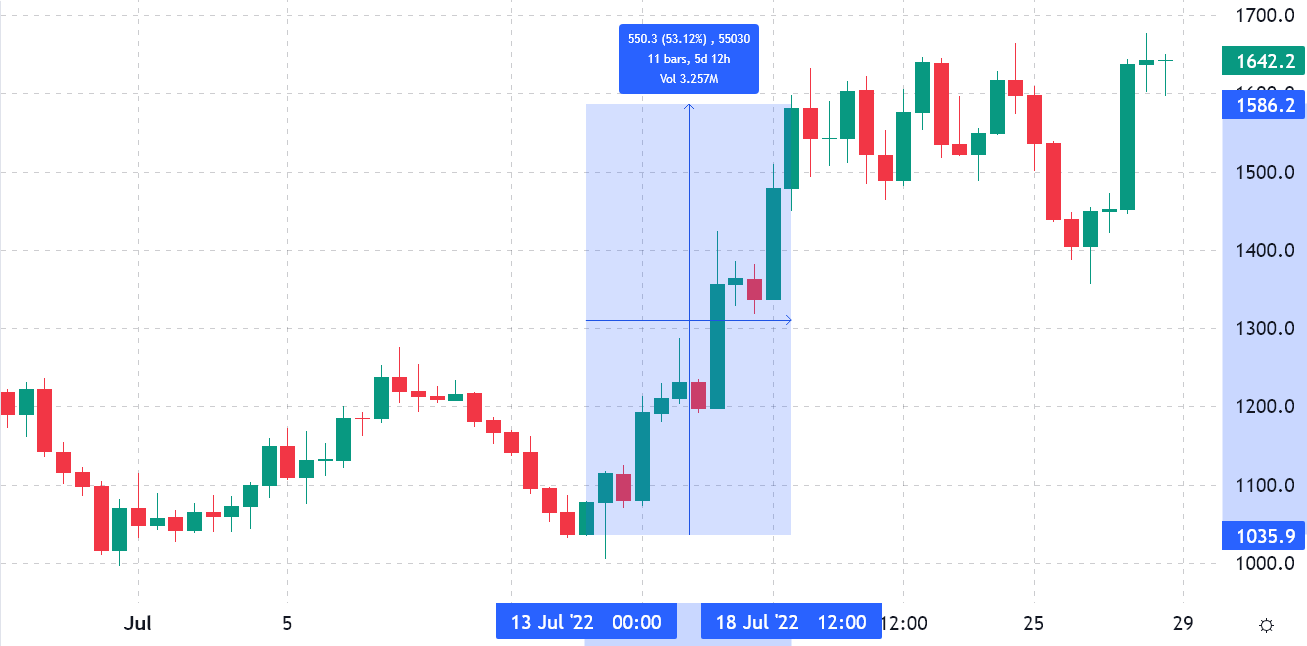

Ether’s (ETH) 53% rally between This summer 13 and 18 gave bulls an advantage in July’s $1.26 billion monthly options expiry. The move happened as Ethereum developers set a tentative date for that “Merge,” a transition from the troublesome proof-of-work (Bang) mining mechanism.

Based on some analysts, by taking out the additional ETH issuing accustomed to finance the power cost needed on traditional mining consensus, Ether could finally attain the “ultra-seem money” status.

On Beacon Chain, the issuance is going to be around 1,600 ETH each day reducing the inflation considerably from 13,000 ETH each day on Bang.

Merge sets effects on financial policies of Ethereum to get Ultrasound money.

(10/15) pic.twitter.com/9hWjhuGpNK

— Akshay Jain (@akshayjain865) This summer 25, 2022

Whether seem financial policy involves constantly altering the issuing and burning rules remains a wide open question, but it looks like the Ethereum developers’ video call on This summer 14 helped to catapult ETH cost.

On This summer 26, an abrupt dramatic spike in Ethereum network active addresses elevated multiple speculations about whether Ether is targeting its previous all-time high. Analytics firm Santiment reported that the amount of 24-hour daily active addresses arrived at 1.06 million, smashing the previous 718,000 high challenge in 2018. Theories for example “Binance carrying out a maintenance sweep” emerged, but nothing is proven yet.

The primary victims of Ether’s impressive 20% recovery on This summer 27 were leveraged bearish traders (shorts) who faced $335 million in aggregate liquidations at derivatives exchanges, based on data from Coinglass.

