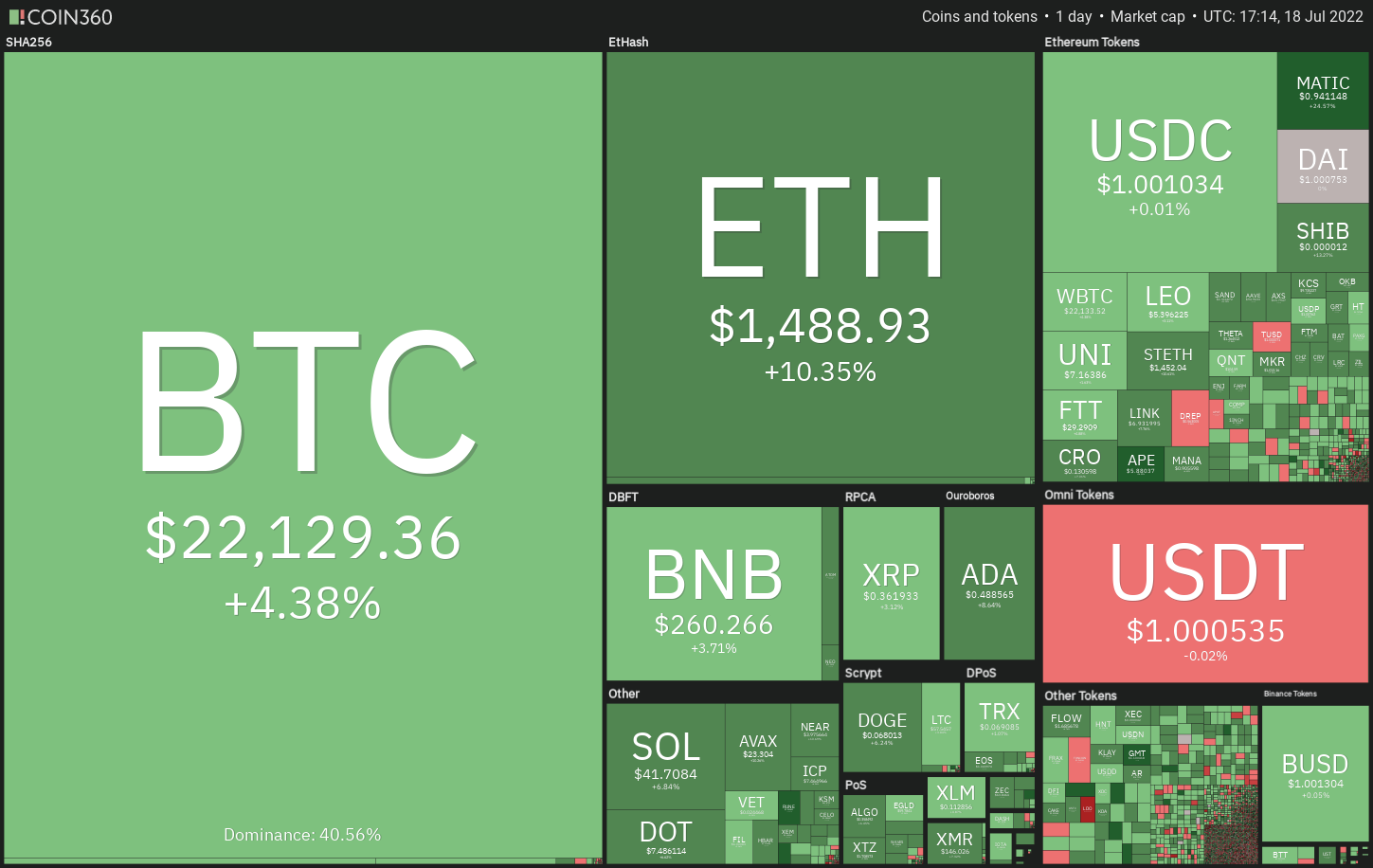

Bitcoin (BTC) rose above $22,000 and Ether (ETH) traded above $1,500 on This summer 18, indicating that bulls are progressively coming back towards the cryptocurrency markets. This pressed the total crypto market capital above $1 trillion the very first time since June 13, raising hopes the worst from the bear market might be behind us.

