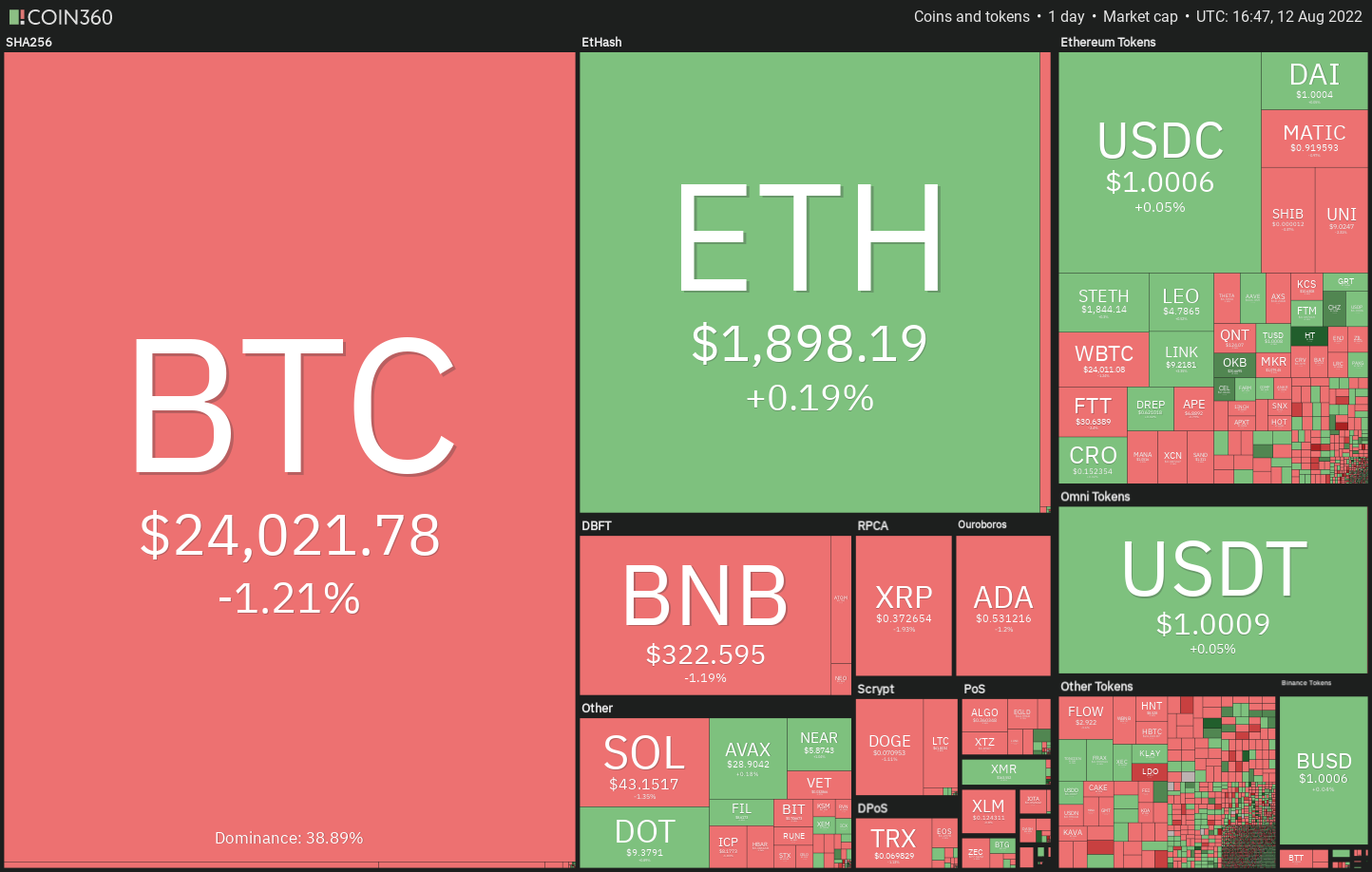

Bitcoin (BTC) couldn’t overcome the barrier at $25,000 on August. 11 despite the fact that it’d two catalysts by means of a “favorable” Consumer Cost Index print and news that BlackRock — the earth’s largest asset manager, overseeing over $10 trillion as a whole assets — had launched a place Bitcoin investment product.

