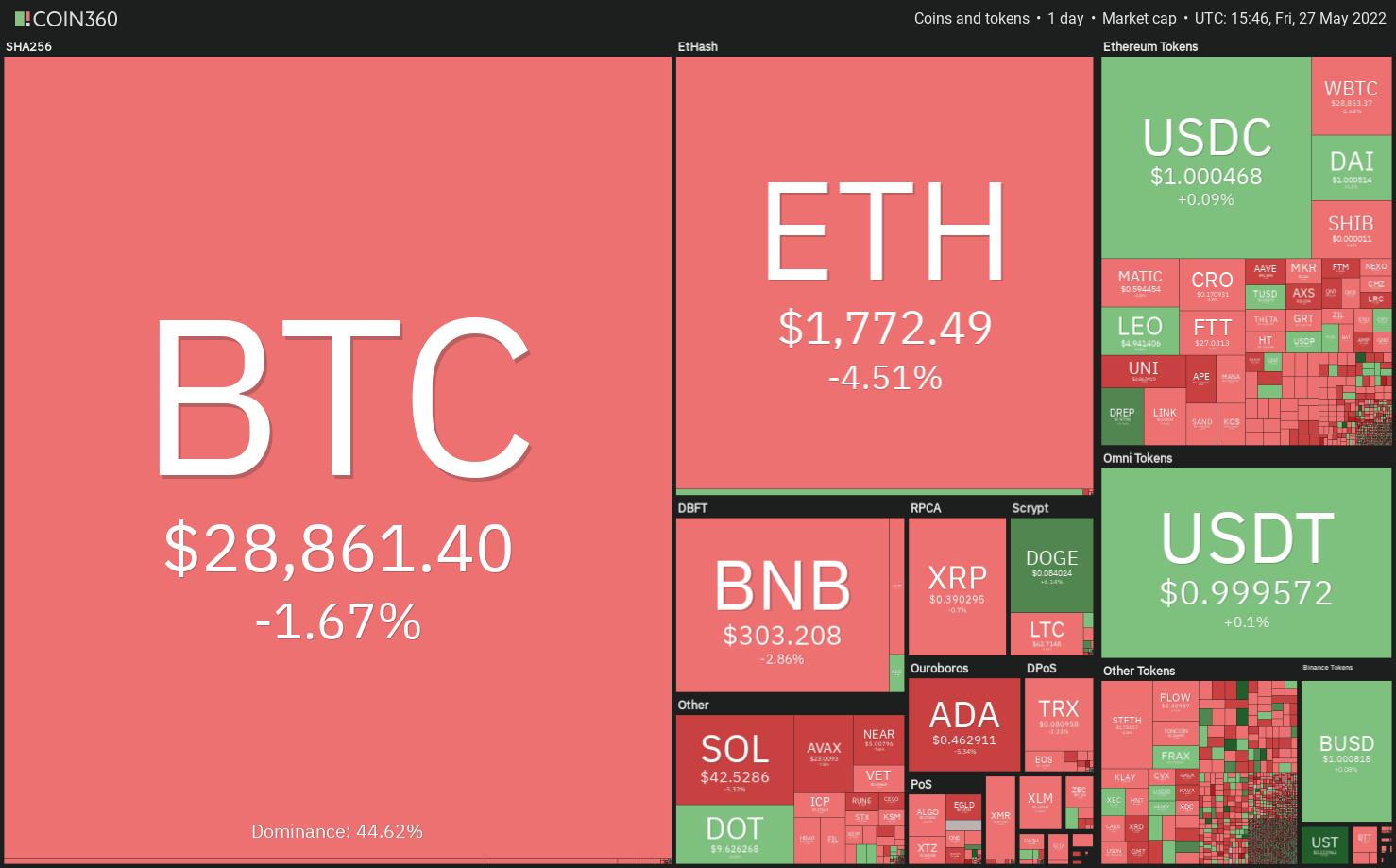

Equities markets within the U . s . States rallied dramatically on May 25 and 26 but Bitcoin (BTC) and altcoins haven’t adopted an identical trajectory. This means that traders aren’t certain that the crypto markets have bottomed out yet.

