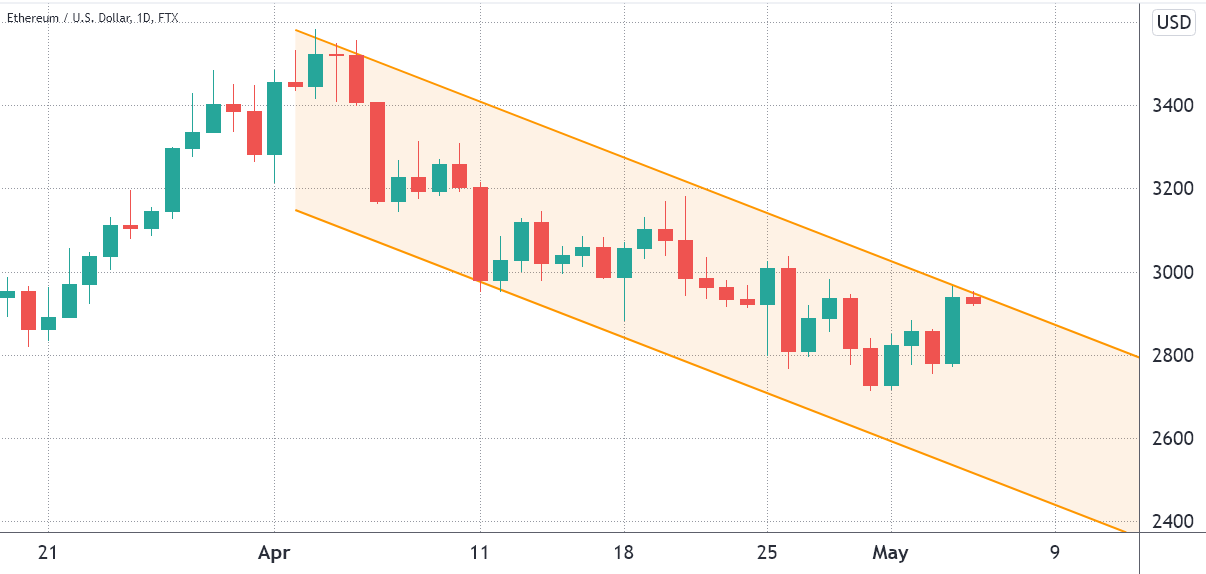

Despite bouncing from the 45-day have less April 30, Ether (ETH) cost continues to be stuck inside a climbing down funnel and also the subsequent 9% gain in the last four days only agreed to be enough to obtain the altcoin to check the pattern’s $2,870 resistance.

Fed financial policy remains a significant affect on crypto prices which week’s volatility is probably linked to comments in the FOMC. On May 4, the U . s . States Fed elevated its benchmark overnight rate of interest by half a portion point, the greatest hike in 22 years. Even though it would be a broadly expected and unanimous decision, the financial authority stated it might reduce its $9 trillion asset base beginning in June.

Chairman Jeremy Powell described the Fed is decided to revive cost stability even when which means hurting the economy with lower business investment and household spending. Powell also ignored the significance of the gdp decline within the first three several weeks of 2022.

Despite the fact that Ether’s cost has remedied by 14% during the period of per month, the network’s value kept in smart contracts (TVL) elevated by 7% in thirty days to 25.two million Ether, based on data from DefiLlama. Because of this, it’s worth exploring when the cost drop below $3,000 impacted derivatives traders’ sentiment.

ETH futures show traders continue to be bearish

To know if the market has flipped bearish, traders must evaluate the Ether futures contracts’ premium, also referred to as the foundation rate. Unlike a continuous contract, these fixed-calendar futures don’t have a funding rate, so their cost will differ vastly from regular place exchanges.

It’s possible to gauge the marketplace sentiment by calculating the cost gap between futures and also the regular place market.

To pay for traders’ deposits before the trade settles, futures should trade in a 5% to 12% annualized premium in healthy markets. Yet, as displayed above, Ether’s annualized premium continues to be below this type of threshold since April 5.

Despite a small improvement in the last 24 hrs, the present 3.5% basis rates are usually considered bearish because it signals too little interest in leverage buyers.

Related: Given hikes rates of interest by 50 basis points in effort to combat inflation

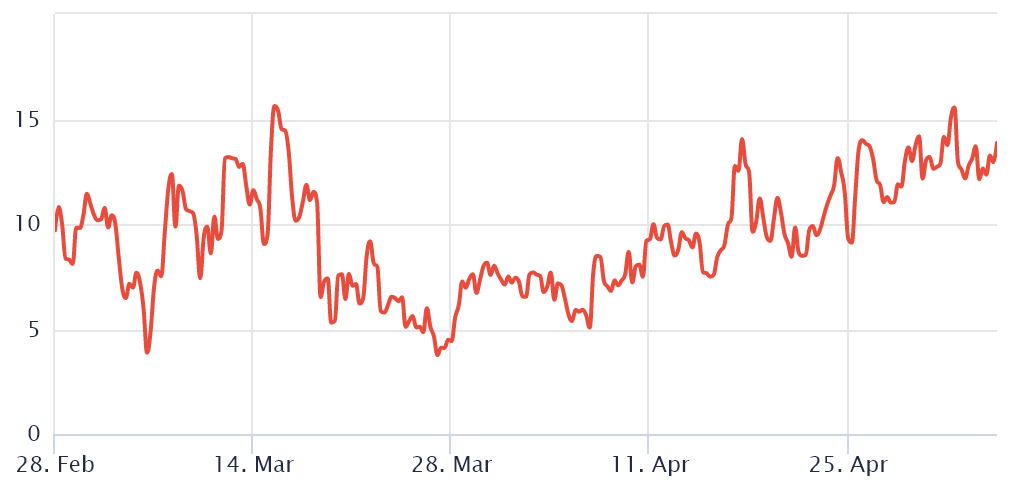

Sentiment in options markets worsened

To exclude externalities specific towards the futures instrument, traders also needs to evaluate the choices markets. For example, the 25% delta skew compares similar call (buy) and set (sell) options.

This metric will turn positive when fear is prevalent since the protective put options fees are greater than similar risk call options. The alternative holds when avarice is prevalent, resulting in the 25% delta skew indicator to shift towards the negative area.

A 25% skew indicator range from negative 8% and positive 8% is generally considered an unbiased area. However, the metric continues to be above this type of threshold since April 16 and it is presently at 14%.

With option traders having to pay greater premiums for downside protection, it’s safe to summarize the sentiment has worsened previously thirty days. Presently, there’s an increasing feeling of bearish sentiment on the market.

Obviously, none of the data can predict if Ether continuously respect the climbing down funnel, which presently holds a $2,950 resistance. Still, thinking about the present derivatives data, there’s need to think that an eventual pump above $3,000 will probably be short-resided.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.