The U . s . States Labor market added 528,000 jobs in This summer, a lot better than the 258,000 estimate. Wages saw development of 5.2% year-over-year and .5% within the month. This means that inflation remains high and also the U.S. Fed may continue its rate hikes soon.

After remaining in close correlation using the U.S. equities markets within the last several several weeks, the crypto space could anticipate to chalk out a brand new course.

Bloomberg Intelligence senior commodity strategist Mike McGlone and senior market structure analyst Jamie Coutts stated inside a recent are convinced that Bitcoin (BTC) has began base building like the one seen near $5,000 in 2018–2019. They expect the recovery to decouple from stocks and behave a lot more like U.S. “Treasury bonds or gold.”

Although crypto prices have stepped dramatically throughout the ongoing bear market, it’s not dented investors’ appetite. A study by crypto analytics firm Messari and Dove Metrics demonstrated the crypto space elevated $30.3 billion in funds in 2022, surpassing the quantity elevated in 2021.

Could Bitcoin continue its recovery or will bears pose a powerful challenge at greater levels? Let’s read the charts from the top-10 cryptocurrencies to discover.

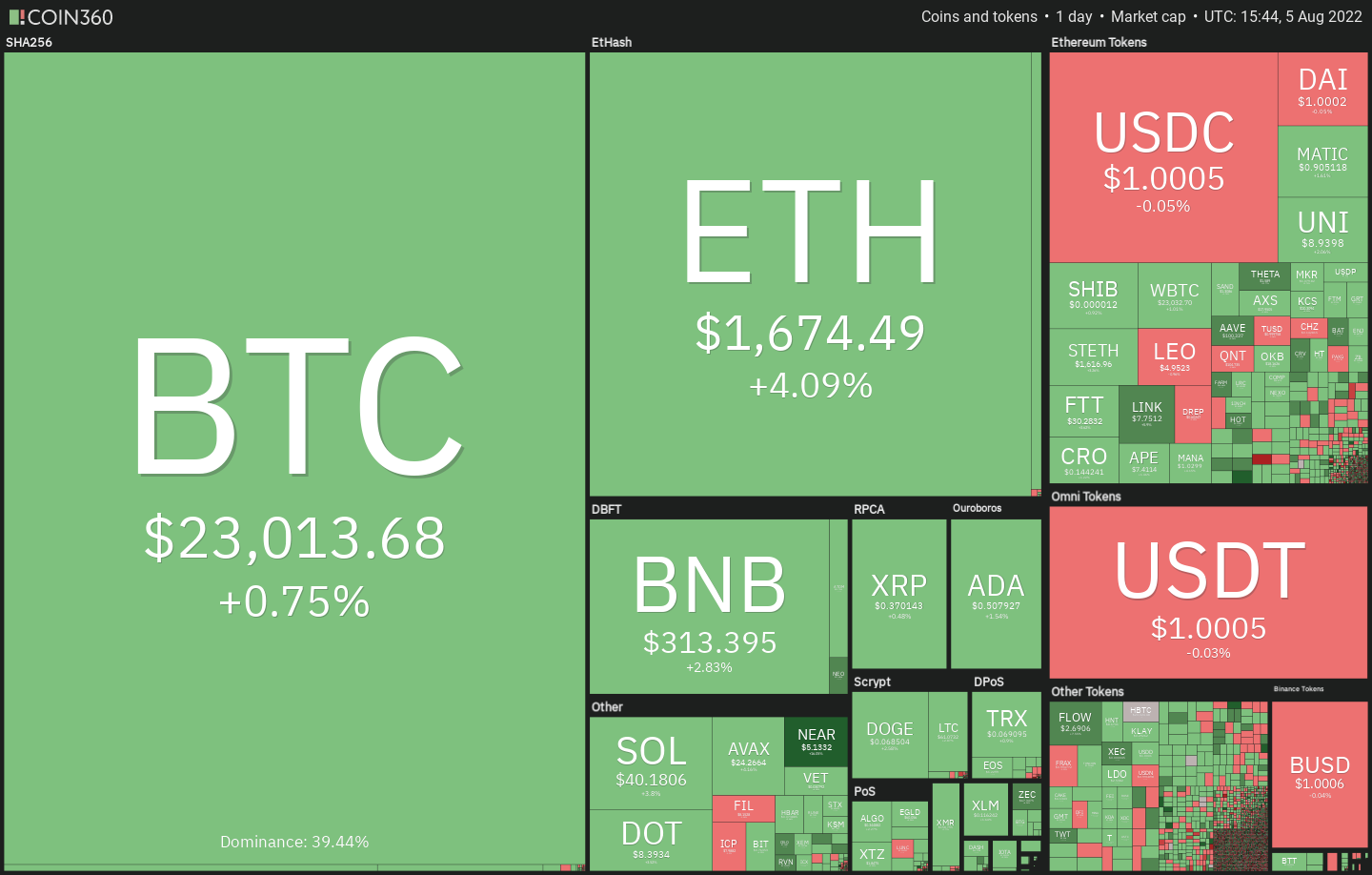

BTC/USDT

The bears pulled the cost underneath the 20-day exponential moving average (EMA) ($22,630) on August. 4 but tend to not sustain the low levels. This signifies the bulls are protecting the amount strongly.

The progressively up-sloping 20-day EMA and also the relative strength index (RSI) within the positive territory indicate a small benefit to buyers. When the cost increases from the 20-day EMA, the bulls will endeavour to push the BTC/USDT pair towards the overhead resistance at $24,668.

It is really an important level to keep close track of if the cost breaks above $24,668, the happy couple could get momentum and rally toward $28,000 after which onto $32,000. This type of move will claim that the happy couple might have bottomed out.

Unlike this assumption, when the cost turns lower in the current level or even the overhead resistance and breaks underneath the 20-day EMA, it’ll claim that bears still sell on minor rallies. That may open the doorways for any drop towards the 50-day simple moving average (SMA) ($21,388).

