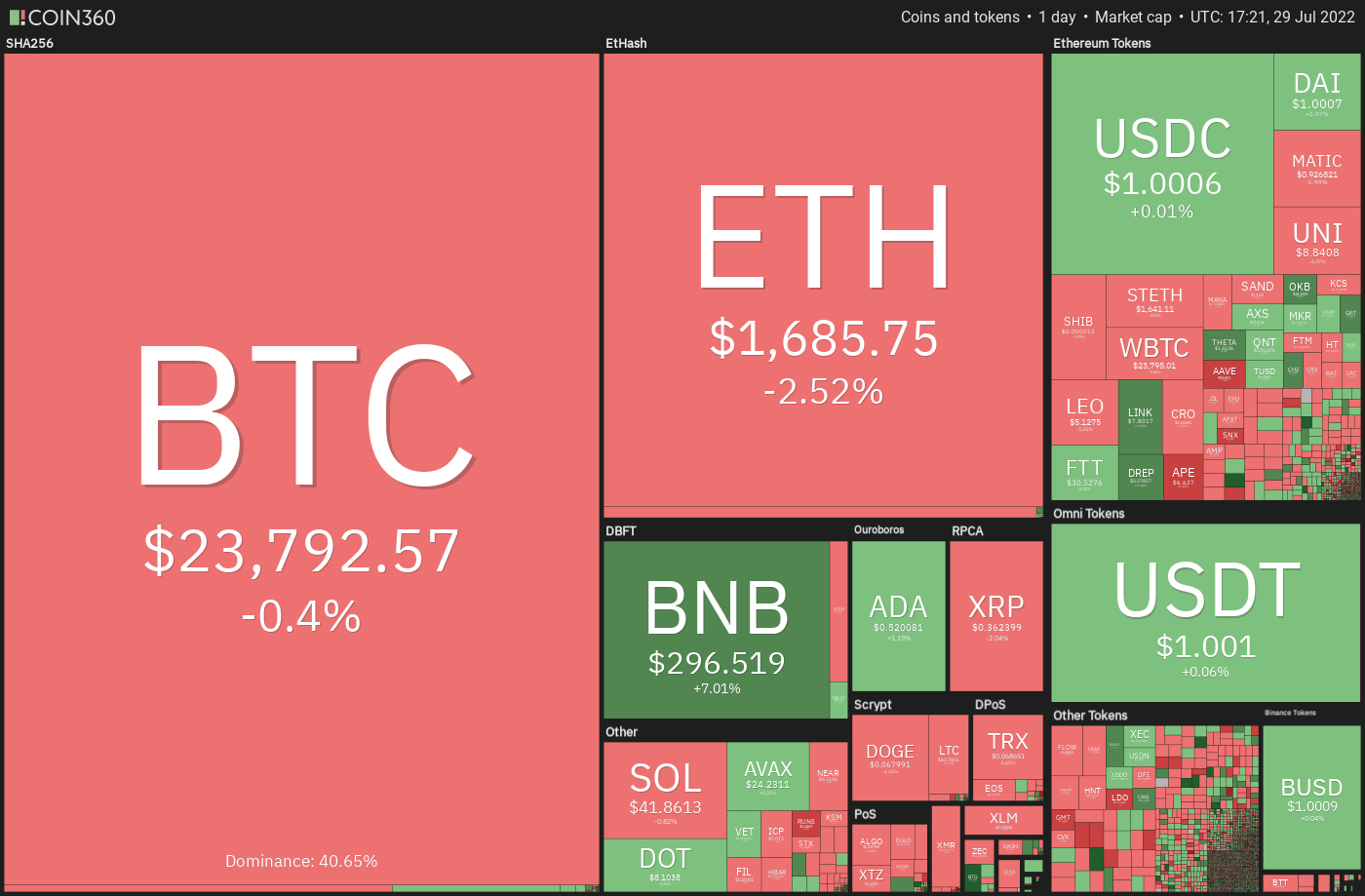

Bitcoin (BTC) hit a six-week high above $24,000 on This summer 29, extending its rally that selected up momentum following the U . s . States Fed hiked rates by 75 basis points on This summer 27. When the rally sustains for the following 2 days, Bitcoin might be on the right track to shut the month of This summer with gains in excess of 20%, based on data from Coinglass.