In another positive sign, greater than 80% from the total Bitcoin supply denominated within the U . s . States dollar continues to be dormant not less than three several weeks, based on crypto intelligence firm Glassnode. During previous bear markets, this kind of occurrence preceded the finish from the bear phase.

However, a study by Grayscale Investments voices another opinion. It shows that the present bear market in Bitcoin began in June 2022 and when history repeats itself, the bear phase could go on for 250 more days.

Can buyers maintain their momentum at greater levels or will bears still sell on rallies? Let’s read the charts from the top ten cryptocurrencies to discover.

BTC/USDT

After hesitating close to the 20-day exponential moving average (EMA) ($20,986) for 2 days, Bitcoin designed a decisive move greater on This summer 18. This up-move has damaged over the resistance type of the symmetrical triangular, indicating a potential trend reversal.

The 20-day EMA is flat however the relative strength index (RSI) has risen in to the positive territory, indicating the momentum favors the buyers. The bulls will make an effort to overcome the barrier at $23,363.

When the cost turns lower out of this level but rebounds from the breakout level in the triangular, it’ll suggest buying at ‘abnormal’ amounts. That may increase the potential of a rest above $23,363. The happy couple could then rally towards the pattern target of $28,171.

On the other hand, when the cost does not sustain over the triangular, it’ll indicate the bears are strongly protecting the overhead zone between your resistance type of the triangular and $23,363. That may keep your pair within the triangular for any couple of more days.

ETH/USDT

Ether broke and closed over the overhead resistance at $1,280 on This summer 16, which completed the climbing triangular pattern The bears attempted to stall the up-move in the 50-day simple moving average (SMA) ($1,336) on This summer 17 however the bulls didn’t relent.

The buyers started again their purchase on This summer 18 and pressed the cost above $1,500. This means the beginning of a brand new upward trend. The ETH/USDT pair could rally towards the overhead resistance at $1,700 in which the bears may pose a powerful challenge.

When the next correction will get arrested in the 20-day EMA ($1,234), it’ll claim that the sentiment has shifted from selling on rallies to purchasing on dips. That may boost the prospects of the break above $1,700.

This positive view could invalidate for the short term when the cost turns lower and slips underneath the 20-day EMA. That may pull the happy couple towards the support type of the triangular.

BNB/USDT

BNB rose over the 20-day EMA ($238) on This summer 14 and removed the overhead hurdle in the 50-day EMA ($247) on This summer 16. The bears attempted to drag the cost back underneath the 50-day SMA on This summer 17 however the bulls held their ground.

The BNB/USDT pair started again its up-move ahead This summer 18, suggesting the low might have been made at $183. The 20-day EMA has began to show up and also the RSI is incorporated in the positive zone, indicating that bulls have been in control.

When the cost sustains over the 50-day SMA, the happy couple could rally to $300 after which attempt an up-proceed to $350. This level will probably behave as a stiff resistance.

This positive view could invalidate for the short term when the cost turns lower and breaks underneath the 20-day EMA. That may pull the happy couple to $211.

XRP/USDT

Ripple (XRP) broke over the downtrend line on This summer 16 however the bears stalled the relief rally in the 50-day SMA ($.35). The sellers attempted to drag the cost underneath the 20-day EMA ($.34) on This summer 17 however the bulls didn’t budge and purchased the dip.

The 20-day EMA has began to show up progressively and also the RSI has leaped in to the positive zone, indicating benefit to the bulls.

The XRP/USDT pair removed the overhead hurdle in the 50-day SMA on This summer 18, invalidating the bearish climbing down triangular pattern. If bulls sustain the cost over the 50-day SMA, the happy couple could get momentum and rally to $.45.

To invalidate this bullish view, the bears will need to pull the happy couple into the triangular. This type of move could trap the aggressive bulls and sink the happy couple towards the important support at $.30.

