It’s broadly recognized the fate from the cryptocurrency market depends largely around the performance of Bitcoin (BTC), making occasions such as these for crypto traders preferring to purchase altcoins.

When BTC cost is lower, altcoins have a tendency to follow, but because a bottoming process begins, altcoins have a tendency to improve during Bitcoin’s consolidation phases which typically results in a demand an altcoin season. While Bitcoin’s current dip below $30,000 shows that it is bit premature to to have an altseason, analysts continue to be charting a number of different outcomes that could indicat an altcoin season. Let us take a look.

ETH/BTC cost action happens to be an early indicator

Understanding of the potential of an altcoin season while using ETH/BTC chart being an indicator was discussed by analyst and pseudonymous Twitter user PlanDeFi, who published the next chart evaluating the 2016 to 2017 performance of ETH/BTC from the pair’s performance in 2021–2022.

PlanDeFi stated,

“Looks damn similar, right? Accumulation>Breakout>Ascending Funnel>Breakout. The marketplace is larger now — you just need longer.”

In line with the projection provided, the following altseason could start sometime after the beginning of This summer also it can extend with the finish of 2022.

A 2017 fractal suggests an altseason is imminent

Further evidence the market might be approaching an inflection point was supplied by El_Crypto_Prof, who published the next chart searching in the good reputation for the altcoin market capital.

El_Crypto_Prof stated,

“When you are looking at altcoins, I can tell the next scenario happening. You will find way too many similarities using the previous cycle. RSI also looks incredible. The following wave up leaves many behind.”

Related: Given money printer adopts reverse: Exactly what does it mean for crypto?

The marketplace is firmly in “Bitcoin Season”

While fractals are pleasing towards the eye and provide aspire to disillusioned traders, most neglect to materialize and they’re not accurate analysis techniques to depend on when buying and selling.

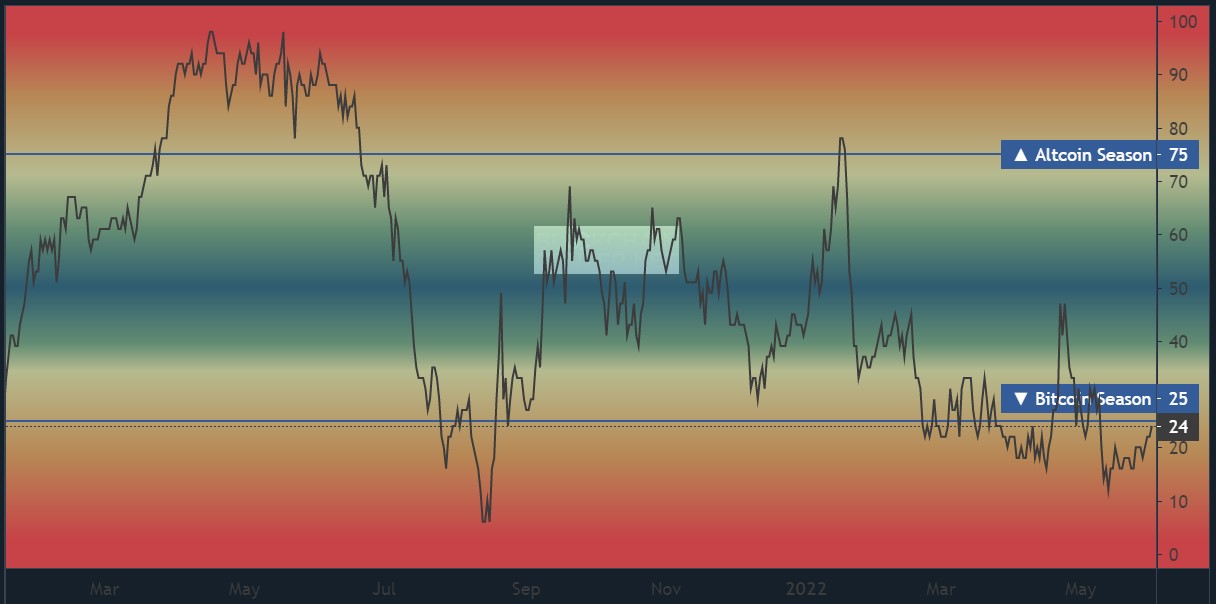

The Altseason Indicator supplies a more metrics-based way of predicting once the marketplace is in “Bitcoin season” and “altcoin season.”

Based on the chart above, it doesn’t appear as if an altseason will probably happen in the near future since the metric is presently supplying a readout of 24, as the level required to signify an altseason is 75.

In line with the past performance from the index, it’s taken no less than 2 to 3 several weeks for this to climb in the area indicating that it’s Bitcoin season towards the altcoin season level. Current projections, according the the indicator, claim that an altcoin season may not start until August or September 2022.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.