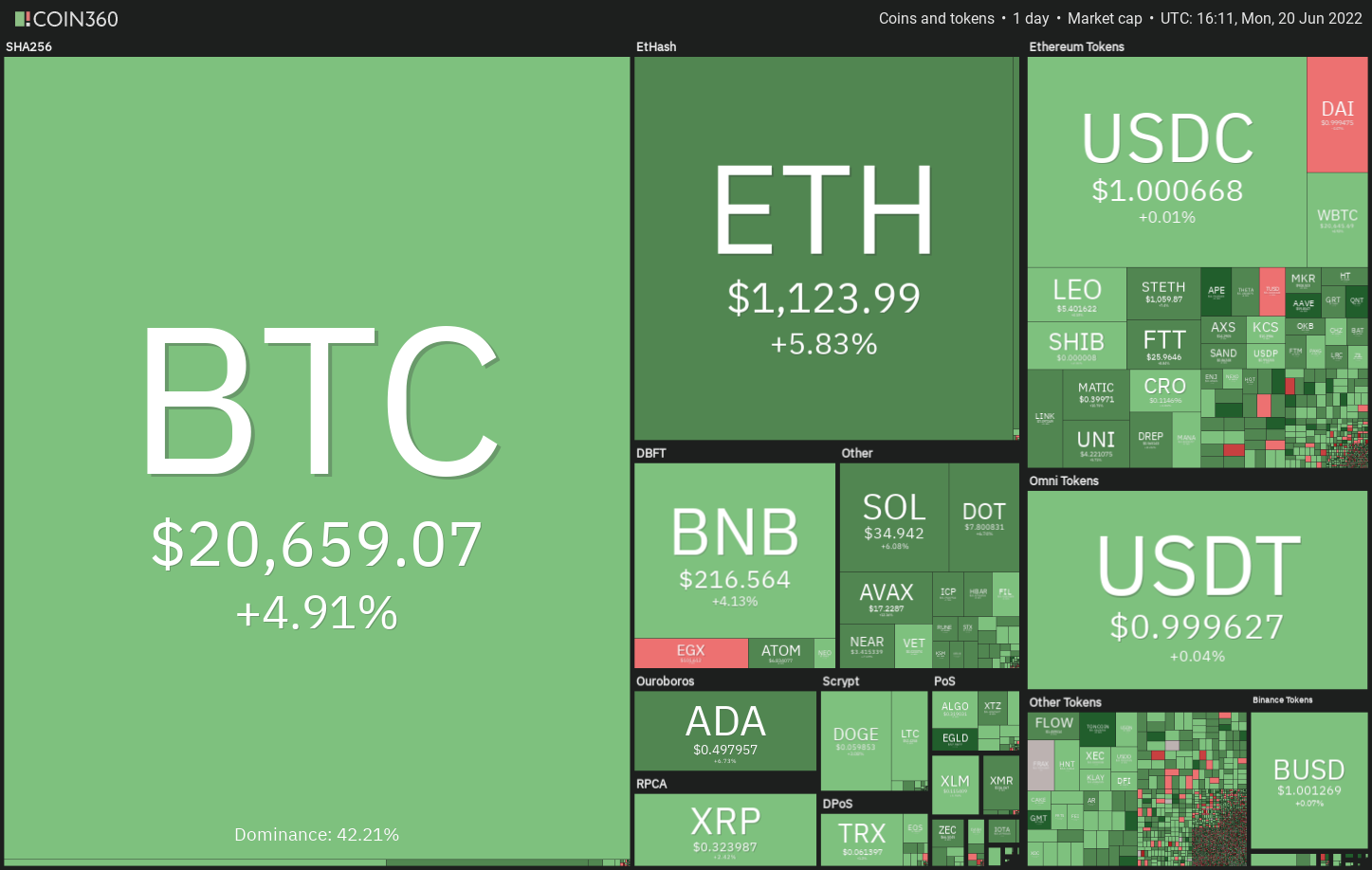

The crypto markets will be in a strong bear phase within the last several several weeks but JPMorgan Chase analysts expect that to alter and they’ve forecasted a significant upside in the current levels. The analysts reported the increasing share of stablecoins within the total crypto marketplace for their bullish outlook.

