Bitcoin (BTC) cost is constantly on the struggle at $20,000 and repeat dips under this level have brought some analysts to project much deeper downside within the short-term. Earlier within the week, independent market analyst Philip Quick tweeted the Crypto Fear and Avarice Index had dropped consecutive to “Extreme Fear,” reflecting softening sentiment among investors.

The marketplace isn’t enjoying $BTC hanging out $20k. Back to Extreme Fear today.

Live chart: https://t.co/Jr5151zN7I pic.twitter.com/UnztrZP7FP

— Philip Quick (@PositiveCrypto) August 31, 2022

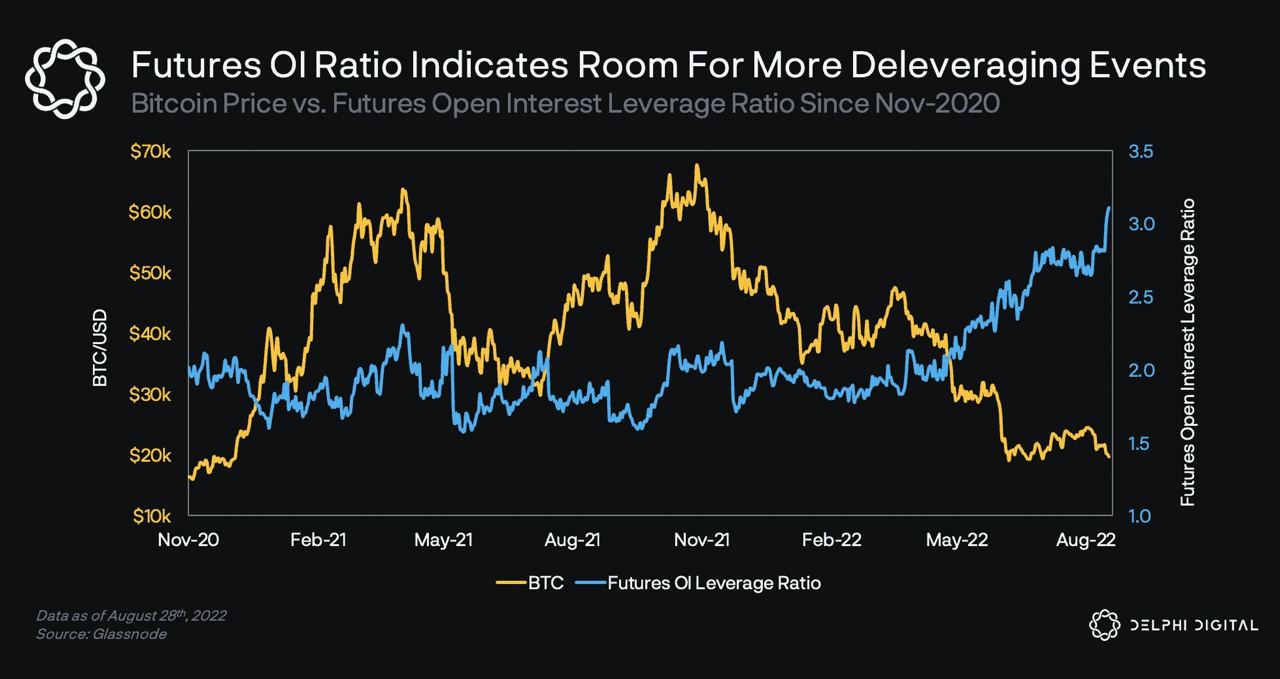

On August 29, analytics firm Delphi Digital highlighted Bitcoin open interest hitting a brand new record-high and stated:

“The Futures Open Interest Leverage Ratio for BTC arrived at its greatest level ever recorded at greater than 3% of BTC market cap, following a market-wide collapse on August 26th.”

Based on Delphi Digital, “higher values claim that open interest rates are large, in accordance with market size. This means a greater chance of market squeezes, liquidation cascades or delivering occasions.”

Precisely what might catalyze this kind of event remains unknown, but any continuation of the present downtrend in stocks which saw the Dow jones and S&P 500 summary a 4th day’s decline to finish August baffled could still weigh on Bitcoin cost. Data from CNBC shows the Dow jones closed August lower 4.1% and also the S&P 500 and Nasdaq closed the month with 4.2% and 4.6% losses.

Cleveland Fed President Loretta Mester also commented that they expects the benchmark rate of interest to increase above 4% and she or he recommended that it’s highly unlikely that you will see any cuts through the whole of 2023. 4% is well over the Fed’s target 2.25% to two.5% range.

Thinking about how crypto markets have performed because the Given first started raising rates on This summer 26, 2022, cheap BTC and equities markets reflect a powerful correlation, it wouldn’t come as a surprise to determine a lengthy attracted out decline from Bitcoin cost within the coming several weeks.

Related: Potential Bitcoin cost double-bottom could spark BTC rally to $30K despite ‘extreme fear’

However, traders seem to be bullish around the approaching Merge. Ether and ETH staking-related tokens have organized relatively well since bouncing from last week’s sell-off. After shedding to $1,422 on August. 28, Ether has acquired 11.3% and trades just below $1,600. Lido (LDO), the biggest ETH staking service, expires 12% at the time and 32% from last week’s drop to $1.55.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.