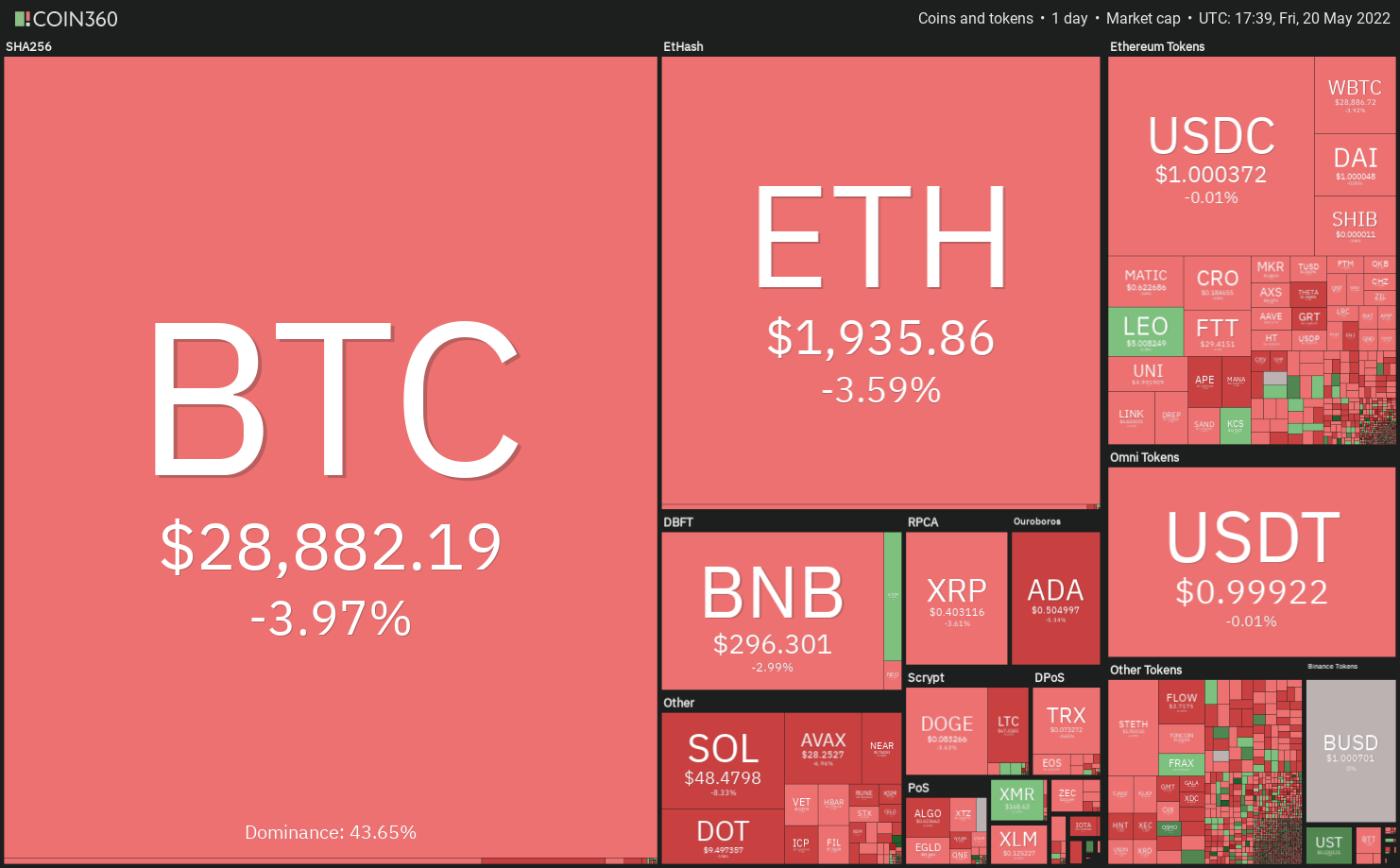

Bitcoin’s (BTC) tight correlation using the legacy markets remains a drag, especially because the U . s . States equity markets stay in a strong bear trend. The Dow jones Johnson Industrial Average is on the right track because of its eighth consecutive negative week and also the S&P 500 is near to plunging in to the bear market territory.

