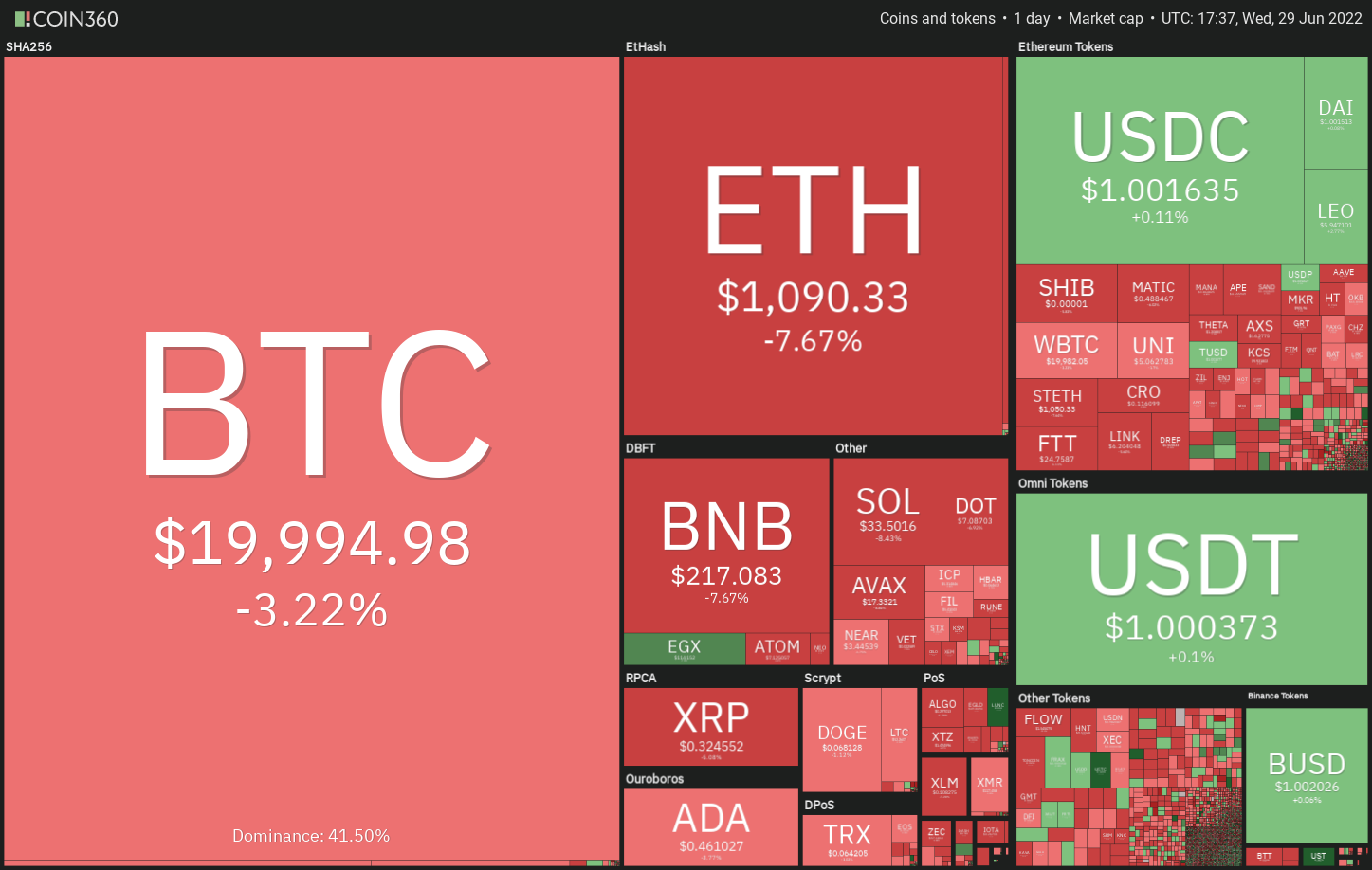

The U . s . States equities markets have returned a few of the gains made a week ago which has pulled Bitcoin towards the mental support at $20,000. This means that investors are nervous to purchase dangerous assets at greater levels.

