Thanks for visiting Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a e-newsletter crafted to create you significant developments during the last week.

Following the Mango Markets exploit a week ago, Compound protocol stopped the availability of 4 tokens as lending collateral to safeguard it against any cost manipulation.

Crypto staking protocol Freeway stated certainly one of its buying and selling strategies “appears to possess unsuccessful,” forcing the firm to prevent services the 2009 week. October remains covered with DeFi hacks as the second DeFi lockup protocol, Team Finance, lost $14.5 million during contract migration, despite an audit clearance.

MakerDAO community dicated to approve the child custody of $1.6 billion USD Gold coin (USDC) using the institutional brokerage platform Coinbase Prime.

The very best 100 DeFi tokens demonstrated bullish momentum after nearly three days of cost performance covered with the bears. Most of the tokens traded within the eco-friendly around the weekly charts, with a number of them seeing double-digit gains.

After Mango Markets exploit, Compound pauses 4 tokens to safeguard against cost manipulation

Decentralized lending protocol Compound has stopped the availability of 4 tokens as lending collateral on its platform, planning to safeguard users against potential attacks involving cost manipulation, like the recent $117 million exploit of Mango Markets, based on an offer on Compound’s governance forum which was lately passed.

Using the pause, users won’t be able to deposit Yearn.finance’s YFI (YFI), 0x’s ZRX, Fundamental Attention Token (BAT) and Maker’s MKR (MKR) as collateral to consider loans.

Freeway’s withdrawal halt attributed to ‘failed’ buying and selling strategy

Crypto staking platform Freeway pointed in the failure of 1 of their cryptocurrency buying and selling strategies, together with market conditions, because the leading reason behind halting user withdrawals the 2009 week.

The crypto yield platform on March. 23 announced it was halting various transactions associated with its high-yield Supercharger product, citing “unprecedented volatility” at that time, without giving anymore details at that time, which saw its token cost plummet.

Team Finance exploited for $14.5M during protocol migration despite contract audit

DeFi lockup protocol Team Finance stated that more than $14.5 million price of tokens were exploited with the Uniswap v2 to v3 migration function on its platform. As relayed through blockchain security firm PeckShield, the hacker transferred liquidity from Uniswap v2 assets on Team Finance for an attacker-controlled v3 pair with skewed prices. By locking tokens towards the contract, the attacker bypassed existing validation mechanisms and pocketed the large leftovers like a refund to make money.

Uniswap v3 was created with better efficiency for liquidity providers (LP) than v2 on its decentralized exchange. However, v2 smart contracts continue to be operational, and users must communicate with a migration smart contract emigrate their LP assets from v2 to v3. PeckShield believed the initial attack vector needed with this interaction costs just 1.76 Ether (ETH).

MakerDAO community votes to approve child custody of $1.6B in USDC with Coinbase

Coinbase Prime, an institutional prime brokerage platform for crypto assets, announced on March. 24 it has joined right into a partnership with MakerDAO to become custodian of $1.6 billion price of the stablecoin USDC, which MakerDAO may be the largest single holder.

The MakerDAO community dicated to approve the custodianship, that will allow its community to earn single.5% reward on its USDC while holding funds having a leading institutional custodian.

