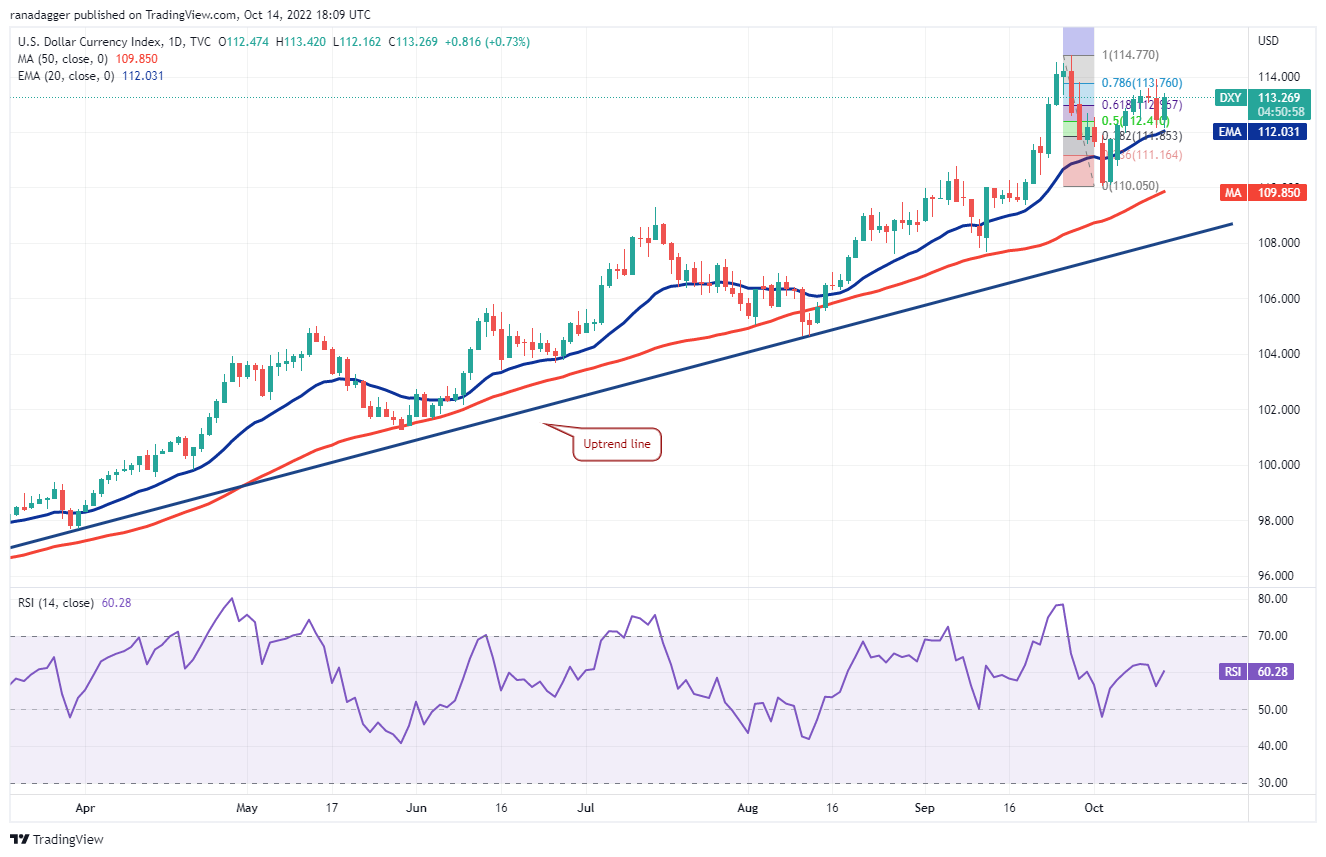

The U . s . States Consumer Cost Index (CPI) elevated 8.2% yearly in September, beating economists’ expectations of the 8.1% rise. The CPI print resided as much as its hype and caused a clear, crisp, but short-term rise in volatile risk assets.

