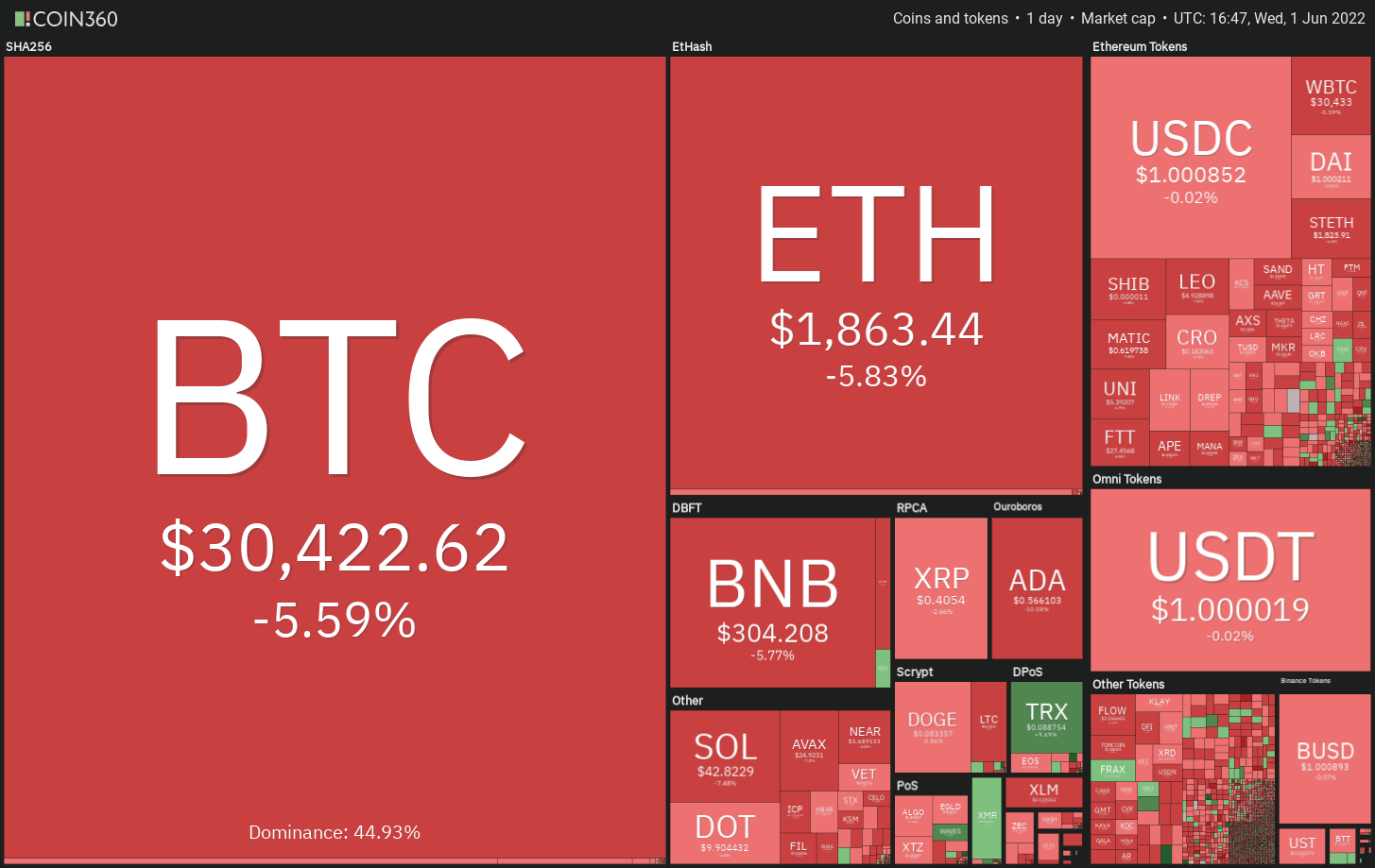

Bitcoin (BTC) makes a tentative begin to the month of June, suggesting that bears haven’t gone into hibernation at this time. Although Bitcoin is buying and selling nearly 55% off its all-time a lot of $69,000, whales and institutions remain careful and also have not leaped in to the market with gusto, based on BlockTrends analyst Caue Oliveira.

