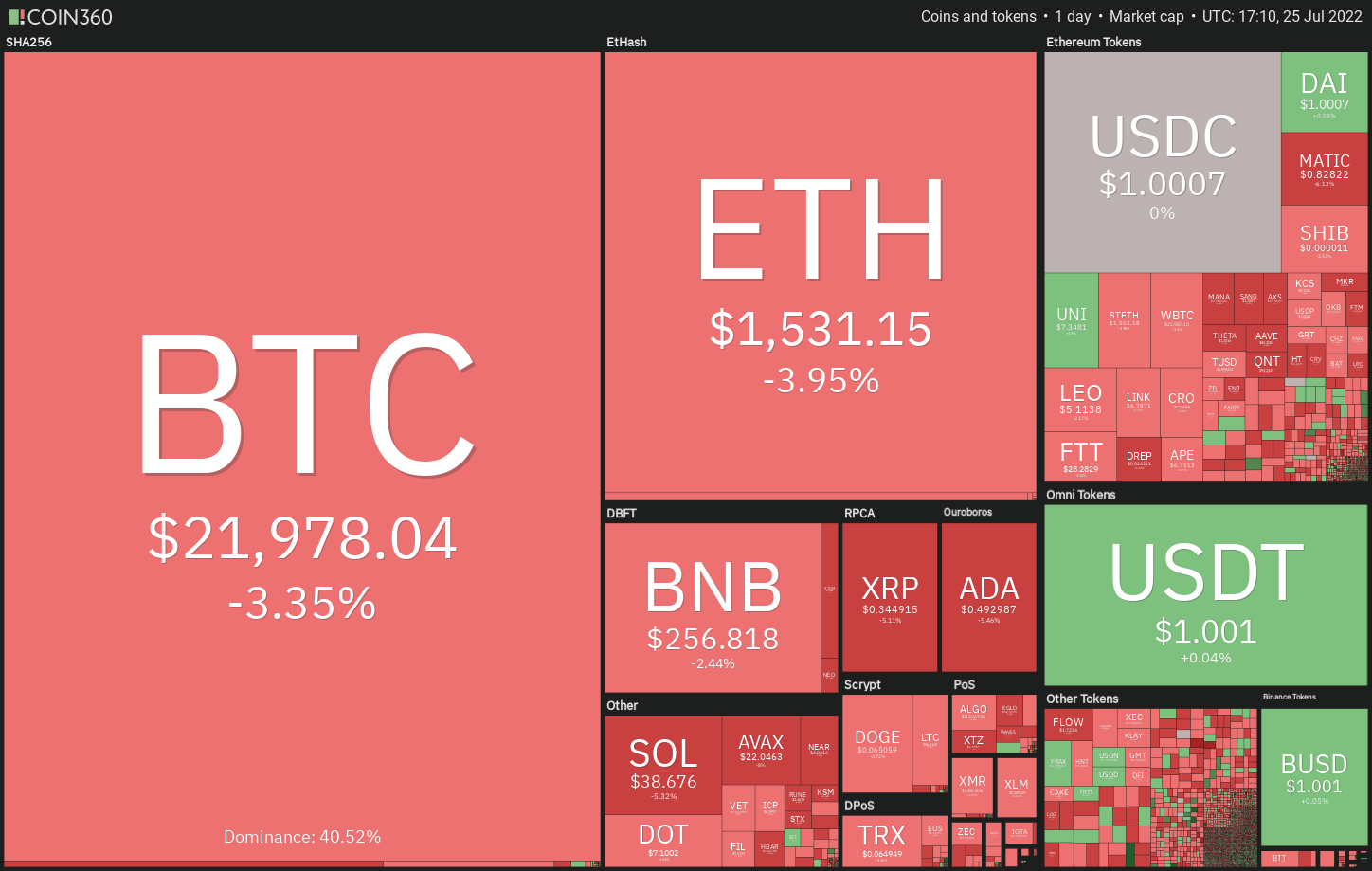

Bitcoin (BTC) and many major altcoins are witnessing profit-booking on This summer 25 because the bulls reduce their positions prior to the Federal Open Market Committee meeting on This summer 26 through This summer 27. This signifies the sentiment remains fragile which bulls aren’t confident about transporting lengthy positions in to the event.