The S&P 500 oscillated inside its largest buying and selling range since 2020 and Bitcoin (BTC) also observed a sizable intraday range in excess of $1,323 on March. 13. However, Bitcoin still couldn’t shake from the $18,125 to $20,500 range that continues to be within the last a few days.

Both U.S. equities markets and Bitcoin attempted to increase their recovery on March. 14 however the greater levels attracted selling, indicating the bears haven’t yet quit.

Is the elevated volatility culminate having a breakout towards the upside or does it start the next leg from the downtrend?

Let’s read the charts from the S&P 500 index, the U.S. dollar index (DXY) and also the major cryptocurrencies to discover.

SPX

The S&P 500 index (SPX) gapped lower on March. 13 and dropped to $3,491 but ‘abnormal’ amounts attracted huge buying through the bulls. That could have caught several aggressive bears around the wrong paw plus they may have scrambled to pay for their short positions. That propelled the index back over the breakdown degree of $3,636.

Buyers attempted to increase the recovery on March. 14, however the bears had other plans. The sellers intensely defended the 20-day exponential moving average (EMA) ($3,715), indicating the sentiment remains negative and relief rallies are now being offered into.

The bears will attempt to sink the index to $3,491, which is a vital level to keep close track of. If the support cracks, the index could dive to $3,325.

Alternatively, when the index rebounds from the support zone between $3,636 and $3,491, it’ll claim that bulls might be accumulating on dips. Buyers will make an effort to overcome the barrier in the 20-day EMA and challenge the downtrend line. If the resistance collapses, it’ll signal the corrective phase might be over.

