Bitcoin (BTC) saw a brand new rejection at $17,000 on November. 18 as nervous markets weathered more FTX fallout.

BTC will get a $12,000 cost target

Data from Cointelegraph Markets Pro and TradingView demonstrated BTC/USD neglecting to switch $17,000 to aid — a pattern in position for nearly per week.

The happy couple, like major altcoins, continued to be firmly tied lower by cold ft within the FTX debacle and it is knock-on effects for a number of crypto companies.

For analysts, the outlook continued to be just like harsh, with already dismal forecasts worsening considering recent occasions.

“This underperformance of crypto assets is not going anywhere soon until the majority of uncertainly has removed up — likely only close to the turn of 2012,” buying and selling firm QCP Capital authored in the latest circular to Telegram funnel subscribers at the time.

Within an extensive market summary, QCP authored that it is cost forecasts for Bitcoin and Ether (ETH) now needed to drop to mirror the outcome of FTX.

Updating a prognosis according to Elliott Wave theory from June, it confirmed BTC/USD now were built with a target of $12,000 and ETH/USD $800.

“As a side-note, crypto markets happen to be buying and selling similar to goods since the 2017 top — with extended Wave 5s because the longest wave,” the publish added.

“Hence such potential cost action with new lows into 2012 could be sign of previous bear market sell-offs.”

An associated chart highlighted the divergence between crypto and stocks in November, with th correlation together firmly shaken because of crypto’s underperformance.

Popular trader and analyst Cantering Clark, meanwhile, noted when the present bear market in risk assets would copy the global financial trouble, heavy losses remained as in the future.

“The Lehman personal bankruptcy was the climax from the 2008 economic crisis. It had been bottom material qualitatively, however the market stopped after which dedicated to 40% lower,” a part of a tweet read.

“Never say never, out on another enable your guard lower.”

As Cointelegraph reported, $13,500 has additionally be a popular downside target.

Crypto cake “being cut massively”

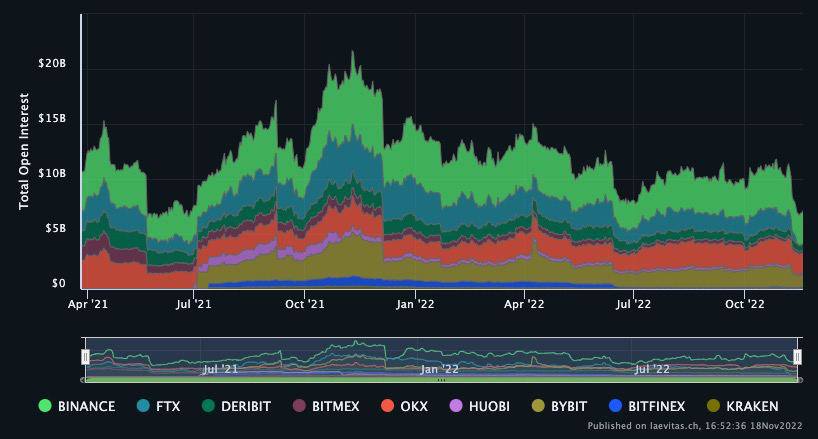

Ongoing, QCP also voiced concerns over declining volumes and open interest (OI) across both centralized (CEXs) and decentralized (DEXs) exchanges.

Related: US crypto exchanges lead Bitcoin exodus: Over $1.5B in BTC withdrawn in a single week

“So far, CEX derivative exchange volumes happen to be most affected. Combined futures OI has become to pre-2021 levels, an enormous backward step for that industry,” it authored.

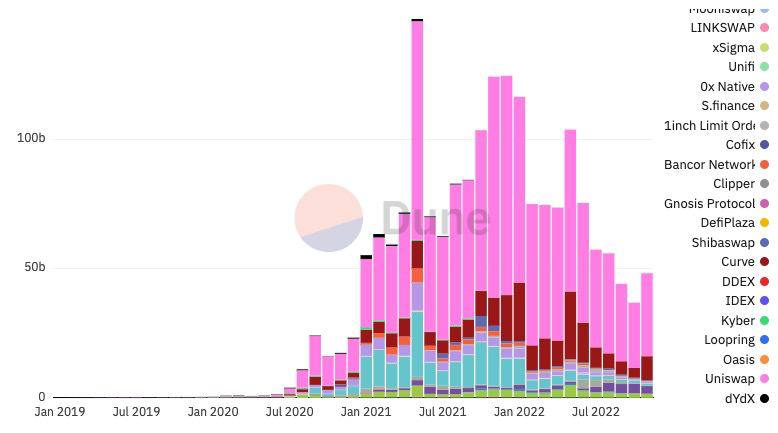

Around the subject of DEXs, it stated the information “implies the whole crypto cake has been cut massively.”

“Overall DeFi TVL has become under 1/4 last year’s peak!” the publish summarized alongside more explanatory charts.

“Even DEXes which may be anticipated to achieve probably the most, only have seen volumes rise to Jul/August levels, even with the emergency token/stables/chain swapping that must be done publish-FTX.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.