Bears placed their bets below $1,600

Outdoors interest for Ether’s This summer monthly options expiry is $1.27 billion, however the actual figure is going to be lower since bears were excessively-positive. These traders got too comfortable after ETH was below $1,300 between June 13 and 16.

The pump above $1,500 on This summer 27 surprised bears since 17% from the put (sell) choices for This summer 29 happen to be placed above that cost level.

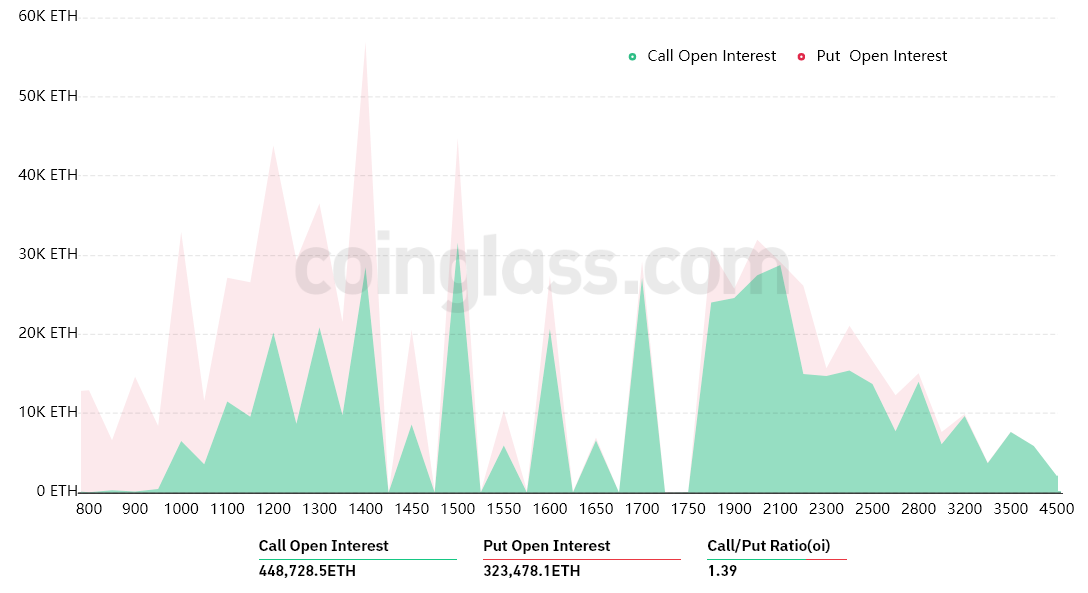

The Fir.39 call-to-put ratio shows the dominance from the $730 million call (buy) open interest from the $530 million put (sell) options. Nonetheless, as Ether stands near $1,600, most bearish bets will probably become useless.

If Ether’s cost remains above $1,500 at 8:00 am UTC on This summer 29, only $80 million put (sell) options is going to be available. This difference is really because the right to market Ether at $1,500 or lower is useless if Ether trades above that much cla on expiry.

Bulls are comfy even below $1,600

Here are the 4 probably scenarios in line with the current cost action. The amount of options contracts on This summer 29 for call (bull) and set (bear) instruments varies, with respect to the expiry cost. The imbalance favoring both sides constitutes the theoretical profit:

- Between $1,400 and $1,500: 120,400 calls versus. 80,400 puts. The internet result favors the phone call (bull) instruments by $60 million.

- Between $1,500 and $1,600: 160,500 calls versus. 55,000 puts. The internet result favors bulls by $160 million.

- Between $1,600 and $1,700: 187,100 calls versus. 43,400 puts. The internet result favors the phone call (bull) instruments by $230 million.

- Between $1,700 and $1,800: 220,800 calls versus. 40,000 puts. Bulls’ advantage increases to $310 million.

This crude estimate views the put options utilized in bearish bets and also the call options solely in neutral-to-bullish trades. Nevertheless, this oversimplification disregards more complicated investment opportunities.

For instance, an investor might have offered a put option, effectively gaining positive contact with Ether over a specific cost, but regrettably, there is no good way to estimate this effect.

Bears should give up and concentrate on the August expiry

Ether bulls have to sustain the cost above $1,600 on This summer 29 to have a decent $230 million profit. However, the bears’ best situation scenario needs a push below $1,500 to lessen the harm to $60 million.

Thinking about the brutal $330 million leverage short positions liquidated on This summer 26 and 27, bears must have less margin to pressure ETH cost lower. With this particular stated, bulls be more effective positioned to carry on driving ETH greater following the This summer 29 monthly options expiry.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.