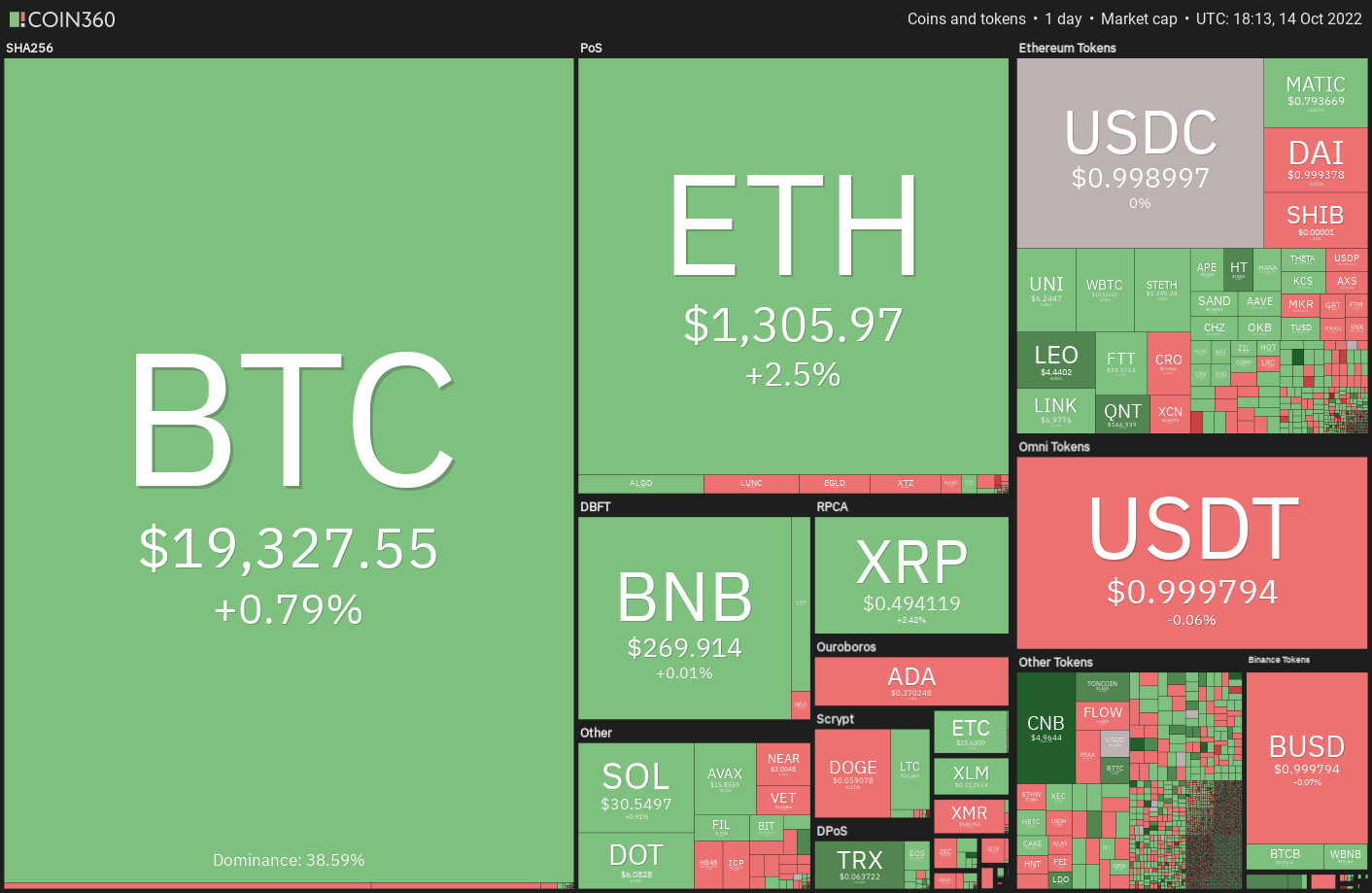

DXY

The U.S. dollar index switched lower from $113.92 on March. 13 however the bulls arrested the decline in the 20-day EMA (112). This means the sentiment remains positive and traders are viewing the dips like a buying chance.

The bulls will attempt to pierce the overhead resistance zone between $113.92 and $114.77. An acceptance above this zone will signal the resumption from the upward trend. The index could then rally to $117.14.

Unlike this assumption, when the cost turns lower in the overhead resistance, the bears will attempt to drag the index underneath the 20-day EMA. A rest below this support would be the first indication the bullish momentum is weakening.

The index could then decline towards the 50-day simple moving average (SMA) (109). A pattern change is going to be signaled if bears sink the cost underneath the upward trend line.

BTC/USDT

Bitcoin sliced with the support at $18,843 on March. 13 and dipped near to $18,125. This level attracted buying, which began a clear, crisp recovery as seen in the lengthy tail around the day’s candlepower unit.

Buyers pressed the cost over the moving averages on March. 14 however the up-move is facing stiff resistance in the downtrend line. The 20-day EMA ($19,466) is flattening out and also the relative strength index (RSI) is close to the midpoint, indicating equilibrium between consumers.

This balance will tilt in support of the bulls when they push and sustain the cost over the overhead resistance at $20,500. The BTC/USDT pair could then rally to $22,800. The bears are anticipated to mount a stiff resistance only at that level.

When the cost sustains underneath the 20-day EMA, the bears will again attempt to pull the happy couple below $18,843 and challenge the support at $18,125.

ETH/USDT

Ether (ETH) broke underneath the support at $1,220 on March. 13 however the bears couldn’t keep your cost lower. The bulls intensely purchased the dip, developing a hammer candlepower unit pattern.

Buyers have sustained the positive momentum on March. 14 and are attempting to push the cost over the overhead zone between your 20-day EMA ($1,331) and also the resistance type of the triangular.

Whether they can accomplish it, the ETH/USDT pair could chance a rally towards the downtrend type of the climbing down funnel pattern. The bulls will need to obvious this obstacle to signal a possible trend change.

The bears will probably produce other plans. They’ll make an effort to halt the recovery within the overhead zone and continue to pull the happy couple below $1,190.

BNB/USDT

BNB has been range-bound between $300 and $258 within the last a few days. Inside a range, traders usually buy close to the support then sell near to the resistance.

