Bitcoin (BTC) hovered at $22,000 in the This summer 18 Wall Street open as analysts cautioned that bulls wouldn’t break resistance all at once.

Can Bitcoin regain bear market support?

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD coming back to consolidate after hitting highs of $22,500 on Bitstamp.

That much cla symbolized the beginning of sell-side positions on exchanges clustered round the 200-week moving average (WMA), a vital area which commentators contended could be difficult to crack.

“Not expecting continuation on Bitcoin, at this time, as we are facing 200-Week MA & range resistance,” Cointelegraph contributor Michaël van de Poppe told Twitter supporters in the latest update.

Fellow trader and analyst Rekt Capital, as others, seemed to be skeptical about the opportunity of Bitcoin to carry on upward momentum immediately.

#BTC still remains underneath the 200-week MA resistance

Until that much cla breaks, it’s technically premature to visualize this really is now a sustained relief rally$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) This summer 18, 2022

Van de Poppe nevertheless added that the breather for that market could be lucrative at current levels. He concluded:

“Slight consolidation would trigger continuation and break above $22.6K would activate massive longs towards $28K. Good occasions.”

Both Bitcoin and altcoins made probably the most of relief on equities markets at the time, with Asia and also the U . s . States making modest gains because the U.S. dollar retreated.

The S&P 500 and Nasdaq Composite Index were up .7% and 1%, correspondingly, during the time of writing, 1 hour following the opening bell.

“Prime here we are at Bitcoin,” on-chain analytics resource Whalemap meanwhile forecast, supplying a more positive take according to major buyer interest below place cost.

Prime here we are at #Bitcoin

Bounce from whale supports at ~$21k and we’re prepared to pic.twitter.com/x8hcmcgUw0

— whalemap (@whale_map) This summer 18, 2022

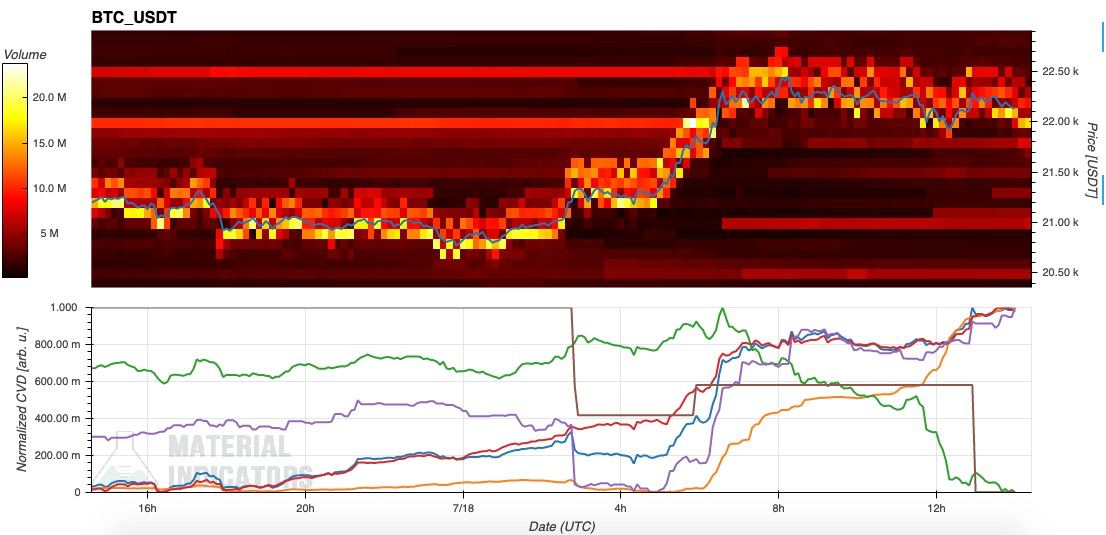

Data from fellow monitoring resource Material Indicators demonstrated similar support building around the Binance order book.

Ethereum preserves performance

On altcoins, the show had been stolen by Ether (ETH), which lingered near $1,500 after sealing its greatest levels in more than a month, with huge gains against BTC incorporated.

Related: BTC miners ‘finally capitulating’ — 5 items to know in Bitcoin now

Beating even Bitcoin’s progress, ETH/USD was the darling of traders at the time, firmly upending the formerly dire cost action in position from May onwards at the beginning of the Terra (LUNA) — now known as Terra Classic (LUNC) — debacle.

This is actually the very first time, in 110 Days, that #Ethereum has damaged right into a bullish trend, printing Greater Lows & Greater High.

Bears in disbelief.#cryptocurrency pic.twitter.com/MA2KAYzyWu

— wolf (@ImNotTheWolf) This summer 17, 2022

Approaching resistance lay by means of Ethereum’s all-time high in the previous Bitcoin halving cycle at $1,530, so it touched at the begining of 2018.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.