ETH/USDT

Ether (ETH) continues to be buying and selling between your 20-day EMA ($1,560) and also the $1,700 resistance within the last four days. Usually, tight range buying and selling is adopted with a range expansion.

The up-sloping 20-day EMA and also the RSI within the positive zone indicate benefit to buyers. A rest and shut over the overhead resistance zone between $1,700 and $1,785 could open the doorways for any possible rally to $2,000 and then to $2,200.

Alternatively, when the ETH/USDT pair turns lower in the current level and breaks underneath the 20-day EMA, it’ll claim that bears still defend the overhead zone with all of their might. That could cause a decline towards the strong support at $1,280.

BNB/USDT

BNB bounced from the $275 support on August. 2 and broke over the immediate resistance at $302 on August. 3. This signifies the resumption from the up-move.

The up-sloping 20-day EMA ($277) and also the RSI within the overbought zone indicate that bulls have been in command. The BNB/USDT pair could rally towards the stiff overhead resistance at $350. This level will probably attract strong selling in the bears.

To invalidate this bullish view, the bears will need to sink and sustain the cost underneath the 20-day EMA. In the event that happens, short-term traders may hurry towards the exit which could pull the happy couple lower towards the 50-day SMA ($246).

XRP/USDT

The buyers have effectively held the 20-day EMA ($.36) support previously couple of days but have unsuccessful to attain a powerful rebound in XRP. This means that bears can sell on rallies.

The XRP/USDT pair could remain stuck between your 20-day EMA and also the overhead resistance zone between $.39 and $.41. If bulls obvious the overhead hurdle, the positive momentum could get and also the pair could rally to $.48 after which to $.54.

Alternatively, when the cost turns lower and breaks underneath the 20-day EMA, it’ll claim that the demand from customers has dried out. That may sink the happy couple towards the 50-day SMA ($.34) and the happy couple range-bound between $.30 and $.39 for any couple of more days.

