All areas of a token’s production and management, including its allocation to numerous stakeholders, supply, token burn schedules and distribution, are managed through tokenomics analysis. Tokenomics help to look for the potential worth of decentralized finance (DeFi) projects. Because the law of demand and supply can’t be altered, tokenomics dramatically impacts the value of every nonfungible token (NFT) or cryptocurrency.

Related: What’s Tokenomics? A beginner’s guide on demand and supply of cryptocurrencies

However, there are numerous loopholes within the tokenomics design, like a substantial initial supply allocation to insiders, which can be a pump and dump danger signal. Also, there’s no manual about how founders, treasury, investors, community and protocol designers should split the tokens optimally.

Consequently, DeFi protocols, for example Curve, MakerDAO and Uniswap, lack a well planned initial token distribution, which leads to sub-optimal token distribution because greater contributors may not always obtain the best allocation or vice-versa. To resolve these problems, the bend protocol introduced election-escrowed tokenomics or veTokenomics. In the following paragraphs, become familiar with the fundamental idea of veTokenomics how veTokenomics works and it is benefits, and downsides.

What’s veTokenomics?

Underneath the veTokenomics concept, tokens should be frozen for any period of time, which inspires lengthy-term participation and lowers the tokens’ market supply. In exchange, users receive veTokens that can’t be offered and therefore are non-transferable. That stated, to have fun playing the governance mechanism, one should lock their tokens more than a fixed period of time, that will cause a natural token cost increase with time.

It’s possible to already secure your tokens in certain DeFi initiatives to get part of the protocol revenue. However, the veToken architecture differs for the reason that proprietors of those locked tokens can control the emission flow, growing the liquidity of the particular pool.

The speed where cryptocurrencies are produced and released is known as emission. The cryptocurrency’s economic model, particularly whether it’s inflationary or deflationary, affects the emission rate.This can lead to better alignment between your protocol’s success and also the incentives earned through the tokenholders because whales cannot use their votes to control the token prices.

So how exactly does veTokenomics work?

