Ether’s (ETH) impressive 85% gain previously thirty days has surprised the most bullish investors, also it helps make the $800 range observed in mid-This summer appear like ages ago. Bulls now aspire to turn $1,900 to aid, but derivatives metrics tell a totally different story, and also the data shows that professional traders remain highly skeptical.

It’s remember this the leading cryptocurrency, Bitcoin (BTC), acquired 28% within the same period. Thus, tthere shouldn’t be doubt the Ether bull run was driven through the Merge expectation, a transition to some proof-of-stake (PoS) consensus network.

Goerli was the last remaining Ethereum testnet scheduled to apply the Merge, which formally grew to become an evidence-of-stake blockchain by 1:45 UTC on August. 11. This final hurdle was finished with no major setbacks, giving a eco-friendly light for that mainnet transition on Sept. 15 or 16.

There’s a rationale behind investors’ booming expectations toward this major landmark transition. This type of multiphased upgrade aims for greater scalability and very low charges because of sharding, the parallel processing mechanism. However, the only real alternation in the Merge may be the complete elimination of the troublesome mining mechanism.

The bottom line is, the same inflation is going to be drastically cut as miners no more have to be compensated by recently minted coins. Still, the Merge doesn’t address the processing limit, or the quantity of data that may be validated and placed into each block.

Because of this, analysis of derivatives information is useful for focusing on how confident investors take presctiption Ether sustaining the rally and heading toward $2,000 or greater.

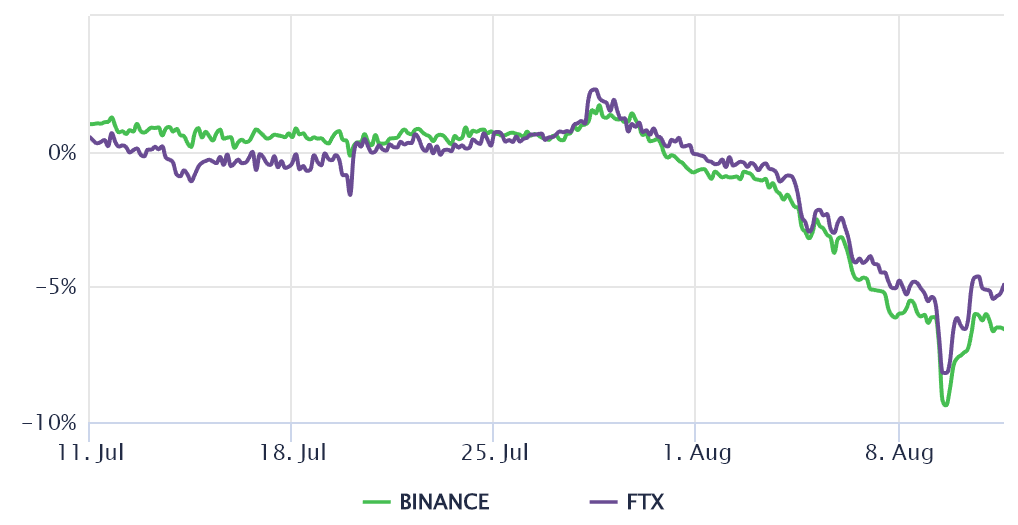

Ether’s futures premium continues to be negative since August. 1

Retail traders usually avoid quarterly futures because of their cost difference from place markets. Still, those are the professional traders’ preferred instruments simply because they avoid the perpetual fluctuation of contracts’ funding rates.

These fixed-month contracts usually trade in a slight premium to place markets because investors require more money to withhold the settlement. This case isn’t only at crypto markets. Consequently, futures should trade in a 4% to eightPercent annualized premium in healthy markets.

The Ether futures premium joined the negative area on August. 1, indicating excessive interest in bearish bets. Usually, this case is definitely an alarming warning sign referred to as “backwardation.”

Based on a publish by Roshun Patel, former v . p . at Genesis Buying and selling, Ether futures have flipped into backwardation because of Ethereum “fork odds,” meaning that traders are offsetting their upside place risks if you take bearish positions on futures contracts.

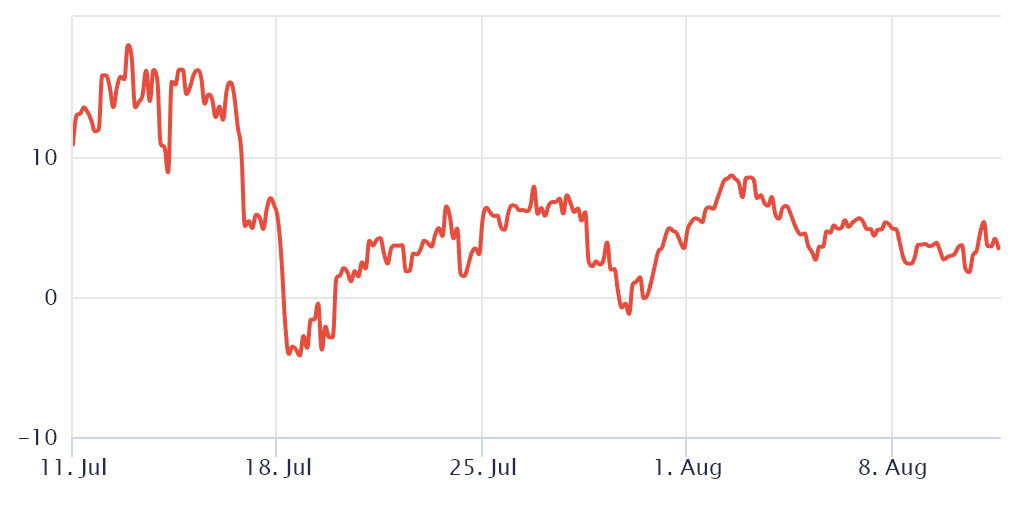

To exclude externalities specific towards the futures instrument, traders should also evaluate the Ether options markets. For example, the 25% delta skew shows when market makers and arbitrage desks are overcharging for upside or downside protection.

In bullish markets, options investors give greater odds for any cost pump, resulting in the skew indicator to fall below -12%. However, a market’s generalized panic induces a 12% or greater positive skew.

The 30-day delta skew bottomed at -4% on This summer 18, the cheapest level since October 2021. Not even close to being positive, such figures reveal traders’ unwillingness to consider downside risks using ETH options. Not really the current 85% rally instilled confidence in professional investors.

Traders expect full-blown volatility ahead

Derivatives metrics claim that pro traders aren’t positive about ETH overtaking the $1,900 resistance in the near future. Furthermore, expectations for big volatile movements round the Merge date corroborate this type of thesis. Based on Mohit Sorout:

Strap in which are more well known crypto play this season.

> Place $eth buyers

> Hedging it with selling 12 , futuresExpect real fuvkery round the merge pic.twitter.com/bu0zBaKZWC

— Mohit Sorout (@singhsoro) August 9, 2022

One factor is certain: Investors expect “free” coins following a potential proof-of-work fork. The issue remains when the craze to wind down individuals futures trades may cause Ether to provide back the majority of the 85% gains in the past thirty days.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph. Every investment and buying and selling move involves risk. You need to conduct your personal research when making the decision.