The crypto market saw declines overall in the last 24 hrs, as bitcoin (BTC) ended a few days below a vital technical level and market participants made an appearance uncertain concerning the near-term direction.

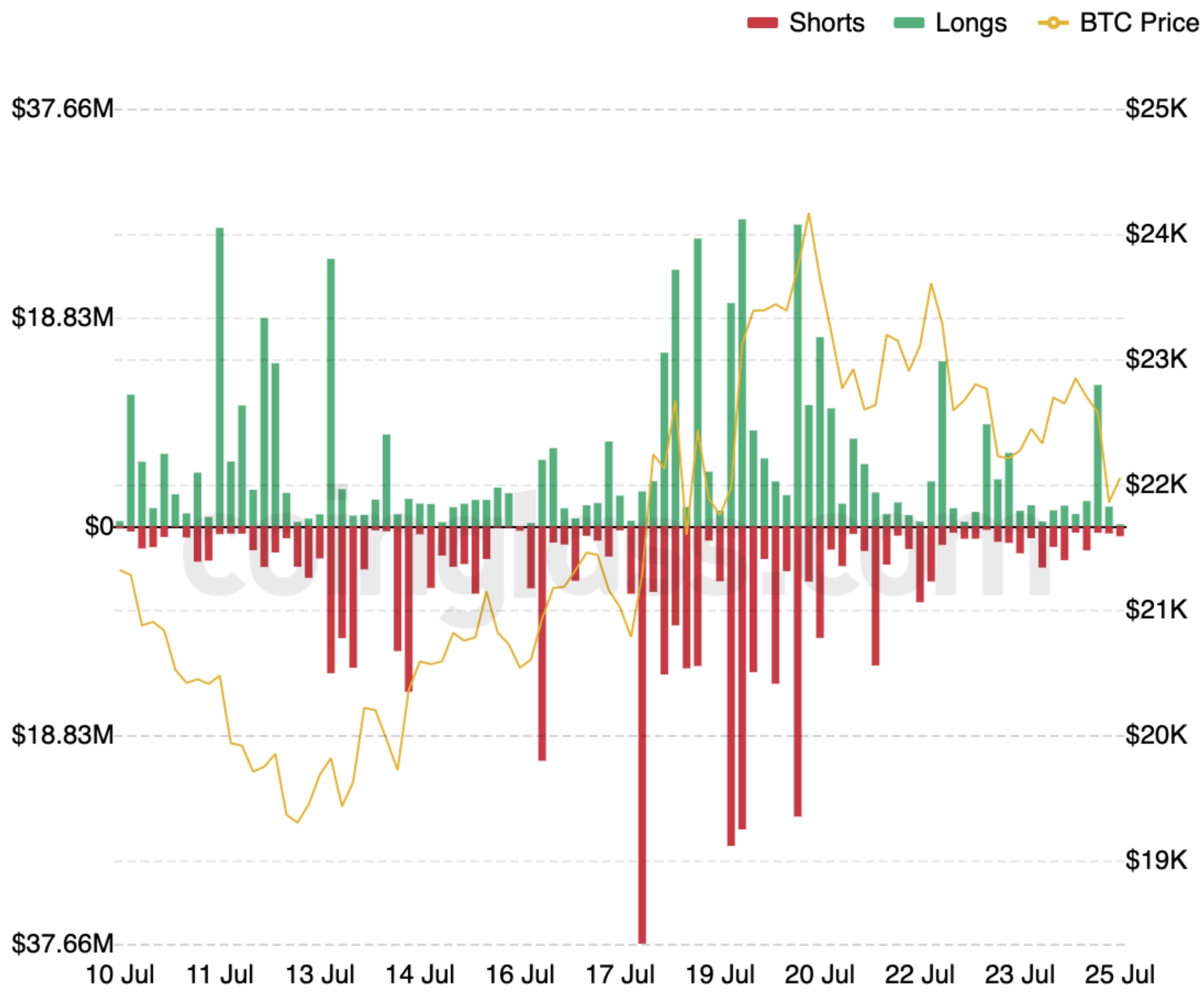

As always, the crypto sell-off was supported by liquidations of leveraged derivatives traders, with lengthy liquidations of leveraged bitcoin positions reaching USD 12.7m within the four hrs from night time to 4 am UTC on Monday.

Still, the amount of liquidations wasn’t unusual, having a sell-off as lately as last Friday resulting in even bigger liquidations.