Celsius (CEL) Chief executive officer Alex Mashinsky believes the short sellers on Wall Street are searching for just about any weakness in crypto companies to “short and destroy.” Mashinsky blamed “the Sharks of Wall Street” for getting lower Terra (LUNA) and seeking to destabilize Tether (USDT) and Maker (MKR) and “many others,” including Celsius.

Bear markets, though painful for the short term, are usually good buying possibilities for lengthy-term investors. However, you need to remember thatwhen the following bull phase starts, not every coins will go back to their former glory.

Every bull market generally includes a new group of leaders hence, traders need to recognize the cryptocurrencies which are leading the marketplace instead of purchasing the laggards. Nic Carter place it nicely as he stated that everything won’t create a comeback and “some things die permanently.”

Could Bitcoin and altcoins break below their recent lows or will bulls defend the supports effectively? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin rebounded from the strong support at $28,630 on May 19 however the bulls couldn’t push the cost over the downtrend line. This means that bears haven’t yet quit plus they still sell on rallies.

The bears will attempt to drag the cost below $28,630. When they manage to achieve that, the BTC/USDT pair could drop towards the May 20 intraday low at $26,700. It is really an important support for that bulls to protect if they fail to achieve that, the happy couple could resume its downtrend. The following support on however $25,000 after which $21,800.

Unlike this assumption, when the cost rebounds off $28,630 and increases over the downtrend line, it’ll suggest strong accumulation at ‘abnormal’ amounts. The buyers will attempt to push the cost towards the 20-day exponential moving average (EMA) ($32,332). If bulls obvious this hurdle, the happy couple could rise toward the 61.8% Fibonacci retracement level at $34,823.

ETH/USDT

The bears pulled Ether (ETH) underneath the immediate support at $1,940 on May 18 and 19 but they couldn’t take advantage of this move. The bulls bought the dip but tend to not push the cost towards the overhead resistance at $2,159.

Strong selling at greater levels has pulled the cost towards the upward trend line on May 20. When the ETH/USDT pair breaks underneath the upward trend line, the decline could include the important support at $1,700. The bears will need to sink the happy couple below this level to point out the beginning of the following leg from the downtrend.

Unlike this assumption, when the cost appears in the current level or $1,700, it’ll suggest buying on dips. The happy couple will make yet another make an effort to obvious the overhead hurdle at $2,159. When they manage to achieve that, it’ll claim that the happy couple might have bottomed out.

BNB/USDT

BNB has been consolidating close to the overhead resistance at $320 within the last couple of days. A good consolidation near a stiff resistance signifies that bulls aren’t dumping their positions because they expect the recovery to carry on.

If bulls thrust the cost over the overhead resistance zone between $320 and also the 20-day EMA ($326), it’ll claim that the BNB/USDT pair might have bottomed out. The happy couple could then start its northward journey toward the 50-day simple moving average (SMA) ($381).

On the other hand, when the cost turns lower in the overhead resistance and breaks below $285, it’ll claim that the bulls have provided up and could be closing their positions. That may pull the happy couple to $265 and after that towards the critical support at $211.

XRP/USDT

Ripple (XRP) bounced from the $.40 to $.38 support zone on May 19 however the bulls couldn’t obvious the overhead resistance at $.45. This means that although bulls are purchasing on dips, the bears have maintained their selling pressure near overhead resistance levels.

When the cost continues lower and breaks below $.38, the XRP/USDT pair could drop to $.33. It is really an important level to keep close track of just because a break below it might resume the downtrend. The happy couple could then drop to $.24.

Unlike this assumption, when the cost rebounds from the support zone once more, the buyers will attempt to push the happy couple to $.50. A rest and shut above this level would be the first indication the pair might be bottoming out. The following stop around the upside may be the 50-day SMA ($.64).

ADA/USDT

The bulls are trying to defend the $.50 support in Cardano (ADA) however the bears have been in no mood to forget about their advantage plus they still sell on every minor rally.