Compared, Ether (ETH) has were able to keep its recent gains on news the Goerli testnet had effectively activated proof-of-stake, clearing the road for Ethereum’s mainnet transition planned for Sept. 15 or 16. Data from Santiment implies that Ether whale transactions have elevated together with possible whale accumulation.

However, analysts remain divided concerning the prospects of the present recovery. Although some think that Bitcoin’s rally could go above $28,000, other medication is not too bullish plus they expect the cost to show lower and resume the downtrend.

Could buyers obvious the overhead hurdle in Bitcoin and choose altcoins? Let’s read the charts from the top-10 cryptocurrencies to discover.

BTC/USDT

Bitcoin nudged over the overhead resistance at $24,668 on August. 11 however the bulls couldn’t sustain the greater levels. This signifies that bears haven’t yet quit and therefore are selling on rallies.

The cost remains squeezed between your 20-day exponential moving average (EMA) ($23,151) and $24,668. Usually, a good range buying and selling is adopted with a range expansion but it’s hard to predict the direction from the breakout with certainty.

Within this situation, the 20-day EMA is progressively sloping up and also the relative strength index (RSI) is incorporated in the positive territory, indicating the road of least resistance would be to the upside.

If buyers thrust and sustain the cost above $25,000, the bullish momentum could get and also the pair could rally to $28,000 after which to $32,000.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. The happy couple could then decline towards the 50-day simple moving average (SMA) ($21,845).

ETH/USDT

Ether tried to go above $2,000 on August. 11 however the lengthy wick around the day’s candlepower unit shows that bears are protecting the amount with vigor.

However, an optimistic sign would be that the bulls haven’t ceded ground towards the bears. This means that traders aren’t hastening to reserve profits because they anticipate the up-proceed to continue.

The upsloping moving averages and also the RSI close to the overbought territory indicate benefit to buyers. If bulls drive the cost above $2,000, the ETH/USDT pair could rally towards the downtrend line.

Alternatively, when the cost turns lower dramatically in the current level, the bears will attempt to sink the happy couple towards the breakout degree of $1,700. The bulls are anticipated to purchase the dip for this support.

BNB/USDT

BNB has been facing stiff resistance in the overhead resistance zone between $338 to $350. Although bears have frequently thwarted attempts through the bulls to obvious this hurdle, the buyers haven’t quit much ground. This signifies the bulls aren’t hurrying towards the exit because they expect moving greater.

A good consolidation close to the overhead resistance increases the probability of a rest above it. In the event that happens, the BNB/USDT pair could chance a rally to $380 after which to $414.

The key support to take into consideration on however the 20-day EMA ($300). If bears sink the cost below this level, the happy couple could decline to $275 after which towards the 50-day SMA ($261). A rest below this support could tilt the benefit in support of the bears.

XRP/USDT

Ripple (XRP) remains stuck between your overhead resistance at $.39 and also the 20-day EMA ($.37). The bears tried to resolve this uncertainty within their favor on August. 9 and 10 however the bulls purchased the dip and pressed the cost back over the 20-day EMA.

The buyers attempted to push the cost above $.39 on August. 11 however the bears held their ground. This signifies that $.39 and also the 50-day SMA ($.35) would be the critical levels to take into consideration for the short term.

If buyers obvious the overhead hurdle, the XRP/USDT pair could rally to $.48 and then to $.54. On the other hand, when the cost slips underneath the 50-day SMA, the happy couple could slide toward the important support at $.30.