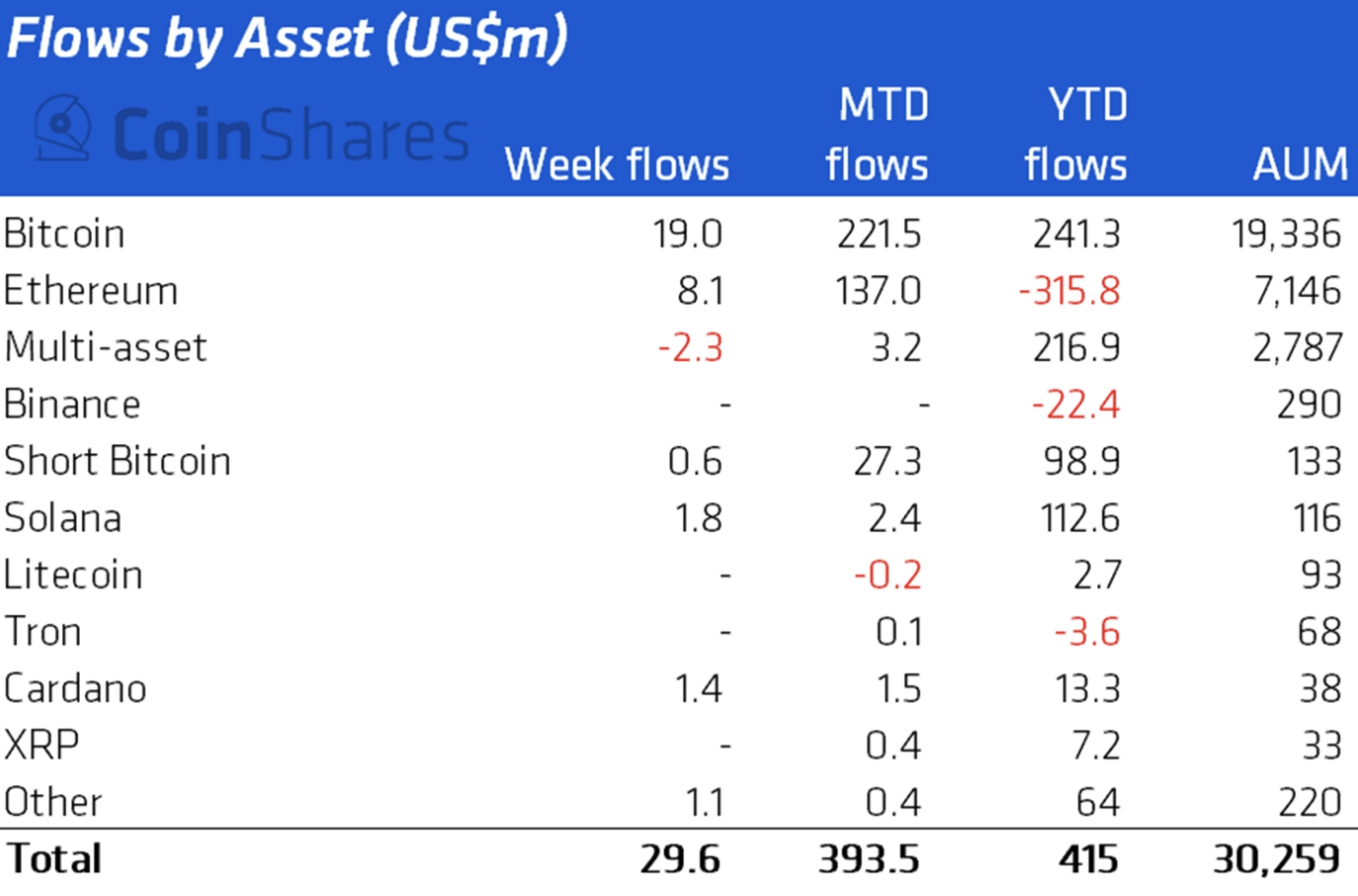

Meanwhile, fresh data in the crypto investment and research firm CoinShares on Monday demonstrated that crypto-backed investment funds once more saw inflows a week ago. As a whole, a few days ended with inflows of USD 30m, with USD 19m of individuals flowing into BTC-backed funds.

Following bitcoin, the 2nd-most widely used cryptoasset among fund investors a week ago was ethereum (ETH), with USD 8.1m of inflows. The multi-asset fund category was the only real category that saw outflows a week ago, with USD 2.3m brought out.

Particularly, the most recent data release from CoinShares also incorporated a correction from the figures in the prior week, when USD 12m of inflows was reported overall for that sector. After comprising late reporting of trades, time continues to be adjusted to USD 343m – the biggest weekly inflows observed in crypto investment funds since November 2021.

The inflows came despite bitcoin ending a week ago underneath the key 200-week moving average line. The road – by many people considered a vital technical level that BTC hasn’t traded below for just about any prolonged time period – is presently at USD 22,786, using the bitcoin cost buying and selling below it since Sunday night in Europe.

BTC weekly chart with 200-week moving average:

On Monday at 10:55 UTC, BTC traded at USD 22,058, lower 2.1% in the last 24 hrs or more 5.9% for that week.

Apart from bitcoin, other major coins that was out during the time of writing incorporated ETH, that was lower 2.4% within the last 24 hrs to USD 1,547, and solana (SOL), which traded lower 3.2% to USD 39.1. SOL expires 1% on the 7-day basis, while ETH elevated by over 15% over the same time frame period.

‘Signs of exhaustion’ on the market

Commenting around the outlook for that crypto market prior to the weekend, Singapore-based crypto buying and selling firm QCP Capital authored within an update that they’re “not confident that the upside momentum continues greatly.”

“The speed of the move greater felt positioning-driven (market was caught short) and also the marketplace is beginning to exhibit some indications of exhaustion,” the buying and selling firm authored.

