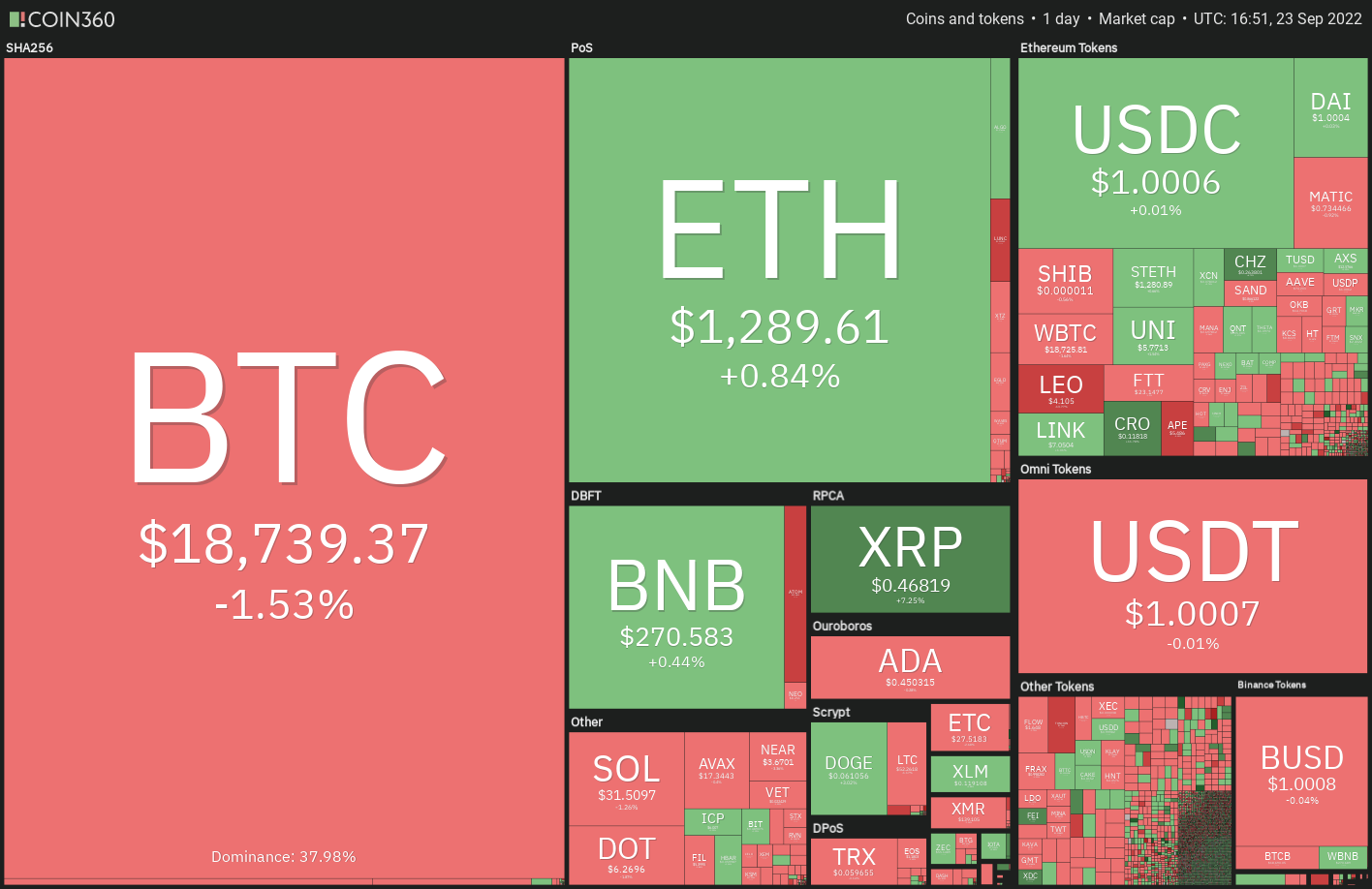

The S&P 500 index has declined about 5% now as the Nasdaq Composite is lower greater than 5.5%. Investors fear the Federal Reserve’s aggressive rate hikes might cause a fiscal downturn. The yield curve backward and forward-year and 10-year Treasury notes, that is viewed carefully by analysts for predicting an economic depression, has inverted probably the most since year 2000.