Meanwhile, while talking with the hosts from the Bankless podcast on June 23, Mark Cuban stated the crypto bear market could finish following the cost will get so cheap that investors go and begin buying or perhaps an application with utility is launched that draws users.

Several analysts expect Bitcoin to carry on falling and finally bottom out between $10,000 and $12,000. However, John Bollinger, the creator from the popular Bollinger Bands buying and selling indicator, said that the monthly charts claim that Bitcoin’s cost has arrived at “a logical place to set up a bottom.”

Could bears keep up with the selling pressure and pull cryptocurrency prices lower? Let’s read the charts from the top ten cryptocurrencies to discover.

BTC/USDT

Bitcoin switched lower from $22,000 on June 26 and it has progressively tucked towards the immediate support at $19,637. This means the bears stay in command and each rally has been offered into.

When the cost breaks below $19,637, the BTC/USDT pair might be vulnerable to shedding towards the crucial support at $17,622. It is really an important level to take into consideration just because a break and shut below it might start the following leg from the downtrend. The happy couple could then decline to $15,000.

However, when the cost rebounds off $19,637, it’ll suggest demand at ‘abnormal’ amounts. The buyers will attempt to push the cost over the 20-day exponential moving average (EMA) ($22,393). When they succeed, the happy couple could rally towards the 50-day simple moving average (SMA) ($26,735).

ETH/USDT

Ether (ETH) switched lower in the 20-day EMA ($1,268) on June 26, suggesting the sentiment remains negative and traders can sell on rallies.

The downsloping moving averages and also the RSI within the negative zone indicate that bears have been in control. The sellers will endeavour to drag the cost underneath the immediate support at $1,050. When they succeed, the ETH/USDT pair could plunge towards the June 18 intraday low of $881.

A rest below this support could signal the resumption from the downtrend. The following support on however at $681.

Unlike this assumption, when the cost rebounds off $1,050, it’ll suggest demand at ‘abnormal’ amounts. The buyers will make another make an effort to push the cost over the 20-day EMA and begin your way toward $1,500 and then $1,700.

BNB/USDT

The buyers unsuccessful to push and sustain BNB above the 20-day EMA ($238) between June 24 to twenty-eight. This led to profit-booking, that has pulled the cost towards the strong support of $211.

The 20-day EMA has began to show lower once more and also the RSI has dipped in to the negative territory. This means that bears possess the upper hands. When the cost slides below $211, the BNB/USDT pair could drop towards the critical support of $183. If the support collapses, the happy couple could resume its downtrend and plummet toward $150.

On the other hand, when the cost rebounds off $211, it’ll claim that bulls are trying to form a greater low. A powerful bounce could boost the prospects of the break above $250. The happy couple could then rally towards the 50-day SMA ($273).

XRP/USDT

Ripple (XRP) tucked underneath the breakout degree of $.35 on June 28, which implies that bears still sell strongly at greater levels.

The 20-day EMA ($.35) is flattish however the RSI has dropped below 40, suggesting the bears possess a slight edge. The sellers will endeavour to drag the cost towards the vital support at $.28. It is really an important level to keep close track of if it provides way, the XRP/USDT pair could start the following leg from the downtrend.

On the other hand, when the cost appears in the current level or $.28, it’ll claim that bulls are purchasing at ‘abnormal’ amounts. That may keep your pair range-bound between $.28 and also the 50-day SMA ($.38) for any couple of days.

ADA/USDT

The bears thwarted repeated attempts through the bulls to push Cardano (ADA) over the 20-day EMA ($.50) previously couple of days. This means the bears are protecting the amount strongly.