The most recent update from QCP Capital marks a softening within the firm’s bearish stance from early This summer, if this stated its “positive outlook is waning” and cautioned that “any significant upside is going to be capped soon.”

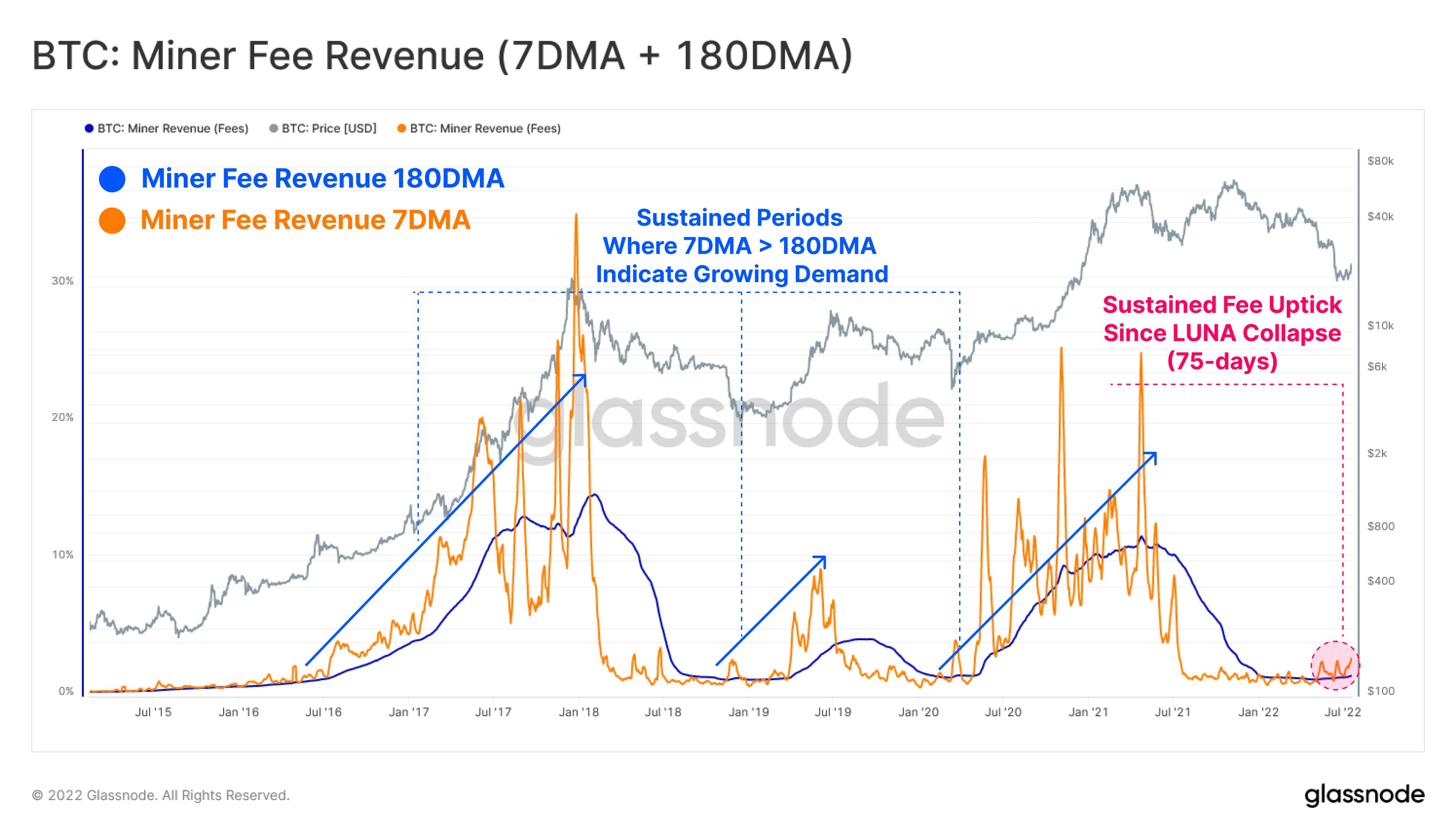

Others, such as the on-chain analysis firm Glassnode, pointed with a early indications of bullishness in Bitcoin, because of the elevated transaction charges which have been seen around the network because the collapse from the Terra (LUNA) network.

“A regime of greater charges, in which the [7-day moving average] is greater compared to [180-day moving average], is in the past an indication of market recovery,” the firm authored on Twitter. Additionally, it shared a chart that shows how similar occasions have performed out in the past.

____

Find out more:

– Bitcoin Mining Difficulty Sees Its Greatest Fall in 12 Several weeks

– Volatile Several weeks Ahead for Ethereum & USD 1,711 Likely for Year-Finish, States Crypto Industry Panel

– Little Upside for Solana This Season, But Lengthy-Term Future Remains Vibrant, Panel Predicts

– Cardano Cost to Finish Year at USD .63, More and more Bearish Panel Predicts

– Crypto Winter Will Finish Before 2022 Has Gone Out – Korbit

– Did Tesla Make Profit on its Bitcoin Investment?