It isn’t just the crypto markets which have seen a publish-Federal Open Market Committee (FOMC) rally. The U.S. equities markets are on the right track for giant monthly gains in This summer. The S&P 500 and also the Nasdaq Composite are up 8.8% and 12% in This summer, on the right track for their best monthly gains since November 2020.

The crypto and equities markets have risen within the expectation the pace of rate hikes through the Given will slow lower later on. Arthur Hayes, ex-Chief executive officer of derivatives platform BitMEX, believes the Given won’t increase rates further and could eventually go back to an accommodative financial policy and much more neutral rates.

Could Bitcoin and altcoins extend their recovery within the next couple of days? Let’s read the charts from the top ten cryptocurrencies to discover.

BTC/USDT

Bitcoin closed underneath the 20-day exponential moving average (EMA) ($22,213) on This summer 25 however the bears couldn’t sustain the low levels. The bulls bought the dip below $21,000 and propelled the cost back over the moving averages on This summer 27.

The moving averages have finished a bullish crossover and also the relative strength index (RSI) is incorporated in the positive territory, indicating that bulls have been in control. If buyers drive the cost above $24,276, the BTC/USDT pair could get momentum and rally toward the pattern target of $28,171. If the level is entered, the following stop might be $32,000.

Alternatively, when the cost turns lower in the current level or does not sustain above $24,276, it’ll claim that demand dries up at greater levels. For the reason that situation, the critical level to look at on however the 20-day EMA. If the support cracks, it’ll claim that the bullish momentum has weakened. The happy couple could then decline towards the 50-day simple moving average (SMA) ($21,589).

ETH/USDT

Ether (ETH) rebounded dramatically from the 20-day EMA ($1,470) on This summer 27 and broke over the critical resistance at $1,700 on This summer 28. However, the bears will not relent and are attempting to pull the cost back below $1,700 on This summer 29.

The bulls and bears may participate in a difficult fight near $1,700 however the upsloping 20-day EMA and also the RSI within the positive zone indicate a benefit to buyers. If bulls sustain the cost above $1,700, the momentum could get and also the ETH/USDT pair could rally to $2,000 and then to $2,200.

On the other hand, if bears pull the cost below $1,590, aggressive bulls might get trapped and also the pair may drop towards the 20-day EMA. A powerful rebound off this level will raise the chance of a rest above $1,700 however a break underneath the 20-day EMA could sink the happy couple to $1,280.

BNB/USDT

BNB has been buying and selling in a climbing funnel within the last couple of days. The cost bounced from the 50-day SMA ($239) on This summer 26 and rose over the downtrend line, indicating a possible alternation in trend.

The bullish momentum ongoing and also the buyers have driven the cost over the resistance type of the climbing funnel. If bulls sustain the cost over the funnel, the BNB/USDT pair could rally towards the overhead resistance at $350.

Alternatively, if bulls neglect to sustain the cost over the funnel, it’ll claim that bears are active at greater levels. The happy couple could then re-go into the funnel and drop towards the downtrend line. A powerful rebound off this level could enhance the prospects of the break over the funnel. The bears will need to sink the cost underneath the funnel to achieve top of the hands.

XRP/USDT

Ripple (XRP) is range-bound inside a downtrend. The bears pulled the cost underneath the moving averages on This summer 25 but tend to not sustain the low levels and challenge the strong support at $.30.

This means strong demand at ‘abnormal’ amounts. The buyers pressed the cost back over the moving averages on This summer 27 and are trying to obvious the overhead hurdle at $.39. When they succeed, it’ll suggest the beginning of a brand new up-move. The happy couple could then rally towards the target objective at $.48.

Unlike this assumption, the cost has switched lower from $.39. The bears will attempt to sink the XRP/USDT pair underneath the moving averages. When they do this, the happy couple could consolidate between $.30 and $.39 for any couple of more days.

