Bitcoin (BTC) cost remains pinned below $22,000 because the lingering impact from the August. 19 sell-off at $25,200 remains felt over the market.

Based on analysts from on-chain monitoring resource Glassnode, BTC’s tap in the $25,000 level was adopted by “distribution” as profit-takers and short-term holders offered as cost experienced a trendline resistance carrying out a 23-consecutive-day upward trend that saw BTC buying and selling above it’s recognized cost ($21,700).

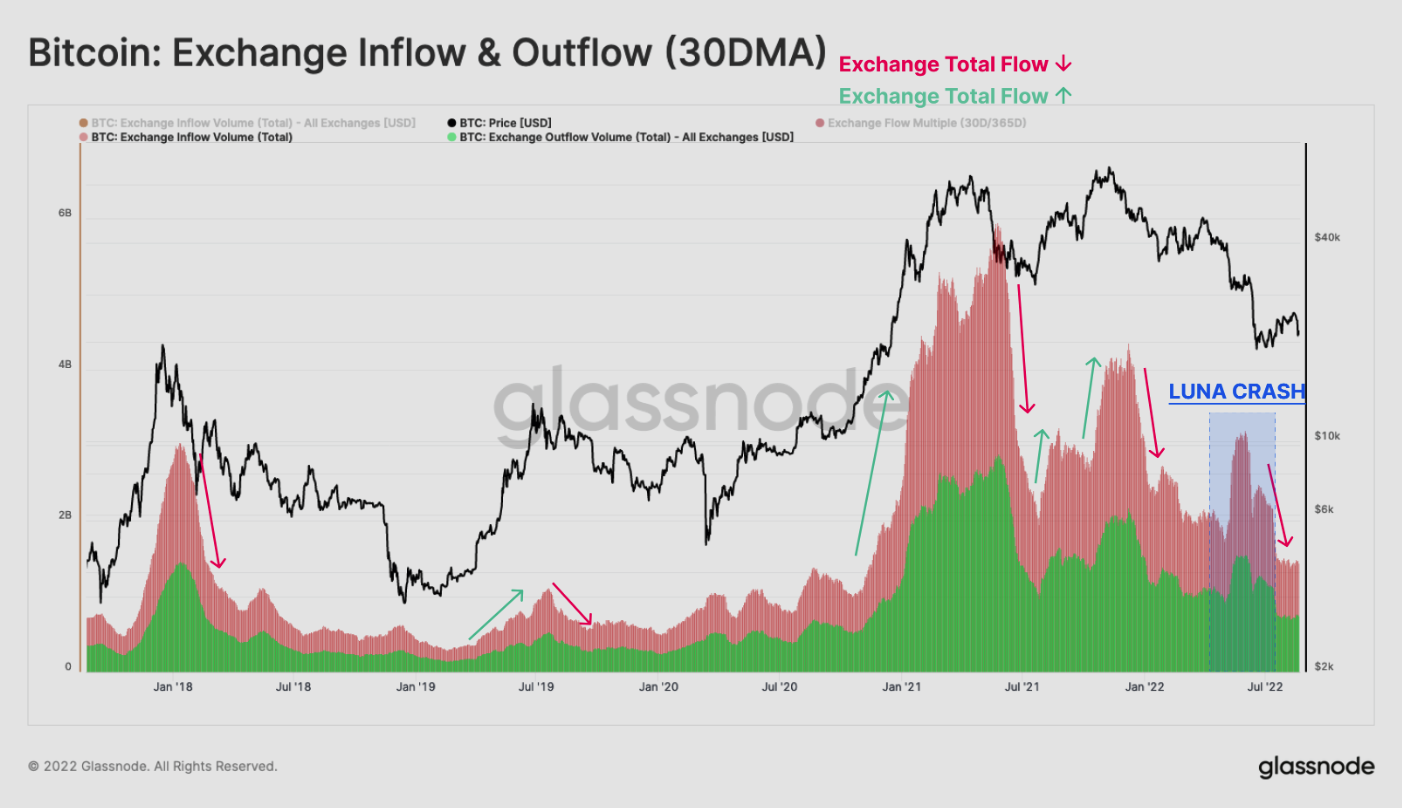

The firm also noted the “total inflows and outflows to any or all exchanges” metric shows exchange flows at multi-year lows and to “late-2020 levels,” which reflects a “general insufficient speculative interest.”

