Ether (ETH) cost expires 60% since May 3, outperforming leading cryptocurrency Bitcoin (BTC) by 32% over that span. However, evidence suggests the present $1,600 support lacks strength as network use and smart contract deposit metrics weakened. Furthermore, ETH derivatives show growing sell pressure from margin traders.

The positive cost move was mainly driven by growing certainty of the Merge, that is Ethereum’s transition to some proof-of-stake (PoS) consensus network. Throughout the Ethereum core developers business call on This summer 14, developer Tim Beiko suggested Sept. 19 because the tentative target date for that Merge. Additionally, analysts expect the brand new way to obtain ETH to become reduced by as much as 90% following the network’s financial policy change, thus developing a bullish catalyst.

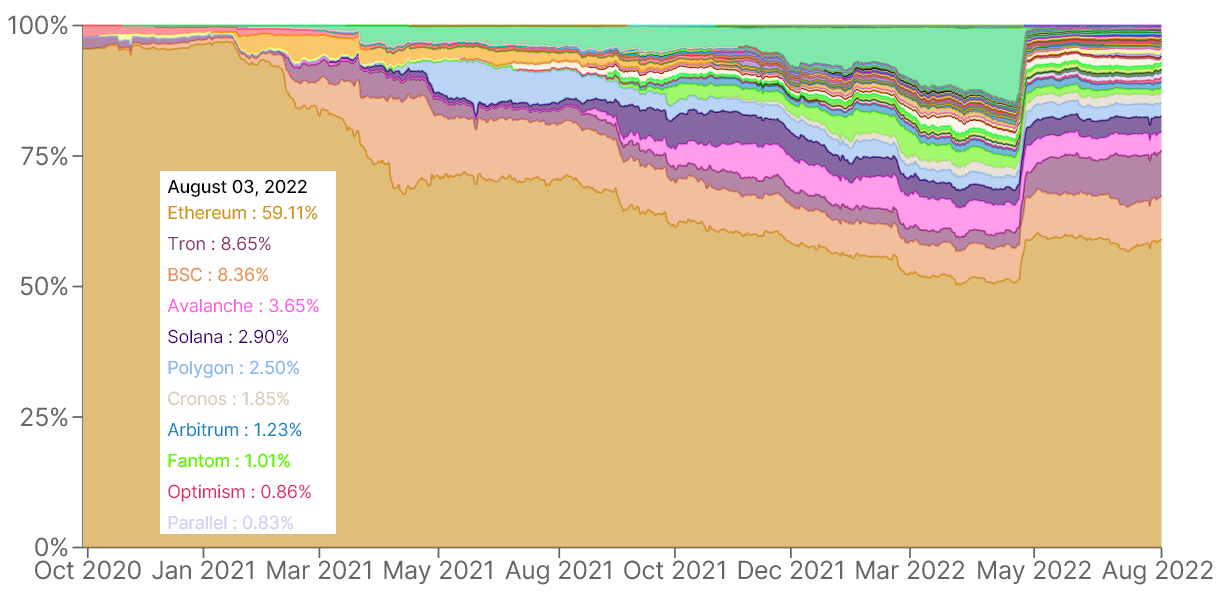

Ethereum’s total value locked (TVL) has vastly taken advantage of Terra’s ecosystem collapse in mid-May. Investors shifted their decentralized finance (DeFi) deposits towards the Ethereum network because of its robust security and fight-tested applications, including MakerDAO (MKR) — the work behind the DAI stablecoin.

Presently, the Ethereum network holds a 59% share of the market of TVL, up from 51% on May 3, based on data from Defi Llama. Despite gaining share, Ethereum’s current $40 billion deposits on smart contracts appear less space-consuming than the $100 billion observed in December 2021.

Interest in decentralized application (DApp) experience Ethereum appears to possess weakened, thinking about the median transfer charges, or gas costs, which presently stand at $.90. This is a sharp drop from May 3, once the network transaction costs surpassed $7.50 typically. Still, one might reason that greater utilization of layer-two solutions for example Polygon and Arbitrum have the effect of the low gas charges.

