Affluent investors in Asia are neither shy nor ignorant about crypto, with research revealing that 52% of these held some type of an electronic asset during Q1 2022.

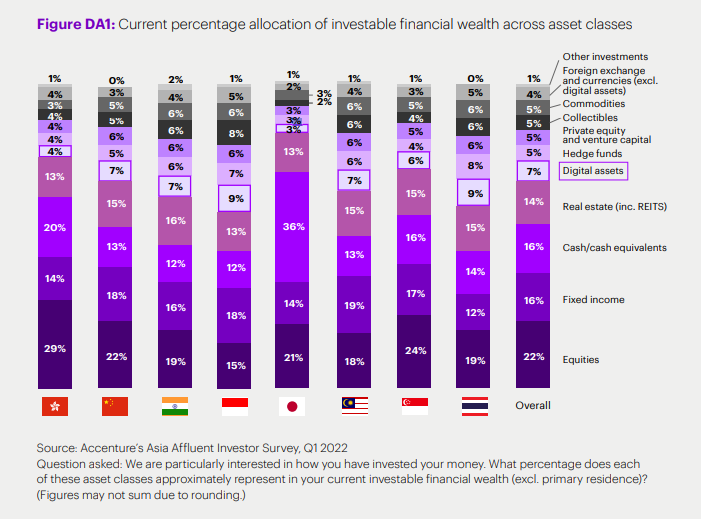

Based on research from Accenture printed on June 6, digital assets, including cryptocurrencies, stable coins, and crypto funds, composed typically 7% from the surveyed investors’ portfolios, which makes it the 5th-largest asset class for investors in Asia.

It had been greater than they allotted to foreign currency, goods, and collectibles, and perhaps was on componen with or exceeded the quantity committed to private equity financeOrendeavor capital and hedge funds.

Accenture stated laptop computer was conducted using more than 3,200 clients across China, Hong Kong, India, Indonesia, Japan, Malaysia, Singapore, and Thailand. The organization defines an affluent investor as anybody that manages investable assets which is between US$100,000 to $a million.

Investors in Thailand and Indonesia had the biggest number of digital assets within their portfolios when compared with their peers.

Though 1 / 2 of the investors in Asia were already holding digital assets in Q1 2022, Accenture’s research signifies that the further 21% are likely to invest inside them through the finish of 2022, meaning as much as 73% of wealthy Asian investors could hold an electronic asset through the finish of the season.

“Digital assets represent an uncommon, obvious industry white-colored space with significant business chance.”

Wealth managers holding back

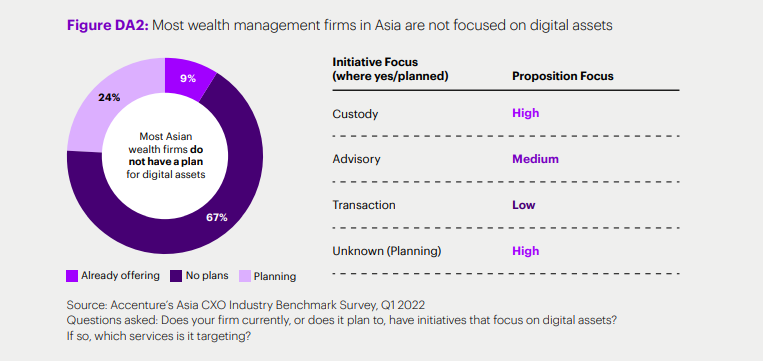

However, the firm discovered that wealth management firms, individuals that offer financial planning, tax, investment recommendations, and estate intending to their customers, happen to be slow to board the crypto train. 67% of wealth management firms stated other product intends to offer digital asset services or products.

“For wealth management firms, digital assets really are a US$54bn revenue opportunity— that many are ignoring.”

Wealth management firms reported too little belief and knowledge of digital assets, a wait-and-see mindset, and also the operational complexity of launching an electronic asset offering because the primary reason behind holding back, leading these to prioritize other initiatives rather.

Accenture stated the possible lack of engagement by firms implies that investors happen to be forced to have their financial assistance with crypto from hard to rely on sources.

“This insufficient engagement by firms means many customers are seeking assistance with digital assets on unregulated forums, including peer-to-peer suggestions about social networking.”

Related: Social networking blamed for $1B in crypto scam losses in 2021

However, Accenture has stressed the significance for wealth management firms to push forward in to the digital asset space, or risk being left out.

“While many firms are reluctant to go in digital assets space, as well as for a variety of reasons, their competitors have proven that success can be done.”

Asia’s investors happen to be starting to warm up to crypto, especially in the this past year.

In April, a study by Gemini cryptocurrency exchange discovered that crypto adoption skyrocketed in 2021, specifically in countries for example India and Hong Kong. Around 45% of respondents within the Asia Off-shore purchased their first crypto in 2021.