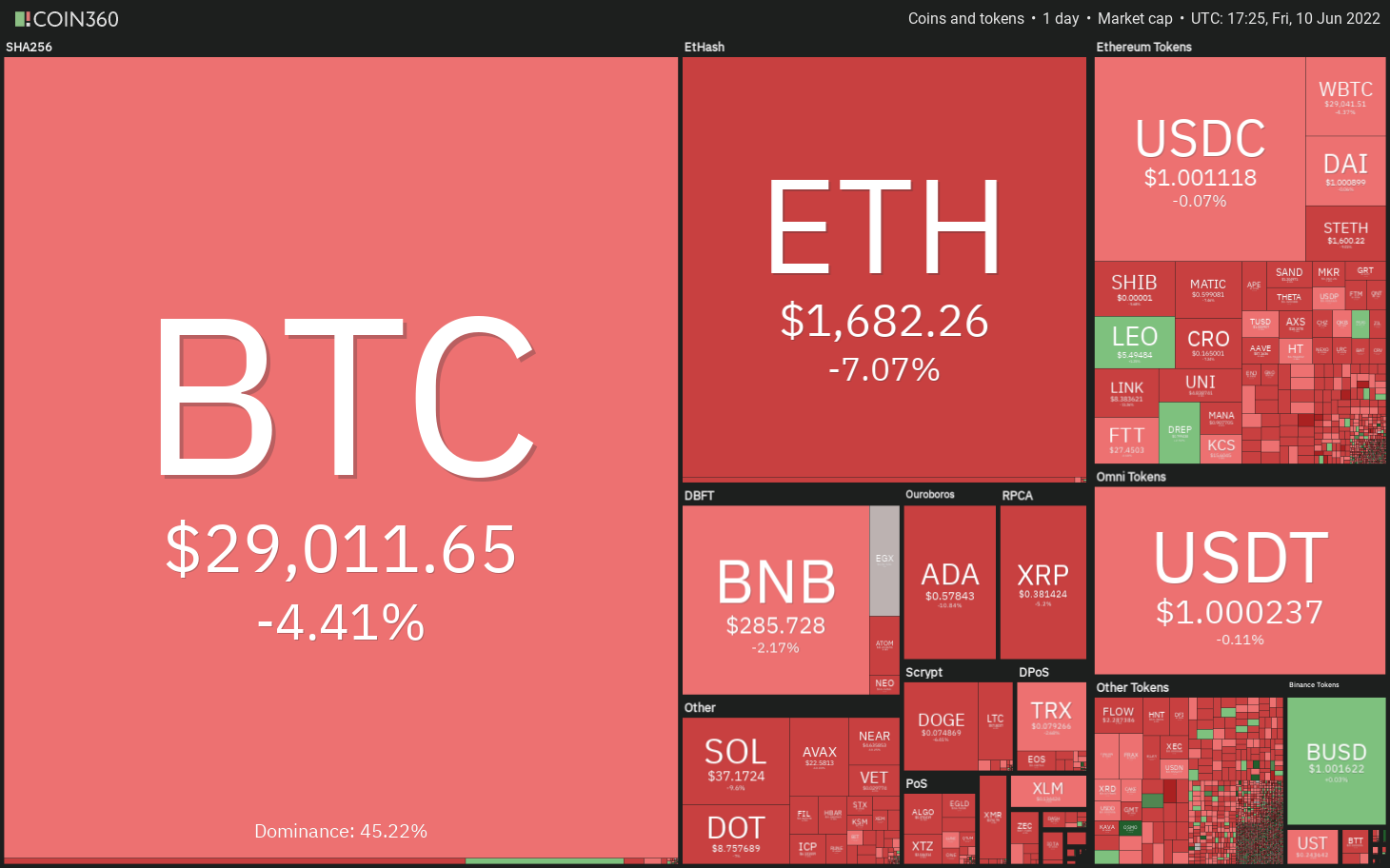

The U . s . States equities markets tumbled on June 10 following the Consumer Cost Index (CPI) report demonstrated inflation soaring 8.6% from last year, the greatest increase since 1981. The most recent figures reveal that talks of inflation getting peaked were premature and based on Bloomberg, investors are prices in the key rate of interest of threePercent through the finish of the season.

