Financial markets are frightening at this time, even though everything is prone to worsen, it doesn’t mean investors have to sit out watching in the sidelines. Actually, history has shown that among the best occasions to purchase Bitcoin (BTC) happens when nobody is speaking about Bitcoin.

Recall the 2018–2020 crypto winter? I actually do. Hardly anybody, including mainstream media, was speaking about crypto inside a negative or positive way. It had been during this period of prolonged downtrend and extended sideways chop that smart investors were accumulating when preparing for the following bull trend.

Obviously, nobody understood “when” this parabolic advance would occur, however the example is solely designed to illustrate that crypto may be inside a crab market, but you may still find great techniques for purchasing Bitcoin.

Let’s check out three.

Accumulation via dollar-cost averaging

It’s useful to become cost agnostic with regards to purchasing assets within the lengthy term. A cost agnostic investor is safe from fluctuations in value and can identify a couple of assets they have confidence in and then increase the positions. When the project has good fundamentals, a powerful, active use situation along with a healthy network, it will work better to simply dollar-cost average (DCA) right into a position.

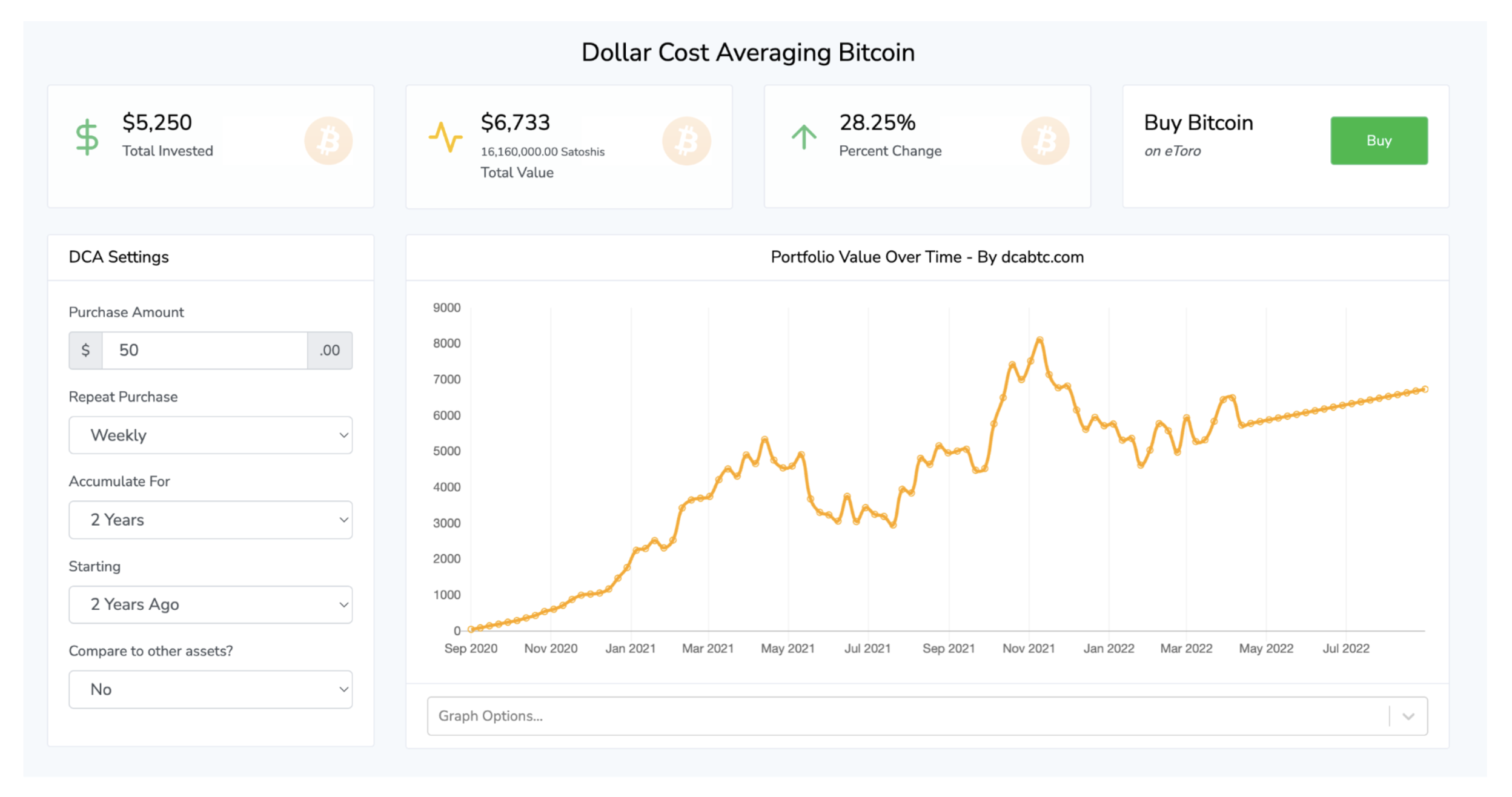

Take, for instance, this chart from DCA.BTC.

Investors who auto-purchased $50 in BTC weekly more than a two-year span continue to be in profit today, by DCA, there’s you don’t need to make trades, watch charts, or subject yourself towards the emotional stress that’s connected with buying and selling.

Trade the popularity and go lengthy off extreme lows

Apart from steady, reasonably sized dollar-cost averaging, investors ought to be creating a war chest of dry powder and merely located on their hands awaiting generational buying possibilities. Entering the marketplace when it’s deeply oversold and all sorts of metrics have been in extreme is usually the right place to spread out place longs however with under 20% of one’s dry powder.