Of all the mayhem, it’s encouraging to determine that Bitcoin (BTC) has outperformed both major indexes and it has fallen under 4% within the week. Could this be considered a sign that Bitcoin’s bottom might be near by?

On-chain data implies that the quantity of Bitcoin supply held by lengthy-term holders in losses arrived at about 30%, that is 2% to fivePercent underneath the level that coincided with Bitcoin’s bottom in March 2020 and December 2018. This metric shows that Bitcoin might have more room to fall before it bottoms out.

Let’s read the charts from the S&P 500 index, the U.S. dollar index (DXY) and also the major cryptocurrencies to find out if the trend continues or maybe a reversal is probably.

SPX

The S&P 500 index (SPX) broke underneath the 3,900 support on Sept. 16 and also the bears effectively defended the amount on retests on Sept. 17 and 21. Hence, this becomes an essential level to keep close track of like a break above 3,900 would be the first sign that bulls take presctiption a comeback.

The downsloping 20-day exponential moving average (EMA) (3,920) signifies a benefit to bears however the relative strength index (RSI) within the oversold territory shows that the index may chance a rebound in the strong support zone between 3,715 and three,636.

An inadequate rebound off this zone will indicate too little aggressive buying through the bulls. That may increase the potential of a decline underneath the crucial June low at 3,636. If the support collapses, the index could plunge toward 3,325.

On the other hand, a powerful rebound from the support zone could cause a recovery to three,900. A rest above this resistance could signal a possible trend change soon.

DXY

The U.S. dollar index (DXY) has been around a powerful upward trend within the last couple of several weeks. Every dip has been purchased strongly and also the index is constantly on the scale new heights. Attempts through the bears to pressure a pattern change unsuccessful once the cost rebounded from the 50-day simple moving average (SMA) ($108) on Sept. 13.

After remaining inside a tight range for any couple of days, the index started to a different 52-week at the top of Sept. 21. This started again the upward trend and also the index could next chance a rally to 115.

The sharp rally of history couple of days has pressed the RSI in to the overbought zone, which implies a small consolidation or correction can be done within the next couple of days.

The 20-day EMA (109) is a vital support to look out for around the downside just because a break below it might sink the cost towards the 50-day SMA. The bears will need to pull the cost below 107 to point a potential trend change soon.

BTC/USDT

Buyers happen to be purchasing the dip below $18,626 in Bitcoin however the failure to push the cost over the 20-day EMA ($19,841) implies that bears have been in no mood to forget about their advantage. This increases the potential of a retest from the vital June low at $17,622.

A rest and shut below $17,622 could create panic and also the BTC/USDT pair may plummet to another major support at $14,500.

As the downsloping moving averages indicate benefit to bears, the positive divergence around the RSI shows that the selling pressure might be reducing. This view could strengthen if bulls drive and sustain the cost over the 20-day EMA.

That may push the cost toward the overhead resistance zone between your 50-day SMA (21,200) and $22,799. This type of move will claim that the happy couple may continue its bottoming formation within the large range from $17,622 and $25,211 for extended.

ETH/USDT

Ether (ETH) continues to be buying and selling in the climbing down funnel pattern within the last couple of days. Inside a funnel, traders usually buy close to the support then sell near to the resistance.

The bears attempted to sink the cost underneath the funnel on Sept. 21 however the bulls defended the amount effectively. The bulls will attempt to push the cost towards the 20-day EMA ($1,467) where they might face stiff resistance in the bears.

When the cost turns lower in the current level or even the 20-day EMA, it’ll claim that the sentiment remains negative and traders can sell on every minor rally. The bears will on the other hand attempt to pull the cost underneath the funnel and challenge the mental support at $1,000.

Contrarily, when the cost increases over the 20-day EMA, the happy couple could achieve the resistance type of the funnel. A rest and shut over the funnel could advise a potential trend change.

BNB/USDT

BNB has been oscillating between your 20-day EMA ($276) and $258 within the last couple of days. This implies that the bulls are protecting the immediate support at $258 however they have unsuccessful to push the cost over the 20-day EMA.

