organizations (DAOs) happen to be heralded as the way forward for governance, unlocking a far more egalitarian method of decision-making. However, decentralizing leadership isn’t an enchanting solution that instantly results in better results. To really get the most from a decentralized organization, steps must automatically get to regulate weighted voting and tokenomics. Otherwise carefully balanced, DAOs can implode — and a few curently have.

Decentralized governance described

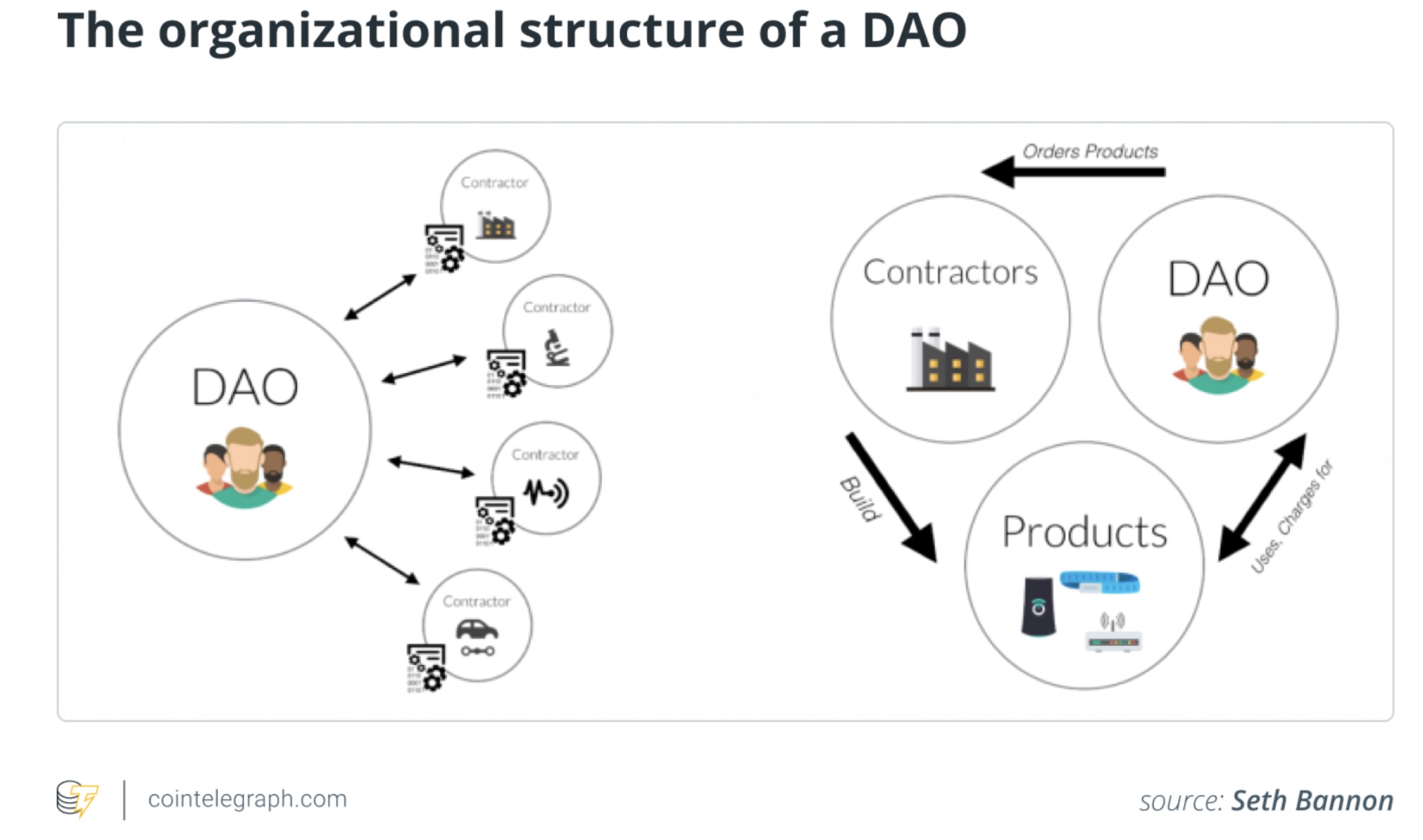

DAOs provide a model for building a project or company that distributes voting legal rights across all people. There’s usually no central authority, just the will from the collective. Although this sounds equitable theoretically, the alternative could be true for several governance models.

Possibly most problematic of structures are DAOs that work on an expression-based voting system. Despite being one that is decentralized, token-weighted governance — by which users most abundant in tokens possess the greatest share of voting power — can unintentionally finish up paying control to some couple of wealthy participants and stripping it from the many. Out of the box immediately apparent, this completely undermines the philosophy that DAOs were built on and enables wealthy whales to possess a disproportionate say.

Related: DAOs are focused more about community than profit. Here’s why

This could wreak more damage than centralization alone token-based voting systems can result in hostile takeovers by DAO token whales along with other malicious actors — for example within the takeover from the Build Finance DAO. In Feb, the DAO fell victim for an attacker who held enough assets to proceed an offer providing them with total charge of the work.

Due to its token-based governance model, this takeover fell entirely using the rules, departing devs or even the community little option but to fork the work and begin on your own. Clearly, voting weighted by asset allocation isn’t our advice.

Overcoming DAO problems

The thing is that asset-weighted voting isn’t the perfect method for decentralized governance systems, particularly if they aim to replace legacy models. The lengthy-term goal is so that you can run companies, organizations, as well as nations having a decentralized system that meaningfully provides a voice to each individual but additionally considers what that member is supplying. Many forms of personalized, blockchain-enforced IDs, in addition to a voting structure according to meritocracy, might be just precisely what it takes to balance the equation.

Imagine new, one where voting people are assessed against certain key performance indicators (KPIs). These may involve engagement and development metrics inside the DAO, along with a failure to satisfy these KPIs can lead to that user’s voting power being reduced or removed entirely. Using this approach would encourage all entities to create decisions which are within the broader interest from the community, not only themselves.

It may also affect just about any factor from the platform, for example future technological developments or how community money is allotted. It might even create new social organizing structures for charitable organization, ecological groups and whole governments — supplying bigger motives than capital gain alone.

Related: Decentralization, DAOs and also the current Web3 concerns

Already, NFT communities have shown that they’ll incentivize functions benefiting the collective, for example participation as being a prerequisite to become “whitelisted” to have an NFT drop. It isn’t uncommon for effective Web3 projects to provide some type of collaborative, mutually shared goal, and existing systems of leadership don’t offer that direct incentive to sign up. For example take modern governments, by which citizens election for a person to become make the position of centralized power. Web3 and DAOs are demonstrating how things perform in different ways, through mutual benefits and incentivized participation.

Case one vision, however the fundamental premise remains. New structures should be explored to make sure decentralized organizations remain incorruptible. You will find a lot of attack vectors affecting important projects, and when DAO governance would be to come to be a worldwide movement and ever see implementation beyond crypto, then these problems have to be addressed at some point.

Sasha Ivanov may be the founding father of the Waves Platform, a worldwide public blockchain platform that arrived at market capital more than $5.4 billion in 2022. It had been crowdfunded with 30,000 BTC, representing the 2nd-largest effectively crowdfunded blockchain project (after Ethereum). The name references his background like a theoretical physicist and also the lately-discovered gravitational waves predicted by Einstein a hundred years ago.

This information is for general information purposes and isn’t supposed to have been and cannot be used as legal or investment recommendations. The views, ideas, and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.