Unperturbed through the current fall, retail traders happen to be adding Bitcoin (BTC) for their portfolios. The quantity of wallet addresses holding one Bitcoin surged by 13,091 to some record a lot of 865,254. Similarly, the amount of addresses holding about .1 Bitcoin has additionally observed a clear, crisp rise previously ten days, based on data from Glassnode.

Bitcoin’s sharp recovery in the June 18 fall shows strong buying at ‘abnormal’ amounts and according to Whalemap, it has brought towards the formation of the new “whale level,” which might behave as short-term support.

Is the recovery in Bitcoin and major altcoins continue soon? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin stepped below $20,000 on June 18 but made a similarly sharp recovery on June 19, indicating aggressive buying at ‘abnormal’ amounts. If bulls sustain the cost above $20,000, it might improve sentiment and get more buyers.

The BTC/USDT pair could first rise towards the 38.2% Fibonacci retracement degree of $23,024 after which towards the 20-day exponential moving average (EM($24,890). The bears will probably defend this zone with all of their might.

When the cost turns lower out of this zone, the sellers can make another make an effort to pull the happy couple below $20,000. A rest and shut below $17,622 could start the following leg from the downtrend.

Alternatively, if buyers push the cost over the 20-day EMA, it’ll signal a possible alternation in trend. The happy couple could then rally towards the 50-day simple moving average (SMA) ($29,386) in which the bears may mount a powerful defense.

ETH/USDT

Ether (ETH) plummeted underneath the mental degree of $1,000 on June 18, which implies the downtrend remains intact. A small positive would be that the bulls purchased the dip as seen in the lengthy tail around the day’s candlepower unit.

The buyers sustained the momentum on June 19 and pressed the cost back above $1,000. The ETH/USDT pair could rise to $1,250 and then towards the 20-day EMA ($1,429). This continues to be the critical resistance to take into consideration.

When the cost turns lower in the current level or even the 20-day EMA, it’ll claim that the bears are active at greater levels. The sellers will attempt to pull the happy couple towards the June 18 intraday low of $881. A rest and shut below this level could signal the resumption from the downtrend.

BNB/USDT

BNB broke and closed underneath the strong support at $211 on June 18 however the bears couldn’t build this advantage. This means that ‘abnormal’ amounts still attract buyers.

The bulls pressed the cost back over the breakdown degree of $211 on June 19. If buyers sustain this level, it’ll claim that the breakdown on June 18 might have been a bear trap.

If bears hurry to pay for their positions, it might result in a short squeeze and push the BNB/USDT pair toward the 20-day EMA ($251). If bulls overcome this barrier, the happy couple could rise towards the 50-day SMA ($297).

Unlike this assumption, when the cost turns lower in the current level and breaks below $211, it’ll claim that bears can sell on minor rallies. The bears will attempt to sink the happy couple below $183 and resume the downtrend.

ADA/USDT

The bulls once more effectively defended the $.44 to $.40 zone on June 18. That began a recovery in Cardano (ADA), that has arrived at the 20-day EMA ($.52).

If bulls drive the cost over the moving averages, the ADA/USDT pair could rise towards the overhead resistance zone between $.70 and $.74. The bears will probably defend this zone with all of their might.

When the cost turns lower from this, the happy couple could remain stuck in an array between $.40 and $.74 for any couple of days. The following trending move could begin after bulls push the cost above $.74 or bears pull the happy couple below $.40.

XRP/USDT

Ripple (XRP) tucked below $.29 on June 18 however the bears couldn’t take advantage of the benefit. This means that selling dries up at ‘abnormal’ amounts.

