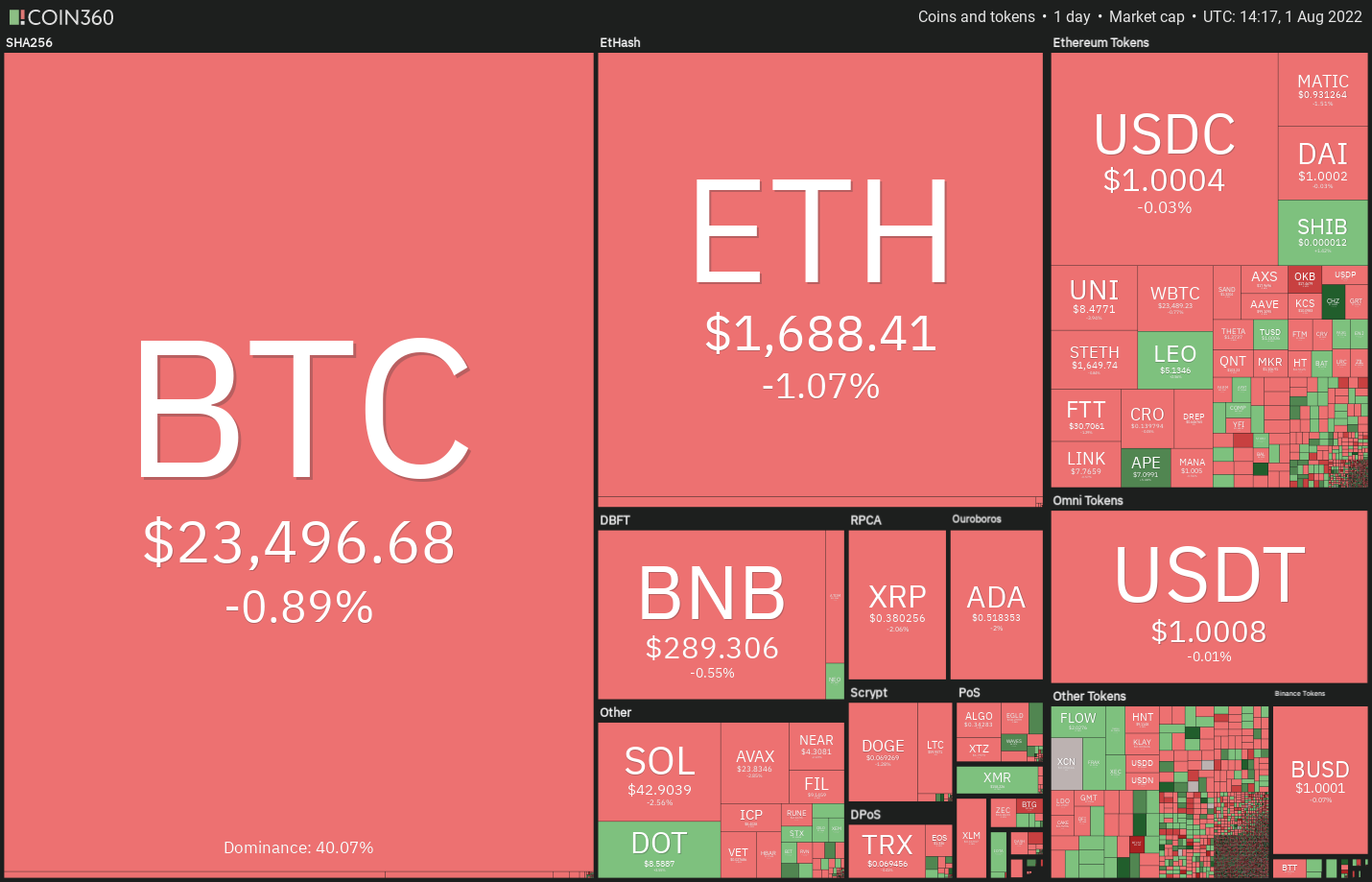

After strong monthly gains in This summer, Bitcoin (BTC) and also the altcoins have began the brand new month on the tentative note. The U . s . States equities markets have began August on the soft note.