ADA/USDT

The bulls pressed Cardano (ADA) over the moving averages on This summer 27, indicating strong buying close to the $.44 support. The cost has arrived at the overhead resistance at $.55, that could behave as a stiff barrier.

When the cost turns lower from $.55, the ADA/USDT pair could drop towards the moving averages. A rest below this support can keep the happy couple range-bound between $.44 and $.55 for any couple of days. The bears will need to sink the happy couple underneath the $.44 to $.40 support zone to signal the resumption from the downtrend.

On the other hand, if bulls thrust the cost above $.55, it’ll suggest the beginning of a brand new up-move. The happy couple could then rally to $.63 and then to $.70.

SOL/USDT

Solana (SOL) rebounded from the support line on This summer 26, indicating strong buying at ‘abnormal’ amounts. The bulls built upon the momentum and pressed the cost over the moving averages on This summer 27.

The SOL/USDT pair could achieve the overhead resistance at $48, which is a vital level to keep close track of. If bulls overcome this barrier, the happy couple will complete an climbing triangular pattern. The happy couple could then start an up-move toward the pattern target at $71.

On the other hand, when the cost turns lower from $48, the happy couple may extend its stay within the triangular for any couple of more days. A rest and shut underneath the support line could tilt the benefit in support of the bears.

DOGE/USDT

Dogecoin (DOGE) bounced from the trendline from the climbing triangular pattern on This summer 27 and rose over the moving averages. This signifies strong demand at ‘abnormal’ amounts.

The bulls will attempt to push the cost toward the overhead resistance at $.08. The moving averages have finished a bullish crossover and also the RSI has leaped in to the positive territory indicating benefit to buyers.

If bulls drive the cost above $.08, the bullish setup will complete and also the DOGE/USDT pair could rally towards the pattern target of $.11. The bears will need to sink the cost underneath the trendline from the triangular to invalidate the bullish view.

Related: Bitcoin bear market over, metric hints as BTC exchange balances hit 4-year low

Us dot/USDT

Polkadot (Us dot) switched up and broke over the moving averages on This summer 27, indicating that ‘abnormal’ amounts are attracting buyers. The cost has arrived at the strong overhead resistance at $8.50 in which the bears may mount a powerful defense.

The moving averages are near a bullish crossover and also the RSI is incorporated in the positive territory, indicating the bears might be losing their grip. If bulls push and sustain the cost above $8.50, it’ll suggest the beginning of a brand new up-proceed to $10 and then to $10.80.

Unlike this assumption, when the cost turns lower from $8.50 and slips underneath the moving averages, it’ll claim that the Us dot/USDT pair may oscillate in the range for any couple of more days. The bears will need to sink the happy couple below $6 to begin the following leg from the downtrend.

MATIC/USDT

Polygon (MATIC) bounced from the 20-day EMA ($.79) on This summer 26 and rose over the downtrend line on This summer 27. This established that the minor corrective phase was over.

The bulls pressed the cost to $.98 on This summer 28 and 29 however the lengthy wick around the candlesticks shows that the bears are protecting the amount with vigor. The upsloping 20-day EMA and also the RSI within the positive territory indicate the road to least resistance would be to the upside.

If bulls push the cost over the mental degree of $1, the MATIC/USDT pair could extend its rally to $1.26. This bullish view might be invalidated soon when the cost turns lower and breaks underneath the 20-day EMA.

AVAX/USDT

Avalanche (AVAX) rebounded from the 50-day SMA ($19.48) on This summer 26 and it is nearing the overhead resistance at $26.38 on This summer 29. The bears will attempt to stall the recovery only at that level.

The progressively upsloping 20-day EMA ($22.10) and also the RSI within the positive territory indicate a benefit to buyers. If bulls drive the cost above $26.38, the bullish momentum could get and also the AVAX/USDT pair could rally to $33 after which to $38.

Unlike this assumption, when the cost turns lower from $26.38 and breaks underneath the 20-day EMA, the bears can make yet another make an effort to sink the happy couple underneath the 50-day SMA and challenge the support line.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.