Several analysts have hung on to their bearish view after Bitcoin unsuccessful to sustain over the 200-week moving average at $22,780. CryptoQuant contributor Venturefounder expects the supplying resume and Bitcoin to fall as little as $14,000 before a macro bottom is confirmed.

The institutional investors appear to become absent in the markets and also the recovery has been driven through the retail investors. Data from on-chain analytics firm Glassnode demonstrated that investors holding one Bitcoin or fewer happen to be accumulating strongly “more now than ever before.”

Could retail investors continue their frantic pace of buying and set the ground below Bitcoin and altcoins? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin rebounded from the 20-day exponential moving average (EMA) ($21,857) on This summer 23 however the bulls couldn’t obvious the hurdle at $23,363 on This summer 24. This means that bears are strongly protecting the overhead resistance.

The cost has came back towards the 20-day EMA, which is a vital level to keep close track of. If the level cracks, the BTC/USDT pair could drop to $20,750. This type of move will invalidate the breakout in the symmetrical triangular.

The 20-day EMA is flattening out and also the relative strength index (RSI) has dropped towards the midpoint, indicating an account balance between demand and supply.

This advantage could tilt in support of buyers when the cost breaks above $23,363. In the event that happens, the happy couple could rally to $28,171 after which to $30,000. The bears will need to sink the cost underneath the support line to achieve top of the hands.

ETH/USDT

The bears have effectively defended the overhead resistance at $1,700 previously couple of days. However, a small positive would be that the bulls haven’t permitted Ether (ETH) to decrease below $1,464, indicating buying at ‘abnormal’ amounts.

When the cost once more rebounds off $1,464, the ETH/USDT pair could continue its tight range-bound action for any couple of more days. The increasing 20-day EMA ($1,397) and also the RSI within the positive zone indicate the road to least resistance would be to the upside.

A rest and shut above $1,700 could signal the resumption from the up-move. The happy couple could then rally to $2,000.

This positive view could invalidate when the cost slips underneath the 20-day EMA. In the event that happens, the happy couple may drop to $1,280. A powerful rebound off this level can keep the happy couple range-bound between $1,280 and $1,700 for any couple of days.

BNB/USDT

BNB turned lower in the downtrend line on This summer 23, indicating the bears still defend the amount with vigor. The bears will make an effort to sink the cost underneath the moving averages.

When they succeed, the BNB/USDT pair could test the support type of the climbing funnel. When the cost rebounds off this level, the bulls will again attempt to push the happy couple over the downtrend line and challenge the resistance type of the funnel.

Another possibility would be that the bears sink the cost underneath the support type of the funnel. In the event that happens, the benefit will tilt in support of the bears and also the pair could decline towards the strong support at $211.

XRP/USDT

Ripple (XRP) continues to be consolidating between $.30 and $.39 within the last couple of days. Even though the cost bounced from the moving averages on This summer 23, the rally couldn’t achieve the overhead resistance at $.39. This means that demand dries up at greater levels.

The bears are attempting to sink the cost underneath the moving averages. When they manage to achieve that, the XRP/USDT pair could progressively decline toward $.30. The buyers will probably defend this level with all of their might if the support cracks, the happy couple could resume the downtrend.

Alternatively, when the cost rebounds from the current level, the bulls will again attempt to obvious the overhead hurdle at $.39 and begin a brand new up-move. The happy couple could then rally to $.50.

ADA/USDT

Cardano (ADA) tried to go above the overhead resistance at $.55 on This summer 24 however the bears effectively defended the amount. That could have attracted profit-booking in the short-term traders.