Options traders are neutral, exiting the “fear” zone

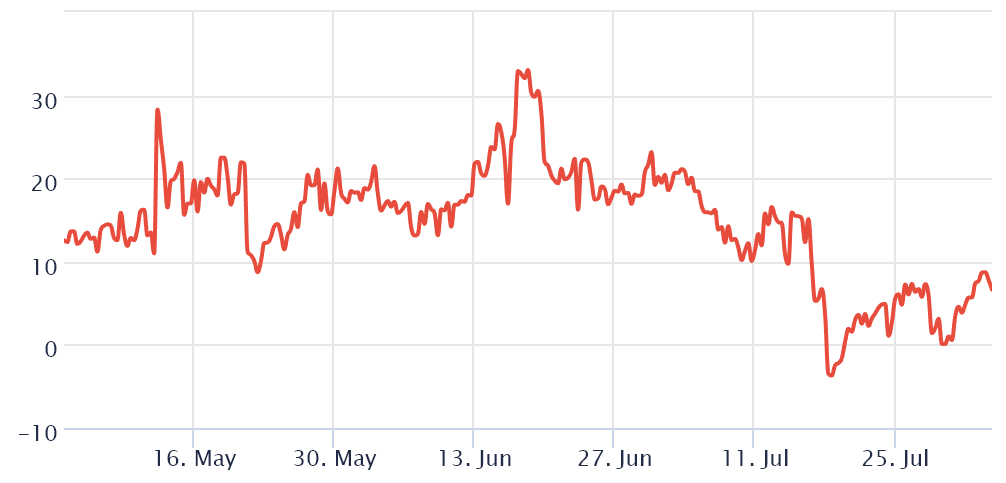

To know how whales and market makers are situated, traders need to look at Ether’s derivatives market data. For the reason that sense, the 25% delta skew is really a telling sign whenever professional traders overcharge for upside or downside protection.

If investors expect Ether’s cost to rally, the skew indicator moves to -12% or lower, reflecting generalized excitement. However, a skew above 12% shows desire not to take bullish strategies, usual for bear markets.

For reference, the greater the index, the less inclined traders will be to cost downside risk. As displayed above, the skew indicator exited “fear” mode on This summer 16 as ETH broke over the $1,300 resistance. Thus, individuals option traders no more have greater likelihood of an industry downturn because the skew remains below 12%.

Related: Ethereum will outpace Visa with zkEVM Rollups, states Polygon co-founder

Margin traders are reducing their bullish bets

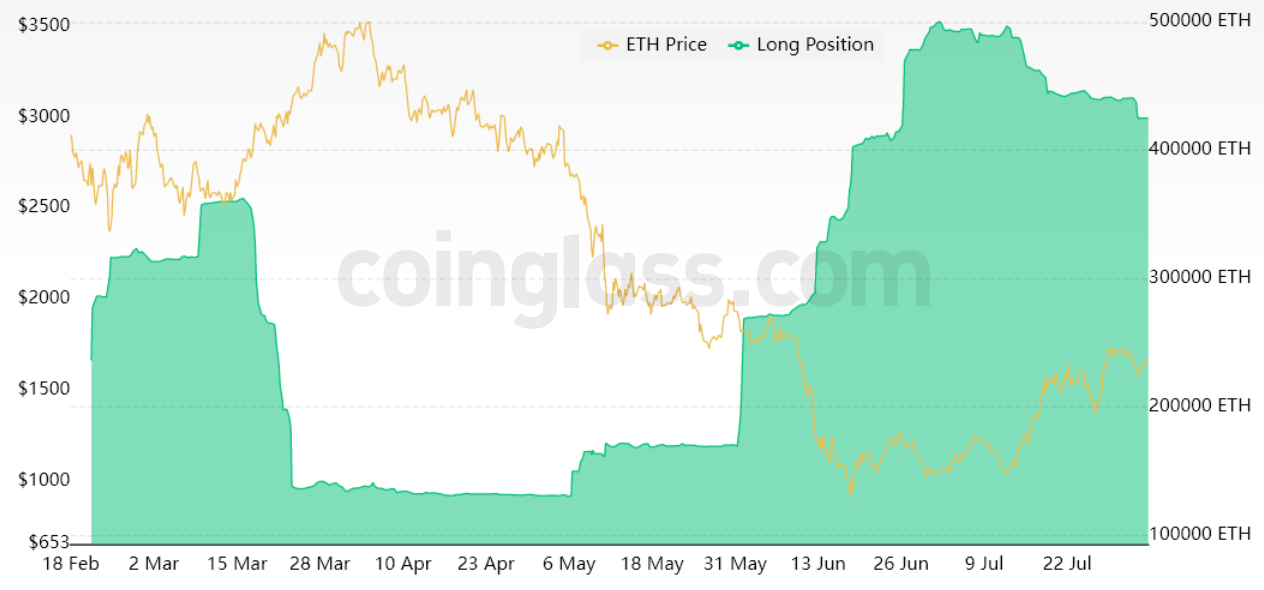

To verify whether these movements were limited towards the specific options instrument, you ought to evaluate the margin markets. Lending enables investors to leverage their positions to purchase more cryptocurrency. When individuals savvy traders open margin longs, their gains (and potential losses) rely on Ether’s cost increase.

Bitfinex margin traders are recognized for creating position contracts of 100,000 ETH or greater in an exceedingly small amount of time, indicating the participation of whales and enormous arbitrage desks.

Ether margin longs peaked at 500,000 ETH on This summer 2, the greatest level since November 2021. However, data shows individuals savvy traders have reduced their bullish bets because the ETH cost retrieved a number of its losses. Data shows no proof of Bitfinex margin traders anticipating the 65% correction from May to sub-$1,000 in mid-June.

Options risk metrics show pro traders are less frightened of a possible crash, but simultaneously, margin markets players happen to be unwinding bullish positions because the ETH cost attempts to set up a $1,600 support.

Apparently, investors continuously monitor the impacts of nominal TVL deposits and interest in smart contracts on network gas charges prior to making additional bullish bets.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.