Ongoing its tight correlation using the S&P 500, Bitcoin (BTC) dipped below $30,000 on June 10. Analysts continue to be divided concerning the near-term cost action but Fundstrat co-founder Tom Lee stated within an interview with CNBC that Bitcoin might have already bottomed. However, Lee appears to possess toned lower his expectations because he stated that Bitcoin could “remain flat for that year, possibly up.”

One of the constant flow of negative news, there is a ray of hope from news that Bloomberg expanded coverage of cryptocurrency data on its Bloomberg Terminal to 50 crypto assets. Bloomberg cryptocurrency product manager Alex Wenham, gave positive vibes because he stated that institutional curiosity about digital assets keeps growing.

Since Bitcoin is buying and selling near swing lows again, is really a capitulation-level crisis a danger? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The bulls attempted to push the cost over the 20-day exponential moving average (EMA) ($30,365) on June 9 however the bears didn’t relent. The selling ongoing on June 10 and also the bears have pulled the cost underneath the trendline from the climbing triangular.

The 20-day EMA has began to show lower progressively and also the relative strength index (RSI) is incorporated in the negative territory, indicating benefit to sellers.

When the cost sustains underneath the trendline, it’ll invalidate the bullish setup. That may pull the BTC/USDT pair lower to $28,630, which might behave as strong support but when this level cracks, the decline could include $26,700.

Alternatively, when the cost rebounds off $28,630 and increases over the 20-day EMA, the up-move could achieve $32,659.

ETH/USDT

Strong selling on June 10 has pulled Ether (ETH) underneath the critical support at $1,700. When the cost sustains below this support, the happy couple could resume its downtrend.

The ETH/USDT pair could first decline to $1,500 and when this level also gives way, the following stop may be the vital support at $1,300. The bulls are anticipated to protect this level with all of their might.

Unlike this assumption, if bears neglect to sustain the cost below $1,700, it’ll suggest accumulation at ‘abnormal’ amounts. The very first manifestation of strength is a break and shut over the 20-day EMA. That may open the doorways for any possible rally to $2,159.

The symptoms are giving an assorted signal since the downsloping moving averages favor the sellers however the positive divergence around the RSI shows that a relief rally might be nearby.

BNB/USDT

BNB has been buying and selling underneath the support type of the symmetrical triangular within the last 72 hours however the bears haven’t been in a position to build upon the breakdown. This means that selling dries up at ‘abnormal’ amounts.

The buyers will attempt to push the cost into the triangular. In the event that happens, the aggressive bears and also require gone short around the break underneath the support line could get trapped. That could cause a brief-covering, that could push the cost over the resistance type of the triangular. This type of move will claim that the bears might be losing their grip.

Unlike this assumption, when the cost continues lower in the current level and plummets below $273, it will raise the chance of a rest underneath the critical support of $260. The happy couple could then begin a decline toward the vital support of $211.

ADA/USDT

The bulls pressed Cardano (ADA) over the 50-day simple moving average (SMA) ($.64) on June 21 and 9 but tend to not sustain the greater levels. That could have enticed short-term traders to reserve profits.

The bears are trying to sustain the cost underneath the 20-day EMA ($.58). When they manage to achieve that, the ADA/USDT pair could plummet to another support at $.53. If the level also gives way, the decline could include $.44.

Alternatively, when the cost rebounds from the current level, it’ll claim that the sentiment has switched positive and also the bulls are purchasing on dips. The bulls will make yet another make an effort to obvious the overhead hurdle in the 50-day SMA. When they succeed, the happy couple could rally towards the breakdown degree of $.74, which might again behave as a resistance.