When the cost slips and sustains below $.50, the ADA/USDT pair could retest the critical support at $.40. It is really an important level for that bulls to protect just because a break below it might signal the resumption from the downtrend. The happy couple could then drop to $.33 and after that to $.28.

Unlike this assumption, when the cost appears in the current level, the buyers will endeavour to push the happy couple over the 20-day EMA ($.63). When they manage to achieve that, it’ll claim that the selling pressure might be reducing. The happy couple could then rise towards the breakdown level at $.74.

SOL/USDT

Solana (SOL) is within a powerful downtrend. Attempts through the bulls to begin a recovery on May 19 unsuccessful as bears still sell at greater levels. The bears pulled the cost back underneath the mental level at $50 on May 20.

When the cost continues lower, the SOL/USDT pair could drop to $43. This level may behave as a powerful support but when bears pull the cost below it, the following stop might be $37. If the level also cracks, the decline could include $32.

On the other hand, when the cost appears dramatically in the current level or even the support, it’ll suggest accumulation through the bulls. The buyers will make an effort to push the happy couple towards the 20-day EMA ($64). A rest and shut above this level could open the doorways for any possible rally to $75.

DOGE/USDT

Dogecoin (DOGE) bounced from the immediate support at $.08 on May 18 however the recovery is constantly on the face selling at greater levels. This means the sentiment remains negative and traders can sell on every minor rise.

When the cost continues lower and breaks below $.08, the bears will fancy their chances and then try to pull the DOGE/USDT pair underneath the May 12 intraday low at $.06. When they manage to achieve that, the following leg from the downtrend could begin and also the pair may drop to $.04.

This negative view could invalidate for the short term when the cost appears in the current level or even the support beneath and increases over the mental resistance at $10. This type of move could open the doorways for any recovery towards the 50-day SMA ($.12).

Related: Ethereum preparing a ‘bear trap’ in front of the Merge — ETH cost to $4K next?

Us dot/USDT

Polkadot (Us dot) tucked below $10.37 on May 18 however the bulls purchased this dip and attempted to push the cost back over the level on May 19. However, the bears was their ground and are trying to switch $10.37 into resistance.

When the cost slips below $9.22, the Us dot/USDT pair could retest the support zone between $8 and $7.30. The bears will need to sink and sustain the cost below this zone to point the resumption from the downtrend. The following support on however $5.

On the other hand, when the cost rebounds from the support levels, the bulls will endeavour to push the cost towards the 20-day EMA ($12). This level may behave as a powerful resistance but when bulls overcome this barrier, it’ll claim that the sellers might be losing their grip. The happy couple could then chance a rally towards the 50-day SMA ($16).

AVAX/USDT

Avalanche (AVAX) is within a downtrend. The cost action of history couple of days has created a pennant, which often functions like a continuation pattern.

When the cost breaks underneath the support type of the pennant, the AVAX/USDT pair could retest the critical support at $23.51. A rest and shut below this level could signal the resumption from the downtrend. The happy couple could drop to $20 and after that to $18.

Alternatively, when the cost increases in the current level, the buyers will attempt to push the happy couple over the pennant. When they manage to achieve that, the happy couple could get momentum and rise towards the 20-day EMA ($42.35). The bulls will need to obvious this barrier to challenge the breakdown level at $51.

SHIB/USDT

Shiba Inu (SHIB) continues to be stuck between $.000010 and $.000014 within the last couple of days, indicating indecision one of the bulls and also the bears. This signifies that bulls are trying to form a bottom however the bears aren’t allowing the rebound to sustain.

When the cost increases above $.000014, it’ll claim that bulls have absorbed the availability. That may obvious the road for any possible rally to $.000017 in which the bears may again pose a powerful challenge. The bulls will need to obvious this potential to deal with indicate a possible trend change.

Unlike this assumption, when the cost slips below $.000010, the happy couple could drop towards the May 12 intraday low at $.000009. If the support cracks, the decline could include $.000007 after which to $.000005.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.