The U . s . States equities markets extended their decline to begin a few days on June 13. The S&P 500 hit a brand new year-to-date low and dipped into bear market territory, falling greater than 20% from the all-time high made on Jan. 4.

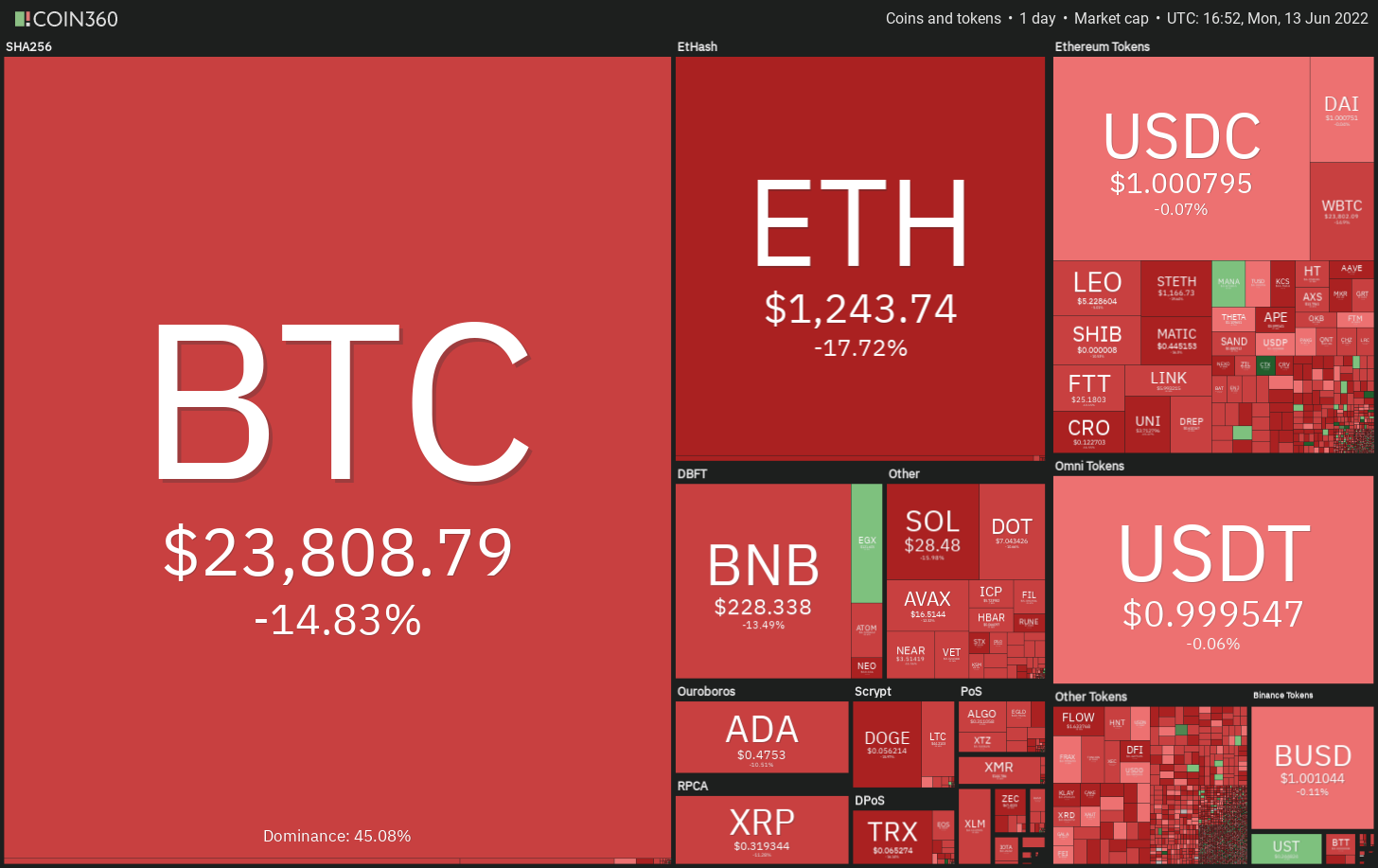

The cryptocurrency financial markets are tracking the equities markets lower and also the selling pressure further intensified because of the rumored liquidity crisis of major lending platform Celsius and traders possibly selling positions to satisfy margin calls. This pulled the total crypto market capital below $1 trillion.

The sharp declines have brought some analysts to project very bearish targets. While anything can be done within the markets which is hard to call a bottom, capitulations are likely to begin a bottoming formation. Traders could get their buy list ready and think about accumulating gradually following the cost stops falling.

Do you know the important levels that could arrest the loss of Bitcoin (BTC) and major altcoins? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin broke underneath the immediate support at $28,630 on June 11. This faster selling and also the bears pulled the cost underneath the critical support at $26,700 on June 12. This indicated the resumption from the downtrend.

The bears maintained their selling pressure on June 13 and sent the BTC/USDT pair tumbling for an intraday low of $22,600. The sharp fall of history couple of days has pulled the relative strength index (RSI) in to the oversold zone. This means that the relief rally or consolidation is probably within the next couple of days.

Any recovery will probably face selling within the zone between $26,700 and $28,630. If bears switch this zone into resistance, it’ll claim that sentiment remains negative. Traders could make yet another make an effort to resume the downtrend. A rest below $22,600 could sink the happy couple towards the mental level at $20,000.

The bulls will need to push and sustain the cost above $28,630 to point out the bears might be losing their grip.

ETH/USDT

Ether (ETH) plummeted underneath the vital support of $1,700 on June 10, indicating that bears have been in control. This signaled the beginning of the following leg from the downtrend.