On-chain analytics firm Glassnode stated the quantity of Bitcoin whales continues to be reducing as well as on May 27, the metric fell towards the cheapest level since This summer 2020.

On May 24, Miller Value Partners founder and chief investment officer Bill Miller backed Bitcoin investing and known as it an “insurance policy against financial catastrophe.”

Inside a note to the clients on May 25, JPMorgan stated that Bitcoin’s fall appears like capitulation plus they anticipate Bitcoin and also the crypto markets to rally. The bank’s analysts believe Bitcoin’s fair value is $38,000, that is about 30% greater compared to current level.

Could Bitcoin stick to the U.S. equities markets greater or does it decouple and then languish at ‘abnormal’ amounts? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin stepped underneath the strong support of $28,630 on May 26 however the bulls couldn’t sustain the low levels. The lengthy tail around the day’s candlepower unit implies that the bulls strongly purchased the dip.

The bulls are again attempting to defend the support at $28,630, which is a vital level to keep close track of. When the cost increases in the current level and breaks over the 20-day exponential moving average (EMA) ($30,868), it’ll claim that the BTC/USDT pair might have bottomed out. The happy couple could then rally towards the 50-day simple moving average (SMA) ($35,721).

On the other hand, when the cost turns lower in the current level or even the overhead resistance, it’ll suggest too little demand at greater levels. That could raise the chance of a rest below $28,630. In the event that happens, the happy couple could retest the important level at $26,700. A rest and shut below this level could intensify selling and also the pair may plummet toward $20,000.

ETH/USDT

Ether (ETH) dipped and closed underneath the upward trend line on May 25, suggesting that bears were trying to re-establish their supremacy. The selling selected up momentum on May 26 and also the cost stepped underneath the May 12 intraday low at $1,800.

The bears are attempting to defend the important support at $1,700 however the rebound lacks momentum. This means that bulls aren’t strongly buying in the support. That may embolden the bears who may make an effort to sink and sustain the cost below $1,700. When they succeed, the ETH/USDT pair could plummet to $1,300.

On the other hand, if bulls effectively defend the support at $1,700, the happy couple could start an up-move toward $2,159. That may keep your pair range-bound between $2,159 and $1,700 for many more days.

BNB/USDT

The lengthy wick on BNB‘s May 25 candlepower unit implies that bears can sell on rallies nearing the critical overhead resistance at $350. The selling ongoing on May 26 and also the cost broke underneath the 20-day EMA ($320).

There’s a small support at $286 in which the bulls will endeavour to arrest the decline. When they succeed, it’ll claim that the sentiment has altered from selling on rallies to purchasing on dips. The bulls will on the other hand make an effort to push the cost to $350.

Alternatively, when the cost breaks below $286, it’ll claim that the aggressive bulls, and also require been trapped finally, before using the break above $320, might be exiting their positions. That may sink the BNB/USDT pair to $260.

XRP/USDT

Ripple (XRP) broke underneath the immediate support at $.38 on May 26 however the lengthy tail around the day’s candlepower unit suggests strong buying at ‘abnormal’ amounts. The buyers will attempt to push the cost toward the downtrend line.

When the cost turns lower in the downtrend line, the bears will again make an effort to sink the XRP/USDT pair below $.38. In the event that happens, the happy couple could drop towards the May 12 intraday low at $.33 in which the bulls will probably mount a powerful defense. The bears will need to pull the cost below this support to point the resumption from the downtrend.

However, if bulls push the cost over the downtrend line, the happy couple could rally towards the 20-day EMA ($.44). This level may again behave as a stiff resistance but when bulls overcome this barrier the recovery could achieve the mental level at $.50.

ADA/USDT

Cardano’s (ADA) tight-range buying and selling between $.49 and $.56 resolved towards the downside on May 26. The bulls are trying to defend the minor support at $.46 but when they fail, the drop could include $.40.