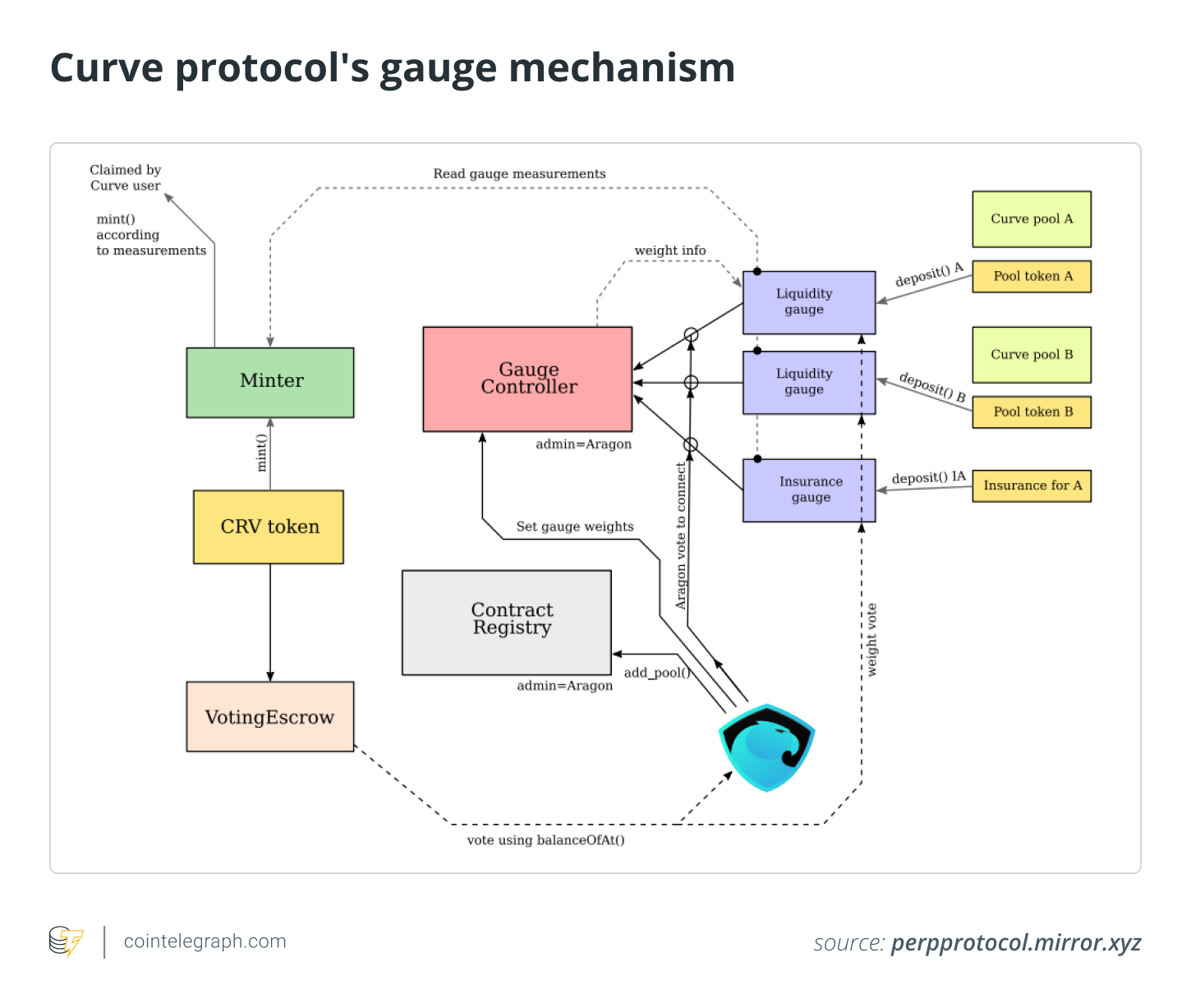

To know the significant of election deposit tokenomics, let us observe how Curve implements veTokenomics. Much like other DeFi protocols, liquidity providers (LPs) earn LP tokens for offering liquidity to Curve’s pools. These LP tokens could be deposited in to the Curve gauge to obtain the Curve DAO token (CRV), which liquidity providers can enhance by locking CRV. The liquidity gauge calculates just how much liquidity each user is adding. For instance, it’s possible to stake their liquidity provider tokens in every Curve pool’s unique liquidity gauge.

Furthermore, veCRV holders and LPs share the charges generated by Curve Finance. You have to lock their CRV governance tokens for any fixed period of time (1 week to 4 years) and quit their liquidity to acquire veCRV. Which means that lengthy-term stakers want the work to achieve success and aren’t inside it just to earn short-term gains.

veCRV holders can increase stake rewards by locking tokens for any lengthy time, choose which liquidity pools receive token emissions and obtain rewarded for staking by securing liquidity through swaps on Curve. However, the amount of time tokenholders have locked their veTokens affects just how much influence they’ve within the voting process.

Consider Bob and Alex, who each have a similar quantity of CRV. Bob locked his tokens for 2 years, while Alex only had them for just one year. The veCRV, voting power and connected yields are bending for Bob while he locked his tokens a bit longer than Alex. This type of dynamic promotes lengthy-term engagement in decentralized autonomous organization (DAO) projects and assures the token issuance is carried out democratically.

Other types of veTokenomics include Balancer, which introduced veBAL tokens in March 2022 having a maximum locking time as high as twelve months. Frax Finance also recommended using veFXS tokens, letting proprietors choose gauges that will distribute FXS emissions among various pools on several decentralized exchanges (DEXs).

Do you know the advantages and disadvantages of veTokenomics?

From comprehending the basics of veTokenomics, it’s apparent that tokenholders get rewarded for blocking the availability of veTokens, which cuts down on the way to obtain LP tokens and therefore selling pressure. What this means is tokenholders holding a large amount of tokens cannot manipulate their cost. In addition, this popular tokenomics model promotes adding more liquidity to pools, strengthening a stablecoin’s capability to keep its peg.

Since there wasn’t any marketplace for tokens of liquidity providers apart from exercising governance legal rights and speculating, the first DeFi governance tokens had virtually no effect on the cost. However, locked veTokens positively change up the supply dynamics since the community expects enhanced yields, valuable governance legal rights and aligning the priorities of stakeholders.

Regardless of the above pros from the vetoken model, there are numerous drawbacks of veTokenomics that stakeholders should be aware. Since not everybody invests for that lengthy-term, the protocol following a veTokenomics model might not attract short-term investors.

Additionally, if tokens are locked for extended, the chance costs could be excessive as you can’t unlock them up until the maturity date when they change their mind. Furthermore, this model diminishes lengthy-term oriented incentives and weakens the decentralization of governance when the protocol offering such tokens has nearly all veTokens.

The way forward for the veTokenomics model

Within the traditional tokenomics model, governance tokens that just grant the ability to election are thought invaluable by Curve Finance (the pioneer from the veTokenomics model). Furthermore, it believes there’s little reason behind anybody to get fully dedicated to a task when “governance” may be the only factor driving demand.

The brand new tokenomic system known as veTokenomics is really a significant advancement. Even though it lowers the availability, compensates lengthy-term investors and harmonizes investor incentives using the protocol, the veTokenomics model continues to be immature.

Later on, we might experience additional protocols incorporating veTokenomics to their design architecture additionally to developing novel methods to build distinctive economic systems which use veTokens like a middleware base. Nevertheless, because the future is unpredictable, it’s not easy to guess how tokenomics models will evolve within the approaching years.

Buy a licence with this article. Operated by SharpShark.