The bulls may make an effort to push the cost towards the overhead resistance zone between your 20-day EMA ($.35) and also the breakdown degree of $.38. The bears will probably defend this zone strongly but when bulls bulldoze their way through, the XRP/USDT pair could rally towards the overhead resistance at $.46.

This positive view could invalidate when the cost turns lower in the current level or even the overhead zone. The bears will make another make an effort to sink and sustain the cost below $.29.

SOL/USDT

Solana (SOL) remains inside a downtrend however the bulls are trying to begin a recovery. The cost has arrived at the 20-day EMA ($36), which is a vital level to keep close track of.

The positive divergence around the relative strength index (RSI) signifies the bearish momentum might be weakening. If buyers propel the cost over the 20-day EMA, the SOL/USDT pair could rally towards the 50-day SMA ($49). This level may again behave as a resistance but when bulls obvious this hurdle, the following stop might be $60.

On the other hand, when the cost turns lower in the current level, it’ll claim that bears still defend the 20-day EMA with vigor. The bears will need to pull the happy couple below $25 to signal the beginning of the following leg from the downtrend.

DOGE/USDT

The bears pulled Dogecoin (DOGE) underneath the mental support at $.05 on June 18 but they couldn’t sustain the low levels. This means that bulls are purchasing on dips.

Buyers will attempt to push the cost towards the 20-day EMA ($.07) that could behave as a stiff barrier. When the cost turns lower out of this level, it’ll claim that bears stay in command. The sellers will make yet another make an effort to sink and sustain the cost below $.05. When they succeed, the DOGE/USDT pair could drop to $.04.

On the other hand, a rest and shut over the 20-day EMA would be the first indication the bulls take presctiption a comeback. The happy couple could then rise towards the 50-day SMA ($.09), which might again behave as a stiff resistance.

Related: Ethereum analyst warns of ‘clean fakeout’ despite 30% ETH cost rebound

Us dot/USDT

The bears attempted to sink Polkadot (Us dot) underneath the support at $6.36 on June 18 however the bulls held their ground. Strong buying at ‘abnormal’ amounts pressed the cost back over the breakdown degree of $7.30 on June 19.

The bulls will endeavour to push the cost over the 20-day EMA ($8.33). When they succeed, it’ll suggest the beginning of a sustained recovery. The Us dot/USDT pair could then rise towards the 50-day SMA ($10.06) and then towards the overhead resistance at $12.44. The positive divergence around the RSI can also be pointing toward a potential relief rally.

Unlike this assumption, when the cost turns lower in the 20-day EMA, the bears will again attempt to sink the happy couple below $6.36 and resume the downtrend. The following support on however $4.23.

LEO/USD

UNUS SED LEO (LEO) dipped underneath the support type of the climbing down funnel on June 18 however the lengthy tail around the day’s candlepower unit suggests aggressive buying at ‘abnormal’ amounts.

The bulls sustained their momentum and pressed the cost over the moving averages on June 20. When the LEO/USD pair maintains over the moving averages, the following stop may be the resistance type of the funnel. The buyers will need to push the cost above this level to point the beginning of a brand new up-move.

Unlike this assumption, when the cost turns lower in the resistance line, it’ll claim that bears are protecting the amount strongly. That may keep your pair stuck within the funnel for any couple of more days.

AVAX/USDT

Avalanche (AVAX) tucked underneath the support at $14.50 on June 18 however the bears couldn’t sustain the low levels. The bulls try a rebound on June 20 that could achieve the 20-day EMA ($20).

When the cost turns lower in the 20-day EMA, it’ll claim that bears stay in control and they’re selling on rallies. The bears will make yet another make an effort to sink the cost below $13.71 and resume the downtrend. The following support on however $13.

On the other hand, if bulls thrust the cost over the 20-day EMA, it’ll claim that the bears might be losing their grip. The AVAX/USDT pair could then chance a rally towards the 50-day SMA ($30) in which the bears may again pose challenging.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.