What’s a good investment DAO?

A decentralized autonomous organization (DAO) that raises and invests capital into assets with respect to its community is definitely an investment DAO. Investment DAOs take advantage of the power Web3 to democratize an investment process making it more inclusive.

DAOs can get their units in tokens which are for auction on a crypto exchange. The city rules are decided and governance is enforced through smart contracts. Governance legal rights (voting) could be prorated in line with the holdings within the DAO.

Related: Kinds of DAOs and the way to produce a decentralized autonomous organization

A decentralized organization that invests in cryptocurrencies, property, nonfungible tokens (NFTs) or other asset class has lots of functional variations from traditional investment vehicles. Many of the true once the underlying investment chance is really a crypto start-up. DAOs purchasing startups differ essentially from traditional investment capital (VC).

Before elaborating around the variations between traditional VC and investment DAOs, let’s know how traditional investment capital works.

What’s traditional VC?

A investment capital fund is founded and managed by general partners (Gps navigation). Gps navigation have the effect of sourcing investment possibilities, performing research and shutting investments inside a portfolio company.

Investment capital belongs to the main city pyramid and functions like a conduit that efficiently sources capital from large institutions like pension funds and endowments, and deploys that capital into portfolio firms. These large institutions, family offices and sometimes those who provide capital to some VC fund are known as limited partners (LPs).

The function from the Gps navigation would be to ensure they raise funds from LPs, source high-quality startups, perform detailed research, get investment committee approvals and deploy capital effectively. As startups grow and supply returns to VCs, the VCs spread the returns to LPs.

Traditional investment capital is a effective model which has catalyzed the development from the internet, social networking and most of the Web2 giants in the last 30 years. Yet, it’s not without its frictions which is these the Web3 model offers to address.

Challenges of traditional VC

Competitive with the VC model continues to be, still it has its own issues. They aren’t very inclusive and decision-making is very centralized. VC can also be considered a very illiquid asset class by institutional investors.

Exclusive

The VC model isn’t as inclusive as it may be. Because of the quantity of capital involved and also the risk profile from the asset class, it’s frequently only viable for stylish investors.

It is advisable to make sure that investors understand the risk-return profile of the investments. Therefore, investment capital might not be the best fit for those retail investors. Yet, you will find subsets from the retail investor community who’re sophisticated enough with this asset class. Yet, it’s frequently hard for even sophisticated retail investors to become LPs in VC funds.

This really is either because proven Gps navigation are frequently difficult to achieve for retail investors or since the minimum investment in to these funds is into the millions dollars.

Centralized

If participation being an LP is different, even investment decisions are usually produced by a little group that take a seat on an investment committee from the VC fund. Therefore, the majority of the investment decisions are highly centralized.

This frequently could be a limitation not just to investing globally but additionally to having the ability to identify hyperlocal possibilities within the last mile around the globe. A centralized team are only able to offer a lot when it comes to originations (of investment deals) and deployment abilities around the globe.

Illiquid

Another key problem with traditional VC is it is definitely an illiquid asset class. Capital deployed in to these funds is frequently kept in for a long time. Only if the VC fund comes with an exit, by means of a portfolio company being acquired or going public, perform the LPs see some capital came back.

LPs still purchase the investment capital asset class because the returns are usually better than more liquid assets like bonds and openly listed shares.

Let’s now consider the Web3 alternative for investment capital — investment DAOs.

Benefits of investment DAOs

DAOs gather Web3 ethos and also the operational seamlessness of smart contracts. Investors that have confidence in a particular investment thesis may come together and pool capital to create a fund. Investors can lead in various sizes towards the DAO based on their risk appetite as well as their governance (voting) legal rights are prorated according to their contributions.

Related: What exactly are smart contracts in blockchain and just how will they work?

How can investment DAOs address the shortcomings of traditional investment capital? Let’s talk of the running variations.

Inclusive access

Investment DAOs allow accredited investors to lead in most sizes. Due to their contributions, these investors can election on key investment decisions. Therefore, the processes of purchasing the DAO and choosing investments within the portfolio are generally more inclusive.

Deal sourcing could be decentralized, much like governance. Imagine managing a fund centered on technology for coffee maqui berry farmers around the globe. Getting community people from Nicaragua to Indonesia certainly works well for sourcing the very best last-mile investment possibilities. This enables investment vehicles to become more specialized, more global but highly local.

Because these DAOs could be tokenized and investors can make smaller sized contributions. This enables these to choose among a gift basket of funds that they are able to lead and diversify their risks. Also, DAOs tend to be more available to receiving investments from around the world (with exceptions) than traditional investment capital.

Imagine a certified retail investor with $100,000 wanting contact with subclusters of Web3 and crypto startups. The investor will find a good investment DAO centered on NFTs, decentralized finance, layer-1 cryptocurrencies and so forth, to spread their investment across each one of these different DAOs.

Liquid investments

In traditional VC, LPs aren’t able to liquidate their positions within the fund prior to the fund provides an exit. Tokenized investment DAOs address that issue. Investment DAOs may have a token that derives its value in the underlying portfolio. At any time over time, investors that own these tokens sell them on the crypto exchange.

