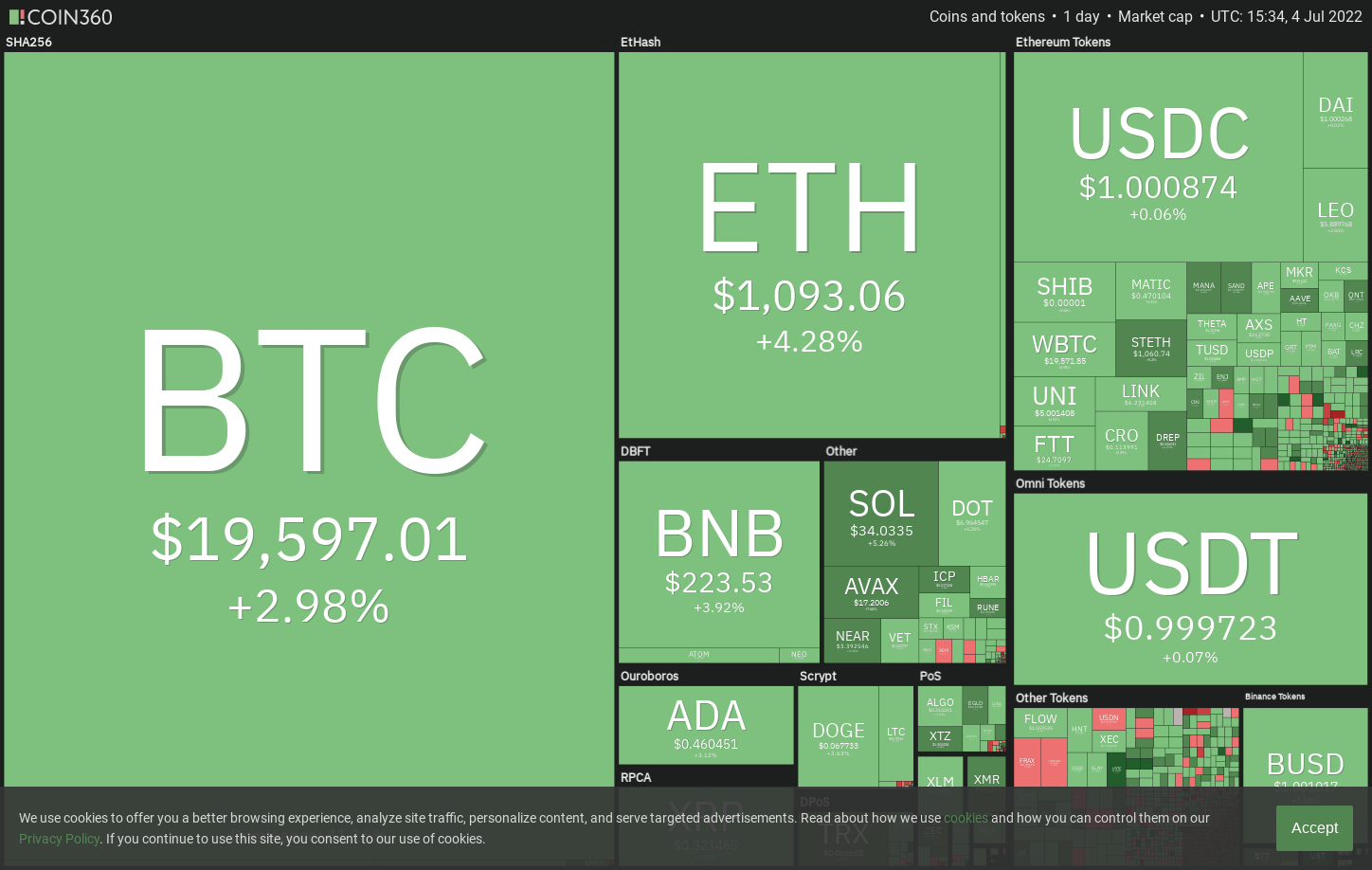

The crypto markets have continued to be relatively stable over the past weekend as well as on This summer 4, that is a holiday for that U . s . States markets because of Independence Day. Although Arthur Hayes, former Chief executive officer of derivatives platform BitMEX, was expecting a “mega crypto dump” around This summer 4, it’s not materialized.

