Crypto markets put a pleasant mind fake now by rallying into resistance on the “positive” Consumer Cost Index (CPI) report, before retracing nearly all individuals gains immediately after Fed Chair Jerome Powell required on the surprisingly hawkish tone throughout his publish-rate-hike presser.

The Given hiked rates of interest by .50%, that was within the expectation on most market participants, however the eyebrow-raiser was the government Open Market Committee consensus that rates will have to achieve the fivePercent–5.5%+ range to be able to hopefully attain the Fed’s 2% inflation target.

This essentially put cold water on traders’ lusty hopes for a Given policy pivot happening within the first 1 / 2 of 2023, and also the damper on sentiment was felt throughout crypto and equities markets.

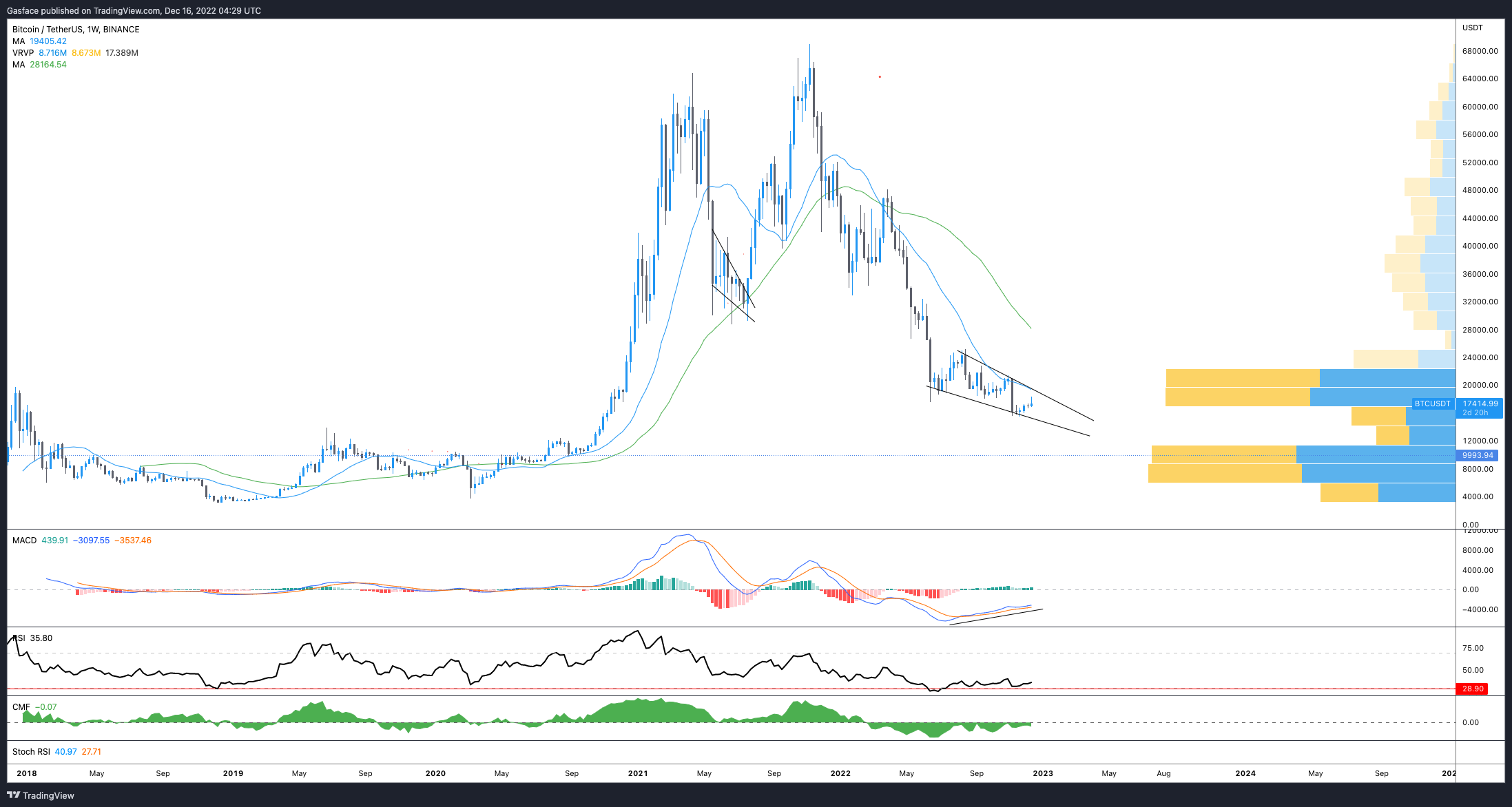

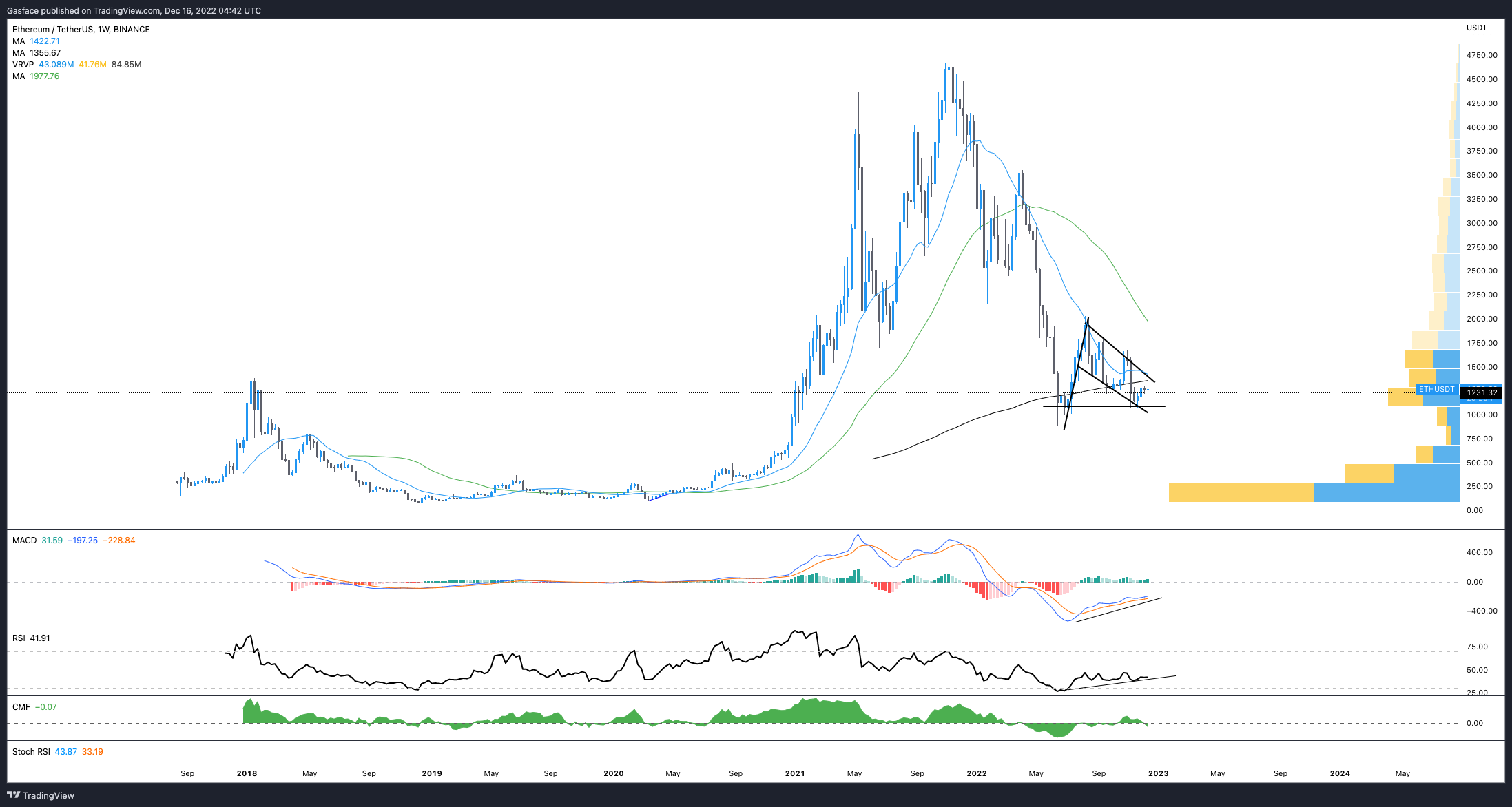

Because the charts below show, Bitcoin (BTC) and Ether (ETH) reversed course right as Powell started his presser on 12 ,. 14.

