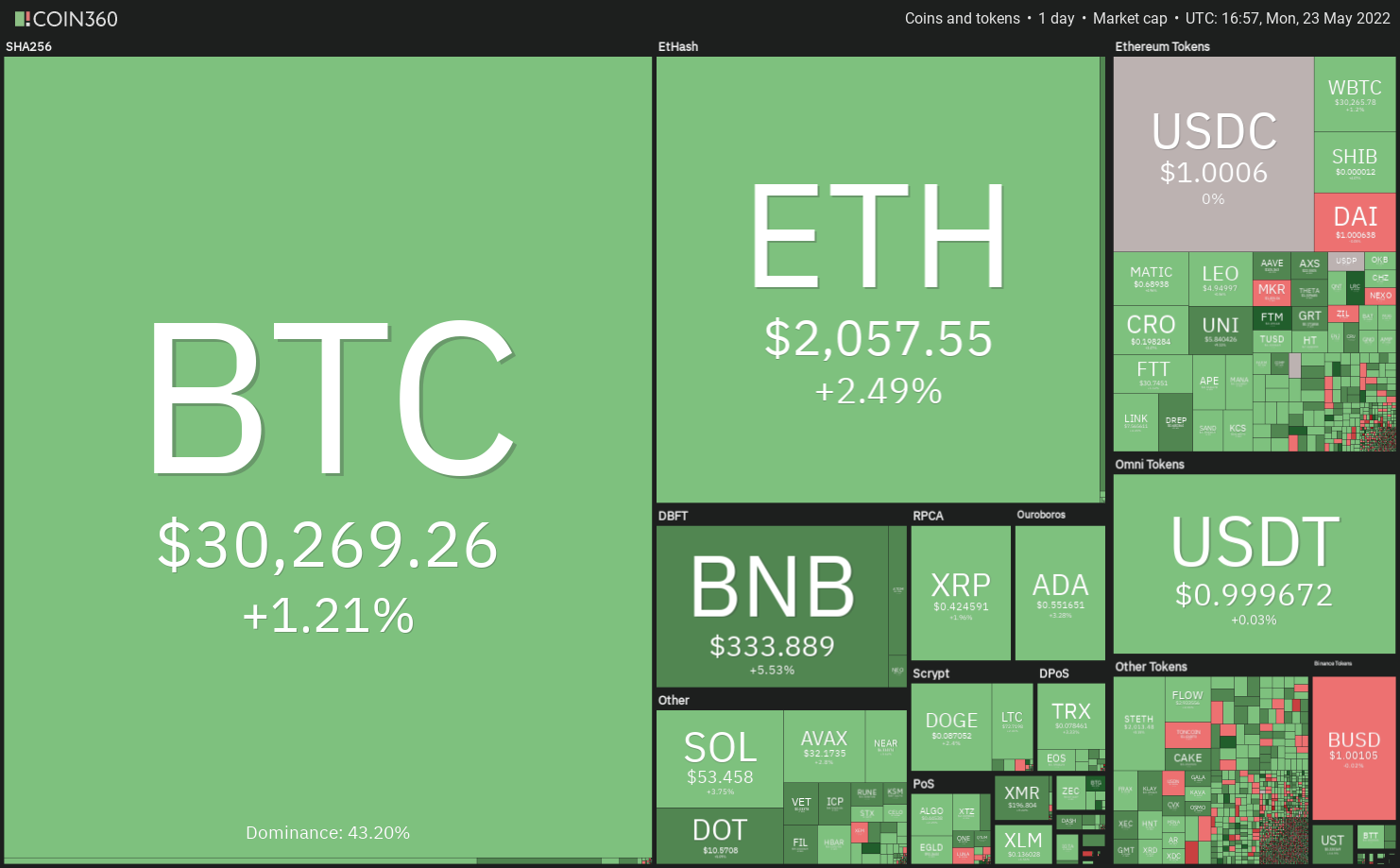

The U . s . States equity financial markets are attempting a recovery after days of relentless selling. Along similar lines, on-chain monitoring resource Material Indicators expects the crypto sell to recover, however they anticipate Bitcoin (BTC) to spend time inside a range before “a real breakout.”

The seven-day moving average from the on-chain transaction volume tracked by Glassnode hit a nine-month have less May 23. This means that Bitcoin’s lackluster cost action in 2022 has brought to reduced participation from traders.

While indications of a brief-term recovery are visible, a sustained recovery might be difficult since the macro conditions remain challenging. Worldwide Financial Fund md Kristalina Georgieva authored inside a blog publish the global economy is witnessing its “biggest test since world war ii.”

Could Bitcoin and altcoins overcome their immediate resistance levels and begin a relief rally? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin held the $28,630 support on May 20, indicating that bulls are purchasing at ‘abnormal’ amounts. The buyers have pressed the cost over the downtrend line, the first manifestation of a recovery.

If buyers sustain the cost over the downtrend line, the BTC/USDT pair could rally towards the 20-day exponential moving average (EMA) ($31,758). The bears will probably defend the 20-day EMA strongly just because a break and shut above it might obvious the road for any possible rally towards the 61.8% Fibonacci retracement level at $34,823.

Alternatively, when the cost turns lower in the current level or even the 20-day EMA, it’ll claim that the sentiment remains negative and traders can sell on rallies. The bears will need to sink the cost below $28,630 to obvious the road for any possible retest from the crucial support at $26,700.

ETH/USDT

Ether (ETH) bounced from the upward trend line on May 21, indicating that bulls are purchasing the dips for this level. The buyers will attempt to push the cost towards the overhead resistance at $2,159 in which the bears may pose a powerful challenge.