The stop by Bitcoin’s (BTC) volatility previously couple of days has led to the squeezing from the Bollinger Band’s width. This signifies a potential rise in volatility within the next couple of days, based on popular analyst Matthew Hyland.

Meanwhile, crypto investors appear to become awaiting clues in the U.S. equities markets and also the U.S. dollar.

Bitcoin’s correlation coefficient using the dollar within the week ending This summer 3 slumped to .77 below zero, the cheapest level in 17 several weeks. A lot of the analysts surveyed by JP Morgan expect the dollar to finish at or underneath the current cost levels of approximately 105. Any weakness within the dollar might be advantageous for Bitcoin.

Could bulls begin a recovery for the short term? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The failure from the bears to increase Bitcoin’s decline below $19,637 suggests too little sellers at ‘abnormal’ amounts. The bulls will make an effort to push the cost back over the resistance at $19,637.

In the event that happens, the BTC/USDT pair could rise towards the 20-day exponential moving average (EMA) ($21,255). This level could again behave as a stiff resistance but when bulls obvious this hurdle, the happy couple may rise towards the overhead zone between $22,000 and $23,362.

A rest above this zone could open the doorways for any possible rally towards the 50-day simple moving average (SMA) ($25,710). The bulls will need to overcome this barrier to signal a possible trend change.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that the sentiment remains bearish and traders can sell on rallies. That may increase the potential of a retest from the critical support at $17,622. If the support cracks, the decline could include $15,000.

ETH/USDT

Ether (ETH) tucked underneath the mental level at $1,000 on June 30 however the bears couldn’t take advantage of this weakness. This means that bulls are purchasing on dips.

The bulls will attempt to push the cost over the 20-day EMA ($1,192) and gain top of the hands. When they do this, the ETH/USDT pair could rise to $1,280 after which towards the 50-day SMA ($1,535). This level could again behave as a powerful resistance. The bulls will need to propel the cost above $1,700 to signal the beginning of a brand new up-move.

On the other hand, when the cost turns lower in the 20-day EMA, it’ll claim that the sentiment remains negative and bears can sell on rallies. The bears will attempt to sink the cost below $998 and challenge the critical support at $881.

BNB/USDT

The buyers have effectively defended the support at $211 since June 29, indicating strong demand at ‘abnormal’ amounts. The bulls are trying to push BNB above the 20-day EMA ($231).

When they succeed, it’ll claim that the BNB/USDT pair might have bottomed out at $183. The buyers will make an effort to drive the happy couple towards the 50-day SMA ($266). A rest and shut above this resistance could signal a possible alternation in trend.

Unlike this assumption, when the cost turns lower in the 20-day EMA, it’ll claim that bears can sell on every minor rally. The bears will on the other hand attempt to sink the cost below $211 and gain top of the hands.

XRP/USDT

XRP has been buying and selling in the symmetrical triangular pattern, indicating indecision one of the bulls and also the bears. The symmetrical triangular usually functions like a continuation pattern but on some occasions, additionally, it works as a reversal pattern.

The cost has rebounded from the support type of the triangular and also the bulls will endeavour to push the XRP/USDT pair over the 20-day EMA ($.33). When they succeed, the happy couple could rise towards the resistance type of the triangular.

A rest and shut above this level could suggest the beginning of a brand new up-move. The happy couple could then rally to $.48.

Another possibility would be that the cost turns lower dramatically in the 20-day EMA and breaks underneath the support type of the triangular. That may pull the happy couple lower towards the critical support at $.28. If the level cracks, the following stop might be $.23.

ADA/USDT

Although Cardano (ADA) continues to be buying and selling close to the $.44 level since June 30, the bears haven’t been in a position to pull and sustain the cost underneath the support. This means that bulls are purchasing the dips toward $.44.

