Whomever created the saying “sell in May and go away” had brilliant insight and also the performance of crypto and stock markets in the last three days has proven the expression still rings true.

May 20 has witnessed a pan selloff across all asset classes, departing traders with couple of choices to escape the carnage as inflation concerns and rising rates of interest still dominate the headlines.

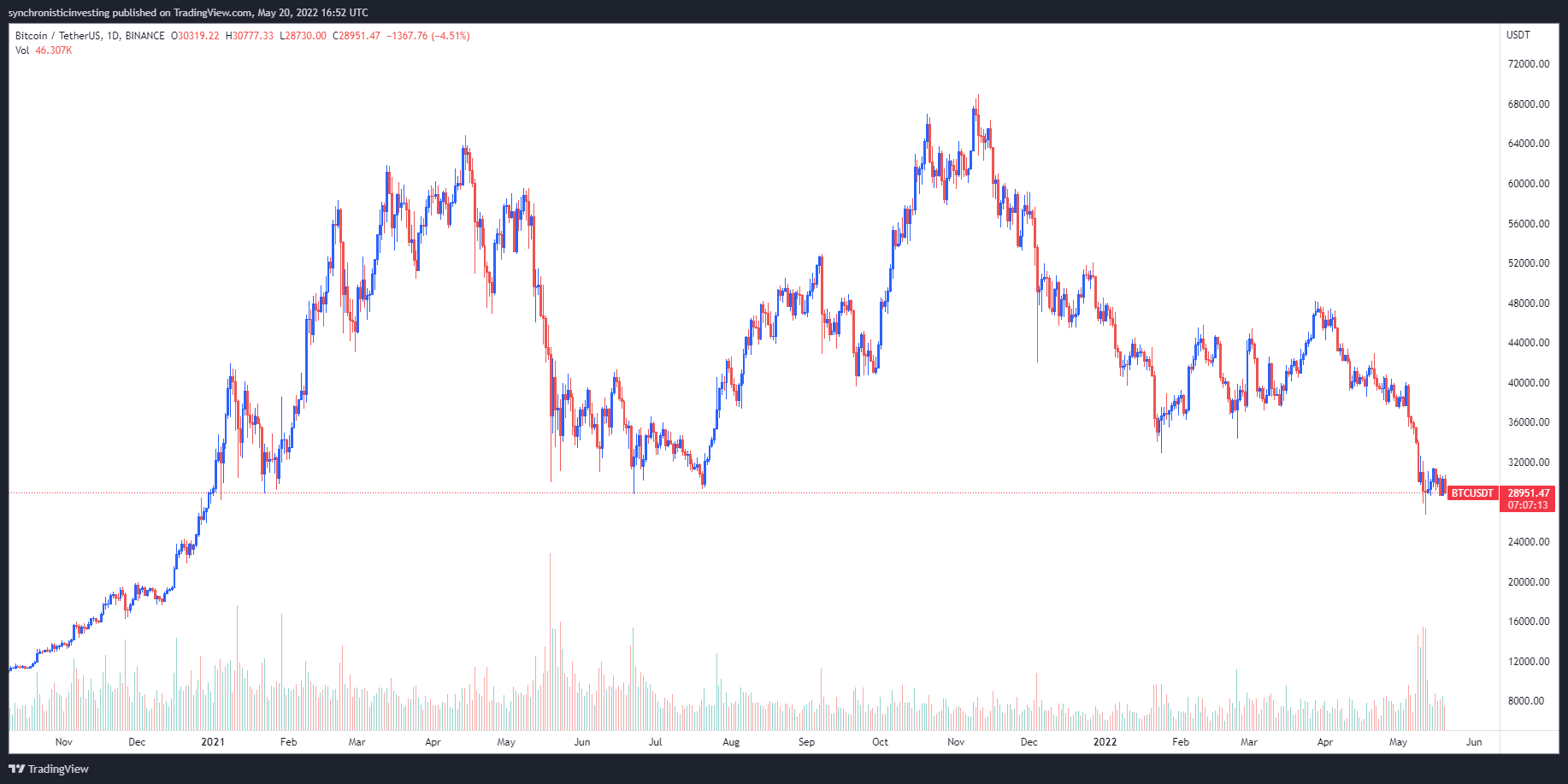

Data from Cointelegraph Markets Pro and TradingView implies that the cost of Bitcoin (BTC) dealing with water below $29,000 and traders worry that losing this level will make sure a vacation to the low $20,000s within the coming week.

Reported by Cointelegraph, some analysts warn that BTC could possibility decline to $22,700 according to its historic cost performance carrying out a dying mix.

Further proof of muted expectations from traders can be based in the put/call ratio for BTC open interest, which hit a 12-month a lot of .72 on May 18 based on the cryptocurrency research firm Delphi Digital.

Delphi Digital stated,

“A high put/call ratio signifies that investors are speculating whether Bitcoin continuously sell, or it might mean investors are hedging their portfolios against a downward move.”

Stocks enter bear market territory

May 20 introduced more discomfort towards the traditional markets because the S&P 500 fell another 1.62%, marking a far more than 20% decline from the The month of january 2022 all-time high and additional stoking recession fears. When the index seems to close your day lower 20% in the all-time-high, that will formally place the benchmark index in bear market territory.

The Nasdaq Composite and Dow jones also have seen significant losses among the prevalent weakness, using the Nasdaq losing 275 points for any 2.42% loss, as the Dow jones has fallen 362 points, marking a decline of just one.28%.

Related: Crypto veterans extend a helping hands to deal with market newbies

What’s harmful to BTC is a whole lot worse for altcoins

Altcoins also offered off dramatically as BTC, Ether and stocks retracted, reversing increases seen earlier at the time.

The couple of vibrant spots were Ellipsis (EPS), Persistence (XPRT) and 0x (ZRX), which acquired 30%, 13.92% and 12.34% correspondingly.

The general cryptocurrency market cap now is $1.234 trillion and Bitcoin’s dominance rates are 44.6%.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.