When the cost turns lower in the overhead resistance, it might drop towards the upward trend line. It is really an important level to keep close track of for the short term. When the cost rebounds from the upward trend line, it might boost the prospects of the break above $2,159. In the event that happens, the ETH/USDT pair could chance a rally to $2,500.

However, when the cost turns lower in the current level or even the overhead resistance and breaks underneath the upward trend line, it’ll claim that the happy couple may remain stuck between $2,159 and $1,700 for any couple of days.

BNB/USDT

The bulls have pressed BNB above the 20-day EMA ($324), the first sign the downtrend might have ended.

If buyers sustain the cost over the 20-day EMA, the BNB/USDT pair could rally to $350 and then towards the 50-day simple moving average (SMA) ($374). The bears may again make an effort to stall the up-relocate this zone. When the cost turns lower out of this zone but rebounds from the 20-day EMA, it will raise the chance of a rest over the 50-day SMA.

This bullish view is going to be invalidated for the short term when the cost turns lower and breaks below $320. That will indicate selling through the bears at greater levels. The happy couple could then progressively drop to $286.

XRP/USDT

Ripple (XRP) is wanting a recovery following the bulls effectively defended the immediate support at $.38 on May 19. The buyers will attempt to push the cost towards the 20-day EMA ($.47).

The downsloping moving averages and also the RSI within the negative territory indicate that bears possess the upper hands. The sellers will endeavour to protect the 20-day EMA with vigor. In the event that happens, the XRP/USDT pair could turn lower in the overhead resistance and drop towards the strong support at $.38.

On the other hand, if bulls push the cost over the 20-day EMA, it might advise a possible alternation in rapid-term trend. The happy couple could then rise towards the overhead zone between $.50 and $.55, which might behave as a significant obstacle.

Around the downside, the bears will need to sink and sustain the cost below $.38 to spread out the doorways for any possible retest from the May 12 intraday low at $.33.

ADA/USDT

The bulls effectively defended the mental level at $.50 previously couple of days, indicating demand at ‘abnormal’ amounts. The buyers will attempt to push Cardano (ADA) over the 20-day EMA ($.60).

When they succeed, the ADA/USDT pair could chance a rally towards the breakdown degree of $.74. The bears will probably pose a stiff challenge only at that level. If bulls arrest the following decline in the 20-day EMA, it’ll suggest a general change in sentiment from selling on rallies to purchasing on dips.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll indicate that bears still sell on rallies. The bears will attempt to pull the cost below $.50 and retest the important support at $.40.

SOL/USDT

The bulls purchased the dip to $47 on May 20 and are trying to push Solana (SOL) toward the 20-day EMA ($61). The bears are anticipated to protect this level strongly.

When the cost turns lower in the 20-day EMA, the SOL/USDT pair could drop to $47 in which the bulls will endeavour to stall the decline. In the event that happens, the happy couple may trade between $47 and $60 for any couple of days.

A rest and shut over the 20-day EMA would be the first indication the bulls are during the game. The happy couple could then rally towards the breakdown level at $75. Alternatively, when the cost turns lower and breaks below $47, the happy couple could slide towards the strong support at $37.

DOGE/USDT

Dogecoin (DOGE) is consolidating inside a downtrend. The bulls defended the $.08 support previously couple of days and are trying to push the cost towards the overhead resistance at $.10.

When the cost turns lower from $.10, it’ll claim that bears are attempting to switch this level into resistance. When they succeed, the DOGE/USDT pair could continue its range-bound action for any couple of more days.

The buyers will need to propel the cost above $.10 to point out the downtrend might be weakening. The happy couple could then rally to $.12.

Alternatively, when the cost turns lower in the current level and breaks below $.08, the happy couple could retest the critical support at $.06.

Related: Monero enters ‘overbought’ danger zone after XMR cost gains 75% in 2 days

Us dot/USDT

The bulls are trying to push and sustain Polkadot (Us dot) over the overhead resistance at $10.37. When they succeed, the cost could rally towards the 20-day EMA ($11.57).

The buyers will need to push the cost over the 20-day EMA to point a possible alternation in rapid-term trend. The Us dot/USDT pair could then rally towards the overhead resistance zone between $14 and $16 in which the bears may mount a powerful defense.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that the popularity remains negative and traders can sell on rallies. The bears will attempt to pull the happy couple below $9.22 and retest the important support at $7.30.

AVAX/USDT

Avalanche (AVAX) rebounded from the support type of the pennant, indicating that bulls are protecting this level strongly. The buyers will attempt to push the cost over the pennant.

When they manage to achieve that, the AVAX/USDT pair could rally towards the 20-day EMA ($39). It is really an important level to take into consideration since the bears are anticipated to protect it with vigor.

When the cost turns lower in the 20-day EMA but doesn’t re-go into the pennant, it’ll advise a possible alternation in trend. The buyers will on the other hand make an effort to obvious the overhead hurdle in the 20-day EMA and push the happy couple toward $51.

On the other hand, when the cost turns lower in the current level or even the 20-day EMA and breaks underneath the support line, it’ll claim that bears are active at greater levels. The happy couple could then slide to $23.

SHIB/USDT

Shiba Inu (SHIB) is trying to go above the immediate resistance at $.000013 however the lengthy wick around the day’s candlepower unit shows that bears are trying to stall the rally.

When the cost turns lower in the current level, the SHIB/USDT pair could take the additional time within the range from $.000010 and $.000014. The following trending move could start following the cost breaks below or above the number.

If buyers propel the cost over the 20-day EMA ($.000014), the happy couple could chance a rally to $.000017. This level could again behave as a stiff resistance.

Alternatively, when the cost turns lower and breaks below $.000010, the happy couple could slide to $.000009. It is really an important level to keep close track of if it cracks, the following stop might be $.000005.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.