Based on CryptoQuant contributor Venturefounder, if Bitcoin repeats the historic patterns seen following the previous halving cycles, a bottom might be created between $14,000 and $21,000 within the next six several weeks. After that, Bitcoin may chop round the $28,000 to $40,000 range for most from the the coming year and become around $40,000 throughout the halving.

Crypto’s bear market hasn’t stopped Goldman Sachs from exploring the potential of integrating its derivatives products into FTX.US derivatives choices. This means the investment bank expects derivatives demand to get later on.

Has Bitcoin began a bottoming formation? May be the short-term downtrend in altcoins over? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin arrived at the overhead resistance at $32,659 on May 31 however the bulls couldn’t obvious this hurdle. The Doji candlepower unit pattern on May 31 signifies uncertainty one of the consumers.

This uncertainty resolved in support of the bears on June 1 plus they pulled the cost underneath the 20-day exponential moving average (EMA) ($30,741). When the cost sustains underneath the 20-day EMA, the following stop might be $28,630. The buyers are anticipated to protect this level with all of their might.

When the cost rebounds off $28,600, the BTC/USDT pair could again chance a rally to $32,659. In the event that happens, the happy couple may consolidate between both of these levels for any couple of days.

The following trending move could begin when the cost breaks below or above the number. When the cost soars above $32,659, the rally could achieve the 50-day simple moving average (SMA) ($34,629). The downtrend could resume away underneath the $28,630 to $26,700 support zone.

ETH/USDT

The bears stalled Ether’s (ETH) relief rally in the 20-day EMA ($2,009) on May 31, indicating that they’re not allowing the bulls to obtain a foothold.

The bears will attempt to drag the cost towards the vital support at $1,700. It is really an important level for that bulls to protect if it cracks, the ETH/USDT pair could witness panic selling. The happy couple could then resume its downtrend and plummet to $1,300.

Alternatively, when the cost rebounds off $1,700, it’ll claim that the bulls are purchasing proactively at these levels. The bulls will on the other hand attempt to push the cost over the 20-day EMA and challenge the stiff resistance at $2,159.

BNB/USDT

BNB rose over the immediate resistance of $320 on May 30 however the bulls haven’t been in a position to build this move. This signifies that bears are posing a powerful challenge at $325.

The sellers have pulled the cost towards the upward trend line. It is really an important level to keep close track of soon. When the cost rebounds off this level, it’ll claim that bulls are accumulating on dips. That may boost the prospects of the break above $325.

Unlike this assumption, if bears sink the cost underneath the upward trend line, the BNB/USDT pair could drop towards the strong support zone between $286 and $265. A rest below $265 could send the happy couple tumbling towards the vital support at $211.

XRP/USDT

Ripple (XRP) rose over the downtrend line on May 30 however the bulls couldn’t obvious the overhead hurdle in the 20-day EMA ($.43). This means that bears will not surrender their advantage.

The bears will attempt to sink the cost underneath the downtrend line. In the event that happens, the XRP/USDT pair could decline to $.38. The buyers will probably defend this level along with a bounce off it’ll point to the consolidation soon.

On the other hand, when the cost rebounds from the downtrend line, it’ll claim that bulls are trying to switch this level to aid. In the event that happens, the potential of a rest over the 20-day EMA increases. The happy couple could then rally towards the mental resistance at $.50.

ADA/USDT

Cardano (ADA) broke over the 20-day EMA ($.56) on May 30 and adopted up with another sharp up-move ahead May 31. This pressed the cost towards the 50-day SMA ($.70) however the lengthy wick around the day’s candlepower unit shows that bears can sell near this level.

