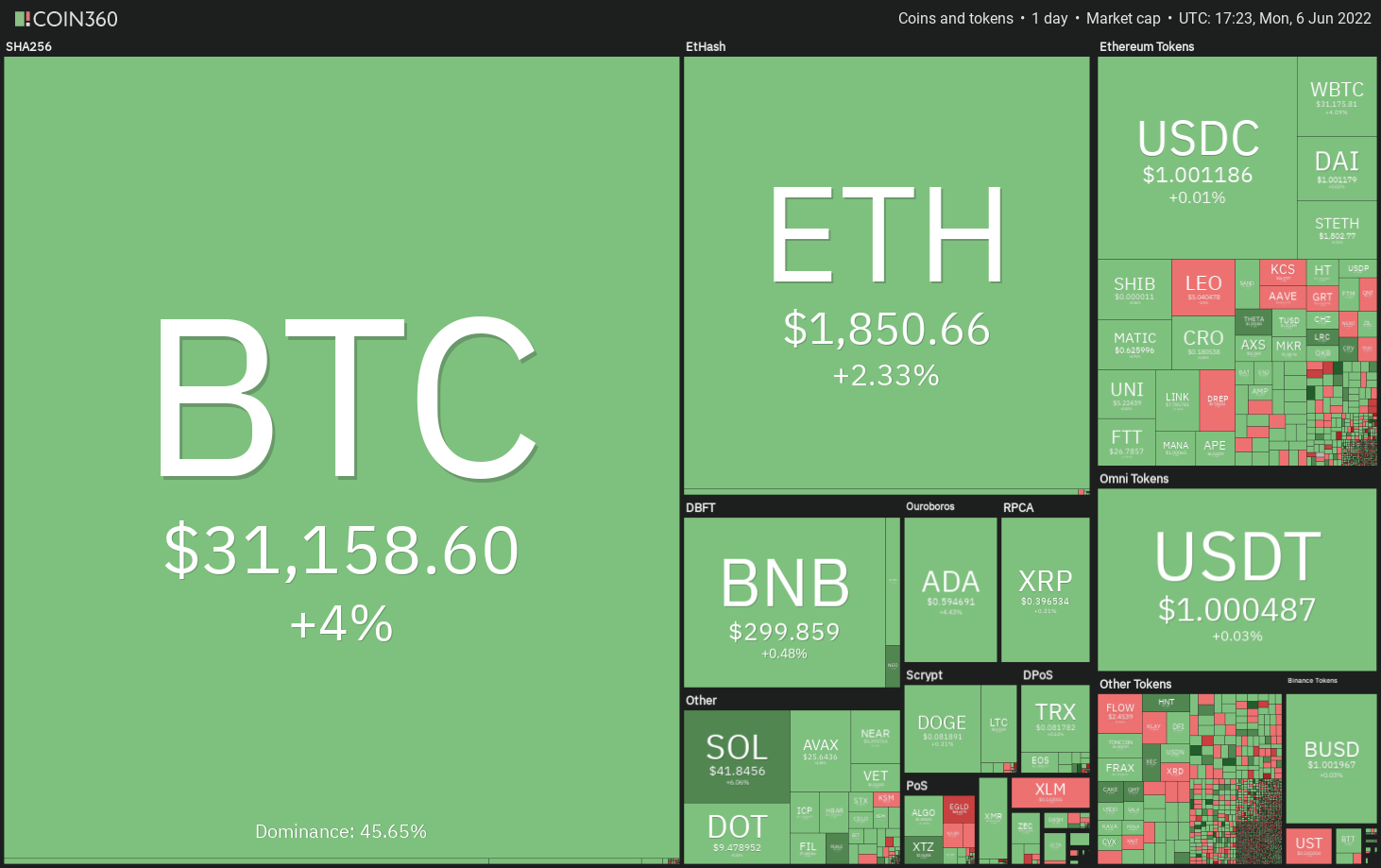

After nine successive days of red weekly candle lights, Bitcoin (BTC) printed a eco-friendly weekly candle on June 5. Leading into now, buyers stored up their momentum having a strong weekly open that boosted BTC cost to $31,800.

Moving forward, traders might keep an eye on the customer Cost Index (CPI) data for May, that is due on June 10. With respect to the figures, this might keep your volatility elevated as investors digest the report and speculate around the next possible move from the U . s . States Fed.

Analysts are divided concerning the next directional move for Bitcoin. Although some believe a bottom has been created, others anticipate another leg lower. For analyst Bob Loukas, the cost action within the summer time could remain unexciting and he expects the brand new cycle to start late around.

Could bulls sustain greater levels or will bears sell strongly and pull the cost lower? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

After two small range days on June 4 and 5, the number expanded on June 6 and Bitcoin soared over the 20-day exponential moving average (E($30,510). The bulls are trying to push the cost towards the overhead resistance at $32,659.

The cost action of history couple of days has created an climbing triangular pattern, that will complete away and shut above $32,659. In the event that happens, the BTC/USDT pair could begin a new up-move. The pattern target from the breakout in the triangular is $38,618.

The 20-day EMA has flattened out and also the relative strength index (RSI) is close to the midpoint, suggesting the selling pressure is reducing.

This positive view could invalidate when the cost turns lower dramatically and plunges underneath the trendline from the triangular. The happy couple could then drop towards the strong support at $28,630 in which the bulls may attempt to arrest the decline. A rest and shut below this support could tilt the benefit in support of the bears.

ETH/USDT

Ether (ETH) bounced off $1,737 on June 3, indicating that bulls are trying to defend the important support of $1,700. The buyers are trying to push the cost over the overhead resistance in the 20-day EMA ($1,930) on June 6.

