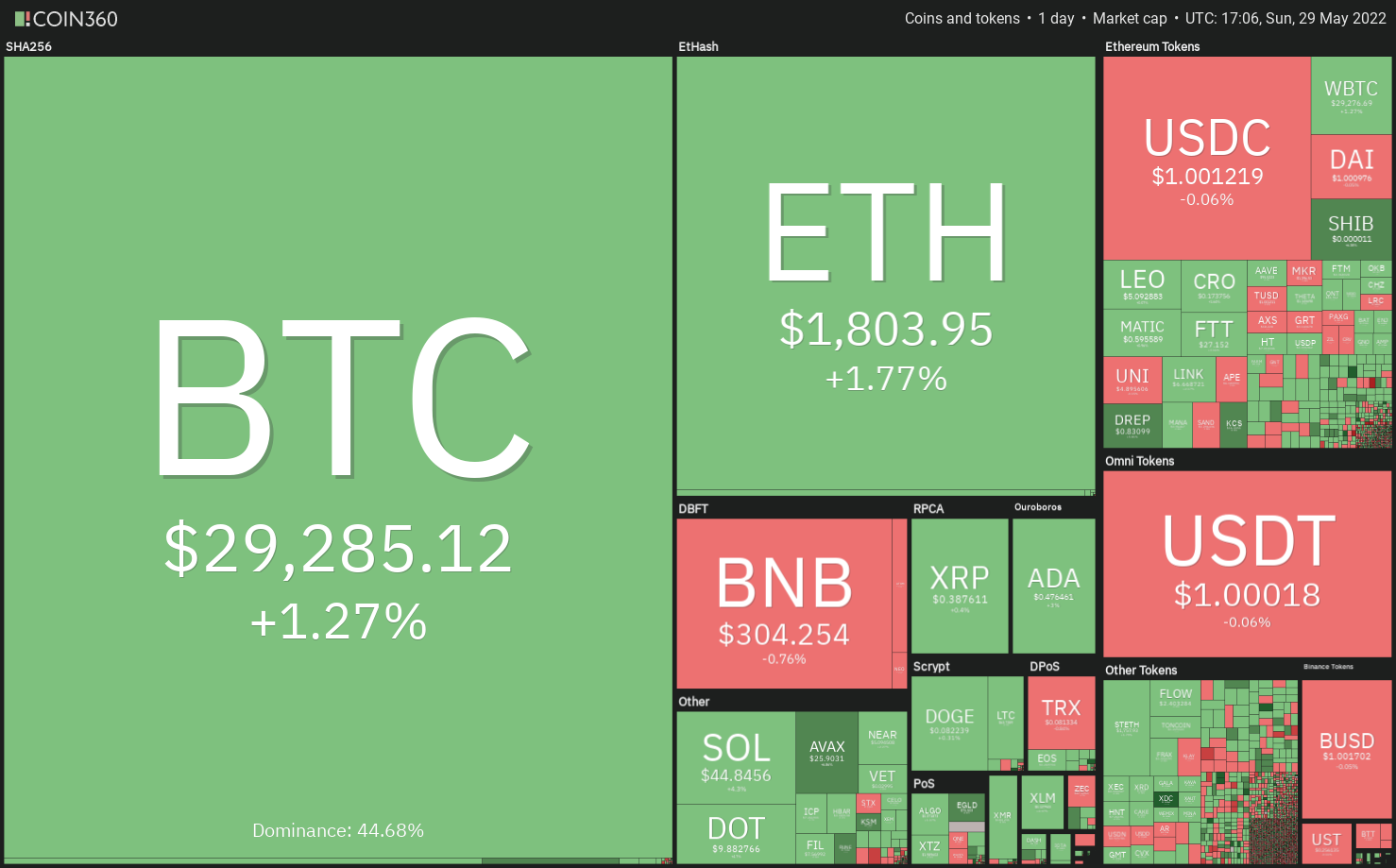

After declining for eight successive days, the Dow jones Johnson Industrial Average rebounded dramatically a week ago to finish greater by 6.2%. However, Bitcoin (BTC) has not had the ability to replicate the performance from the U . s . States equities markets and it is threatening to color a red candle for that ninth week consecutively.

An optimistic sign is the fact that Bitcoin whales happen to be purchasing the market correction. Glassnode data implies that the amount of Bitcoin whale wallets having a balance of 10,000 Bitcoin or even more has risen to the greatest level since Feb 2021. The accumulation within the whale wallets shows that their lengthy-term view for Bitcoin remains bullish.

Blockware Solutions highlighted the Mayer Multiple metric, which blogs about the 200-day simple moving average using the current cost, was languishing “near a few of the cheapest readings on record.” The firm stated a couple of other indicators also claim that Bitcoin is trying to form a bottom.

If Bitcoin starts a recovery for the short term, certain altcoins will probably abide by it greater. Let’s read the charts from the top-5 cryptocurrencies that could lead the relief rally.

BTC/USDT

Bitcoin remains stuck in the tight range from the downtrend line and also the support at $28,630. The bears pulled the cost below $28,630 on May 26 and could 27 but tend to not sustain the low levels. This led to a rebound on May 28.

The bulls will attempt to push the cost over the downtrend line and challenge the 20-day exponential moving average (EMA) of $30,538. When they succeed, the BTC/Tether (USDT) pair could get momentum, and also the rally could achieve the 50-day simple moving average (SMA) of $35,181.

The positive divergence around the relative strength index (RSI) shows that the bearish momentum might be weakening along with a rally might be nearby.

However, when the cost turns lower in the overhead resistance, the bears will again attempt to pull the happy couple below $28,630. When they manage to achieve that, the happy couple will develop a bearish climbing down triangular pattern, with a target purpose of $24,601.