May be the bottom in?

BofA Securities mind of U.S. equity and quantitative strategy Savita Subramanian stated inside a recent observe that the stock exchange usually bottoms after earnings estimates are revised lower however that hasn’t yet happened throughout the current downturn.

Analysts within the crypto space also remain divided on if the current rise is really a bear market rally or the beginning of a brand new bull phase.

However, a small positive would be that the world’s first Bitcoin place cost exchange-traded fund (ETF), the reason Bitcoin ETF, has added 2,600 Bitcoin to the holdings. Even though the total assets under management remain well underneath the all-time high, the current addition is an indication that some institutional investors might have began bottom fishing.

Could Bitcoin and altcoins find buyers at ‘abnormal’ amounts? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

The bulls frequently unsuccessful to sustain Bitcoin over the overhead resistance at $24,276 previously couple of days, indicating the bears are protecting the amount with all of their might.

The cost has retracted towards the 20-day exponential moving average (EMA) ($22,515), which will probably behave as strong support. When the cost increases in the 20-day EMA, the bulls will again attempt to obvious the overhead hurdle.

When they succeed, the BTC/USDT pair could get momentum along with a rally to $28,171 can be done. The up-sloping 20-day EMA and also the relative strength index (RSI) within the positive territory indicate benefit to buyers.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 50-day simple moving average (SMA) ($21,310). The happy couple could then decline towards the support line, which is a vital level for that bulls to protect.

ETH/USDT

Ether (ETH) is witnessing a difficult fight between your bulls and also the bears close to the important level at $1,700. Even though the bulls frequently pressed the cost above this level previously four days, they couldn’t continue the up-move.

The bears will attempt to drag the cost towards the 20-day EMA ($1,525) which is a vital level to take into consideration. When the cost rebounds here, it’ll claim that the sentiment has switched positive and traders are purchasing on dips.

That may increase the probability of a rest over the $1,700 to $1,785 resistance zone. In the event that happens, the ETH/USDT pair could rise to $2,000 and then to $2,200.

On the other hand, when the cost breaks underneath the 20-day EMA, it’ll claim that the happy couple may remain range-bound between $1,280 and $1,785 for any couple of days.

BNB/USDT

BNB‘s recovery is facing strong resistance at $300 however the shallow pullback implies that the bulls aren’t closing their positions in a rush because they expect the up-proceed to continue.

The bulls will endeavour to protect the zone between $275 and also the 20-day EMA ($264). When the cost rebounds off this zone, the bulls will again attempt to drive the BNB/USDT pair above $300. When they manage to achieve that, the happy couple could start its northward march toward the stiff overhead resistance at $350.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. In the event that happens, the happy couple could decline towards the 50-day SMA ($240).

XRP/USDT

XRP price rose over the overhead resistance of $.39 on This summer 30 and 31 however the bulls couldn’t sustain the greater levels. This means the bears haven’t yet quit and then defend the $.39 level strongly.

The progressively up-sloping 20-day EMA ($.36) and also the RSI within the positive territory indicate a small benefit to buyers. When the cost rebounds from the 20-day EMA, it’ll enhance the prospects of the rally over the overhead zone between $.39 and $.41. In the event that happens, the XRP/USDT pair could rally to $.48.

On the other hand, when the cost slips underneath the 20-day EMA, it’ll claim that traders are booking profits because they expect the happy couple to stay range-bound for any couple of more days. A rest underneath the 50-day SMA ($.34) could open the doorways for any drop to $.30.

ADA/USDT

Cardano (ADA) switched lower in the overhead resistance at $.55 on This summer 30, indicating the bears have been in no mood to permit the bulls to obtain their way.