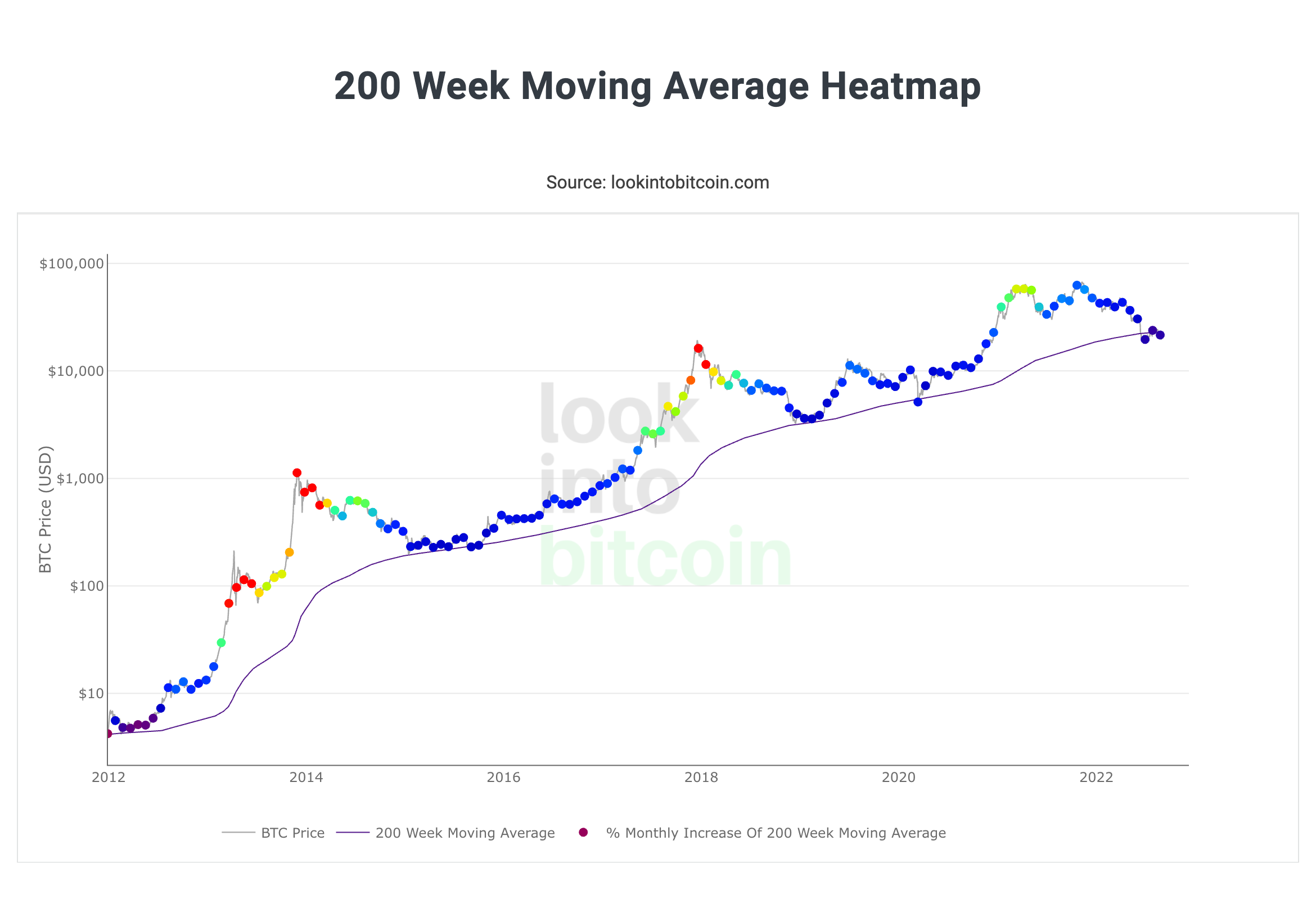

When assets and cost indicators are several standard deviations from the norm, it’s time for you to start searching around. Some traders zoom to a 3-day or weekly time period to determine when assets correct to greater time period support levels or previous all-time highs like a sign to take a position.

Others search for cost to switch key moving averages such as the 118 DMA, 200 WMA and 200 DMA to support. On-chain fanatics typically stick to the Puell Multiple, MVRV Score, Bitcoin Pi indicator or Recognized Cost indicator to determine when extreme multi-year lows are hit as an indication of when you should buy.

In either case, opening place longs during extreme sell-offs usually happens to be a great swing trade or perhaps access point for any multi-year-lengthy position.

Related: Wen moon? Most likely not soon: Why Bitcoin traders should make buddies using the trend

Do nothing at all, before the trend changes

Buying and selling throughout a bear marketplace is hard, and capital and portfolio upkeep would be the top priorities. Because of this, it’s perfect for some investors to simply watch for confirmation of the trend change. As they say, “the trend is the friend.” Everybody is really a genius along with a superb trader throughout a bull market, therefore if which was you, then wait for a next bull trend to roll around and go be considered a happy-go-lucky genius then.

Downtrends, consolidation and bear financial markets are well known for chopping up traders and reducing one’s portfolio size, so it’s foolish to trade from the trend unless of course you have a PNL positive way of buying and selling during bear trends and a few skill at shorting.