XRP/USDT

Ripple (XRP) have been buying and selling near to the downtrend line within the last 2 days. The failure to push the cost over the overhead resistance might have attracted profit-booking in the short-term traders.

The XRP/USDT pair has dipped towards the strong support of $.38 in which the buyers may make an effort to stall the decline. When the cost rebounds from the support and increases over the downtrend line, the happy couple could rally to $.46.

On the other hand, if bears sink and sustain the cost below $.38, it’ll develop a bearish climbing down triangular pattern. That may intensify the selling and pull the cost lower to $.33. A rest below this support could signal the resumption from the downtrend.

SOL/USDT

Solana (SOL) is buying and selling between your 20-day EMA ($44) and $37 within the last couple of days. The buyers attempted to push the cost over the 20-day EMA on June 9 however the bears held their ground.

The positive divergence around the RSI signifies a small benefit to buyers as the downsloping moving averages claim that bears possess the upper hands. This uncertainty is not likely to carry on for lengthy. If bears sink the cost below $35, the SOL/USDT pair may resume the downtrend The following stop around the downside might be $30.

Unlike this assumption, if bulls propel the cost over the 20-day EMA, the happy couple could rally to $50 after which towards the overhead resistance at $60.

DOGE/USDT

The bulls battled to sustain Dogecoin (DOGE) above $.08 on June 21 and 9. This might have attracted further selling and also the support collapsed on June 10.

The bears will attempt to construct upon their advantage and try to sink the cost towards the vital support of $.07. A rest and shut below this level could signal the beginning of the following leg from the downtrend.

This negative view could invalidate for the short term when the cost appears and breaks over the 20-day EMA ($.08). That may attract purchasing from the aggressive bulls, that could push the DOGE/USDT pair to $.10.

Related: Ethereum eyes fresh yearly lows versus. Bitcoin as bulls snub effective ‘Merge’ wedding rehearsal

Us dot/USDT

The bulls attempted to push Polkadot (Us dot) into the symmetrical triangular on June 9 however the bears defended the amount strongly. This means the bears have flipped the support line into resistance.

The bears will endeavour to sink the cost underneath the immediate support of $8.56. When they succeed, the Us dot/USDT pair could drop towards the critical level at $7.30. The bears will need to pull the cost below this support to point the resumption from the downtrend.

This bearish view could invalidate when the cost rebounds off $8.56 and increases over the resistance line. In the event that happens, the happy couple could attract clients who will then make an effort to push the cost to $11 and then to $12.50.

AVAX/USDT

Avalanche (AVAX) created a Doji candlepower unit pattern within the last 2 days indicating indecision one of the bulls and also the bears. This uncertainty resolved towards the downside on June 10 and bears are attempting to pull the cost towards the strong support at $21.

The cost is stuck between your 20-day EMA ($27) and $21. This tight-range buying and selling will probably resolve having a range expansion within the next couple of days. Even though the positive divergence around the RSI signifies a small benefit to buyers, the downsloping moving averages claim that bears possess the upper hands.

When the range expands towards the downside and also the cost drops below $21, it’ll suggest the resumption from the downtrend. The AVAX/USDT pair could then decline to $18. Alternatively, when the cost explodes over the 20-day EMA, it might obvious the road for any possible rally to $33 after which $37.

SHIB/USDT

Shiba Inu (SHIB) continues to be buying and selling near to the strong support at $.000010 since June 7. Although bulls have defended the support, they’ve unsuccessful to attain a powerful rebound.

This increases the potential of a rest underneath the strong support at $.000010. In the event that happens, the SHIB/USDT pair will develop a bearish climbing down triangular pattern. The happy couple could then decline towards the May 12 intraday low of $.000009. If the support also cracks, the following stop might be $.000006.

To invalidate this bearish view, the buyers will need to push the cost over the downtrend line. That may obvious the road for any possible rally to $.000014.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.