Stocks and crypto clearly risk off until we hear the Given perspectives appearing out of Jackson Hole nowOrfinish. $BTC cost is constantly on the range, but looks a little “soft.” pic.twitter.com/jpVjG2jslh

— Big Smokey (@big_smokey1) August 23, 2022

From the greater-time period perspective, Bitcoin’s current cost action is only a continuation of their near three-month-lengthy chop within the $18,500 to $22,000 range, however the real damper on sentiment is persistent non-crypto-related concerns within the U . s . States and global economy.

On August 25, the Jackson Hole Economic Symposium begins and out of this, the general public will find out more about the government Reserve’s perspective around the U.S. economy, its plans for future rate of interest hikes, if the inflation target remains at 2% and when the Given thinks the U.S and global economy have been in an economic depression. Anticipation within the symposium has clearly made investors nervous which frayed nerves may be seen in the S&P 500, DJI and crypto markets now.

Based on Serhii Zhdanov, Chief executive officer of EXMO cryptocurrency exchange:

“It seems there’s not one driver for that recent decline. The worldwide crises continue, which is not sure in which the bottom is. Inflation is forcing individuals to eliminate their investments to obtain cash to pay for daily expenses. In lots of countries the quantity of charge card debts are breaking to new record highs. Recent data implies that Covid isn’t gone and geopolitical tension further adds fuel to global markets’ decline.”

Ether marches towards the beat of their own drum

Ether (ETH), however, seems to become showing some upside promise from the technical analysis perspective. A week ago, the asset remedied alongside BTC and suffered a couple of blows associated with centralization fears following the Office of Foreign Assets Control, or OFAC, sanctioned Tornado Cash and also the crypto community increased fearful over potential connection between the proof-of-stake transition making the network (and it is largest ETH stakers) prone to censorship and regulation.

Generally, the bullish “merge” narrative remains in play and also the large cup and take care of pattern seen on Ether’s daily time-frame, as well as the bounce from the $1,500 level are sufficient to aid traders’ hopes for ETH cost rising in to the $2,500 to $2,900 range.

Ether looks similarly juicy in the ETH/BTC pair, which bounced off support within the .073 BTC range.

MVRV on-chain data suggests undervalued Bitcoin

As @big_smokey1 pointed out “stocks and crypto [are] clearly risk off” with Jackson Hole approaching and when it comes to cost action, this will probably manifest as ongoing resistance at Bitcoin’s lengthy-term climbing down trendline until an adequate catalyst to impress a pattern change emerges.

Related: What crashed the crypto relief rally? Discover now available on the market Report