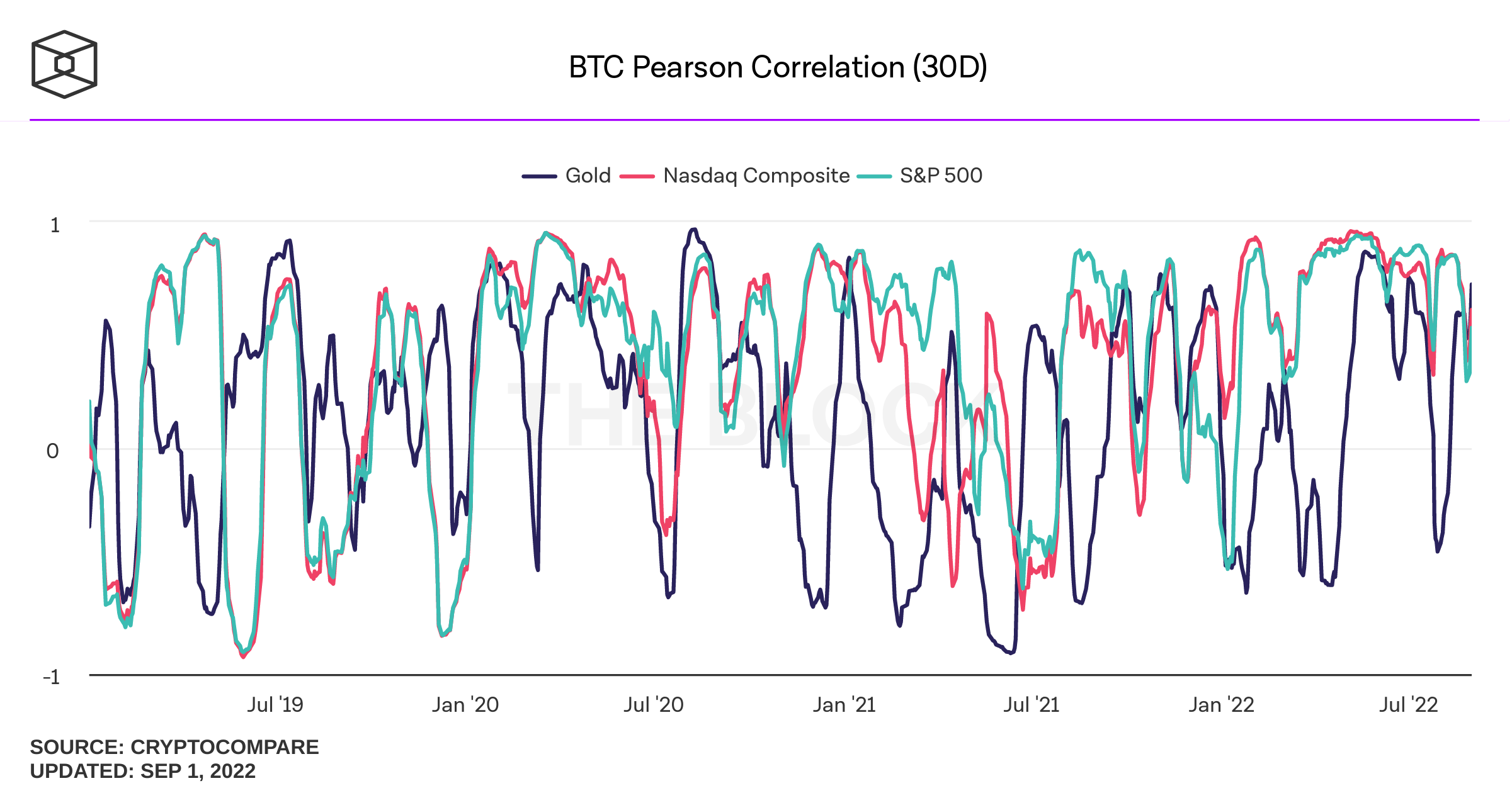

For crypto investors, it’s important not to reside in vacuum pressure and keep close track of the equities markets. Crypto traders possess a inclination to simply concentrate on crypto markets, which is an error because equities markets and BTC and Ether (ETH) prices have proven a powerful correlation previously 2 yrs. In one’s charting suite of preference, it might be a good idea to keep your S&P 500, Dow jones Johnson or Nasdaq charts up alongside BTC’s or ETH’s daily chart.

In the newest trend reversal, BTC’s cost action was the canary within the coal mine that started to chirp louder and louder because the U . s . States Fed amplified its intent to boost rates of interest. You can easily be fooled through the minuscule moves that exist in Bitcoin’s four-hour and daily cost charts, and something could be easily lured into some hefty positions in line with the thought that BTC is near a reversal.

Keeping track of the marketplace structure and cost action from the largest equities indexes will give you crucial understanding of the force and time period of any bullish or bearish trend that Bitcoin might exhibit.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey will write market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

Disclaimer. Cointelegraph doesn’t endorse any content of product in this article. Basically we are designed for supplying all of you information that people could obtain, readers must do their very own research when considering actions associated with the organization and bear full responsibility for his or her decisions, nor this short article can be viewed as being an investment recommendations.