Ether (ETH) cost continues to be not able to shut above $1,400 within the last 29 days and contains been buying and selling inside a relatively tight $150 range. Right now, the $1,250 support and also the $1,400 resistance appear hard to break, but two several weeks ago, Ether was buying and selling at $2,000. The present cost range for Ether simply reflects how volatile cryptocurrencies could be.

In one side, investors are calm as Ether trades 50% over the $880 intraday have less June 18. However, the cost continues to be lower 65% year-to-date regardless of the most enjoyable upgrade within the network’s sev-year history.

More to the point, Ethereum’s greatest rival, BNB Chain, endured a mix-chain security exploit on March. 6. The $568 million exploit caused BNB Chain to temporarily suspend all transactions around the network, which holds $5.4 billion in smart contracts deposits.

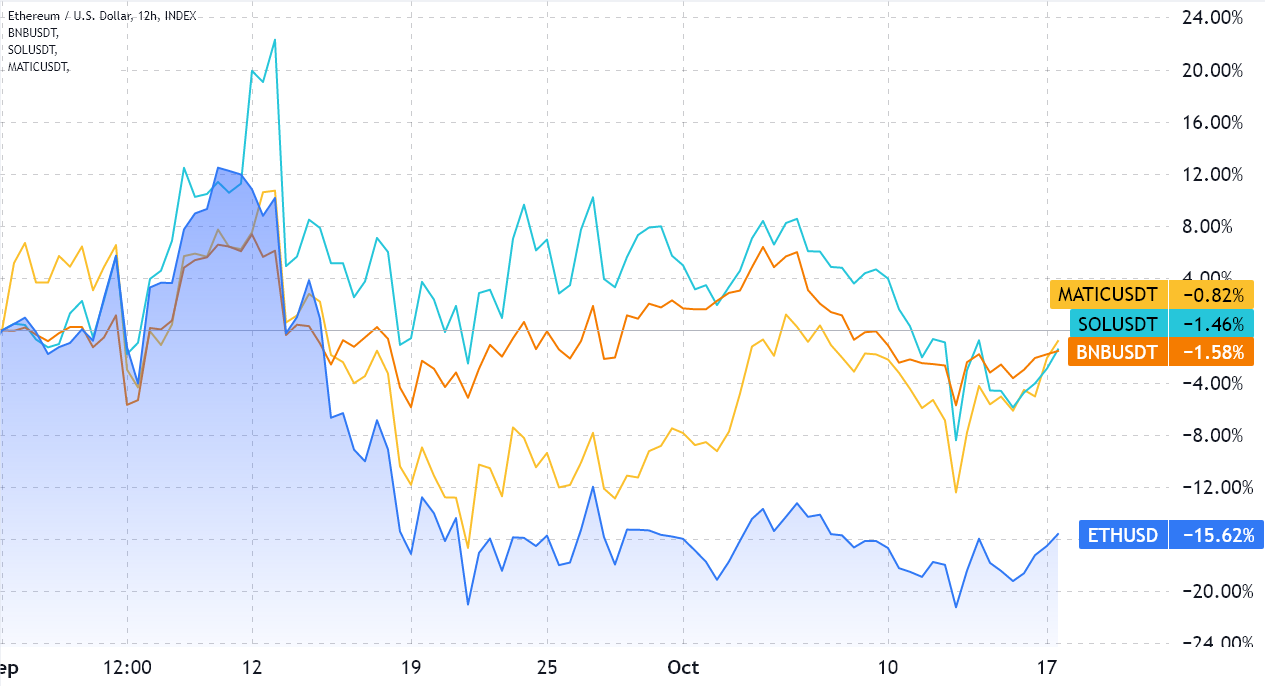

Ether underperformed competing smart contracts like BNB, Cardano (ADA), and Solana (SOL) by 14% since September, despite the fact that its TVL in ETH terms elevated by 9% throughout the period. This means the Ethereum network’s issues, like the $3 average transaction charges, considered around the ETH cost.

Traders need to look at Ether’s derivatives markets data to know how whales and market makers are situated.