The cost could drop towards the strong support zone at $.44 to $.40. When the cost rebounds off this zone with strength, it’ll claim that bulls are accumulating on dips. The buyers will on the other hand attempt to propel the cost over the moving averages. Whether they can accomplish it, the ADA/USDT pair could start an up-move toward $.70.

This positive view could invalidate for the short term if bears sink the happy couple underneath the support zone. In the event that happens, the happy couple could indicate the resumption from the downtrend. The following support reaches $.33.

SOL/USDT

The tight range buying and selling in Solana (SOL) resolved towards the downside having a break underneath the 20-day EMA ($37). The bears are trying to pull the cost underneath the immediate support at $33.

When they succeed, the SOL/USDT pair could decline to $27 after which retest the June 14 intraday low of $25.86.

Unlike this assumption, when the cost rebounds off $33, it’ll claim that the bulls are trying to form a greater low. The buyers will attempt to obvious the overhead hurdle at $43. In the event that happens, the happy couple could signal a possible alternation in trend. The happy couple will then rise to $60 in which the bears may again mount a powerful defense.

DOGE/USDT

Dogecoin (DOGE) switched lower in the 50-day SMA ($.08) on June 27 and broke underneath the 20-day EMA ($.07) on June 28. This means that bears haven’t quit plus they still sell on rallies.

The bears will attempt to sink the cost to $.06. If the level cracks, the following stop might be a retest from the critical level at $.05.

Alternatively, when the cost appears in the current level or even the support at $.06 and increases back over the 20-day EMA, it’ll claim that bulls are trying to form a greater low. The bullish momentum could detect a rest above $.08. The DOGE/USDT pair could then chance a rally towards the mental degree of $.10.

Related: Double bubble? Terra’s defunct ‘unstablecoin’ all of a sudden climbs 800% in a single week

Us dot/USDT

Repeated failures to push and sustain the cost over the 20-day EMA ($7.93) might have enticed short-term traders to reserve profits in Polkadot (Us dot). The cost switched lower in the 20-day EMA and tucked to $7.30 on June 28.

Both bulls and also the bears are battling it for supremacy close to the $7.30 level. When the bears emerge on the top, the Us dot/USDT pair could drop towards the crucial degree of $6.36. The bulls are anticipated to protect this level strongly just because a break below it might signal the resumption from the downtrend.

On the other hand, when the cost rebounds from the current level, the buyers will again attempt to acquire a close over the 20-day EMA. When they manage to achieve that, the happy couple could rise towards the 50-day SMA ($8.97).

SHIB/USDT

Shiba Inu (SHIB) tucked back underneath the 50-day SMA ($.000011) on June 28, suggesting the bears are active at greater levels. Even though the cost dipped below $.000010, the bears haven’t been in a position to build this advantage.

This means that selling dries up at ‘abnormal’ amounts. The bulls will again attempt to push the cost over the 50-day SMA and challenge the resistance at $.000012. A rest and shut above this level could open the doorways for any possible rally to $.000014.

The 20-day EMA ($.000010) has flattened out and also the RSI is simply underneath the midpoint, indicating an account balance between demand and supply. When the cost slips below $.000009, the benefit could tilt in support of the sellers. The happy couple will then drop to $.000007.

LEO/USD

UNUS SED LEO (LEO) broke and closed over the resistance type of the climbing down funnel on June 25 however the bulls couldn’t push the cost above $6. That could have attracted profit-booking from short-term traders, which pulled the cost into the funnel on June 27.

The 20-day EMA ($5.57) is sloping up and also the RSI is incorporated in the positive territory, suggesting that bulls possess the upper hands. The buyers are again trying to obvious the overhead hurdle at $6. When they succeed, the LEO/USD pair could rally to $6.50 after which towards the pattern target at $6.90.

Unlike this assumption, when the cost once more turns lower from $6, it’ll claim that bears are protecting this level with vigor. The sellers will make an effort to sink the cost underneath the 20-day EMA and challenge the 50-day SMA ($5.24).

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.