When the cost breaks underneath the moving averages, the ADA/USDT pair could drop to $.45. This type of move will claim that the happy couple may remain stuck within the large range from $.40 and $.55 for any couple of more days.

However, when the cost rebounds from the moving averages, it’ll claim that bulls are purchasing on dips. The bulls will once more attempt to push the happy couple above $.55. When they succeed, the happy couple could rise to $.63, and then to $.70.

SOL/USDT

The bears thwarted an effort through the bulls to push Solana (SOL) over the overhead resistance at $48 on This summer 30. This might have attracted profit-booking in the short-term traders which has pulled the cost towards the 20-day EMA ($40).

When the cost rebounds from the 20-day EMA, the bulls can make yet another make an effort to push the SOL/USDT pair over the overhead resistance. When they succeed, the happy couple will complete an climbing triangular pattern which has a target purpose of $71.

Alternatively, when the cost breaks underneath the 20-day EMA, the happy couple could challenge the support type of the triangular. If the level gives way, the bullish setup is going to be negated. That may open the doorways for any decline to $30.

DOGE/USDT

The bulls attempted to push Dogecoin (DOGE) over the overhead resistance at $.08 however the bears had other plans. They offered at greater levels and also have pulled the cost back toward the moving averages.

When the cost continues lower and breaks underneath the moving averages, the trendline may are in danger of collapsing. In the event that happens, the developing bullish climbing triangular pattern is going to be invalidated. That may tilt the benefit in support of the bears.

On the other hand, when the cost rebounds from the moving averages, it’ll claim that bulls still buy at ‘abnormal’ amounts. The bulls will on the other hand make an effort to push the DOGE/USDT pair above $.08 and begin a brand new up-proceed to $.10.

Related: An upswing of pretend cryptocurrency apps and the way to prevent them

Us dot/USDT

Polkadot (Us dot) broke and closed over the overhead resistance of $8.50 on This summer 31 however the lengthy wick around the candlepower unit shows selling at greater levels. The bears are trying to trap the aggressive bulls by pulling the cost back underneath the breakout level.

When they succeed, the Us dot/USDT pair could decline towards the 20-day EMA ($7.64). It is really an important level to keep close track of just because a break and shut below it’ll claim that the happy couple may extend its stay within the range from $6 and $8.50 for any couple of more days.

Alternatively, when the cost increases in the current level or even the 20-day EMA, it’ll claim that bulls are purchasing on dips. That may enhance the prospects of the rally towards the mental degree of $10 after which to $10.80.

MATIC/USDT

The buyers pressed Polygon (MATIC) over the mental resistance at $1 on This summer 31 however the lengthy wick around the day’s candlepower unit shows aggressive selling at greater levels.

The bears will attempt to drag the cost towards the 20-day EMA ($.82), which will probably behave as a powerful support. When the cost rebounds off this level, it’ll claim that bulls still buy on dips. That could raise the chance of a rest above $1. In the event that happens, the MATIC/USDT pair could rally to $1.26.

The RSI is showing the very first indications of developing an adverse divergence, indicating the bullish momentum might be weakening. If bears sink the cost underneath the 20-day EMA, the happy couple could drop to $.75. A bounce off this level could claim that the happy couple may remain range-bound between $.75 and $1 for any couple of days.

AVAX/USDT

Avalanche (AVAX) switched lower in the overhead resistance at $26.38 on This summer 30, indicating that bears still defend the amount with vigor.

The bears will endeavour to sink the cost underneath the 20-day EMA ($22.55). When they manage to achieve that, the AVAX/USDT pair could decline towards the 50-day SMA ($19.73), that is placed just over the support line. A rest and shut below this support could claim that bears have returned in charge.

On the other hand, when the cost rebounds from the moving averages, it’ll claim that bulls still buy on dips. The bulls will make another make an effort to obvious the overhead hurdle at $26.38 and begin the brand new up-proceed to $33, after which to $38.

Market information is supplied by HitBTC exchange.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.