Mike Belshe, the Chief executive officer of digital asset custodian BitGo has confirmed that Alameda Research tried to redeem 3,000 Wrapped Bitcoin (wBTC) dads and moms before FTX’s personal bankruptcy filing on November. 11.

Throughout a 12 ,. 14 Twitter Spaces located by decentralized finance (DeFi) investigator Chris Blec, Belshe confirmed the firm knocked back the redemption request since the unknown Alameda representative involved didn’t pass Bitgo’s security verification process and appeared not really acquainted with the way the wrapped Bitcoin burning process labored.

Full convo here. This part starts at 1:09:30. https://t.co/0KQg6bzd8k

— Chris Blec (@ChrisBlec) December 14, 2022

“[The safety details] did not match the procedure. Therefore we held up so we stated no, no, no, no. This isn’t exactly what the burn appears like. And we have to know who this individual was.”

“So we held it even though these folks were it, awaiting an answer on individuals issues [Alameda] went bankrupt not to mention, after they went bankrupt, everything stopped,” Belshe added.

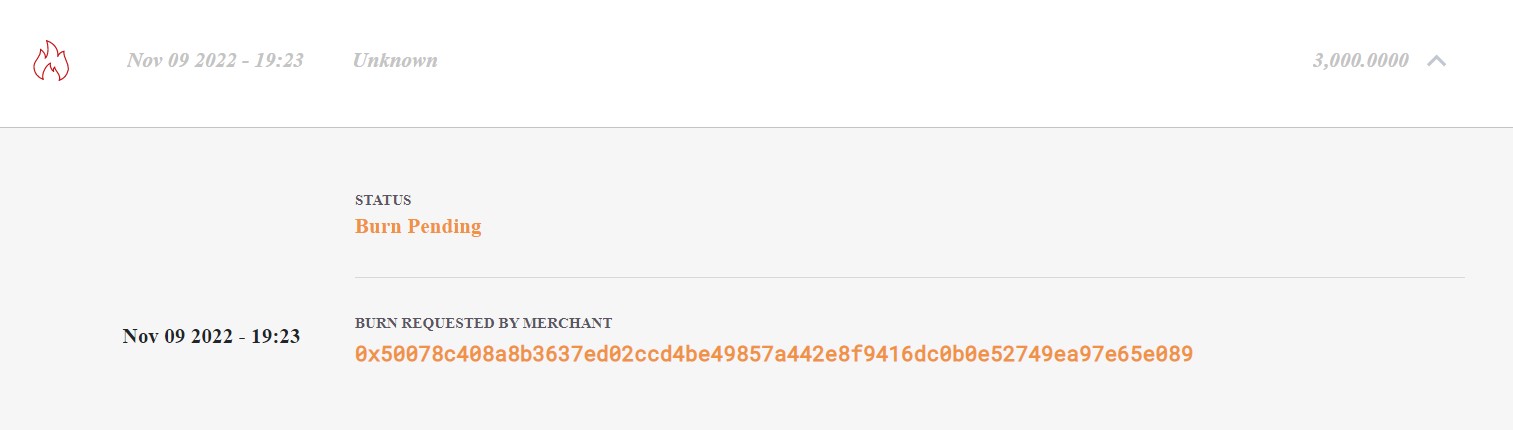

The Bitgo Chief executive officer also stated that Alameda’s 3,000 BTC mint request remains “stuck” around the platform’s dashboard, adding the firm would definitely leave the tokens where they’re until they’re worked with through the trustees dealing with Alameda’s personal bankruptcy situation.

Alameda’s attempt to unwrap the three,000 wBTC seemed to be confirmed around the Ethereum transaction aggregator Etherscan.

Although this might have ordinarily triggered the redemption of BTC, Bitgo includes a security mechanism set up prior to the conversion happens, that is what Alameda unsuccessful.

It’s not understood exactly what the motive was for trying to redeem the $50 million price of wBTC, but it’s understood that FTX executives were trying to raise funds from a number of sources to prevent personal bankruptcy up to the final minute.

Analysis from Arkham Intelligence on November. 25 discovered that Alameda pulled $204 million from eight different addresses from FTX.US 5 days before its parent firm eventually declared Chapter 11.

Related: Alameda had ‘unfair’ buying and selling advantage, special use of FTX funds: CFTC filing

wBTC is really a tokenized form of BTC, which may be redeemed for BTC when it’s delivered to a burn address, triggeringthe discharge of BTC. The conversion is created in a 1:1 ratio.

The tokenization of wrapped Bitcoin enables Bitcoin holders to have interaction with Ethereum-based smart contracts and decentralized applications.

Bitgo co-developed wBTC in 2019 alongside blockchain interoperability protocol Ren and multi-chain liquidity platform Kyber. wBTC can also be managed through the decentralized autonomous organization wBTC DAO, which comprises over 30 people.

The wBTC dashboard presently implies that BitGo now holds 202,255 BTC in child custody against 199,238 wBTC in circulation, amounting for an overcollateralization rate of 101.51%.