The selling selected up momentum on June 11 and bears have pulled the cost underneath the strong support at $1,300. This means that traders are gripped with fear and therefore are dumping their positions.

The aggressive selling of history 72 hours has pulled the RSI below 22. In the past, the ETH/USDT pair starts a relief rally once the RSI falls near to 21. This means the pair could chance a rally towards the breakdown degree of $1,700.

Alternatively, if bears sustain their selling pressure, the happy couple could drop to mental support at $1,000.

BNB/USDT

The failure from the bulls to push BNB back in to the triangular might have attracted strong selling through the bears on June 11. The selling selected up momentum and also the cost has dropped close to the strong support at $211.

When the cost rebounds off $211, it’ll suggest accumulation at ‘abnormal’ amounts. The buyers will try to push the cost over the 20-day exponential moving average ($289). When they succeed, it’ll indicate the BNB/USDT pair may remain range-bound between $211 and $350 for any couple of days.

On the other hand, if bears sink the cost below $211, it’ll signal the beginning of the following leg from the downtrend. The mental degree of $200 offer a small support however, if the level gives way, the following support might be at $186.

ADA/USDT

Cardano (ADA) broke underneath the 20-day EMA ($.56) on June 10 and attempts through the bulls to push the cost back over the level on June 11 met with strong selling at greater levels.

The bears have pulled the cost towards the strong support zone between $.44 and $.40. This zone will probably attract strong buying through the bulls just because a break below it might signal the resumption from the downtrend. The ADA/USDT pair could then start its southward journey toward the following major support at $.30.

Alternatively, when the cost increases in the current level, the bulls will endeavour to push the happy couple over the 50-day simple moving average (SMA($.61). In the event that happens, the happy couple may consolidate between $.74 and $.40 for any couple of days.

XRP/USDT

Ripple (XRP) broke and closed underneath the support at $.38 on June 11. This completed a bearish climbing down triangular pattern, signaling that sellers possess the upper hands.

The selling selected up momentum and bears pulled the cost underneath the crucial support at $.33 on June 13. This signifies the beginning of the following leg from the downtrend. Rapid-term bears may book profits close to the pattern target of $.30.

When they do this, the XRP/USDT pair could begin a relief rally that could achieve the breakdown degree of $.33 after which $.38. Alternatively, if bears sink the cost below $.30, the happy couple could drop to another strong support at $.24.

SOL/USDT

Solana (SOL) have been stuck between your 20-day EMA ($40) and $35 for any couple of days. This uncertainty resolved towards the downside on June 11 as bears pulled the cost underneath the support.

This faster the selling and also the bears pulled the cost underneath the immediate support at $30. The following support on however $22 and then $20.

The sharp selling of history couple of days has sent the RSI in to the oversold territory. This means a relief rally or consolidation is probably soon. The bulls will endeavour to push the cost over the breakdown degree of $35 and also the 20-day EMA. When they succeed, it’ll claim that the present breakdown might have been a bear trap.

DOGE/USDT

Dogecoin’s (DOGE) tight range buying and selling expanded towards the downside on June 10. The bears pulled the cost underneath the May 12 intraday low of $.07 on June 11, indicating the resumption from the downtrend.

The selling further selected up momentum and also the bears pulled the DOGE/USDT pair towards the mental support of $.05. This level could behave as a brief-term support since the deeply oversold levels around the RSI advise a relief rally can be done.

Around the upside, the bears will endeavour to stall the recovery in the breakdown degree of $.07. When the cost turns lower out of this resistance, the bears will endeavour to resume the downtrend and sink the happy couple to $.04. The very first manifestation of strength is a break and shut over the 20-day EMA ($.08).

Related: How you can survive inside a bear market? Strategies for beginners

Us dot/USDT

The failure from the bulls to push Polkadot (Us dot) into the symmetrical triangular attracted aggressive selling through the bears on June 10. That began a downward move that pulled the cost underneath the critical support of $7.30.

The bulls are trying to push the cost back over the breakdown degree of $7.30. When they manage to achieve that, it’ll claim that the break below $7.30 might have been a bear trap. The Us dot/USDT pair could then rise towards the 20-day EMA ($9.17).

Alternatively, when the cost does not go above $7.30, it’ll claim that the bears have flipped the amount into resistance. That may resume the downtrend using the next stop to be the mental degree of $5 and so the pattern target of $4.23.

LEO/USD

UNUS SED LEO (LEO) continues to be buying and selling in the climbing down funnel within the last several days. The bears are posing challenging near $5.60 but they are discovering it hard to pull the cost underneath the 20-day EMA ($5.24).

When the cost bounces from the current level and increases above $5.60, the LEO/USD pair could progressively move to the resistance type of the funnel. The bears will probably defend this level strongly.

When the cost turns lower in the resistance line, the bears will endeavour to sink the happy couple underneath the 20-day EMA. In the event that happens, the happy couple may progressively dip toward the support line. This type of move will claim that the happy couple may extend its stay within the funnel for many additional time.

The following trending move could begin following the bulls push the cost over the resistance line or bears sink the happy couple underneath the support line.

AVAX/USDT

Avalanche’s (AVAX) tight range buying and selling between your 20-day EMA ($24) and also the critical support of $21 resolved towards the downside on June 11. This indicated the resumption from the downtrend.

The selling selected up momentum and sliced with the support at $18 on June 12. There’s a small support at $15 but when this level breaks lower, the AVAX/USDT pair could plummet to another strong support of $13.

Even though the downsloping moving averages indicate benefit to sellers, the oversold levels around the RSI claim that the selling might have been overdone soon. That could cause a relief rally towards the breakdown degree of $21. The bulls will need to push the cost over the 20-day EMA to point the bears might be losing their grip.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.