How can you like them apples?

It is also unsurprising that BTC and ETH cost action and market structure around the lower periods also look identical.

So, yes, markets retraced their recent gains over not so good news, but has anything really “changed?” Bitcoin continues to be buying and selling having a obvious range Ether does exactly the same, nor asset makes new yearly lows lately.

As they say, while in doubt, zoom out. So, let’s do this briefly and have a better consider the lay from the land.

While in doubt, zoom out!

Around the weekly time-frame, Bitcoin continues to be bouncing around inside a falling wedge, a vintage technical analysis pattern that has a tendency to lean bullish. The cost does virtually what you might expect the cost to complete inside the framework of technical analysis.

There’s expected resistance in the 20-MA, that is arranged using the climbing down trendline. The amount profile metric shows a majority of activity within the $18,000–$22,500 range, and also the wrist from the falling wedge has to date functioned as support.

Similar cost action was observed in May 2021–July 2021, however, the situations were entirely different, so that’s some apples-to-oranges comparison. There is a divergence around the MACD and RSI. In a nutshell, the cost is trending lower, and MACD and RSI are trending on the weekly time-frame, that is possibly something worth keeping track of.

Things I like concerning the weekly time-frame is the fact that candle lights form gradually, and trends, whether bullish or bearish, are pretty simple to call and ensure. It’s simpler to construct a good investment thesis from the weekly time period than spend endless hrs flowing over four-hour, one-hour and daily charts.

Related: Ethereum and Litecoin take action, while Bitcoin cost looks for firmer footing

Anyhow, breakouts in the falling wedge could be limited to the climbing down trendline, while a failure from the pattern or drop underneath the lower support often see the cost fall as little as $11,400. That’s all inside the market consensus for many analysts.

For Ether, like I covered in depth in last week’s Substack and e-newsletter, it’s still doing the bull flag factor: bouncing around between support and resistance to see breakouts limited to key moving averages and also the climbing down trendline of their bull flag.

$2,000 continues to be the eventual target around the radar on most analysts, and disadvantage to the $1,100 is way from shocking.

A dip under $1,000 will probably raise eyebrows and draw the interest of individuals searching for additional resolute shorts.

Ether cost action is essentially doing exactly the same foreseeable factor as Bitcoin: absolutely nothing to see here, keep to the plan (whatever that could be for you personally). Much like BTC, in addition, there’s a divergence on Ether’s MACD and RSI — something worth keeping track of.

Litecoin update

A week ago, I additionally put eyes on Litecoin (LTC) because of its approaching network reward halving. As the cost has retraced from the local top at $85, the upward trend remains intact, as well as on the daily time-frame, the GMMA indicator continues to be vibrant eco-friendly.

The vertical black lines track LTC’s bullish momentum leading into halvings and also the corrections that occur immediately after the halving occurs. For the moment, everything looks to become proceeding based on plan.

Obviously, none of the is financial advice. Make certain you need to do your personal research, calculate your risk, consider the worst-situation scenarios, weigh your ROIs and take profit, and cut losses zones a couple of days before really creating a trade. Keep in mind that 1:3 and 1:5 may be the optimal risk-to-reward outcome you ought to be running after.

Disregard the short-term FUD and cost action. Zoom out and make a powerful thesis from that standpoint.

This e-newsletter was compiled by Big Smokey, the writer of The Standard Pontificator Substack and resident e-newsletter author at Cointelegraph. Each Friday, Big Smokey writes market insights, trending how-tos, analyses and early-bird research on potential emerging trends inside the crypto market.

The views, ideas and opinions expressed listed here are the authors’ alone and don’t always reflect or represent the views and opinions of Cointelegraph.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.