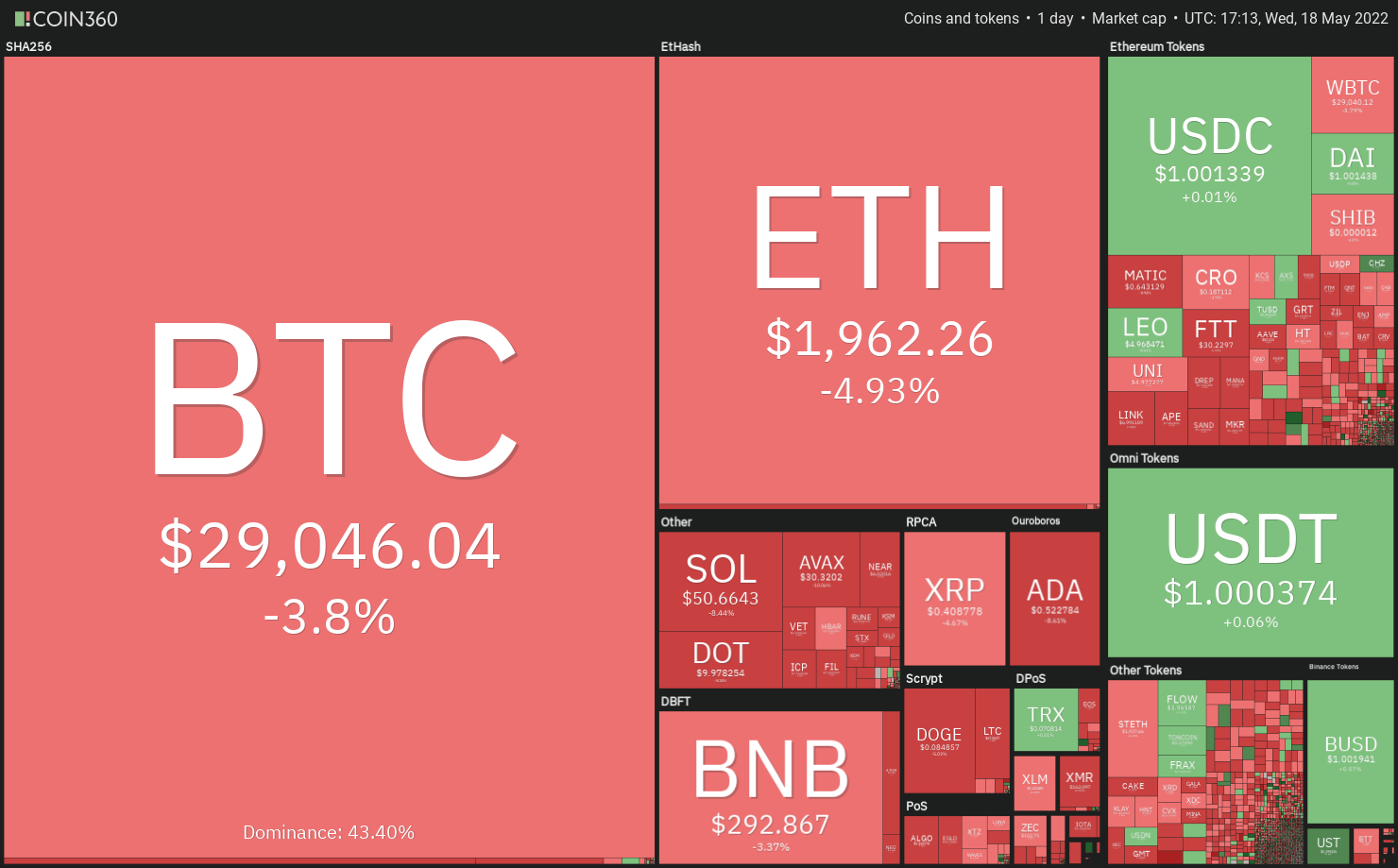

On May 17, U . s . States Fed Chairman Jerome Powell told the Wall Street Journal the 50-basis-point rate hikes would continue until inflation is in check. Powell’s focus on a hawkish policy shows that financial conditions will probably remain tight in 2022, that could limit the upside in dangerous assets.

On-chain market intelligence firm Glassnode stated that in the past, Bitcoin (BTC) has bottomed out once the cost breaks underneath the recognized cost. However, barring the 2019 to 2020 bear market, during previous bear cycles, Bitcoin’s cost remained underneath the recognized cost for between 114 to 299 days. This means when macro the situation is not favorable, a fast recovery is not likely.

As the current loss of U.S. equity markets and Bitcoin has similarities using the crash in March 2020, the recovery might not stick to the same trajectory because market the weather is different. In 2020, the Given supported the markets by having an unparalleled stimulus, however in 2022 the main focus will stay on reducing inflation and financial tightening.

Could Bitcoin and altcoins resume their downtrend or will ‘abnormal’ amounts attract buying? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin’s recovery unsuccessful to increase over the 38.2% Fibonacci retracement level at $31,721 suggesting the trend remains negative and traders can sell on minor rallies.

The BTC/USDT pair could drop towards the immediate support at $28,630. When the cost rebounds off this level, the happy couple could consolidate between $28,630 and $31,721 for a while.

A rest and shut over the 20-day exponential moving average (EMA) ($32,979) would be the first manifestation of a possible alternation in trend. The happy couple could then rally towards the 61.8% retracement level at $34,823.

However, when the cost slips below $28,630, the bears will attempt to cement their position by pulling the happy couple below $26,700. In the event that happens, the negative momentum could get and also the pair may slide to $25,000 and after that to $21,800.

ETH/USDT

Ether’s (ETH) failure to increase over the overhead resistance at $2,159 might have enticed short-term traders to reserve profits. That pulled the cost below $1,940 however the bulls are trying to defend the amount.

