Institutional investors offloaded $101.5 million price of digital asset products a week ago in ‘anticipation of hawkish financial policy’ in the U.S. Fed based on CoinShares.

U.S. inflation rates hit 8.6% year-on-year in the finish of May, marking coming back to levels not seen since 1981. Consequently, the marketplace is expecting the Given to consider considerable action to catch inflation, with a few traders prices in three more .5% rate hikes by October.

Based on the latest edition of CoinShares’ weekly Digital Asset Fund Flows report, the outflows between June 6 and June 10 were mainly brought by investors in the Americas at $98 million, while Europe taken into account just $two million.

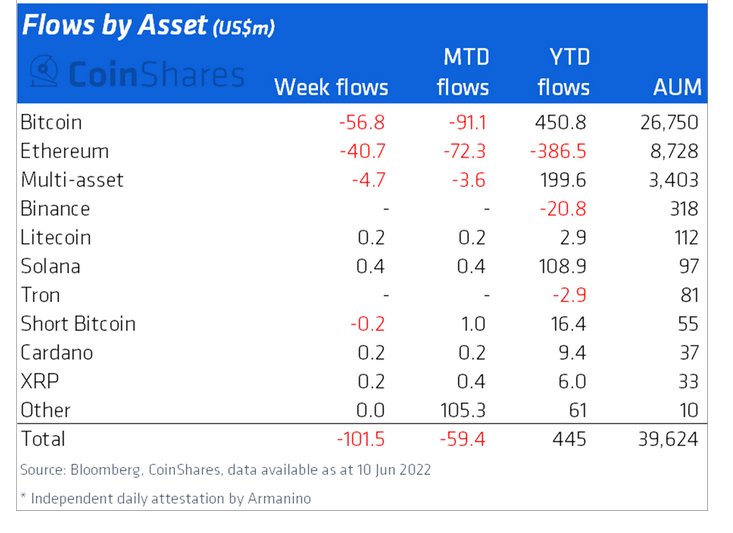

Products offering contact with crypto’s top two assets, Bitcoin (BTC) and Ethereum (ETH), taken into account almost all outflows at $56.8 million and $40.seven million a bit. The month-to-date figures also paint a harsh figure at $91.a million price of outflows for BTC products and $72.3 million as a whole outflows for ETH products.

“What has pressed Bitcoin right into a “crypto winter” during the last six several weeks can generally be described as a result of an more and more hawkish rhetoric in the US Fed.”

While CoinShares recommended that Bitcoin continues to be pressed right into a crypto winter, the entire year-to-date (YTD) inflows for BTC investment products still stand at $450.8 million. Compared, funds offering contact with ETH have experienced hefty YTD outflows of $386.5 million, suggesting the sentiment among institutional investors still heavily favors digital gold.

The report also highlighted the total assets under management (AUM) for Ether funds have “fallen from the peak peopleDollar23bn in November 2021 to all of usDollar8.7bn” by a week ago.

Particularly, it seems the institutional investors offloaded their BTC and ETH products before the majority of the latest cost carnage became of both assets.

Related: Bitcoin cost drops to cheapest since May as Ethereum market trades at 18.4% loss

Based on data from CoinGecko, between June 6 and June 10, the cost of BTC and ETH dropped 4.7% and 5.9% each. However, since June 11, BTC and ETH have stepped around 25.7% and 33.2% correspondingly.

Aside from BTC and ETH outflows, multi-asset funds saw outflows of $4.seven million, and Short Bitcoin products published minimal outflows of $200,000. Simultaneously, investors also “steered obvious of contributing to altcoin positions.”