In offering this functionality, investment DAOs offer returns much like individuals of traditional VCs, although having a lesser liquidity risk. This will make them a much better investment vehicle just in line with the risk-return profile.

What’s the issue?

Every chance carries risk and the other way around investment DAOs aren’t any exceptions. Despite their structural brilliance to traditional VCs, you may still find areas that remain unclear.

For example, because of the anonymous nature of crypto investments, it’s frequently hard to find out the sophistication from the investor. What this means is it’s harder to safeguard investors from taking high risks on the volatile asset. This can be a space that regulators are searching to deal with by governing the way a DAO markets itself to create investors onboard.

There’s also challenges in establishing a DAO in which the legal language is programmatically set into smart contracts. In traditional markets, these investment vehicles are frequently handcrafted by large legal teams. To depend on smart contracts to achieve that effectively poses a legitimate along with a technological risk.

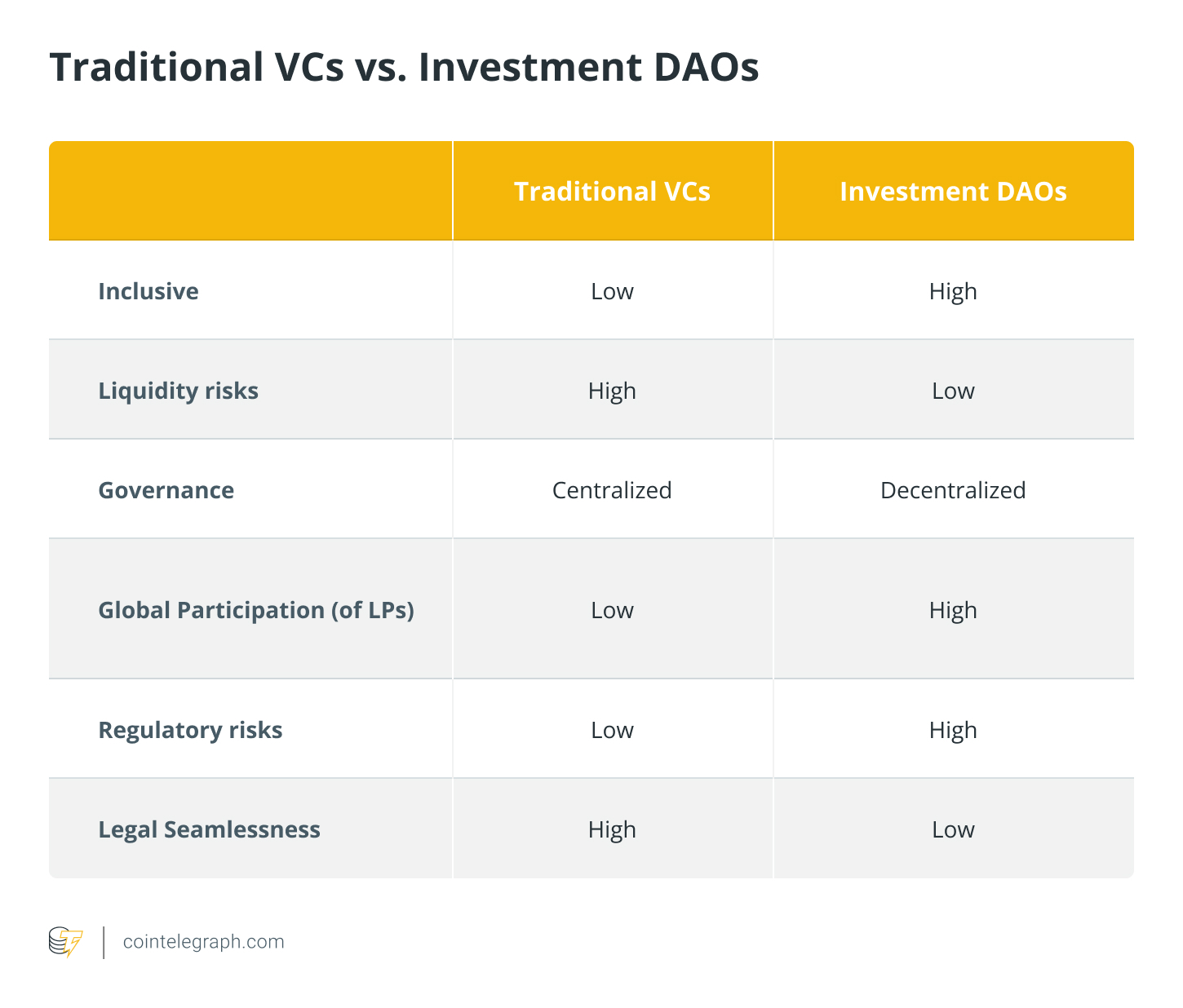

However, you will find firms like Doola that provide services to bridge the legal gap between Web3 and also the real life. This is a table that illustrates key variations backward and forward approaches.

Investment DAOs continue to be works happening. Yet, the model shows promise. When the legal and regulatory risks are fixed, investment DAOs may be the model that traditional VCs embrace.