DeFi market overview

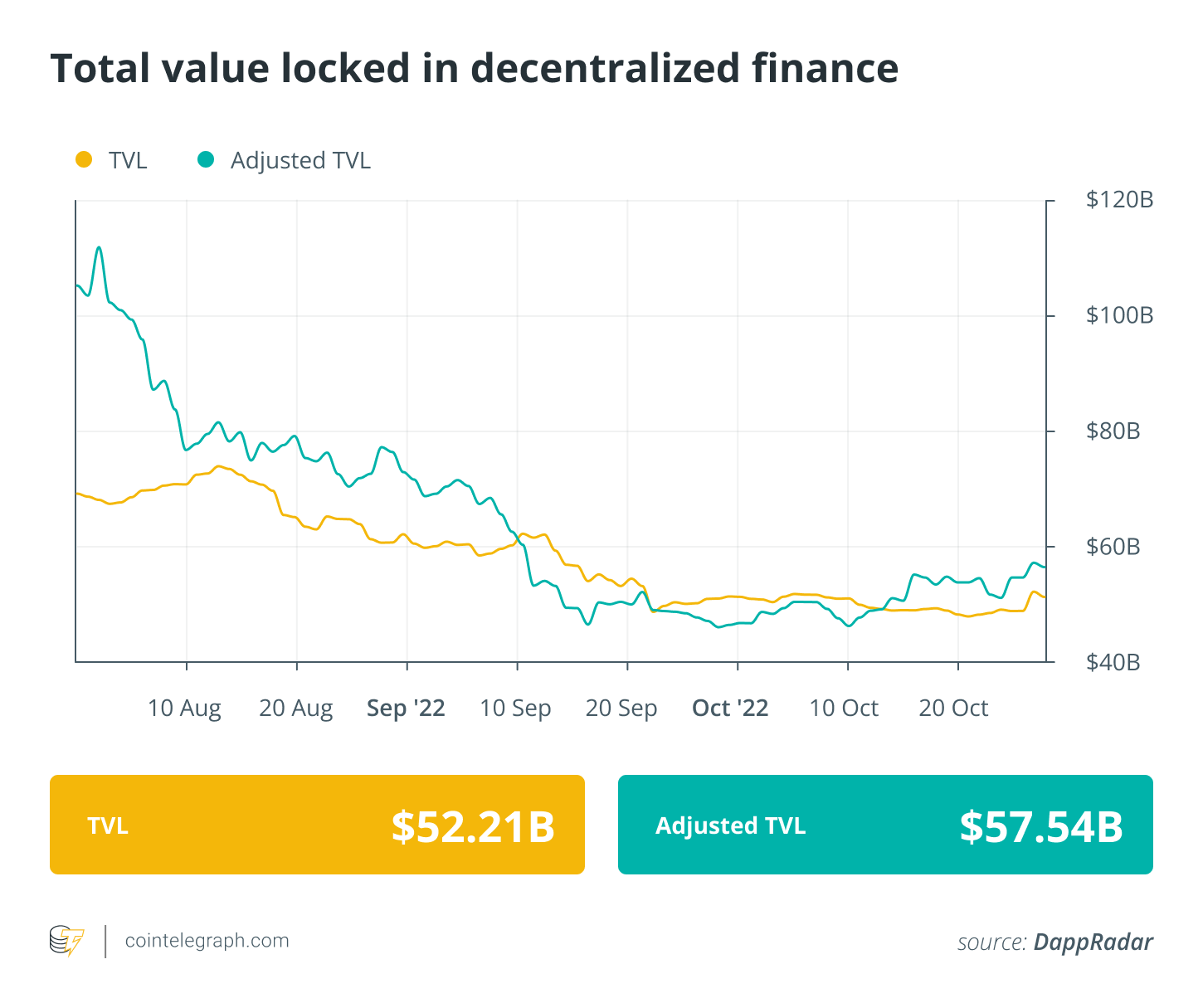

Analytical data reveals that DeFi’s total value registered an outburst toward the finish of October, using the total value locked (TVL) rising above $50 billion during the time of writing. Data from Cointelegraph Markets Pro and TradingView reveal that DeFi’s best players tokens by market capital were built with a bullish week, with a lot of the tokens buying and selling within the eco-friendly around the 7-day chart, barring a couple of.

Theta Network (THETA) was the greatest gainer in the last week, registering an every week rush of 14.68%, adopted by Avalance (AVAX) having a 12.85% surge around the 7-day chart. A number of other DeFi tokens registered single-digit weekly gains, barring a couple of that traded at a negative balance.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.