ADA/USDT

Buyers tried to push Cardano (ADA) over the overhead resistance at $.55 on August. 11 however the bears held the amount effectively. The cost could now drop towards the 20-day EMA ($.51).

The tight range buying and selling between your 20-day EMA and $.55 is not likely to carry on for lengthy. If buyers drive the cost above $.55, the ADA/USDT pair could rally to $.63 after which towards the stiff overhead resistance at $.70.

Unlike this assumption, when the cost turns lower and breaks underneath the 20-day EMA, the bears will endeavour to challenge the support at $.45. When the support holds, the happy couple may extend the consolidation between $.45 and $.55 for many additional time.

SOL/USDT

Solana (SOL) bounced from the 50-day SMA ($39) on August. 10, indicating that bulls still buy at ‘abnormal’ amounts. The bulls tried to push the cost towards the overhead resistance at $48 however the bears stalled the recovery at $45.32 on August. 11.

The SOL/USDT pair could still trade within the climbing triangular formation for many additional time. The bears will need to sink the cost underneath the support line to invalidate this bullish setup.

Alternatively, the bulls will need to push and sustain the cost above $48 to accomplish the bullish pattern. In the event that happens, the happy couple could rally to $60 and then suggest moving towards the pattern target at $71.

DOGE/USDT

Dogecoin (DOGE) once more switched lower in the overhead resistance at $.08 on August. 11, indicating that bears still defend the amount strongly.

The bears will endeavour to sink the cost underneath the moving averages and challenge the trendline from the climbing triangular pattern. A rest and shut below this support will invalidate the bullish setup, opening the doorways for any possible retest of $.06.

Unlike this assumption, when the cost rebounds from the moving averages, it’ll claim that bulls still buy at ‘abnormal’ amounts. The bulls will need to push the cost above $.08 to accomplish the climbing triangular pattern. In the event that happens, the DOGE/USDT pair may rally to $.10.

Related: 3 cryptocurrencies that are in position to outshine ETH cost because of Ethereum’s Merge

Us dot/USDT

Polkadot (Us dot) continues to be witnessing a detailed fight between your bulls and also the bears close to the breakout degree of $9. The bears are trying to pull the cost back below $9 as the bulls are attempting to switch the amount into support.

The increasing 20-day EMA ($8.47) and also the RSI within the positive territory, indicating benefit to buyers. When the cost increases in the current level and breaks above $9.65, the Us dot/USDT pair could rally to $10.80 and then to $12.

Alternatively, when the cost breaks underneath the strong support zone of $9 and also the 20-day EMA, it’ll claim that the current breakout might have been a bull trap. The happy couple could then decline towards the 50-day SMA ($7.62).

MATIC/USDT

Polygon (MATIC) continues to be buying and selling inside a tight range from the 20-day EMA ($.88) and $.96 within the last couple of days, indicating indecision among consumers.

If the uncertainty resolves towards the upside, the MATIC/USDT pair could rally towards the stiff overhead resistance at $1.02. The bulls will need to overcome this barrier to signal the beginning of the following leg from the up-proceed to $1.26 and then to $1.50.

Unlike this assumption, when the cost turns lower and breaks underneath the 20-day EMA, rapid-term advantage could tilt in support of the bears. The happy couple could then decline towards the strong support at $.75.

AVAX/USDT

Avalanche (AVAX) continues to be buying and selling over the breakout degree of $26.38 within the last couple of days which implies that bulls have been in no hurry to surrender their advantage.

The progressively rising 20-day EMA ($25.6) and also the RSI close to the overbought zone indicate benefit to buyers. If bulls propel the cost above $31, the AVAX/USDT pair could get momentum and rally to $33 and then towards the pattern target of $39.05.

This positive view could invalidate soon when the cost turns lower and breaks underneath the 20-day EMA. In the event that happens, the happy couple could decline towards the 50-day SMA ($21.91) after which towards the support line.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.