The 20-EMA and also the 50-SMA around the 4-hour chart have flattened out and also the RSI is simply over the midpoint, suggesting an account balance between demand and supply.

If bulls drive the cost over the downtrend line, the negative climbing down triangular pattern is going to be negated. That could cause a brief squeeze because the short-term bears may close their positions. That may obvious the road for any possible rally towards the 200-SMA.

On the other hand, the bears can come out on the top when the cost turns lower and plummets below $28,630. That could cause a retest from the crucial support at $26,700.

ETH/USDT

Ether (ETH) has been around a downtrend however the bulls are trying to stall the decline in the crucial support of $1,700. The cost rebounded off this support on May 28 and also the bulls are trying to develop the recovery on May 29.

The RSI is developing a bullish divergence, indicating the downtrend might be weakening. If bulls push the cost over the 20-day EMA of $2,036, the ETH/USDT pair could rise towards the overhead resistance at $2,159. The bears are anticipated to protect this level strongly. When the cost turns lower out of this resistance, the happy couple may remain range-bound between $2,159 and $1,700 for any couple of days.

However, when the cost turns lower in the current level or even the 20-day EMA, the bears will again make an effort to sink the happy couple below $1,700. When they succeed, the happy couple may resume its downtrend using the next major support at $1,300.

The bounce from the $1,700 support has arrived at the 20-EMA, in which the bears may mount a powerful defense. When the cost turns lower out of this level, it might boost the prospects of the break below $1,700. In the event that happens, the downtrend may resume.

On the other hand, if bulls push the cost over the 20-EMA, the happy couple may rise towards the 50-SMA. This level may again behave as a resistance but when bulls obvious this hurdle, the happy couple could rally towards the mental resistance at $2,000.

XTZ/USDT

Tezos (XTZ) is consolidating inside a downtrend. Although bulls pressed the cost over the 20-day EMA of $2.00 on May 24, they couldn’t sustain the recovery. The cost dipped back underneath the 20-day EMA on May 26.

The 20-day EMA is flattening out and also the RSI is above 46, suggesting the selling pressure is reducing. If bulls push the cost over the 20-day EMA, the XTZ/USDT pair could rally toward the 50-day SMA of $2.45. If the resistance also gives way, the buyers will endeavour to push the cost over the upward trend line.

In comparison, when the cost turns lower in the current level, it’ll claim that bears still defend the 20-day EMA. The sellers will make an effort to sink the happy couple below $1.75, that could open the doorways for any fall to $1.64.

Some-hour chart shows the recovery switched lower in the 200-SMA, however the pair bounced from the upward trend line. The bulls have pressed the cost over the 50-SMA and can now make an effort to obvious the overhead hurdle in the 200-SMA. When they manage to achieve that, it’ll suggest the beginning of a brief-term up-move.

Alternatively, when the cost turns lower in the current level or even the 200-SMA, the happy couple may drop towards the upward trend line. A rest and shut below this support could pull the cost lower to $1.61.

Related: Bitcoin to create a brand new record 9-week losing streak with BTC cost lower 22% in May

KCS/USDT

KuCoin Token (KCS) broke over the 20-day EMA of $15.61 on May 20, however the bulls couldn’t push the cost over the 50-day SMA of $17.19. This might have enticed short-term traders to reserve profits, which pulled the cost back underneath the 20-day EMA on May 26.

The bears couldn’t build upon their advantage and sustain the cost underneath the 20-day EMA, indicating strong buying through the bulls at ‘abnormal’ amounts. The buyers have pressed the cost back over the 20-day EMA on May 29.

If bulls sustain the cost over the 20-day EMA, the potential of a rest over the 50-day SMA increases. In the event that happens, the KCS/USDT pair may rally to $18.44 and then towards the 200-day SMA of $19.63.

Unlike this assumption, when the cost turns lower in the current level, it’ll claim that traders can sell on rallies. A rest and shut below $14.92 could open the doorways for any further decline to $12.90.

The happy couple continues to be facing stiff resistance in the 200-SMA, however the shallow correction signifies that bulls are purchasing on minor dips. If bulls push the cost over the 200-SMA, the following stop might be $17.14. A rest and shut above this level could start the following leg from the up-move.

On the other hand, when the cost turns lower in the overhead resistance, the bears may pull the happy couple lower towards the 38.2% Fibonacci retracement level at $14.20 after which towards the 50% retracement level at $13.30. This zone will probably behave as a powerful support.

AAVE/USDT

Aave (AAVE) rallied towards the 20-day EMA of $101 on May 23, however the bulls couldn’t push the cost above it. This means that bears still defend the amount strongly, however a minor positive would be that the buyers haven’t quit much ground.

When the cost appears and breaks over the 20-day EMA, it’ll indicate the beginning of a more powerful relief rally. The AAVE/USDT pair could then rally towards the 50-day SMA of $132, in which the bears may again mount a powerful defense.

Alternatively, when the cost turns lower in the current level or even the 20-day EMA and breaks below $89, rapid-term bulls and also require bought at ‘abnormal’ amounts could close their positions. That may pull the cost lower to $79 and then to $64.

Some-hour chart implies that the happy couple continues to be oscillating between $90 and $110 for a while. The 20-EMA and also the 50-SMA are flattish and also the RSI is simply over the midpoint, suggesting an account balance between demand and supply.

This equilibrium could tilt in support of buyers when they push and sustain the cost above $110. When they do this, the happy couple could rally toward $130 after which $143. On the other hand, when the cost plummets below $90, the bears will gain top of the hands. The happy couple could then decline to $80 and then to $70.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.