ADA/USDT

The bears frequently attempted to sink Cardano (ADA) underneath the 20-day EMA ($.50) previously 72 hours however the bulls held their ground.

The ADA/USDT pair has rebounded from the 20-day EMA and also the buyers will endeavour to push the cost over the overhead resistance at $.55. When they manage to achieve that, the bullish momentum could get and also the pair could rise to $.63 and then toward $.70.

Alternatively, when the cost turns lower in the overhead resistance, it’ll claim that bears are active at greater levels. The sellers will on the other hand make an effort to sink the cost underneath the moving averages and support the pair within the range from $.40 and $.55 for many additional time.

SOL/USDT

The bears attempted to sink the cost underneath the support line on August. 3 however the bulls defended the amount effectively. Solana (SOL) created an internal-day candlepower unit pattern on August. 4, which resolved towards the upside on August. 5.

If buyers sustain the cost over the 20-day EMA ($40), the SOL/USDT pair could climb to $44 after which retest the stiff overhead resistance at $48. The bulls will need to obvious this hurdle to signal the development of the climbing triangular pattern. This bullish setup includes a target purpose of $71.

Unlike this assumption, when the cost turns lower and breaks underneath the support line, the bullish setup is going to be invalidated. The happy couple could then slide toward the strong support at $31.

DOGE/USDT

Dogecoin (DOGE) bounced from the 50-day SMA ($.07) on August. 4 and also the bulls extended the up-move over the 20-day EMA ($.07) on August. 5.

The bulls will endeavour to push the cost toward the overhead resistance at $.08. It is really an important level for that bears to protect just because a break and shut above it’ll complete an climbing triangular pattern. The DOGE/USDT pair could then start an up-proceed to $.10 after which towards the pattern target at $.11.

However, when the cost turns lower in the current level and breaks underneath the 50-day SMA, it’ll claim that bears can sell on rallies. The happy couple could then drop towards the support type of the triangular. A rest below this level could negate the bullish setup.

Related: Bitcoin does not beat $23.4K sellers as US payrolls upend inflation debate

Us dot/USDT

Polkadot (Us dot) bounced from the 20-day EMA ($7.78) on August. 3, indicating demand at ‘abnormal’ amounts. The buyers will endeavour to push the cost towards the overhead resistance zone between $9 and $9.21.

If bulls obvious this overhead hurdle, the Us dot/USDT pair could get momentum and begin its northward march toward $10.80 after which $12. The up-sloping 20-day EMA and also the RSI within the positive zone indicate that buyers have been in control.

To invalidate this bullish view, the bears will need to sell strongly and sink the happy couple underneath the moving averages. In the event that happens, the happy couple may remain stuck within the range from $6 and $9 for many additional time.

MATIC/USDT

The buyers have effectively held Polygon (MATIC) over the 20-day EMA ($.85) throughout the correction, which implies a general change in sentiment from selling on rallies to purchasing on dips.

Both moving averages are sloping up and also the RSI is incorporated in the positive territory, indicating benefit to buyers. If bulls thrust the cost over the overhead resistance at $1.02, the MATIC/USDT pair could rally to $1.26 after which to $1.50.

On the other hand, when the cost turns lower and breaks underneath the 20-day EMA, it’ll claim that the happy couple may extend its stay within the range from $.75 and $1 for many additional time. The sellers will gain top of the hands away below $.75.

AVAX/USDT

Avalanche (AVAX) has bounced from the 20-day EMA ($22.86), indicating that bulls are purchasing the dips for this support.

The buyers will drive the cost towards the stiff overhead resistance at $26.38. The progressively up-sloping 20-day EMA and also the RSI within the positive territory indicate benefit to buyers. If bulls push the cost above $26.38, the AVAX/USDT pair will develop a bullish climbing triangular pattern. The happy couple could then rally to $33 and then to $38.

Unlike this assumption, when the cost turns lower in the overhead resistance and breaks underneath the 20-day EMA, the happy couple could drop towards the support line.

Market information is supplied by HitBTC exchange.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.