The bears will attempt to drag the cost back underneath the 20-day EMA and trap the aggressive bulls. In the event that happens, the ADA/USDT pair could drop to $.44 where buying may emerge.

That may advise a consolidation within the large range from $.44 and $.74. The flattening 20-day EMA and also the relative strength index (RSI) just beneath the midpoint also indicate a variety-bound action soon.

The bulls may gain top of the hands when the cost rebounds from the 20-day EMA and breaks above $.74. This type of move will claim that the downtrend might be over.

SOL/USDT

Solana’s (SOL) relief rally is facing stiff resistance in the bears close to the mental level at $50. This means that bears haven’t yet quit plus they still sell on rallies.

The bears will attempt to drag the cost towards the strong support at $40. The bulls are anticipated to purchase the dips for this level. When the cost rebounds off this support, the buyers will again attempt to push the SOL/USDT pair over the 20-day EMA ($51). When they succeed, the happy couple could rally to $60 and after that attempt an up-proceed to the breakdown degree of $75.

However, if bears sink the cost below $40, the happy couple could drop towards the May 12 intraday low of $37. The happy couple could resume its downtrend if bears pull the cost below this important support.

DOGE/USDT

Dogecoin’s (DOGE) cost continues to be buying and selling close to the 20-day EMA ($.09) within the last 2 days however the bulls have unsuccessful to attain an outbreak. This means that bears are protecting the 20-day EMA with vigor.

The bears will attempt to sink the cost towards the strong support at $.07. This level has held on two previous occasions hence, the bulls will again attempt to defend it. When the cost rebounds off this support, the DOGE/USDT pair may remain stuck in the range from $.10 and $.07 for a while.

If bulls drive the cost above $.10, it’ll claim that the downtrend might be weakening. The happy couple could then rally to $.12. On the other hand, the downtrend could resume away below $.07.

Related: Axie Infinity V-shape recovery fizzles as AXS cost drops 20% from three-week high

Us dot/USDT

Polkadot (Us dot) is facing resistance in the 20-day EMA ($10.55) however the bulls haven’t permitted the cost to sustain below $10. This means strong demand at ‘abnormal’ amounts.

If bulls push and sustain the cost over the 20-day EMA, the Us dot/USDT pair could rally to $12. This level may behave as a small hurdle but when entered, the recovery could achieve the strong overhead resistance at $14.

Unlike this assumption, when the cost turns lower and sustains below $10, the decline could include the strong support at $8. A powerful bounce off this support will claim that the happy couple may remain range-bound between $8 and $12 for a while.

AVAX/USDT

Avalanche (AVAX) switched lower in the downtrend line on May 31, suggesting that bears still defend the amount with vigor. The bears will attempt to pull the cost underneath the strong support zone of $23.51 to $21.35.

When they succeed, the AVAX/USDT pair will develop a climbing down triangular pattern, indicating the beginning of the following leg from the downtrend. The happy couple could then decline to $20.

Even though the downsloping 20-day EMA ($31.33) favors the bears, the positive divergence around the RSI shows that the bearish momentum might be weakening. When the cost appears in the current level and breaks over the 20-day EMA, buying could resume. The bulls will attempt to propel the happy couple to $38.

SHIB/USDT

Shiba Inu’s (SHIB) recovery is facing stiff resistance in the 20-day EMA ($.000012), suggesting the sentiment remains negative and bears can sell on rallies.

The bears will attempt to drag the cost towards the strong support at $.000010. This level will probably attract aggressive buying through the bulls. When the cost rebounds off $.000010, the SHIB/USDT pair could rally toward the 20-day EMA.

If buyers push the cost over the 20-day EMA, the happy couple could rise to $.000014 and then towards the breakdown degree of $.000017. Around the downside, the bears will need to sink the cost below $.000009 to signal the resumption from the downtrend.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.