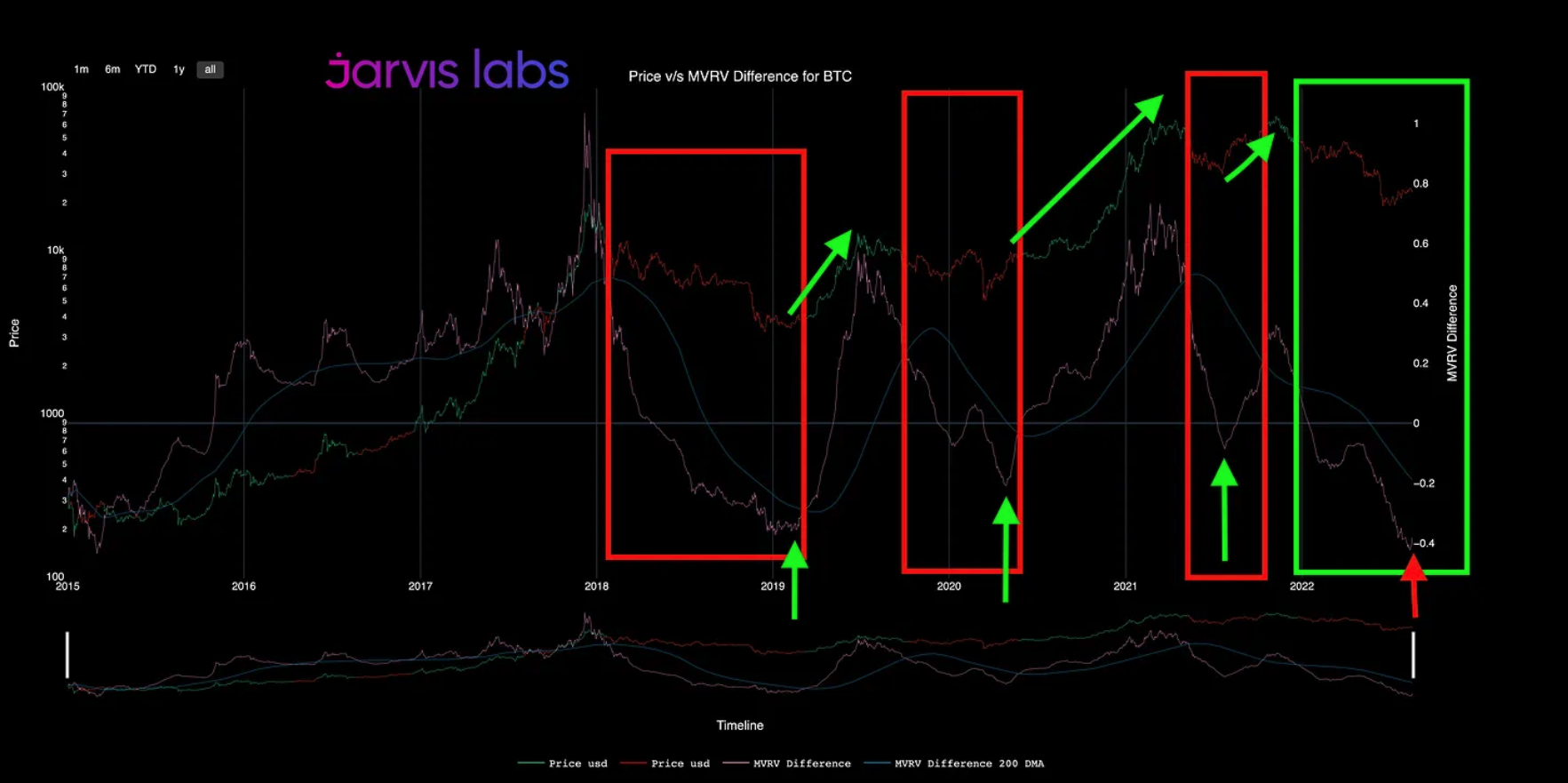

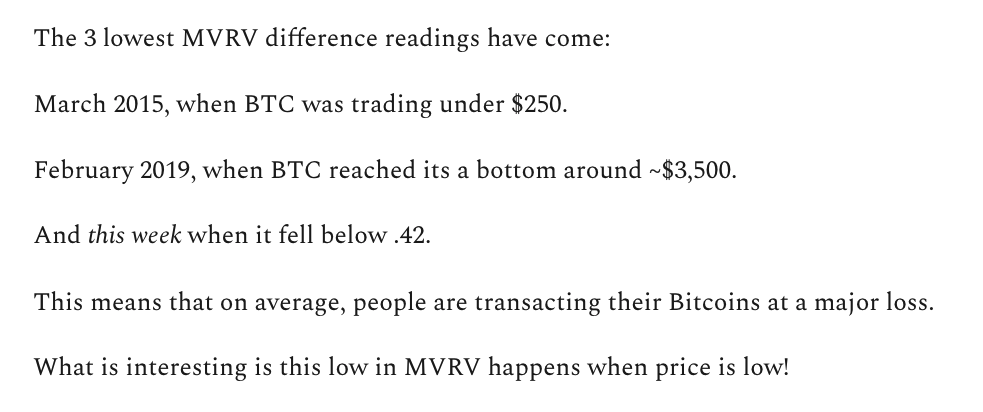

For the moment, Bitcoin’s short-term cost prospects are under positive, but Jarvis Labs resident analyst “JJ” pinpointed a vital on-chain metric that implies BTC is buying and selling inside a generational buy zone.

Based on JJ, Bitcoin’s MVRV (Market Capital versus Recognized Capital) indicator is printing a studying that’s “extremely low.”

Performs this imply that investors should get out there and put every last cent into BTC? Most likely not, but because the MVRV chart above shows, dollar cost averaging into BTC when its on-chain and technical metrics hit extreme lows has shown to be a lucrative strategy within the last three bull markets.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.