The downsloping moving averages and also the RSI close to the oversold territory claim that bears have been in command. If bears sink and sustain the cost below $.40, the selling could get momentum and also the ADA/USDT pair may plummet to $.33.

On the other hand, when the cost rebounds in the current level or even the support, it’ll suggest strong buying at ‘abnormal’ amounts. The bulls will attempt to drive the cost over the 20-day EMA ($.56). When they succeed, the happy couple could rally to $.61 and then to $.74.

SOL/USDT

Solana (SOL) broke underneath the immediate support at $47 on May 26 suggesting that traders and also require purchased at ‘abnormal’ amounts are closing their positions. This opens the doorways for any possible drop towards the crucial support at $37.37.

When the cost rebounds off $37.37, the buyers will endeavour to push the cost towards the 20-day EMA ($55). It is really an important level for that bears to protect just because a break and shut above it’ll claim that the SOL/USDT pair might have bottomed out. The happy couple could then chance a rally towards the overhead resistance at $75.

Alternatively, if bears sink the cost below $37.37, it’ll suggest the resumption from the downtrend. The happy couple could then extend its decline to another support at $32.

DOGE/USDT

Dogecoin’s (DOGE) tight-range buying and selling resolved towards the downside on May 26 and bears pulled the cost below $.08. This means supplying exceeds demand.

If bears sustain the cost below $.08, the DOGE/USDT pair could drop towards the vital support at $.06. Because this level had acted like a strong support on May 12, the bulls may again attempt to defend it. When the level holds, the happy couple could climb toward the 20-day EMA ($.09).

Another possibility is when bulls push the cost back above $.08, it’ll suggest demand at ‘abnormal’ amounts. The buyers will attempt to propel the cost toward the 20-day EMA. A rest and shut above this resistance will claim that the bears might be losing their grip. The happy couple could then rally towards the mental level at $.10.

Related: three reasons why Bitcoin is regaining its crypto market dominance

Us dot/USDT

Polkadot’s (Us dot) failure to climb and sustain over the breakdown level at $10.37 attracted selling by traders. The bears pulled the cost underneath the immediate support of $9.22 on May 26 but they are battling to sustain the low levels.

The cost rebounded from the immediate support at $8.56 and also the bulls are trying to obvious the overhead hurdle in the 20-day EMA ($10.88). When they manage to achieve that, it’ll claim that the downtrend might be weakening.

Unlike this assumption, when the cost once more turns lower in the overhead resistance, the bears will attempt to drag the Us dot/USDT pair below $8.56. When they do this, the following stop might be $7.30.

The bulls will probably defend this level strongly but when they fail within their endeavor, the happy couple could start the following leg from the downtrend.

AVAX/USDT

Avalanche (AVAX) ongoing lower and stepped underneath the important support of $23.51 on May 26. This signifies the resumption from the downtrend.

Even though the downsloping moving averages favor the bears, the RSI within the oversold territory suggests a relief rally or consolidation soon. When the cost appears and increases above $23.51, it might trap several aggressive bears, producing a short squeeze. That may push the AVAX/USDT pair towards the 20-day EMA ($34).

Alternatively, if bears sustain the cost below $23.51, the selling could get momentum and also the pair may decline towards the mental support at $20.

SHIB/USDT

Shiba Inu (SHIB) remains pressurized. Although bulls are protecting the support at $.000010, the rebound lacks strength. This means weak demand at current levels.

The bears will endeavour to drag the cost below $.000010 and when they succeed, the SHIB/USDT pair could decline towards the critical support at $.000009. It is really an important level to keep close track of just because a break and shut below it might indicate the resumption from the downtrend. The happy couple could then decline toward $.000007.

Alternatively, when the $.000010 level holds, the happy couple could rise towards the 20-day EMA ($.000013). This level may again behave as a resistance but when entered, the upward move could achieve $.000017.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.