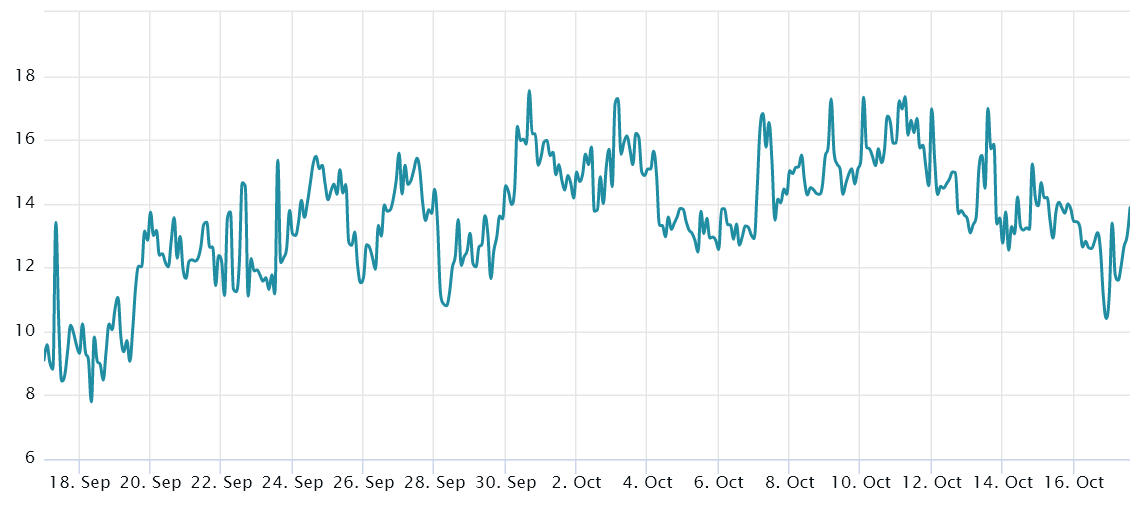

Options traders remain moderately risk-averse

The 25% delta skew is really a telling sign whenever professional traders overcharge for upside or downside protection. For instance, if traders expected an Ether cost crash, the choices markets skew indicator would move above 12%. However, generalized excitement reflects an adverse 12% skew.

In layperson’s terms, the greater the index, the less inclined traders will be to offer downside risk protection. The indicator continues to be signaling fear since Sept. 19, if this last held something below 10%. On that day marked the temporary bottom of the 28% weekly correction, because the $1,250 support strengthened after this type of test.

Lengthy-to-short data show traders adding longs

The very best traders’ lengthy-to-short internet ratio excludes externalities that may have exclusively impacted the choices markets. By aggregating the positions around the place, perpetual and quarterly futures contracts, it’s possible to better understand whether professional traders are leaning bullish or bearish.

You will find periodic methodological discrepancies between different exchanges, so viewers should monitor changes rather of absolute figures.

Binance displayed a modest rise in its lengthy-to-short ratio between March. 13 and 17, because the indicator moved from 1.04 to at least one.07 in individuals four days. Thus, individuals traders slightly elevated their bullish bets.

Huobi data shows a reliable pattern because the lengthy-to-short indicator remained near .98 whole time. Lastly, at OKX exchange, the metric stepped to .72 on March. 13, largely favoring shorts simply to rebound to the present 1.00.

Typically, based on the lengthy-to-short indicator, the very best traders from individuals three exchanges happen to be growing lengthy positions because the $1,200 support test on March. 13.

Skew and leverage are important to sustaining the $1,250 support

There wasn’t any significant improvement in pro traders’ derivatives positions despite Ether gaining 12% because the March. 13 crash lower to $1,185. Furthermore, options traders fear that the move below $1,250 remains achievable, thinking about the skew indicator remains over the 10% threshold.

If these whales and market makers had firm convictions of the sharp cost correction, that could have been reflected within the exchange top traders’ lengthy-to-short ratio.

Investors should carefully monitor both metrics. The 25% delta skew should stay at 18%, and also the lengthy-to-short ratio above .80 to sustain the $1,250 support strength. These indicators really are a telling manifestation of if the bearish sentiment from top traders is gaining momentum.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.