The bears are trying to sink the cost underneath the moving averages. When they manage to achieve that, the ADA/USDT pair could drop to $.44. When the cost rebounds off this level, the happy couple may oscillate between $.44 and $.55 for any couple of days.

Another possibility would be that the cost rebounds from the moving averages. In the event that happens, the bulls will again attempt to push the happy couple over the overhead resistance. When they succeed, the happy couple could get momentum and rally to $.63 after which to $.70.

SOL/USDT

Solana’s (SOL) failure to rebound from the 20-day EMA ($39) signifies the bullish momentum might be weakening. The bears will endeavour to sink the cost towards the support line, which is a vital level to keep close track of.

When the cost rebounds from the support line, the buyers can make another make an effort to push the SOL/USDT pair toward the overhead resistance at $48. The bulls will need to obvious this hurdle to signal the conclusion from the climbing triangular pattern. This bullish setup includes a target purpose of $71.

On the other hand, if bears sink the cost underneath the support line, the bullish pattern is going to be negated. The happy couple could then decline to $30. A rest below this level will indicate the bears have returned in charge.

DOGE/USDT

The bears have pulled Dogecoin (DOGE) underneath the moving averages on This summer 25, which opens the doorways for any loss of the trendline. The bulls will probably defend this level strongly.

When the cost rebounds from the trendline, the bulls will endeavour to push the DOGE/USDT pair over the moving averages. In the event that happens, the happy couple could rise towards the overhead resistance at $.08. A rest and shut above this level will complete an climbing triangular pattern which has a target purpose of $.11.

On the other hand, when the cost breaks underneath the trendline, the bullish setup is going to be negated. That may sink the happy couple to $.06 and then towards the crucial support at $.05.

Related: Ethereum’s bearish U-turn? ETH cost momentum fades after $1.6K rejection

Us dot/USDT

The bulls frequently unsuccessful to push Polkadot (Us dot) over the 50-day simple moving average (SMA) ($7.47) previously couple of days, indicating that bears are protecting the amount strongly.

The Us dot/USDT pair tucked underneath the 20-day EMA ($7.23) on This summer 25. If bears sustain the cost below this level, the happy couple could slide toward the strong support at $6. It is really an important level to keep close track of just because a break and shut below it might signal the resumption from the downtrend.

Another possibility would be that the cost appears in the current level and breaks over the 50-day SMA. In the event that happens, it’ll suggest demand at ‘abnormal’ amounts. The happy couple could then rise to $8.79 and then towards the mental degree of $10.

MATIC/USDT

Polygon (MATIC) switched lower in the resistance line on This summer 25, indicating that bears can sell on minor rallies. The bears will endeavour to sink the cost to another support at $.75.

The increasing 20-day EMA ($.75) and also the RSI within the positive territory indicate that buyers possess a slight edge. When the cost rebounds off $.75, the bulls will again make an effort to push the MATIC/USDT pair over the resistance line.

When they succeed, the happy couple could rally towards the mental degree of $1. The bulls will need to obvious this hurdle to begin an up-proceed to $1.26.

On the other hand, when the cost breaks below $.75, it’ll claim that the bullish momentum has weakened. The happy couple could then slide to $.63.

AVAX/USDT

Avalanche (AVAX) created a Doji candlepower unit pattern on This summer 23 as well as an inside-day candlepower unit pattern on This summer 24, indicating indecision one of the bulls and also the bears.

This uncertainty resolved towards the downside on This summer 25 and also the AVAX/USDT pair declined towards the breakout level at $21.35. When the cost rebounds off this level with strength, it’ll claim that bulls are purchasing on dips.

That may increase the potential of a retest at $26.50. A rest above this resistance could obvious the road for any rally to $29 after which to $33.

Unlike this assumption, when the cost breaks below $21.35, the happy couple could drop towards the support line. The bulls will probably defend this level strongly.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.