When they succeed, the ETH/USDT pair could get momentum and rally to $2,016. Above this level, the happy couple could achieve the stiff overhead resistance at $2,159. The bears will probably defend this level strongly. When the cost turns lower out of this resistance, the happy couple could consolidate between $2,159 and $1,700 for any couple of more days.

The lengthy wick around the June 6 candlepower unit shows that bears still defend the 20-day EMA. This signifies the sentiment remains negative and traders can sell on rallies. The bears will attempt to pull the happy couple below $1,700 and resume the downtrend.

BNB/USDT

BNB has created a symmetrical triangular pattern, indicating indecision one of the bulls and also the bears. The bulls are trying to push the cost over the resistance line however the bears will not cede ground.

When the cost turns lower in the overhead resistance, the bears will again attempt to pull the BNB/USDT pair underneath the support line. When they manage to achieve that, the happy couple could decline to $265 where buying may emerge.

Alternatively, if bulls push and sustain the cost over the resistance line, it’ll claim that the sellers are losing their grip. The happy couple could then rally towards the breakdown degree of $350. It is really an important level to keep close track of just because a break and shut above it might signal the downtrend might be over.

XRP/USDT

Ripple (XRP) continues to be buying and selling in the bearish climbing down triangular pattern. The bulls are trying to push the cost over the downtrend line however the bears are posing a powerful challenge as seen in the lengthy wick around the day’s candlepower unit.

If bulls propel the cost over the downtrend line, it’ll negate the bearish pattern. That may result in a short squeeze, pushing the XRP/USDT pair to $.46 and then towards the mental level at $.50.

On the other hand, when the cost turns lower in the downtrend line, the happy couple could drop towards the $.38 support. If bears pull the cost below $.38, the climbing down triangular pattern will complete. The happy couple could then decline towards the important support at $.33. A rest and shut below this support could resume the downtrend.

ADA/USDT

Cardano (ADA) have been sustaining over the 20-day EMA ($.56) within the last couple of days suggesting accumulation through the bulls. Buying selected on June 6 and also the bulls are attempting to push the cost over the 50-day SMA ($.66).

When they succeed, the ADA/USDT pair could rally towards the breakdown degree of $.74. This level may again behave as a significant hurdle however, if the bulls overcome it, the recovery could get momentum. The happy couple could then rally to $.90.

The 20-day EMA has flattened out and also the RSI is simply over the midpoint, suggesting a small edge to buyers.

This bullish view could invalidate for the short term when the cost turns lower and breaks underneath the 20-day EMA. In the event that happens, the happy couple could progressively slide toward the strong support at $.44.

SOL/USDT

Solana (SOL) stepped underneath the critical support of $37 on June 4 however a minor positive would be that the bulls bought at ‘abnormal’ amounts. This might have caught the aggressive bears off-guard, which led to a powerful recovery as seen in the lengthy tail around the day’s candlepower unit.

The RSI has created an optimistic divergence, indicating the bearish momentum might be reducing. The bulls are trying to push the cost over the 20-day EMA ($46). When they succeed, the SOL/USDT pair could rally to $55 and after that to $60.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that the popularity remains negative and bears can sell on rallies. The bears will make yet another make an effort to resume the downtrend by pulling the happy couple below $35.

DOGE/USDT

Dogecoin (DOGE) is stuck between your 20-day EMA ($.08) and $.08 within the last couple of days however this tight range buying and selling is not likely to carry on for lengthy.

If buyers push the cost over the 20-day EMA, the DOGE/USDT pair could rally toward the mental resistance at $.10. This level may again behave as a hurdle but when bulls overcome it, the happy couple could rally to $.12.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that bears still sell on minor rallies. If bears sink the cost below $.08, the happy couple could drop to $.07. A rest and shut below this support will suggest the resumption from the downtrend.

Related: Is Cardano ready for any go at $1? June’s hard fork FOMO lifts ADA cost to weekly highs

Us dot/USDT

Polkadot (Us dot) has created a symmetrical triangular, which often functions like a continuation pattern. The buyers are trying to push the cost over the 20-day EMA ($10) and challenge the resistance type of the triangular.

A rest and shut over the triangular would be the first symbol of a possible trend change. The Us dot/USDT pair could rise to $12 after which chance a rally towards the breakdown degree of $14. The bears will probably defend this level strongly.

Alternatively, when the cost turns lower in the overhead resistance and breaks underneath the triangular, it’ll claim that bears have been in control. The happy couple could then decline to $8 and then retest the May 12 intraday low of $7.30.

AVAX/USDT

Avalanche (AVAX) bounced off $22.14 on June 4, indicating that bulls are protecting the $21.35 support with vigor. The buyers have pressed the cost over the downtrend line and are trying to obvious the overhead hurdle in the 20-day EMA ($28).

When they manage to achieve that, the AVAX/USDT pair could get momentum and begin its northward journey toward $33 after which $37. This type of move will claim that the bulls are during the game.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that bears remain active at greater levels. The happy couple could then slide toward $21.35. A rest and shut below this support could start the following leg from the downtrend.

SHIB/USDT

The buyers have effectively defended the $.000010 support within the last a few days but they haven’t yet had the ability to push Shiba Inu (SHIB) over the 20-day EMA ($.000012). This means that purchasing dries up at greater levels.

The tight range buying and selling between $.000010 and also the 20-day EMA is not likely to carry on for lengthy. If bears sink the cost below $.000010, the SHIB/USDT pair could retest the May 12 intraday low at $.000009. A rest and shut below this level could signal the resumption from the downtrend.

Alternatively, if buyers propel the cost over the 20-day EMA, the happy couple could rally towards the overhead resistance at $.000014. The bears are anticipated to mount a powerful defense only at that level.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.