It is exactly what happened on March. 13 because the bulls purchased the dip to $258. Buyers attempted to push the cost over the moving averages on March. 14 however the lengthy wick around the candlepower unit implies that bears can sell near resistance levels. The bears will again attempt to pull the cost below $258 and extend the decline to $216.

On the other hand, when the cost appears and breaks over the moving averages, the BNB/USDT pair could chance a rally towards the overhead resistance at $300. A rest above this level could set happens for any rally to $338.

XRP/USDT

XRP (XRP) broke underneath the 20-day EMA ($.47) on March. 13 however the bears couldn’t sustain the low levels. The bulls purchased the dip and pressed the cost back over the 20-day EMA.

Both moving averages are sloping up and also the RSI is incorporated in the positive territory, indicating benefit to buyers. The bulls will endeavour to push the cost over the overhead resistance at $.56. In the event that happens, the XRP/USDT pair could resume its upward trend and rally toward the following overhead resistance at $.66.

The very first manifestation of weakness is a break and shut underneath the 20-day EMA. That will indicate that traders might be booking profits at greater levels. The happy couple could then slide towards the breakout degree of $.41.

ADA/USDT

Cardano (ADA) found buying support at $.35 on March. 13 however the bulls are battling to push the cost over the breakdown degree of $.40 on March. 14.

The 20-day EMA ($.41) is constantly on the slope lower and also the RSI is incorporated in the oversold territory, indicating that bears have been in control. When the cost continues lower and breaks below $.35, it’ll claim that bears have flipped $.40 into resistance. That may increase the probability of a drop to $.33.

This bearish view might be negated soon if buyers push the cost over the moving averages. Which will indicate strong accumulation at ‘abnormal’ amounts. The ADA/USDT pair could then climb towards the downtrend line.

Related: Bitcoin bear market can last ‘2-3 several weeks max’ —Interview with BTC analyst Philip Quick

SOL/USDT

Solana (SOL) stepped underneath the $30 support on March. 13 however the bears couldn’t build this strength and sink the cost towards the vital support at $26. The bulls arrested the drop at $27.87 and pressed the cost back above $30.

Buyers attempted to increase the positive momentum on March. 14 but encountered heavy selling close to the downtrend line as seen in the lengthy wick around the candlepower unit. The bears will again attempt to pull the cost below $30 and extend the decline to $26.

If bulls wish to invalidate this bearish view, they’re going to have to rapidly push the SOL/USDT pair over the downtrend line. That may obvious the road for any possible rally to $35.50 and after that to $39 in which the bears may again provide a strong resistance.

DOGE/USDT

Dogecoin (DOGE) rebounded from the strong support near $.06 on March. 13, indicating the bulls are protecting the amount strongly. Buyers are attempting to propel the cost over the moving averages on March. 14.

When they manage to achieve that, the DOGE/USDT pair could rise to $.07. This level is again prone to behave as a powerful resistance but when bulls push the cost above it, the happy couple could chance a rally towards the overhead degree of $.09.

Contrarily, when the cost turns lower in the moving averages, the bears will again make an effort to sink the cost underneath the support near $.06. It is really an important level for that bulls to protect if it cracks, the happy couple could retest the June low near $.05.

MATIC/USDT

The lengthy tail on Polygon’s (MATIC) March. 13 candlepower unit implies that bulls are strongly buying close to the $.71 to $.69 support zone. Buyers ongoing their momentum on March. 14 and attempted to push the cost over the downtrend line however the bears held their ground.

The flattish moving averages and also the RSI close to the midpoint advise a balance between demand and supply. This equilibrium could tilt in support of the buyers when the cost increases over the downtrend line. The MATIC/USDT pair could then rise to $.86 and when this level is entered, the following stop might be $.94.

However, when the cost reverses direction in the downtrend line, it’ll reveal that bears still sell on rallies. The happy couple could then remain stuck between your downtrend line and also the support at $.69.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.