ADA/USDT

After battling to push Cardano (ADA) over the 20-day EMA ($.46), the bulls finally managed the task on This summer 18. The cost has arrived at the 50-day SMA ($.50) that could behave as a powerful resistance.

The RSI within the positive territory signifies the momentum favors the buyers. If bulls push the cost over the 50-day SMA, the ADA/USDT pair could rise to $.60 and then suggest a touch toward the stiff overhead resistance at $.70.

Alternatively, if bulls neglect to sustain the cost over the 50-day SMA, it’ll claim that bears still sell strongly on rallies. The happy couple could then drop back toward the critical support zone between $.44 and $.40.

SOL/USDT

Solana (SOL) broke over the symmetrical triangular pattern on This summer 16, indicating the uncertainty resolved in support of the buyers. The bears tried to pull the cost into the triangular on This summer 17 however the bulls held their ground.

The SOL/USDT pair is trying to go above the immediate resistance at $43. In the event that happens, the happy couple could rally towards the mental level at $50. This level may behave as a hurdle but when entered, the up-move could achieve $60.

On the other hand, when the cost turns lower from $43 and breaks underneath the moving averages, the happy couple could drop towards the support line. A rest and shut below this level could claim that bears are during the game.

DOGE/USDT

Dogecoin (DOGE) is attempting to create a greater low at $.06 and also the bulls are trying to push the cost over the stiff overhead resistance in the 50-day SMA ($.07).

When they manage to achieve that, the DOGE/USDT pair could rally to $.08. It is really an important level to keep close track of just because a break and shut above it might obvious the road for any rally to $.09 after which to $.10.

This positive view could invalidate for the short term when the cost turns lower in the current level and slides underneath the intraday low made on This summer 13. That may sink the happy couple towards the critical level at $.05.

Related: Bitcoin cost gets near critical 200-week moving average as Ethereum touches $1.5K

Us dot/USDT

Polkadot (Us dot) broke and closed over the 20-day EMA ($7.08) on This summer 16 however the bears pulled the cost back underneath the level on This summer 17. This tough tussle between your bulls and also the bears was resolved in support of the buyers on This summer 18.

The 20-day EMA is flattening out and also the RSI is simply over the midpoint, indicating the selling pressure might be reducing. The bulls will need to push and sustain the cost over the 50-day SMA ($7.79) to achieve top of the hands. When they manage to achieve that, the Us dot/USDT pair could rally to $10.

On the other hand, when the cost turns lower in the current level, it’ll claim that the bears are protecting the 50-day SMA strongly. The happy couple could then remain stuck between $6.36 and also the 50-day SMA for any couple of days.

MATIC/USDT

Polygon (MATIC) bounced from the 50-day SMA ($.55) on This summer 13 and rose over the overhead resistance at $.63. This completed the bullish climbing triangular pattern.

The MATIC/USDT pair selected up momentum and arrived at the pattern target of $.95 on This summer 18. The sharp rally of history couple of days has pressed the RSI in to the overbought territory and also the pair is close to the mental degree of $1. This points to the consolidation or correction soon.

The very first support on however the 20-day EMA ($.63). When the cost rebounds off this level, it’ll claim that bulls still buy on dips. The happy couple could then chance a rally towards the 200-day SMA ($1.25). This bullish view could invalidate away below $.63.

AVAX/USDT

Avalanche (AVAX) has damaged over the overhead resistance at $21.35, indicating the conclusion from the climbing triangular pattern. This increases the probability of a pattern reversal.

The 20-day EMA ($19.56) and also the 50-day SMA ($19.79) are near to finishing a bullish crossover and also the RSI is incorporated in the positive territory indicating benefit to buyers. If bulls sustain the cost above $21.35, the AVAX/USDT pair could begin a new up-move. The pattern target from the breakout in the triangular is $29.

Unlike this assumption, when the cost turns lower and breaks underneath the 50-day SMA, it’ll claim that bears still sell strongly at greater levels. That may pull the happy couple lower towards the support line.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.