This tight-range buying and selling is not likely to carry on for lengthy. If buyers propel the cost over the 20-day EMA, the BNB/USDT pair could rise towards the resistance type of the climbing down funnel. The bulls will need to overcome this obstacle to point out the corrective phase might be over. The happy couple could then chance a rally to $338.

When the cost turns lower in the current level or even the resistance type of the funnel, the bears will again attempt to sink the happy couple below $258. When they manage to achieve that, the happy couple could decline towards the support line.

XRP/USDT

XRP broke over the $.41 overhead resistance on Sept. 20. The bears attempted capture the aggressive bulls on Sept. 21 however the buyers had other plans. They purchased the dip with vigor and thrust the cost over the overhead resistance on Sept. 22.

The pattern target from the break in the $.30 to $.41 range was $.52 and also the same was arrived at on Sept. 23. This sharp move pressed the RSI in to the overbought territory, suggesting a small correction or consolidation soon. The lengthy wick around the Sept. 23 candlepower unit shows profit-booking at greater levels.

Usually, following the breakout from the range, the cost has a tendency to retest the breakout level. Within this situation, the cost could drop to $.41. If bulls switch this level into support, the XRP/USDT will attempt to resume the up-move. When the cost increases above $.56, the following stop might be $.66. However, a rest below $.41 could claim that the current breakout would be a bear trap.

ADA/USDT

Cardano (ADA) bounced from the upward trend line on Sept. 22, indicating that bulls are protecting this level with vigor. The cost arrived at close to the downtrend line on Sept. 23 however the lengthy wick around the candlepower unit implies that bears are active at greater levels.

The 20-day EMA ($.46) has began to show lower and also the RSI is simply underneath the midpoint, indicating a small benefit to bears. When the cost continues lower and plummets underneath the upward trend line, the ADA/USDT pair could drop to $.40. It is really an important level for that bulls to protect just because a break below it might resume the downtrend.

If bulls wish to gain top of the hands, they’re going to have they are driving and sustain the cost over the downtrend line. The happy couple could then rise to $.60 in which the bears may again mount a stiff resistance.

Related: XRP hits 13-month high versus Bitcoin with 35% daily surge — But is really a correction inevitable?

SOL/USDT

Solana (SOL) continues to be getting squeezed between your 20-day EMA ($33) and also the immediate support at $30. This signifies a condition of equilibrium between consumers.

This uncertainty is not likely to carry on for lengthy. The bears will attempt to get control by pulling the cost below $30. In the event that happens, the SOL/USDT pair could drop towards the strong support at $26. The bulls are anticipated to protect this level strongly if this support cracks, the SOL/USDT pair could witness panic selling and drop toward $20.

To invalidate this negative view for the short term, buyers will need to drive the cost over the moving averages and also the overhead resistance at $39. When they succeed, the happy couple could rally to $48.

DOGE/USDT

Buyers bought the dip underneath the immediate support on Sept. 21 but they’re battling to sustain Dogecoin (DOGE) over the 20-day EMA ($.06) on Sept. 23. This means that bears still sell on rallies.

The bears will endeavour to improve their advantage by sinking the cost underneath the immediate support near $.06. When they do this, the DOGE/USDT pair could extend its decline towards the June low at $.05. This can be a pivotal level just because a break below it might indicate the beginning of the following leg from the downtrend.

On the other hand, when the cost sustains over the 20-day EMA, the happy couple could rise towards the 50-day SMA ($.07). If bulls pierce this resistance, the happy couple could rally toward $.09.

Us dot/USDT

Buyers effectively defended the critical support of $6 on Sept. 21 and 22 however the shallow bounce shows that demand dries up at greater levels. The more Polkadot (Us dot) trades underneath the 20-day EMA (6.87), the higher the chance of a rest below $6.

If bears sink and sustain the cost below $6, the selling momentum could get and also the Us dot/USDT pair could resume its downtrend. The following major support on however at $4.

Alternatively, when the cost rebounds off $6 or appears dramatically after breaking underneath the support, it’ll claim that bulls still buy at ‘abnormal’ amounts. The bulls will need to propel the cost over the moving averages to obvious the road for any possible up-proceed to $10, which, again, will probably behave as an obstacle.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.

Market information is supplied by HitBTC exchange.