After many years of waiting, Ethereum is finally prepared to become full-fledged proof-of-stake (PoS) blockchain. Besides Ethereum’s native token Ether (ETH), the valuation of countless other tokens haven’t only benefited greatly, but tend to also keep outperforming ETH following the Merge.

Ethereum steps closer toward the Merge

The key smart contract platform completed all of the its three public testnets dubbed “Goerli,” on August. 11. Therefore, tthere shouldn’t be delays in Ethereum’s “Merge,” likely to go survive Sep. 19.

Ether cost leaped 5% to roughly $1,950, its greatest level in over two several weeks, following the Goerli update. Meanwhile, certain crypto assets that may need a effective Merge are undergoing upside moves, and also have even been outperforming ETH previously month.

Will these tokens still outshine ETH cost into September? Let us take particular notice.

Lido DAO (LDO)

The Merge will replace Ethereum’s army of miners with validators, who definitely are needed to front 32 ETH being an economic stake.

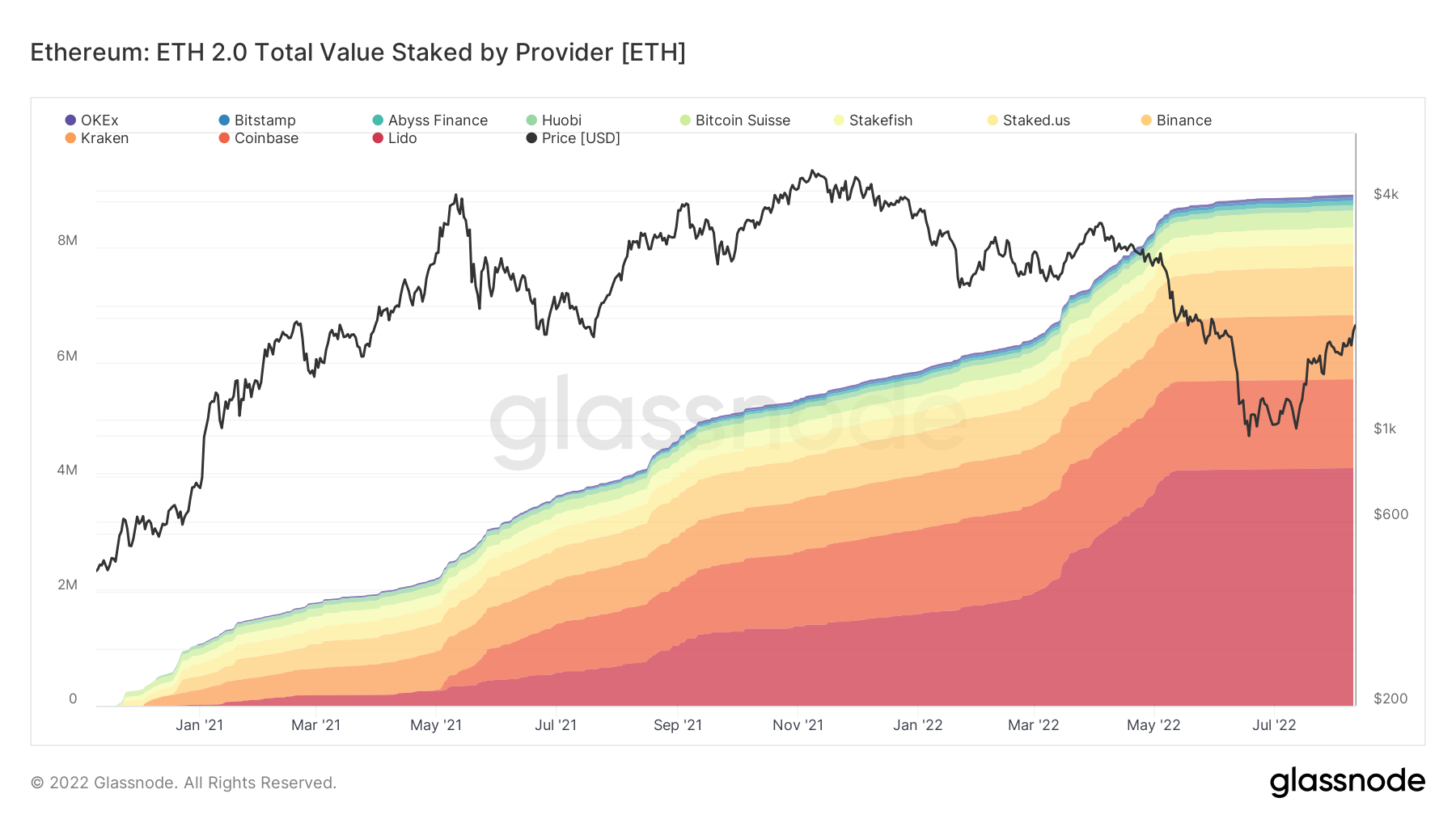

This major staking requirement has opened up up possibilities for middlemen, i.e., platforms that collect Ether from underfunded stakers and set the proceeds together to get validator around the Ethereum blockchain. Lido DAO is a included in this.

Related: Could it be foolish to anticipate an enormous Ethereum cost surge pre- and publish-Merge?

Lido DAO may be the leading staking service when it comes to value locked inside Merge’s official smart contract. Particularly, it’s put 4.15 million ETH in to the so-known as ETH 2. contract, leading Coinbase, that has staked approximately. 1.55 million ETH with respect to its clients.

A effective Merge could raise the interest in Lido DAO services.

Consequently, it might prove bullish for that platform’s official governance token, LDO, whose value had already soared by greater than 200% since This summer 14, when Ethereum first announced the probability of being a PoS chain in September.

Therefore, LDO is among the primary crypto assets that may benefit the best from Ethereum’s effective transition to POS.

Ethereum Classic (ETC)

Ethereum Classic (ETC) is yet another asset which has grabbed the bulls’ attention in recent days. That’s primarily due to the potential to supply a haven for miners exiting the Ethereum network.

Since Ethereum Classic may be the split chain from a contentious hard fork in 2016, it exhibits the majority of the technical characteristics of the present, Bang Ethereum network, which makes it an all natural refuge for ETH miners.

Like LDO, ETC has additionally rallied by over 200% because the Ethereum’s Merge launch announcement on This summer 14. Therefore, its probability of ongoing its upward trend is high ahead after the Merge.

Optimism (OP)

Optimism is definitely an Ethereum rollup service. Quite simply, it aggregates mass transaction data off-chain into batches and releases results to the Ethereum mainnet whenever a consensus is arrived at.

The so-known as layer-2 solution may need Ethereum’s “Rollup-Centric Roadmap” following the Merge. Interestingly, OP, Optimism’s governance token, has rallied nearly 250% because the Merge release date announcement.

The prospects of Ethereum deploying Optimism on its network following the Merge could help as a bullish catalyst for OP cost.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.