When the cost rebounds off $1,940 with strength, the ETH/USDT pair could again rise to $2,159. The bulls will need to push and sustain the cost above $2,159 to obvious the road for any rally towards the 20-day EMA ($2,353). A rest and shut above this resistance will claim that the markets have rejected the low levels.

On the other hand, if bears sustain the cost below $1,940, the happy couple could decline towards the crucial support at $1,700. It is really an important level to keep close track of just because a break below it could cause panic selling. The happy couple could then slump to $1,500 and then to $1,300.

BNB/USDT

The bulls haven’t been in a position to push BNB above the overhead resistance at $320. This means that bears haven’t quit plus they still sell at greater levels.

When the cost slips below $290, the BNB/USDT pair could drop to $265. This level will probably behave as a powerful support but when bears pull the cost below it, the following stop may be the critical level at $211. The bears will need to break this level to signal the beginning of the following leg from the downtrend.

Alternatively, when the cost rebounds off $265, it’ll claim that bulls are trying to form a bottom. That may keep your pair stuck between $320 and $265 for any couple of days. A rest and shut above $320 could claim that the happy couple might have bottomed out.

XRP/USDT

Ripple’s (XRP) recovery unsuccessful to sustain above $.45, indicating too little demand at greater levels. The bears will make an effort to pull the cost underneath the immediate support zone at $.40 to $.38.

When they do this, the XRP/USDT pair could drop to $.33. It is really an important level to keep close track of just because a break and shut below it might signal the resumption from the downtrend. The XRP/UDST pair could then plunge to another support at $.24.

However, when the cost increases from $.38 or $.33, the bulls will again attempt to push the happy couple above $.45. When they succeed, the happy couple could rise towards the stiff overhead resistance zone at $.50 to $.55. The bulls will need to obvious this hurdle to point out the downtrend might be over.

ADA/USDT

Cardano (ADA) continues to be stuck inside a tight range from $.61 and $.51 within the last couple of days. This means a difficult fight between your bulls and also the bears.

When the cost slips below $.51, the ADA/USDT pair could slide towards the support zone between $.46 and $.40. The bulls may mount a powerful defense within this zone. When the cost rebounds off this zone, the buyers will again attempt to push the happy couple over the 20-day EMA. When they succeed, the happy couple could rise to $.74.

On the other hand, when the cost breaks below $.40, the selling could get momentum and also the pair may extend its decline to $.33 after which to $.28.

SOL/USDT

Solana (SOL) is facing strong resistance close to the 38.2% Fibonacci retracement level at $59, suggesting the sentiment remains negative and bears can sell on minor rallies.

When the cost breaks underneath the mental level at $50, the happy couple could slip to $43 and after that to $37. The bulls will probably defend this level with all of their might if the support gives way, the downtrend could resume. The following stop around the downside might be $32.

Alternatively, when the cost appears in the current level and increases above $59, the SOL/USDT pair could rally towards the overhead resistance zone between your 20-day EMA ($67) and $75. A rest and shut above this zone could claim that the downtrend might be over.

DOGE/USDT

Dogecoin (DOGE) is constantly on the trade underneath the breakdown degree of $.10. This means too little emergency to purchase at greater levels. Generally, sharp declines are adopted by consolidations as bulls and bears fight it for supremacy.

The failure from the bulls to push the cost above $.10 may attract another round of promoting through the bears who’ll make an effort to resume the downtrend. When the cost dips below $.08, the DOGE/USDT pair could drop to $.06. If the support cracks, the decline could extend to another support at $.04.

On the other hand, when the cost rebounds off $.08, the happy couple may rise to $.10 and turn into stuck inside this range for any couple of days. The bulls will need to push and sustain the cost over the 20-day EMA ($.10) to point out the downward momentum might be weakening.

Related: Aave cost risks a 25% plunge like a classic bearish reversal pattern emerges

Us dot/USDT

The bulls defended the $10.37 support on May 17 however the shallow rebound recommended too little demand at greater levels. The bears started again their selling on May 18 and pulled the cost below $10.37. Polkadot (Us dot) could now drop to $8.

The buyers are anticipated to strongly defend the zone between $8 and $7.30. When the cost rebounds off this zone, the Us dot/USDT pair could again chance a relief rally. The recovery could get momentum away over the 20-day EMA ($12.53).

Alternatively, if bears sink the cost below $7.30, the selling could accelerate and also the pair may signal the resumption from the downtrend. The happy couple could then plummet toward mental support at $5.

AVAX/USDT

The buyers couldn’t push Avalanche (AVAX) over the immediate resistance at $38. This means that demand dries up at greater levels.

The bears will fancy their chances and try to pull the cost underneath the critical support at $29. When they succeed, the AVAX/USDT pair could retest the May 12 intraday low at $23.51. A rest and shut below this level could open the doorways for any further decline to $20 and then to $18.

Unlike this assumption, when the cost rebounds off $29, the bulls will again attempt to push the happy couple above $38. In the event that happens, the relief rally could achieve the 20-day EMA ($45). The bears may again pose a powerful challenge only at that level.

SHIB/USDT

Shiba Inu (SHIB) continues to be consolidating within the tight range from $.000011 and $.000014 within the last four days. Usually, such tight ranges resolve inside a strong trending move.

When the cost breaks below $.000011, the bears will attempt to drag the SHIB/USDT pair to $.000009. It is really an important level for that bulls to protect just because a break below it might signal the resumption from the downtrend. The happy couple could then decline to $.000007 and then to $.000005.

Unlike this assumption, when the cost appears and breaks over the 38.2% Fibonacci retracement level at $.000014, the bulls will endeavour to push the happy couple towards the breakdown level at $.000017.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.