The buyers are presently trying to push the cost over the 20-day EMA ($.48). When they make this happen task, the ADA/USDT pair could rise towards the 50-day SMA ($.51). It is really an important level to keep close track of just because a break and shut above it might claim that the bears might be losing their grip.

Alternatively, when the cost turns lower in the moving averages, it’ll claim that bears are active at greater levels. The sellers will attempt to sink the happy couple below $.44 and challenge the critical level at $.40.

SOL/USDT

Solana (SOL) continues to be buying and selling just beneath the 20-day EMA ($35) within the last couple of days however the bears haven’t been in a position to take advantage of this weakness. This means too little sellers at ‘abnormal’ amounts.

The buyers will make an effort to push the cost over the 20-day EMA. Whether they can accomplish it, the SOL/USDT pair could rise towards the 50-day SMA ($40). A rest and shut above this resistance could open the doorways for any possible rally towards the mental level at $50.

However, when the cost turns lower in the moving averages, it’ll claim that the sentiment remains negative and traders can sell on minor rallies. The bears will attempt to pull the happy couple below $30. When they do this, the happy couple could decline to $27 after which to $25.

DOGE/USDT

Dogecoin (DOGE) continues to be clinging towards the 20-day EMA ($.07) within the last couple of days. This means the bulls are purchasing the intraday dips because they expect moving greater.

The 20-day EMA has flattened out and also the relative strength index (RSI) is close to the midpoint, indicating the selling pressure might be reducing. The bulls will endeavour to push the cost over the 50-day SMA ($.07) and challenge the immediate resistance at $.08. If the level is entered, the DOGE/USDT pair could rise to $.10.

On the other hand, when the cost turns lower in the current level or even the 50-day SMA, it’ll claim that the bears are protecting the moving averages with vigor. The sellers will attempt to sink the happy couple below $.06 and gain top of the hands.

Related: Hodlers and whales: The master of probably the most Bitcoin in 2022?

Us dot/USDT

Polkadot (Us dot) continues to be buying and selling between $7.30 and $6.36 since June 30. This means that bulls are purchasing at ‘abnormal’ amounts however the bears haven’t permitted the cost to increase over the range.

Even though the downsloping 20-day EMA ($7.52) signifies benefit to sellers, the positive divergence around the RSI signifies the bearish momentum might be weakening. If buyers drive the cost over the 20-day EMA, the Us dot/USDT pair could rally towards the 50-day SMA ($8.63).

This bullish view might be invalidated when the cost turns lower and plummets underneath the crucial support at $6.36. In the event that happens, the happy couple could resume its downtrend toward the following support at $5.

LEO/USD

The bulls and also the bears are battling it for supremacy close to the resistance type of the climbing down funnel. UNUS SED LEO (LEO) dipped towards the 20-day EMA ($5.65) on This summer 2 however the bulls effectively defended the amount.

The buyers are again trying to obvious the resistance type of the funnel. The increasing 20-day EMA and also the RSI within the positive territory indicate the road to least resistance would be to the upside. When the cost sustains above $6, the LEO/USD pair could get momentum and rally to $6.50. Above this level, the rally could include the pattern target at $6.90.

Unlike this assumption, when the cost once more turns lower from $6, it’ll claim that bears are strongly protecting this level. The bears will make an effort to sink the happy couple underneath the 20-day EMA. When they manage to achieve that, the happy couple could slide towards the 50-day SMA ($5.30).

SHIB/USDT

Shiba Inu (SHIB) continues to be buying and selling near to the mental level at $.000010. This means the bulls are trying to form a greater low near this support.

The 20-day EMA ($.000010) is flat and also the RSI is close to the midpoint, indicating an account balance between demand and supply. When the cost breaks over the 50-day SMA ($.000010), the SHIB/USDT pair could rally to $.000012. This level could again behave as a stiff barrier but when removed, the happy couple could rise to $.000014.

On the other hand, when the cost turns lower in the moving averages, the bears will attempt to drag the happy couple below $.000009. When they succeed, the happy couple could retest the critical support at $.000007.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.